Understanding the impact of news events on Forex Factory’s data is crucial for savvy forex traders. This guide explores how various news sources – from economic calendars to forum chatter – influence Forex Factory’s data and, consequently, currency movements. We’ll dissect how to analyze this data, spot trends, and even anticipate market shifts. Get ready to unlock the power of Forex Factory’s insights!

We’ll cover different data types available on Forex Factory, examining their reliability and timeliness. Then, we’ll delve into how specific news events—economic releases, political shifts, geopolitical tensions—impact forex prices, both immediately and long-term. We’ll show you how to use charts and other visualization tools to analyze this data effectively, including methods for sentiment analysis within Forex Factory’s discussion forums.

Finally, we’ll address the limitations of relying solely on Forex Factory data and emphasize the importance of a holistic approach to forex trading.

Data Sources and Types on Forex Factory: Understanding The Impact Of News Events On Forex Factory’s Data

Forex Factory is a popular resource for forex traders, offering a wealth of data beyond just price charts. Understanding the different data sources and their characteristics is crucial for interpreting the impact of news events on the forex market. This section will explore the key data types available on Forex Factory related to news events and how they can be used to gain insights.

Discover more by delving into Forex Factory’s role in managing trading psychology effectively further.

Data Sources on Forex Factory Related to News Events

Forex Factory provides several interconnected data sources that paint a comprehensive picture of market reactions to news. These sources offer varying degrees of timeliness, reliability, and scope, requiring careful consideration when making trading decisions. The primary sources include the economic calendar, news headlines, and the user forum.

Economic Calendar

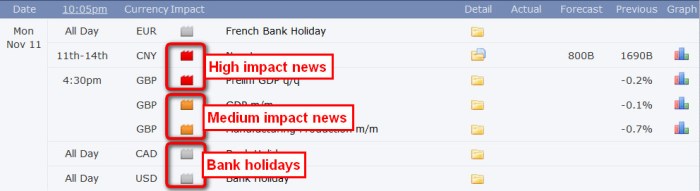

The economic calendar is a central feature, listing upcoming economic announcements and their expected impact. It displays the time of release, the country of origin, the specific data point (e.g., Non-Farm Payrolls, inflation rate), and often includes forecasts from various analysts. Its timeliness is high, as events are scheduled in advance, and the reliability depends on the source of the forecast data, but generally speaking, the information is quite reliable, especially the timing of announcements.

For example, the release of the US Non-Farm Payroll numbers is a major event consistently reflected on Forex Factory’s calendar. The data point here is the change in the number of jobs created, and its impact on the USD is often significant.

News Headlines

Forex Factory aggregates news headlines from various reputable sources, providing quick summaries of breaking economic and political news. The timeliness is extremely high, often providing almost instantaneous updates. However, the reliability depends on the source of the news; Forex Factory itself doesn’t verify the information. For instance, a surprise interest rate hike announced by a central bank would appear as a headline, followed by the market’s immediate reaction reflected in currency pairs.

Forum Discussions

The Forex Factory forum is a dynamic space where traders discuss news events and their interpretations. Timeliness is variable, ranging from immediate reactions to longer-term analyses. Reliability is low as it’s based on opinions and analyses of individual traders, and it’s crucial to distinguish between informed opinions and speculation. For example, a major geopolitical event could spark intense discussion and speculation about its effect on different currencies in the forum.

Data Source Comparison Table

The following table summarizes the key characteristics of each data source:

| Data Source | Data Type | Timeliness | Reliability |

|---|---|---|---|

| Economic Calendar | Scheduled economic announcements, forecasts | High | High (for timing; forecast reliability varies) |

| News Headlines | Breaking news summaries | Very High | Moderate (depends on news source) |

| Forum Discussions | Trader opinions, analyses | Variable | Low (subjective opinions) |

Impact of News Events on Forex Prices

News events significantly impact currency exchange rates, creating both short-term volatility and long-term shifts in market trends. Understanding these impacts is crucial for anyone involved in Forex trading or analysis. The Forex market, being a decentralized and globally interconnected system, reacts rapidly to information, making news analysis a key element of successful trading strategies.

