Using Forex Factory data for hedging and risk diversification opens up a world of opportunity for savvy traders. This guide will show you how to leverage Forex Factory’s wealth of information – from economic calendars and news sentiment to order book data – to build robust hedging strategies and diversify your forex portfolio effectively. We’ll explore practical applications, combining Forex Factory data with other analytical tools for a more comprehensive approach to risk management.

We’ll cover everything from understanding the different data types available on Forex Factory and how to interpret them for hedging purposes, to designing hypothetical strategies and examining real-world case studies. We’ll also address potential limitations and ethical considerations, ensuring you’re equipped with a complete understanding of this powerful tool.

Understanding Forex Factory Data for Hedging

Forex Factory is a treasure trove of information for traders, offering a range of data crucial for effective hedging strategies. By leveraging this data, traders can better anticipate market movements and mitigate potential losses. This section will explore how different Forex Factory data points contribute to a robust hedging approach.

Forex Factory Data Types Relevant to Hedging

Forex Factory provides several data types beneficial for hedging. These include the economic calendar, news sentiment analysis (often reflected in forum discussions and user comments), and various technical indicators derived from historical price data (though these are not directly sourced from Forex Factory itself, they can be used in conjunction with the data found there). Understanding how each data type contributes to your overall market outlook is key to effective hedging.

Using the Economic Calendar for Hedging Decisions

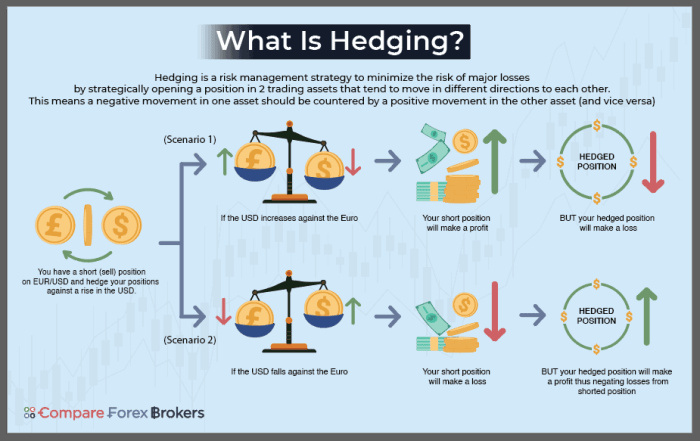

The Forex Factory economic calendar is a powerful tool. It lists upcoming economic announcements (like Non-Farm Payrolls or interest rate decisions) along with their expected impact. By anticipating potential market volatility surrounding these announcements, you can proactively adjust your positions. For example, if a high-impact event is expected to cause significant EUR/USD movement, you might consider hedging a long EUR/USD position by simultaneously taking a short position in a correlated currency pair, like EUR/JPY.

The calendar helps you time your hedging actions effectively.

Utilizing News Sentiment to Adjust Hedging Positions

Forex Factory’s news section and forums provide valuable insight into market sentiment. Analyzing user comments and discussions surrounding specific news events can reveal prevailing market opinions. If the sentiment surrounding a particular currency is overwhelmingly negative, despite positive economic data, it might suggest a potential short-term downward trend, prompting you to adjust your hedging strategy accordingly. For instance, if negative sentiment towards the British Pound is high despite a positive interest rate announcement, you might consider increasing your hedge on a long GBP/USD position or even consider a short GBP/USD position as a hedging strategy.

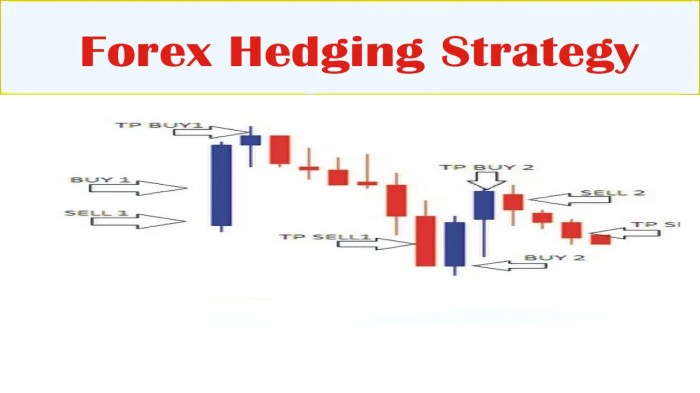

Hypothetical Hedging Strategy: EUR/USD

Let’s consider a hypothetical hedging strategy for the EUR/USD pair. Assume a trader holds a long EUR/USD position and anticipates a high-impact Eurozone economic announcement (e.g., inflation data). Using the Forex Factory economic calendar, they anticipate potential volatility. Based on the news sentiment from Forex Factory’s forums, the trader observes increased negativity surrounding the Euro. To hedge, the trader simultaneously opens a short position in EUR/USD, partially offsetting the risk of their long position.

