Using Forex Factory to improve your trading performance metrics is all about leveraging its powerful tools. This platform offers a wealth of information, from economic calendars and news feeds to insightful forums and data visualizations. Mastering Forex Factory can significantly enhance your trading strategies, helping you make more informed decisions and potentially boosting your overall profitability. We’ll explore how to use its features for technical and fundamental analysis, risk management, and creating effective trading plans.

This guide will walk you through using Forex Factory’s key features. We’ll cover interpreting economic data to anticipate market shifts, utilizing its forums for expert insights, and applying its resources to refine your risk management strategies. You’ll learn how to integrate Forex Factory data into your technical analysis, build a custom dashboard for visualizing key metrics, and ultimately, improve your trading performance metrics.

Leveraging Forex Factory Data for Technical Analysis

Forex Factory is a treasure trove of information for forex traders, offering a wealth of data beyond just price charts. Effectively utilizing this data can significantly enhance your technical analysis and improve your trading decisions. This section explores how to integrate Forex Factory’s resources into your technical analysis workflow.

Identifying Support and Resistance Levels with Forex Factory Data

Forex Factory’s calendar and news sections provide crucial context for identifying potential support and resistance levels. Major economic announcements or geopolitical events often cause significant price swings. By examining the Forex Factory calendar, you can anticipate these events and identify potential price reaction zones. For instance, if a significant central bank interest rate decision is scheduled, the price action around that time could reveal key support or resistance levels.

You can then use these levels in conjunction with your chart analysis to plan entries and exits. Observing past price reactions to similar events, as documented in Forex Factory’s news section, can further refine your understanding of potential support and resistance areas. Analyzing historical price action surrounding previous announcements can give you a better idea of how the market typically reacts to similar news.

Explore the different advantages of Building a robust trading journal using Forex Factory data that can change the way you view this issue.

Interpreting Candlestick Patterns with Forex Factory Data

Candlestick patterns provide valuable insights into market sentiment and potential price movements. Combining candlestick patterns with Forex Factory data allows for a more nuanced interpretation. For example, a bearish engulfing pattern appearing after a positive economic announcement might indicate a temporary pullback rather than a significant trend reversal. Conversely, a bullish hammer candlestick forming after negative news could signal increased buying pressure despite the unfavorable news.

Analyzing the volume accompanying these candlestick patterns, often available on Forex Factory charts linked to their news, enhances the reliability of your interpretations. High volume confirms the significance of the candlestick pattern, while low volume may suggest a weaker signal.

Using Economic Data to Confirm or Refute Technical Signals

Forex Factory’s economic calendar and news section are invaluable for confirming or refuting technical signals. A bullish breakout confirmed by a positive economic surprise provides a higher probability trade setup. Conversely, a bearish breakdown occurring after a negative economic announcement increases the likelihood of the trend continuing. For example, if your technical analysis suggests a potential long position, a positive surprise in Non-Farm Payrolls (NFP) data, as reported on Forex Factory, could significantly strengthen your confidence in the trade.

Conversely, a negative surprise might cause you to reconsider or adjust your position. Always consider the market’s reaction to the news, not just the news itself.

A Step-by-Step Guide to Backtesting Trading Strategies Using Forex Factory Data

Backtesting is crucial for evaluating the effectiveness of your trading strategies. Forex Factory data can significantly enhance this process.

- Define Your Strategy: Clearly Artikel your trading rules, including entry and exit points, risk management, and indicators used.

- Gather Historical Data: Use Forex Factory’s historical charts and economic calendar data to obtain the necessary price and news data for your backtest period.

- Simulate Trades: Manually or using trading software, simulate your trades based on your strategy and the historical data. Record all trades, including entry and exit prices, profits, and losses.

- Analyze Results: Calculate key performance metrics such as win rate, average win/loss, maximum drawdown, and Sharpe ratio. Analyze the results to identify strengths and weaknesses of your strategy.

- Refine Your Strategy: Based on the backtest results, adjust your strategy to improve its performance. Repeat the process until you achieve satisfactory results.

Remember, backtesting with Forex Factory data provides a valuable insight, but it doesn’t guarantee future success. Market conditions constantly evolve. Always use proper risk management techniques in live trading.

Improving Risk Management with Forex Factory Resources: Using Forex Factory To Improve Your Trading Performance Metrics

Forex Factory offers a wealth of resources that can significantly enhance your risk management strategy. By leveraging its diverse data sets and tools, you can move beyond guesswork and establish a more robust and data-driven approach to protecting your trading capital. This involves understanding market sentiment, setting appropriate stop-loss and take-profit levels, and choosing a risk management technique best suited to your trading style.