Mechanisms of News Impact on Forex Rates

News influences currency values primarily through its effect on supply and demand. Positive news, such as unexpectedly strong economic data, tends to increase demand for a currency, pushing its value up. Conversely, negative news, like a surprise interest rate cut, can decrease demand and lower the currency’s value. This interplay of supply and demand is driven by market participants’ expectations and their subsequent actions.

For example, if a major central bank announces a hawkish monetary policy stance (suggesting higher interest rates), investors might anticipate higher returns on investments denominated in that currency, leading to increased demand and a stronger exchange rate. Conversely, news of political instability or a major economic downturn can trigger capital flight, weakening the affected currency.

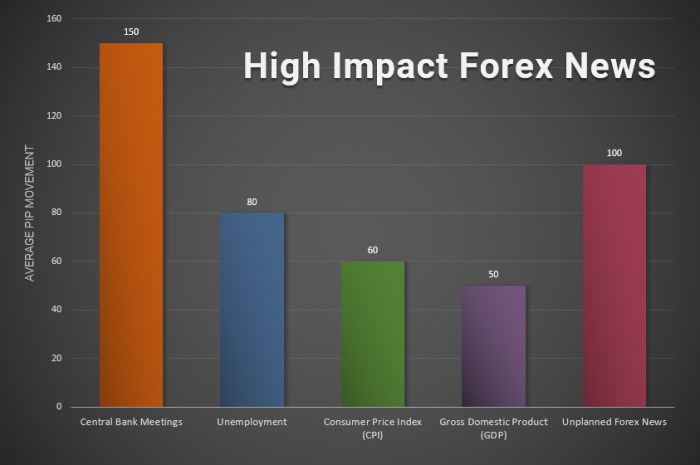

Market Reactions to Different News Types

Different types of news elicit varying market responses. Economic data releases (e.g., GDP growth, inflation rates, employment figures) often cause short-term, sharp movements. Political announcements, such as election results or policy changes, can have both immediate and prolonged effects, sometimes leading to significant volatility. Geopolitical events, like wars or terrorist attacks, can trigger dramatic and unpredictable shifts in currency values, depending on the perceived risk and global impact.

For example, the announcement of a significant trade deal might cause a surge in the value of the currencies involved, while news of a natural disaster could lead to a temporary weakening as investors assess the potential economic damage.

Immediate and Long-Term Impacts of News Events

The impact of news on Forex prices can be categorized by its duration and type. Immediate impacts are often short-lived, reflecting the initial market reaction. Long-term impacts, on the other hand, are more gradual and may reflect a fundamental shift in market sentiment or economic conditions.

- Short-term, positive impacts: A positive economic data release may cause a sharp increase in currency value, lasting for hours or days.

- Short-term, negative impacts: Unexpectedly weak economic data might lead to a quick decline in currency value, potentially recovering within a short timeframe.

- Long-term, positive impacts: A successful economic reform program might lead to sustained growth and a gradual appreciation of the currency over months or years.

- Long-term, negative impacts: A prolonged political crisis can trigger capital flight and a long-term depreciation of the currency.

It’s important to note that the magnitude and duration of these impacts are influenced by various factors, including the unexpectedness of the news, its economic significance, and prevailing market sentiment. Furthermore, the initial reaction may be reversed or amplified as more information becomes available and market participants adjust their positions.

Analyzing Forex Factory Data to Understand News Impact

Forex Factory provides a wealth of data, including news events and corresponding price movements, making it a valuable resource for analyzing the impact of news on the forex market. By combining news calendar information with the price charts and trader sentiment data available on the platform, we can effectively understand the relationship between specific news announcements and subsequent forex price fluctuations.

This analysis allows for a deeper understanding of market reactions and potentially improves trading strategies.

Identifying Correlations Between News Events and Forex Price Changes

To identify correlations, we first need to pinpoint the precise timing of news releases. Forex Factory’s calendar provides this information. Next, we examine price charts for the relevant currency pair around the time of the news release. A significant price movement immediately following the announcement suggests a strong correlation. We can further strengthen our analysis by comparing the price movement to the expected market reaction based on the news content.

For instance, positive economic data for a country might be expected to strengthen its currency, while negative news could weaken it. Discrepancies between the expected and actual reaction can highlight market sentiment and other influencing factors. A detailed comparison of the actual price movement against the anticipated movement provides a clear picture of the news impact.