Their exit strategy would involve closing both positions after the economic announcement, evaluating the market reaction and adjusting their overall EUR/USD exposure based on the outcome. The size of the hedge position would be determined by the trader’s risk tolerance and the anticipated volatility.

Comparison of Forex Factory Data for Hedging

| Data Point | Usefulness for Hedging | Strengths | Limitations |

|---|---|---|---|

| Economic Calendar | High | Provides advance warning of potential market-moving events. | Doesn’t predict the precise market reaction. |

| News Sentiment | Medium | Offers insight into market psychology and potential short-term trends. | Can be subjective and influenced by noise; requires careful interpretation. |

| Forum Discussions | Medium | Provides diverse perspectives and potential early warnings of market shifts. | Can be unreliable due to biased opinions and speculative comments. |

| Technical Indicators (external) | High (when used in conjunction with FF data) | Provides objective signals based on price action. | Can generate false signals and require expertise to interpret effectively. |

Forex Factory Data and Risk Diversification

Forex Factory offers a wealth of data that can significantly enhance your risk management strategies, particularly through diversification. By analyzing various aspects of the Forex market available on the platform, traders can build portfolios less susceptible to large swings caused by the volatility of individual currency pairs. This involves understanding correlation, liquidity, and the limitations of any single data source.

Identifying Less Correlated Currency Pairs

Forex Factory’s historical data, including charts and economic calendars, allows traders to assess the correlation between different currency pairs. Low correlation indicates that the price movements of two pairs are not strongly linked. By identifying pairs with low correlation coefficients (ideally close to zero or even negative), traders can construct a portfolio where the losses in one pair are less likely to be mirrored by losses in another.

For instance, a trader might compare the historical performance of EUR/USD and USD/JPY. If they show a low correlation, holding both could reduce overall portfolio volatility. Analyzing the data over different timeframes (daily, weekly, monthly) helps refine this analysis, revealing potential correlations that might only emerge over longer periods. Remember, correlation doesn’t guarantee independence, but it’s a crucial factor in effective diversification.

Forex Factory’s Order Book Data and Market Liquidity

Forex Factory’s order book data (where available) provides insights into market liquidity. High liquidity means that a large volume of buy and sell orders exist at various price levels, making it easier to enter and exit trades without significantly impacting the price. Diversification strategies benefit from focusing on liquid currency pairs because they offer lower slippage and better execution.

Low liquidity pairs can be riskier, especially during periods of high volatility, as it might be difficult to execute trades at desired prices. Therefore, analyzing order book depth on Forex Factory can help traders select pairs with sufficient liquidity to manage their positions effectively, thereby reducing the risk associated with illiquidity. This is especially critical during news events or periods of high market uncertainty.

Obtain access to The impact of geopolitical events on Forex Factory data and trading to private resources that are additional.

Diversification Strategies: Forex Factory vs. Other Data Sources

While Forex Factory provides valuable data, it’s crucial to acknowledge that it’s not the sole source of information for effective diversification. Other sources like Bloomberg Terminal, Refinitiv Eikon, or even central bank websites offer additional data points, such as economic indicators, political news, and sentiment analysis, which can complement the information gleaned from Forex Factory. Forex Factory excels at providing readily accessible market data and order book information (where offered), which is valuable for a quick assessment of liquidity and recent price action.

However, a holistic diversification strategy often requires integrating data from multiple sources to create a comprehensive view of the market. Relying solely on Forex Factory might provide a narrow perspective and potentially overlook crucial factors impacting currency movements.

