Using Forex Factory to identify high-probability trading setups isn’t just about charts and indicators; it’s about understanding market sentiment, anticipating news impacts, and combining various data points to paint a clearer picture of potential trading opportunities. This guide walks you through leveraging Forex Factory’s powerful tools – from its economic calendar and news section to its charting capabilities and sentiment indicators – to refine your trading strategy and boost your chances of success.

We’ll explore price action patterns, technical indicators, and crucial risk management techniques to help you confidently navigate the forex market.

We’ll cover how to interpret Forex Factory’s economic calendar to anticipate market moves, how to use its news section to gauge market sentiment, and how to combine this information with technical analysis and price action patterns. We’ll also delve into risk management strategies and the importance of backtesting your Forex Factory-based trading plan.

Identifying Price Action Patterns: Using Forex Factory To Identify High-probability Trading Setups

Forex Factory, with its robust charting capabilities, is a fantastic tool for identifying classic price action patterns. These patterns, formed by the interplay of supply and demand, can offer high-probability trading setups, providing clues about potential future price movements. Understanding how to spot and interpret these patterns is crucial for any successful Forex trader.

Common Price Action Patterns

Several recurring price action patterns appear consistently across various Forex pairs. Recognizing these patterns allows traders to anticipate potential reversals or continuations in price trends. Let’s examine some of the most common ones. Accurate identification requires patience and practice, and often confirmation from other technical indicators.

Head and Shoulders Pattern

The head and shoulders pattern is a classic reversal pattern. It’s characterized by three distinct peaks: a central peak (the “head”) that is higher than the two peaks on either side (“shoulders”). A neckline, formed by connecting the troughs between the peaks, provides a crucial support/resistance level. A break below the neckline (in an uptrend) signals a potential bearish reversal.

Conversely, an inverse head and shoulders pattern (with the head being the lowest point) indicates a potential bullish reversal upon a break above the neckline.

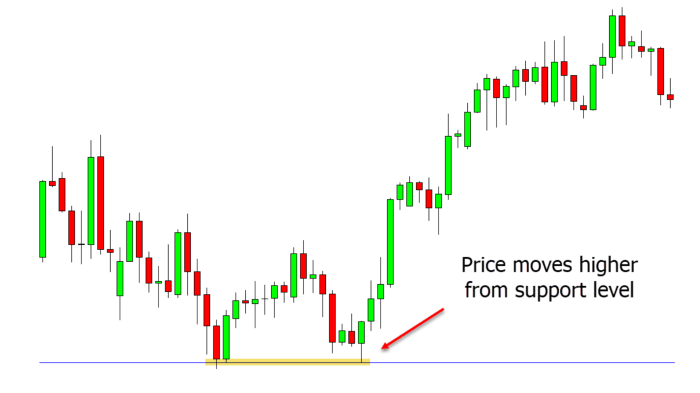

Double Tops and Double Bottoms

Double tops and double bottoms are similar patterns indicating potential trend reversals. A double top shows two similar price highs, followed by a lower low. A break below the neckline (the low point between the two highs) confirms the bearish reversal. Conversely, a double bottom consists of two similar price lows, followed by a higher high. A break above the neckline (the high point between the two lows) signals a potential bullish reversal.

Triangles

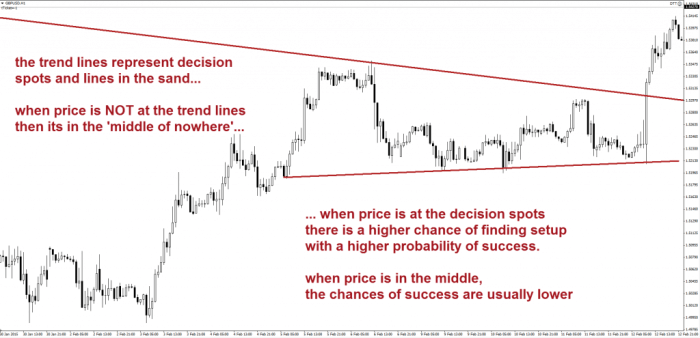

Triangles are continuation patterns, suggesting a period of consolidation before a breakout. There are several types, including symmetrical, ascending, and descending triangles. Symmetrical triangles show converging highs and lows, indicating uncertainty. Ascending triangles have a flat base and rising highs, suggesting a bullish bias. Descending triangles have a flat top and falling lows, hinting at a bearish bias.