Visualizing Correlations Using Charts and Graphs

Visualizations are crucial for understanding the complex interplay between news and price movements. A candlestick chart showing the price action around the news release time is essential. We should focus on the price change immediately before and after the news event. A significant price gap (a sudden jump or drop) at the news release time is a clear indicator of a strong impact.

Supplementing this with a volume chart can reveal whether the price movement was driven by significant trading activity. High volume accompanying the price change confirms the impact of the news. Another useful visualization is an overlay of the news event timing on the price chart, clearly marking the moment of the announcement and highlighting the subsequent price reaction.

This allows for a direct visual comparison between the two.

Hypothetical Scenario and Data Analysis

Let’s consider a hypothetical scenario: The US releases unexpectedly strong employment data. We expect the USD to strengthen against other currencies, particularly the EUR. To analyze this using Forex Factory data, we would first consult the news calendar to note the exact time of the release. Then, we would examine the EUR/USD candlestick chart, focusing on the price action around that time.

We would look for a sharp upward movement in the USD (a downward movement in the EUR/USD pair) immediately after the news. We’d also check the trading volume at that time to gauge the strength of the reaction. Finally, we would compare the actual price movement to the predicted movement based on the positive employment data. A stronger-than-expected price movement could indicate higher market confidence or other reinforcing factors.

Filtering and Processing Relevant Forex Factory Data

Forex Factory allows filtering data by currency pair, time frame, and news category. For our hypothetical scenario, we would filter the news calendar for US employment data. Then, we’d select the EUR/USD chart and set the time frame to include the news release time. We would examine the price action before and after the release, noting any significant price changes and volume spikes.

For instance, if the news was released at 14:30 GMT, we would analyze the chart data from, say, 14:00 GMT to 15:00 GMT to capture the immediate impact. We could also download the chart data to a spreadsheet for further analysis, calculating the percentage price change immediately following the news to quantify the impact. By comparing the filtered data to the expected market response, we can draw conclusions about the actual impact of the news event on the EUR/USD exchange rate.

Discover how Using Forex Factory to identify high-probability trading setups has transformed methods in this topic.

Sentiment Analysis and Forex Factory Data

Forex Factory, with its bustling forums and comment sections, offers a rich source of trader sentiment. Analyzing this sentiment can provide valuable insights into market expectations and potential price movements, complementing the raw price data already available. This section explores how to extract and interpret this sentiment, comparing it to actual market behavior.Extracting Sentiment from Forex Factory DataSentiment analysis on Forex Factory involves systematically processing textual data from forum discussions and news comments to gauge the overall prevailing opinion.

This can be done manually, though time-consuming, or by leveraging automated techniques. The process typically involves identifying s, phrases, and emotional cues associated with bullish or bearish sentiment, then aggregating these to create an overall sentiment score for a given news event or time period. For example, words like “bullish,” “buy,” “strong,” “uptrend” often indicate positive sentiment, while “bearish,” “sell,” “weak,” “downtrend” signal negative sentiment.

More sophisticated methods utilize Natural Language Processing (NLP) techniques to understand the context and nuances of language.Different Approaches to Sentiment AnalysisSeveral approaches exist for sentiment analysis. Lexicon-based methods rely on pre-defined dictionaries of words and their associated sentiment scores. These dictionaries assign numerical values (e.g., +1 for positive, -1 for negative, 0 for neutral) to words, allowing for a simple aggregation of sentiment across a text.

Machine learning techniques, however, offer a more sophisticated approach. These algorithms learn from labeled data (texts with pre-assigned sentiment scores) to identify patterns and predict sentiment in new, unseen text. They can often capture subtle nuances in language that lexicon-based methods miss. Finally, hybrid approaches combine lexicon-based and machine learning techniques to leverage the strengths of both.Comparing Forex Factory Sentiment with Market MovementsAfter analyzing the sentiment expressed on Forex Factory, a comparison with the actual market movements is crucial.

For instance, if a significant news event triggered overwhelmingly positive sentiment on Forex Factory, but the currency pair in question fell in value, it suggests other factors were at play. Conversely, if a negative sentiment on Forex Factory preceded a sharp price drop, it might indicate that the platform’s collective sentiment was a leading indicator of the market’s response.