Case Study: Successful Portfolio Diversification using Forex Factory Data

Imagine a trader using Forex Factory to analyze the historical performance and correlation of EUR/USD, USD/JPY, and GBP/USD. After identifying low correlation between EUR/USD and USD/JPY, they allocated 40% of their capital to EUR/USD and 40% to USD/JPY, hedging against potential losses in either pair. The remaining 20% was invested in GBP/USD, a moderately correlated pair, to achieve a balanced portfolio.

During a period of heightened market volatility triggered by unexpected economic news, the EUR/USD experienced a sharp decline. However, the USD/JPY rose, partially offsetting the losses. The GBP/USD remained relatively stable. By diversifying using Forex Factory’s data-driven approach, the trader mitigated the impact of the negative event on their overall portfolio. This is a simplified example, and actual results vary.

Risks Associated with Sole Reliance on Forex Factory Data

While Forex Factory offers valuable tools, over-reliance on its data for diversification carries several risks:

- Data Limitations: Forex Factory’s data might not encompass all relevant market information, leading to incomplete analysis.

- Lagging Indicators: The data presented may not be real-time, leading to potential delays in reacting to market changes.

- Bias and Inaccuracy: While generally reliable, any data source can contain errors or biases that could affect decision-making.

- Oversimplification: Correlation analysis is a useful tool, but it cannot fully capture the complexities of the Forex market.

- Ignoring Fundamental Analysis: Focusing solely on technical data from Forex Factory could neglect crucial fundamental factors impacting currency values.

Practical Applications

Forex Factory data, while powerful on its own, truly shines when integrated with other tools and techniques. Combining it with technical analysis, fundamental analysis, and backtesting methodologies allows for a more robust and nuanced approach to hedging and risk diversification in forex trading. This section explores practical ways to leverage Forex Factory’s information for enhanced trading strategies.

Integrating Forex Factory Data with Technical Analysis Indicators

Forex Factory provides valuable sentiment data, news announcements, and economic calendar information. This data can be used to confirm or contradict signals generated by technical indicators. For example, a bullish crossover on a moving average might be strengthened if Forex Factory shows a significant increase in bullish sentiment around the same time. Conversely, a bearish signal might be treated with caution if Forex Factory indicates positive economic news that could support the price.

Effective integration involves observing the confluence of technical and sentiment data. A strong divergence between technical signals and Forex Factory sentiment might indicate a potential reversal or a false signal. This approach helps filter out noise and improve the accuracy of trading decisions.

Using Forex Factory Data Alongside Fundamental Analysis

Fundamental analysis focuses on macroeconomic factors influencing currency pairs. Forex Factory’s economic calendar provides crucial data points for fundamental analysis. By cross-referencing Forex Factory’s news releases with fundamental forecasts, traders can anticipate market reactions. For example, a positive surprise in a non-farm payroll report (as announced on Forex Factory) could lead to a strengthening of the US dollar, which can be factored into trading strategies.

Conversely, a negative surprise might result in a weakening of the dollar. This integrated approach allows for more informed predictions of price movements based on both anticipated and actual economic events. Remember to always consider the potential impact of market sentiment, which is often reflected in Forex Factory’s various forums and discussions.

Backtesting Hedging and Diversification Strategies with Forex Factory Data

Backtesting allows traders to evaluate the historical performance of their strategies. Forex Factory’s historical data (available through archives and third-party tools) can be incorporated into backtesting software. For instance, a trader could backtest a hedging strategy that uses Forex Factory’s sentiment data to determine optimal entry and exit points for hedging trades. By comparing the performance of this strategy with a strategy that doesn’t utilize Forex Factory data, the trader can quantify the added value of integrating this information into their trading plan.

This rigorous testing helps to identify strengths and weaknesses, leading to continuous improvement. Remember to consider transaction costs and slippage when conducting backtests for realistic results.

Discover more by delving into Using Forex Factory to identify breakout trading opportunities further.

Flowchart Illustrating Forex Factory Data Integration

[Imagine a flowchart here. The flowchart would start with “Identify Trading Opportunity,” branching to “Check Forex Factory Calendar/News,” then to “Analyze Technical Indicators,” and “Analyze Fundamental Factors.” These would all converge at a “Decision Point” to either “Execute Trade” or “Do Not Execute Trade.” The “Execute Trade” branch would then lead to “Monitor Trade and Forex Factory Sentiment” and finally to “Close Trade.”] This flowchart demonstrates a systematic approach to incorporating Forex Factory data into the decision-making process.