Finish your research with information from building a sustainable and scalable digital marketing business model.

Breakouts from triangles are often accompanied by significant price movements.

Using Forex Factory’s Charting Tools

Forex Factory provides various charting tools to assist in identifying and confirming price action patterns. Tools such as trendlines, Fibonacci retracements, and support/resistance levels can help pinpoint key areas of interest and confirm pattern validity. For example, drawing trendlines to connect the highs and lows of a triangle helps visualize the pattern’s structure and predict potential breakout levels. Similarly, drawing a neckline in a head and shoulders pattern helps to define the crucial support/resistance level.

Fibonacci retracements can assist in identifying potential support and resistance levels within the pattern, potentially providing targets for profit taking or stop-loss placement.

Reliability and Profit Potential

The reliability and profit potential of price action patterns vary. Some patterns, like well-defined head and shoulders, tend to be more reliable than others, such as less distinct triangles. Furthermore, the context of the pattern within the broader market environment plays a significant role. A pattern that appears reliable in a strong trending market might fail in a sideways or choppy market.

Risk management is paramount. Always use stop-loss orders to limit potential losses and only risk a small percentage of your trading capital on any single trade.

Common Price Action Patterns: A Summary

| Pattern Name | Characteristics | Confirmation Methods | Potential Setup |

|---|---|---|---|

| Head and Shoulders | Three peaks (head and two shoulders), neckline | Break below (bearish) or above (bullish) neckline, volume confirmation | Short (bearish) or long (bullish) position after neckline break |

| Double Top/Bottom | Two similar highs (double top) or lows (double bottom), neckline | Break below (double top) or above (double bottom) neckline, volume confirmation | Short (double top) or long (double bottom) position after neckline break |

| Symmetrical Triangle | Converging highs and lows | Breakout above (bullish) or below (bearish) the converging lines, volume confirmation | Long (bullish breakout) or short (bearish breakout) position after breakout |

| Ascending Triangle | Flat base, rising highs | Breakout above the resistance line, volume confirmation | Long position after breakout |

| Descending Triangle | Flat top, falling lows | Breakout below the support line, volume confirmation | Short position after breakout |

Utilizing Forex Factory’s Sentiment Indicators

Forex Factory offers a wealth of sentiment data that can significantly enhance your trading strategies. By understanding and incorporating this information, you can gain a crucial edge in identifying high-probability setups and managing risk more effectively. This goes beyond simply looking at price action; it adds a layer of understanding of market psychology, helping you anticipate potential shifts in momentum.Sentiment indicators on Forex Factory, such as the sentiment polls and the order book analysis, provide valuable insights into the collective market mood towards specific currency pairs.

These indicators aren’t perfect predictors, but when used intelligently alongside your price action analysis, they can significantly improve your trading decisions. They essentially offer a gauge of how bullish or bearish traders are feeling about a particular market at a given time. This can help you confirm existing trends or spot potential reversals before they fully develop.

Interpreting Sentiment Data and Integrating with Price Action Analysis

Successful integration of sentiment data requires a nuanced approach. Don’t simply rely on a single indicator; instead, consider it one piece of a larger puzzle. For example, a strongly bullish sentiment poll might suggest further upward movement, but only if this aligns with a supportive price action pattern, like a bullish flag or continuation pattern. Conversely, a bearish sentiment poll coupled with a bearish engulfing candlestick pattern might signal a high-probability shorting opportunity.

The key is to look for confirmation between the sentiment data and the price action. A divergence – where sentiment and price move in opposite directions – can be particularly revealing.

Sentiment Divergence and Potential Reversals

Sentiment divergence occurs when the price of a currency pair moves in one direction, while the sentiment indicator moves in the opposite direction. For example, imagine the price of EUR/USD is making higher highs, but the Forex Factory sentiment poll shows a declining percentage of bullish traders. This divergence suggests a potential bearish reversal might be imminent. Traders might interpret this as a sign of overbought conditions, where the market price has risen too far, too fast, and sentiment hasn’t kept pace.