This comparative analysis helps assess the predictive power of Forex Factory sentiment and refine the sentiment analysis methodology.Hypothetical Example of Sentiment Shift and Price ChangeImagine a hypothetical scenario involving the EUR/USD currency pair. Prior to a major European Central Bank (ECB) interest rate announcement, the Forex Factory forums show a predominantly bearish sentiment, with many traders expecting a rate cut and subsequent weakening of the Euro.

This negative sentiment is reflected in a decline in the number of bullish posts and an increase in bearish comments and predictions. After the announcement, the ECB unexpectedly hikes interest rates. This immediately reverses the sentiment on Forex Factory, with posts and comments quickly shifting to overwhelmingly bullish. The EUR/USD pair subsequently rises sharply, reflecting the rapid change in sentiment on the platform.

This example illustrates how sentiment on Forex Factory can both precede and reflect actual market movements.

Limitations and Considerations

Forex Factory, while a valuable resource, isn’t a perfect crystal ball. Its data, while plentiful, has inherent limitations that can skew your analysis of news events’ impact on forex prices. Understanding these limitations is crucial for interpreting the data accurately and avoiding misleading conclusions. We’ll explore the potential biases and the importance of incorporating other data sources for a more complete picture.Analyzing news impact solely through Forex Factory data can lead to an incomplete and potentially biased understanding.

The platform primarily reflects the sentiment and trading activity of its users, which may not represent the broader market accurately. This selective representation can significantly impact the conclusions drawn about the overall market reaction to specific news events. Furthermore, the data’s inherent limitations require careful consideration to avoid misinterpretations and inaccurate predictions.

Potential Biases in Forex Factory Data, Understanding the impact of news events on Forex Factory’s data

Forex Factory data is subject to several biases that can distort the true impact of news events. These biases stem from the platform’s user base and the nature of the data collected. For example, the platform’s user base might be skewed towards a particular trading style or geographical region, leading to an overrepresentation of certain viewpoints. Similarly, the timing of posts and comments can influence the perceived sentiment, as early reactions might be more volatile than later, more considered opinions.

This highlights the importance of considering the broader market context and utilizing multiple data sources to verify the information gleaned from Forex Factory.

Limitations of Relying Solely on Forex Factory Data

Relying solely on Forex Factory data for assessing news impact is inherently limited. The platform captures only a fraction of the global forex market’s activity. It predominantly reflects the opinions and trading activity of its registered users, which is not necessarily representative of institutional investors or other market participants. Therefore, conclusions drawn from Forex Factory data alone may not accurately reflect the overall market sentiment or the true impact of a news event on forex prices.

A comprehensive analysis necessitates a more holistic approach that incorporates data from various sources.

Importance of Incorporating Other Data Sources

To gain a comprehensive understanding of news impact on forex prices, it’s essential to supplement Forex Factory data with other reliable sources. Economic indicators, such as inflation rates, GDP growth, and unemployment figures, provide valuable context for interpreting market movements. Central bank statements and announcements offer direct insight into monetary policy decisions, which can significantly influence currency values. News articles from reputable financial sources offer a broader perspective on market sentiment and geopolitical events, helping to contextualize the data from Forex Factory.

Combining these various data sources creates a more robust and reliable analysis, mitigating the biases and limitations associated with relying on a single platform.

Potential Biases and Limitations of Forex Factory Data

- Sampling Bias: Forex Factory’s user base might not represent the entire forex market, leading to skewed sentiment analysis.

- Survivorship Bias: The data might overrepresent successful traders, potentially distorting the analysis of overall market trends.

- Self-Selection Bias: Users actively participating in forums might hold stronger opinions than the average trader, creating an echo chamber effect.

- Time-Based Bias: Early reactions on Forex Factory might be overly emotional and not reflect the long-term market impact of a news event.

- Limited Data Scope: Forex Factory data only reflects a small portion of the global forex market’s trading activity.

- Information Lag: There’s a potential delay between the release of news and its reflection on Forex Factory, affecting the timeliness of the analysis.

Mastering the art of interpreting Forex Factory data in conjunction with news events can significantly enhance your forex trading strategy. By understanding the nuances of data sources, recognizing market reactions, and employing effective analysis techniques, you can gain a valuable edge. Remember, while Forex Factory provides invaluable insights, it’s crucial to incorporate other data sources and remain aware of potential biases for a well-rounded perspective.

Now, go forth and analyze!