It highlights the importance of considering multiple data sources before taking any trading action.

Using Forex Factory Data with Other Trading Platforms or Tools

Many trading platforms offer ways to integrate external data feeds. Forex Factory data can be incorporated using APIs or through manual data entry. For example, a trader using MetaTrader 4 or TradingView might manually input Forex Factory sentiment data into their charts to better interpret price action. Alternatively, some platforms might offer direct integration with Forex Factory’s economic calendar or news feeds.

This seamless integration improves the efficiency of the trading process, allowing for quicker reaction to market events and a more holistic view of the market dynamics. Remember to always verify the reliability of any third-party tools or APIs used to access Forex Factory data.

Limitations and Considerations of Using Forex Factory Data: Using Forex Factory Data For Hedging And Risk Diversification

Forex Factory, while a valuable resource for forex traders, isn’t without its limitations. Relying solely on its data for hedging and diversification strategies can be risky if you don’t understand its inherent flaws and potential biases. This section will highlight crucial aspects to consider before making significant trading decisions based on Forex Factory information.

Potential Biases and Inaccuracies in Forex Factory Data, Using Forex Factory data for hedging and risk diversification

Forex Factory data is crowdsourced, meaning it relies on contributions from various market participants. This introduces the possibility of inaccuracies and biases. For example, sentiment indicators might be skewed if a particular group of traders is more active in contributing than others, leading to an unrepresentative view of overall market sentiment. Similarly, news events reported on the forum could be interpreted differently by various users, potentially leading to conflicting signals.

These biases can significantly impact the effectiveness of hedging and diversification strategies based on this data, leading to inaccurate risk assessments and potentially poor trading decisions. The information presented is not always verified and should be treated as one data point among many.

Challenges of Using Real-Time Forex Factory Data for Hedging and Diversification

The real-time nature of Forex Factory data presents its own set of challenges. The speed at which information is posted and disseminated can be overwhelming, making it difficult to filter out noise and identify genuinely significant market movements. Furthermore, the rapid pace of information flow can lead to impulsive trading decisions, potentially undermining well-thought-out hedging and diversification strategies.

Successfully utilizing real-time data requires significant experience, discipline, and a robust risk management framework to avoid emotional trading based on fleeting market signals.

Importance of Risk Management When Employing Forex Factory Data for Trading Decisions

Effective risk management is paramount when using Forex Factory data. Because the data is not independently verified, relying on it exclusively exposes traders to heightened risk. Always cross-reference Forex Factory information with data from other reputable sources before making any trading decisions. Implement appropriate position sizing and stop-loss orders to limit potential losses. Diversify your trading strategies and don’t put all your eggs in one basket, even if Forex Factory data seems to suggest a particular market opportunity.

Regularly review and adjust your risk management plan based on market conditions and your trading performance. Remember, even the best strategies can fail, and responsible risk management is crucial for long-term success.

Ethical Considerations of Using Forex Factory Data for Trading

The ethical implications of using Forex Factory data should be carefully considered. Market manipulation, whether intentional or unintentional, is a serious offense. Using information from Forex Factory to artificially influence market prices, for example by spreading false or misleading information, is unethical and potentially illegal. Traders should always act with integrity and transparency in their trading activities, ensuring that their actions do not harm other market participants.

The principle of fair play and responsible trading should always guide the use of any market information, including data obtained from Forex Factory.

Factors to Consider Before Relying Heavily on Forex Factory Data for Hedging and Diversification

Before relying heavily on Forex Factory data for your hedging and diversification strategies, consider these factors:

- Data Verification: Always cross-reference information with multiple sources to verify accuracy and identify potential biases.

- Information Overload: Filter out noise and focus on genuinely significant market movements. Avoid impulsive decisions based on fleeting signals.

- Risk Management: Implement robust risk management strategies, including position sizing, stop-loss orders, and diversification.

- Emotional Discipline: Avoid emotional trading decisions based on speculative interpretations of data.

- Ethical Considerations: Ensure your trading practices align with ethical standards and avoid any actions that could be construed as market manipulation.

- Data Source Reliability: Understand the limitations of crowdsourced data and the potential for inaccuracies and biases.

- Alternative Data Sources: Supplement Forex Factory data with information from other reliable sources to gain a more comprehensive view of the market.