Conversely, a rising price with declining bearish sentiment could suggest a potential bullish continuation. It’s important to note that divergence isn’t a guaranteed signal, but it is a powerful warning sign that warrants closer examination and potentially a modification of your trading plan.

Incorporating Sentiment Analysis into a Trading Plan

Let’s consider a practical example. Suppose you’re eyeing a long position on GBP/USD. You’ve identified a bullish pennant pattern on the chart. Checking Forex Factory’s sentiment poll, you see a high percentage of bullish traders, further confirming your bullish bias. This confluence of technical and sentiment analysis strengthens your trading signal.

However, you might also set a tighter stop-loss order than usual, recognizing that even strong signals can fail. Conversely, if the sentiment poll showed a majority of bearish traders despite the bullish pennant, you might reconsider the trade or at least adjust your risk management accordingly. Another example: Imagine you’re considering a short position on USD/JPY. You notice a bearish head and shoulders pattern forming.

Forex Factory’s order book shows a significant increase in sell orders, reinforcing the bearish signal. This combined information provides a higher-confidence setup for a short trade. Remember to always backtest your strategy incorporating sentiment data to refine your approach and optimize your risk management.

Analyzing Forex Factory’s Technical Indicators

Forex Factory offers a wealth of charting tools, including a range of technical indicators that can significantly enhance your ability to identify high-probability trading setups. Understanding how to interpret and combine these indicators is key to improving your trading strategy. This section will explore some common indicators and demonstrate how to use them effectively.

Technical indicators are mathematical calculations based on historical price data, designed to reveal trends, momentum, and potential reversals. While they shouldn’t be used in isolation, they provide valuable context when combined with price action analysis. Remember, no indicator is perfect; they are tools to assist, not dictate, your trading decisions.

Common Technical Indicators on Forex Factory

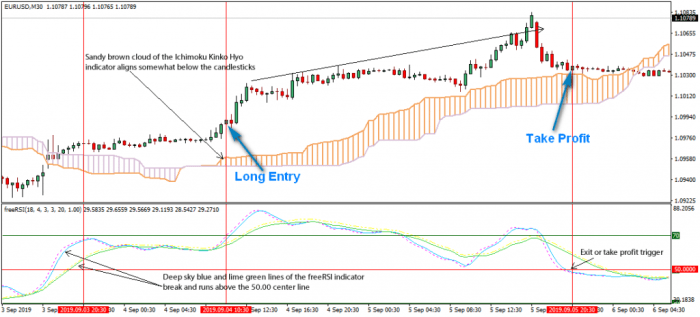

Forex Factory’s charting platform provides access to a wide variety of technical indicators. Let’s focus on three commonly used indicators: Moving Averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). Understanding their individual functions and how they interact is crucial.

Moving averages smooth out price fluctuations, highlighting trends. The RSI measures the speed and change of price movements to evaluate overbought and oversold conditions. The MACD identifies momentum changes by comparing two moving averages.

- Moving Averages (MAs): Simple Moving Averages (SMAs) and Exponential Moving Averages (EMAs) are frequently used. SMAs give equal weight to all data points within the period, while EMAs give more weight to recent data. Traders often use multiple MAs (e.g., a 20-period SMA and a 50-period SMA) to identify support and resistance levels, as well as potential trend changes.

A bullish crossover occurs when a shorter-term MA crosses above a longer-term MA, suggesting a potential uptrend. A bearish crossover is the opposite.

- Relative Strength Index (RSI): The RSI oscillates between 0 and 100. Readings above 70 generally suggest an overbought condition, while readings below 30 suggest an oversold condition. These levels are not absolute buy/sell signals but rather indicate potential reversal points. Divergences between the RSI and price action can also be significant trading signals. For example, if the price makes a new high, but the RSI fails to make a new high, this bearish divergence suggests a potential price decline.

Obtain recommendations related to how to create engaging and shareable social media content that can assist you today.

- Moving Average Convergence Divergence (MACD): The MACD consists of two lines: the MACD line and the signal line. The MACD line is the difference between two exponential moving averages. The signal line is a moving average of the MACD line. Buy signals often occur when the MACD line crosses above the signal line, and sell signals occur when the MACD line crosses below the signal line.

Similar to the RSI, divergences between the MACD and price can also indicate potential reversals.