Forex Factory Sentiment Indicators and Risk Assessment

Forex Factory’s sentiment indicators, such as the “Speculative Sentiment Index” (SSI) and various trader polls, provide valuable insights into prevailing market sentiment. A high SSI reading, for example, suggests a heavily bullish market, potentially indicating a higher risk of a price reversal. Conversely, a low SSI reading might signal an oversold condition, potentially hinting at a bounce. However, it’s crucial to remember that sentiment is not a predictive tool on its own; it’s a piece of the puzzle.

Combining SSI data with other technical indicators and fundamental analysis offers a more holistic risk assessment. For instance, a high SSI coupled with bearish price action on a key support level might suggest a higher probability of a downward trend, prompting a more cautious approach or the avoidance of a long position altogether.

Designing a Risk Management Plan Using Forex Factory Data

A comprehensive risk management plan built on Forex Factory data might include the following components: First, utilize the economic calendar to identify high-impact news events. These events can cause significant volatility, increasing risk. Second, incorporate the sentiment indicators discussed previously to gauge overall market sentiment. Third, use Forex Factory’s historical price charts to identify support and resistance levels, informing your stop-loss and take-profit placement.

Finally, determine your position sizing based on your risk tolerance and account equity, ensuring no single trade jeopardizes a significant portion of your capital. For example, a trader might decide to risk only 1% of their account on any given trade. This means if their account is $10,000, they would only risk $100 per trade.

Setting Stop-Loss and Take-Profit Levels with Forex Factory Data

Forex Factory’s historical charts and technical analysis tools are invaluable in determining appropriate stop-loss and take-profit levels. Support and resistance levels identified on these charts provide natural points to set stop-losses, minimizing potential losses. Similarly, take-profit levels can be set based on previous price action or technical indicators found within the platform. For instance, a trader might set a stop-loss just below a recent support level and a take-profit at a resistance level that has historically held.

Remember, the placement of these levels is highly dependent on the individual trading strategy and risk tolerance.

Examine how Short-term trading strategies leveraging Forex Factory’s real-time data can boost performance in your area.

Comparing Different Risk Management Techniques Informed by Forex Factory Data

Forex Factory data can be used to inform various risk management techniques. For example, a fixed fractional position sizing strategy, where a consistent percentage of your account is risked on each trade, can be easily implemented by combining your risk tolerance with data on potential price movements observed on Forex Factory charts. Alternatively, a volatility-based approach might involve adjusting position sizes based on the historical volatility of the asset pair, information readily available through Forex Factory’s historical data.

Another approach might involve using trailing stop-losses, adjusting the stop-loss as the price moves favorably, locking in profits while minimizing risk. The choice of the most appropriate technique depends on your individual trading style, risk appetite, and the specific characteristics of the market.

Utilizing Forex Factory for Fundamental Analysis

Forex Factory is more than just a technical analysis powerhouse; it’s a treasure trove of fundamental data crucial for informed trading decisions. Understanding the economic events and central bank pronouncements available on the platform allows you to anticipate market movements and adjust your strategies accordingly. By combining fundamental and technical analysis, you can significantly improve your trading performance.

Key Economic Indicators and Their Impact on Currency Pairs

Forex Factory provides access to a wide range of economic indicators released by various countries. These indicators, such as Gross Domestic Product (GDP), inflation rates (CPI), employment data (Non-Farm Payrolls), and manufacturing indices (PMI), directly influence currency values. A strong GDP report, for example, typically strengthens a nation’s currency as it signals economic health and attracts investment. Conversely, higher-than-expected inflation might weaken a currency as it suggests potential central bank intervention to curb price increases.

Understanding the relationship between these indicators and their historical impact on specific currency pairs is vital for successful fundamental analysis. For instance, a positive surprise in the US Non-Farm Payrolls report often leads to a strengthening of the US dollar (USD) against other currencies.

Interpreting Central Bank Announcements and Their Effect on Trading Decisions

Central bank announcements, such as interest rate decisions, monetary policy statements, and press conferences, are pivotal events that significantly impact forex markets. Forex Factory provides timely access to these announcements, along with market reaction summaries and expert commentary. For example, an unexpected interest rate hike typically strengthens the relevant currency as it signals a tighter monetary policy and increased investor confidence.

Conversely, a dovish statement suggesting future rate cuts could weaken the currency. Analyzing the language used in these announcements, considering past actions, and observing the immediate market reaction on Forex Factory provides valuable insights for formulating trading strategies. A hawkish statement from the Federal Reserve, for example, (suggesting a more aggressive approach to inflation control) will often lead to a short-term rise in the value of the US dollar.

Hypothetical Trading Scenario Using Forex Factory’s Fundamental Data

Let’s imagine the Eurozone is about to release its inflation figures. Prior to the release, Forex Factory shows forecasts suggesting inflation will be lower than expected. Using this information, along with technical analysis showing the EUR/USD pair is overbought, a trader might decide to take a short position (betting against the Euro). If the actual inflation figure confirms the lower-than-expected forecast, the Euro could weaken, potentially resulting in a profitable trade.