Advanced Strategies

Forex Factory offers a wealth of data beyond simple price charts. By understanding and strategically utilizing this information, traders can significantly enhance their hedging techniques and manage risk more effectively. This section explores advanced strategies leveraging Forex Factory data for specific hedging applications.

Currency Pair Hedging with Forex Factory Data

Forex Factory provides numerous tools to inform currency pair hedging. For instance, analyzing the economic calendar for announcements affecting specific pairs allows for preemptive hedging. If a major economic release is expected to negatively impact the EUR/USD, a trader might consider simultaneously buying USD/JPY, a potentially less volatile pair, to offset potential losses. Furthermore, sentiment indicators and news threads on Forex Factory can offer insights into market expectations, helping to refine hedging strategies.

A consistently negative sentiment surrounding the GBP, for example, could suggest a need for hedging GBP positions against a stronger currency like the CHF. Using Forex Factory’s data in this manner allows for a more nuanced approach to hedging, moving beyond simple correlation analysis.

Cross-Hedging Strategies Using Forex Factory Data

Cross-hedging involves using a related but not perfectly correlated asset to mitigate risk. Forex Factory’s data can greatly aid this process. For example, a trader heavily exposed to the Australian dollar (AUD) might use the New Zealand dollar (NZD) as a cross-hedge. While not perfectly correlated, both currencies are closely tied to commodity prices and global economic sentiment.

By monitoring economic news and sentiment indicators on Forex Factory related to both currencies, the trader can better assess the appropriate hedge ratio and timing. Analyzing the relative strength of the AUD and NZD based on Forex Factory’s data can help to optimize the hedge and minimize overall portfolio risk.

Hedging Against Interest Rate Risk with Forex Factory Data

Interest rate changes significantly impact currency values. Forex Factory’s central bank announcements and interest rate forecasts allow traders to anticipate these shifts. If a central bank is expected to raise interest rates, the corresponding currency often strengthens. A trader with significant exposure to a currency expected to weaken due to an interest rate cut can use Forex Factory data to identify potential hedging instruments, such as a currency anticipated to strengthen due to a rate hike elsewhere.

Monitoring interest rate swaps and forward contracts discussed in Forex Factory’s forums can further enhance the effectiveness of this hedging strategy.

Hedging Against Geopolitical Events Using Forex Factory Data

Geopolitical events often cause significant currency volatility. Forex Factory’s news section and forum discussions offer real-time insights into unfolding situations and their potential market impact. For instance, escalating tensions in a particular region could negatively impact currencies of countries in that region. By closely monitoring the news and sentiment on Forex Factory, a trader can identify potential risks and implement timely hedging strategies.

This might involve shorting the affected currency or using options to limit potential losses. Forex Factory’s discussions provide valuable context and perspective, allowing for more informed decision-making during periods of heightened geopolitical uncertainty.

Hedging Techniques and Forex Factory Data Suitability

| Hedging Technique | Forex Factory Data Used | Suitability | Example |

|---|---|---|---|

| Currency Pair Hedging | Economic Calendar, Sentiment Indicators, News Threads | High, for correlated pairs | Hedging EUR/USD exposure with USD/JPY before a major Eurozone announcement. |

| Cross-Hedging | Economic News, Sentiment Indicators, Correlation Analysis (though not directly from Forex Factory) | Medium, for related but not perfectly correlated assets | Hedging AUD exposure with NZD based on shared commodity price sensitivity. |

| Interest Rate Risk Hedging | Central Bank Announcements, Interest Rate Forecasts, Discussion Forums | High, for currencies sensitive to interest rate changes | Hedging a currency expected to weaken due to an interest rate cut by using a currency expected to strengthen due to a rate hike elsewhere. |

| Geopolitical Event Hedging | News Section, Forum Discussions, Geopolitical Risk Indicators (though not directly from Forex Factory) | High, for mitigating unexpected volatility | Hedging exposure to a currency affected by escalating regional tensions. |

Mastering the art of hedging and diversification is crucial for long-term success in forex trading. By effectively utilizing the data provided by Forex Factory, along with other analytical methods, you can significantly reduce your risk exposure and enhance your profitability. Remember to always prioritize risk management and continuously refine your strategies based on market dynamics and your own trading experience.

This guide provides a solid foundation; now it’s time to put your knowledge into practice!