Combining Technical Indicators for Improved Accuracy

Using multiple indicators together can help filter out false signals and increase the accuracy of your trading setup identification. This is because each indicator provides a different perspective on market dynamics. For example, combining moving averages with the RSI can help confirm trend direction and identify potential overbought or oversold conditions.

Imagine a scenario where a pair of moving averages (e.g., 20-period and 50-period EMAs) shows a bullish crossover, suggesting a potential uptrend. However, the RSI is already above 70, indicating an overbought market. This combination suggests caution, as the uptrend might be weakening. Conversely, a bearish crossover with an RSI below 30 could suggest a strong buying opportunity.

A Sample Trading Strategy Using Technical Indicators and Price Action

This strategy combines moving averages, RSI, and price action to generate trading signals.

- Identify the Trend: Use a 20-period and 50-period EMA to determine the overall trend. A bullish trend is indicated by the 20-period EMA being above the 50-period EMA, and vice-versa for a bearish trend.

- Look for Confirmation: If the trend is bullish, look for potential buy setups where the price approaches the 20-period EMA as support, and the RSI is in oversold territory (below 30). If the trend is bearish, look for potential sell setups where the price approaches the 20-period EMA as resistance, and the RSI is in overbought territory (above 70).

- Confirm with Price Action: Look for candlestick patterns (e.g., bullish engulfing, hammer) to confirm the potential buy or sell signal.

- Place Your Trade: Enter the trade based on your risk management plan. Always use stop-loss orders to limit potential losses.

Step-by-Step Guide to Using Forex Factory’s Technical Indicators

- Choose Your Currency Pair and Timeframe: Select the currency pair you want to trade and choose a timeframe appropriate for your trading style (e.g., 1-hour, 4-hour, daily).

- Add Your Chosen Indicators: Add the desired technical indicators (e.g., 20-period and 50-period EMAs, RSI, MACD) to the Forex Factory chart.

- Analyze the Chart: Examine the interaction between the indicators and price action. Look for potential trading setups based on the chosen strategy.

- Identify Potential Entry and Exit Points: Determine where to enter and exit the trade based on your chosen strategy and risk management plan.

- Place Your Trade and Manage Risk: Place your trade using appropriate stop-loss and take-profit orders to manage risk effectively.

Risk Management and Position Sizing

Forex Factory, while a powerful tool for identifying potential trading setups, doesn’t eliminate risk. Successful Forex trading hinges on a robust risk management strategy. Ignoring this aspect can quickly lead to significant losses, regardless of how accurate your Forex Factory-based analysis is. This section will Artikel crucial risk management techniques and demonstrate how to integrate them into your trading plan.

Effective risk management is about preserving capital and ensuring you can withstand losing trades. It’s not about avoiding losses entirely – that’s impossible – but about limiting their impact on your account. A well-defined risk management plan protects your trading capital and allows you to continue trading even after a series of unfavorable outcomes. This is particularly crucial when using Forex Factory data, as even the most promising setups can fail.

Stop-Loss Orders, Using Forex Factory to identify high-probability trading setups

Stop-loss orders are your first line of defense against substantial losses. These orders automatically close your position when the price reaches a predetermined level, limiting your potential loss to a predefined amount. When using Forex Factory to identify potential entries, simultaneously determine a logical stop-loss level based on your analysis of price action, support/resistance levels, or technical indicators.

For example, if you enter a long position based on a bullish engulfing pattern identified on Forex Factory, your stop-loss could be placed below the low of the engulfing candle. The key is to set your stop-loss

before* entering the trade, preventing emotional decisions during market fluctuations.

Position Sizing Calculations

Position sizing determines the amount of currency you trade per position. It’s crucial for controlling risk and preventing a single losing trade from wiping out your account. A common approach is to risk a fixed percentage of your account balance on each trade. For instance, a 1% risk management rule means you’ll never risk more than 1% of your account balance on any single trade.

Risk Management Plan Integration with Forex Factory Strategy

A comprehensive risk management plan integrates seamlessly with your Forex Factory-based strategy. This involves:

- Identifying High-Probability Setups: Forex Factory aids in identifying these, but remember no setup is guaranteed.

- Defining Stop-Loss Levels: Before each trade, determine a stop-loss based on chart analysis and risk tolerance.