Conversely, if the inflation figure is higher than expected, the trader would likely incur losses. This highlights the importance of using multiple data sources and analysis methods.

Categorized List of Fundamental Data Available on Forex Factory, Using Forex Factory to improve your trading performance metrics

Forex Factory organizes fundamental data effectively, though the exact presentation may change over time. However, the types of data generally available fall into these categories:

- Economic Indicators: GDP growth, inflation rates (CPI, PPI), unemployment rates, manufacturing PMIs, consumer confidence indices, retail sales figures, and more. These reflect the overall health of an economy.

- Central Bank Announcements: Interest rate decisions, monetary policy statements, press conferences, and minutes from meetings. These provide insight into the central bank’s outlook and planned actions.

- Government Reports: Budget announcements, trade balances, and other official publications impacting the economy and currency.

- Geopolitical News: While not strictly economic, major political events and global news can significantly impact currency markets, and Forex Factory often provides links and summaries of such events.

Visualizing Forex Factory Data for Enhanced Trading

Forex Factory offers a wealth of data, but raw numbers don’t tell the whole story. Visualizing this data through charts and custom dashboards significantly enhances your ability to identify trends, patterns, and potential trading opportunities. By transforming raw data into easily digestible visual representations, you can make more informed trading decisions and improve your overall performance.

Charting Forex Factory Data for Different Trading Styles

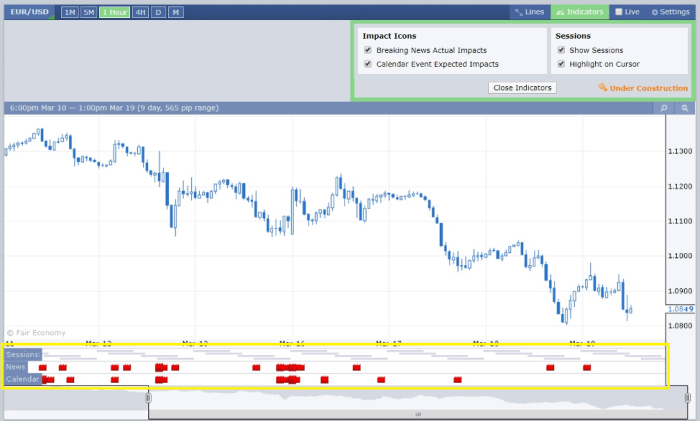

Effective visualization depends on your trading style and timeframe. Scalpers, for example, benefit from highly granular charts showing minute-by-minute price movements alongside Forex Factory’s sentiment indicators. Swing traders, conversely, might focus on daily charts incorporating longer-term economic calendar data from Forex Factory. For longer-term strategies, weekly or monthly charts displaying fundamental data alongside major news events are most beneficial.

A scalper might overlay Forex Factory’s order book data onto a one-minute candlestick chart to identify potential entry and exit points based on order flow imbalances. A swing trader, on the other hand, might plot the Forex Factory sentiment indicator alongside a daily chart to gauge market sentiment before entering a position. A long-term investor could use a monthly chart with overlaid Forex Factory economic calendar events to identify potential shifts in currency value based on fundamental news.

Creating a Custom Forex Factory Data Dashboard

A custom dashboard consolidates key Forex Factory data points into a single, easily monitored view. Imagine a dashboard displaying several key elements. The top section could feature a live feed of the major currency pairs’ price movements. Below this, a section dedicated to Forex Factory’s economic calendar would highlight upcoming events, color-coded by their potential impact (high, medium, low).

Another section could present a graphical representation of the Forex Factory sentiment indicator, showing the overall bullish or bearish sentiment for each currency pair. Finally, a smaller section might display the current open interest for specific currency pairs, sourced from Forex Factory. The interaction is simple: Changes in price, sentiment, or upcoming events would instantly update on the dashboard, providing a dynamic overview of the market.

This allows for quicker reaction times and a more holistic view of market conditions.

Interpreting Visualizations for Trading Opportunities

Visualizing Forex Factory data allows for the identification of patterns and opportunities not readily apparent in raw data. For instance, a divergence between price action and Forex Factory’s sentiment indicator might suggest a potential reversal. If the price is making higher highs but sentiment is weakening, this could signal an upcoming bearish trend. Similarly, a surge in open interest coupled with a significant price move in a specific direction could indicate a strong trend continuation.

By combining visual representations of different Forex Factory data points, traders can identify these subtle clues and gain a significant edge. Observing clusters of economic events on the calendar and their subsequent effect on sentiment and price action over time allows for predictive modeling of future market reactions.

By mastering Forex Factory’s tools and resources, you can significantly enhance your trading approach. From using its economic calendar to predict market movements to leveraging its forum for valuable insights, you’ll be better equipped to make informed trading decisions. Remember to always combine Forex Factory’s data with your own analysis and risk management plan. Consistent practice and a disciplined approach will be key to transforming your trading performance.