- Calculating Position Size: Determine your position size based on your risk percentage and stop-loss level.

- Monitoring Open Positions: Regularly review your open positions and adjust stop-losses if necessary (e.g., trailing stop).

- Record Keeping: Maintain a detailed trading journal documenting your trades, entries, exits, and the rationale behind your decisions.

Position Sizing Examples

Let’s illustrate position sizing with examples. Assume you have a $10,000 account and a 1% risk tolerance. You identify a trade with a stop-loss of 50 pips.

Example 1: If your account is $10,000 and you risk 1%, your maximum risk per trade is $

100. With a 50-pip stop-loss, your position size would be calculated as follows:

Position Size = (Risk Amount / Stop Loss in Pips)

- 10,000 = ($100 / 50 pips)

- 10,000 = 20,000 units

Example 2: Now, let’s say your stop-loss is 100 pips. Using the same 1% risk tolerance ($100):

Position Size = ($100 / 100 pips) – 10,000 = 10,000 units

This shows how a wider stop-loss necessitates a smaller position size to maintain the same risk level. Remember, these are simplified examples; actual calculations might involve adjustments for leverage and pip values of your specific currency pair.

Backtesting and Optimization

Backtesting is crucial for evaluating the effectiveness of your Forex trading strategy developed using Forex Factory data. It allows you to simulate your strategy’s performance on historical data, identifying potential strengths and weaknesses before risking real capital. This process helps refine your approach and increase your chances of success in live trading.

The backtesting process involves feeding your strategy’s rules (entry and exit signals based on Forex Factory indicators and price action) into a historical dataset. This dataset should cover a significant period, ideally encompassing various market conditions (bullish, bearish, sideways). The result will be a performance report showing key metrics like win rate, average win/loss, maximum drawdown, and overall profitability. This information is then used to optimize the strategy.

Backtesting Methodology

A common approach is to use trading platform backtesting tools or dedicated backtesting software. These tools allow you to input your trading rules and automatically test them against historical data. Manually backtesting, while more time-consuming, can offer a deeper understanding of your strategy’s behavior. Regardless of the method, accurate and reliable historical data is essential for meaningful results.

Consider using tick data for the most precise backtesting, though it’s more demanding computationally.

Strategy Optimization Techniques

Once backtesting is complete, you can begin optimizing your strategy. This often involves adjusting parameters within your trading rules. For example, if your strategy uses a moving average crossover, you might experiment with different moving average periods to find the optimal combination that maximizes profitability and minimizes risk. You could also refine your risk management parameters, such as stop-loss and take-profit levels, based on backtested results.

Another common approach is to adjust the filters used to identify your trading setups. Perhaps you find that adding a volume filter significantly improves performance. Systematic adjustments, carefully documented, are key.

Limitations of Backtesting and the Importance of Forward Testing

It’s critical to understand that backtesting has limitations. Historical performance is not necessarily indicative of future results. Market conditions change, and a strategy that performed well in the past may not perform well in the future. Over-optimization, where a strategy is tweaked to fit past data too closely, can lead to poor forward-testing results. Therefore, forward testing, where the strategy is tested on unseen data, is essential to validate its robustness.

This should be done with a smaller account, gradually increasing exposure as confidence builds.

Adjusting a Trading Strategy Based on Backtesting Results

Backtesting might reveal that your strategy struggles during specific market conditions, such as periods of high volatility or sideways trends. This information can guide you to adjust your strategy to better handle these scenarios. For instance, you might add additional filters to your entry rules to avoid trades during periods of high volatility, or you might adjust your position sizing to reduce risk during such times.

Alternatively, if your backtest shows a consistent pattern of losses in certain market conditions, you may decide to completely avoid trading during those times. The goal is to create a strategy that is both profitable and resilient to different market environments.

Mastering the art of using Forex Factory for high-probability setups is a journey, not a destination. By combining insightful data analysis with disciplined risk management and consistent backtesting, you can significantly improve your forex trading performance. Remember, the key is to develop a personalized strategy that integrates the diverse tools offered by Forex Factory, aligning with your trading style and risk tolerance.

Continuously refine your approach, and you’ll be well on your way to achieving greater success in the dynamic world of forex trading.