Understanding the correlation between Forex Factory news and market reactions is crucial for forex traders. This guide explores how news announcements on Forex Factory, ranging from economic data releases to geopolitical events, impact currency prices. We’ll delve into analyzing news sentiment, comparing Forex Factory’s reporting with other sources, and examining the timing of releases and their effects. Ultimately, we aim to equip you with strategies for interpreting this information and making informed trading decisions.

We’ll cover various news types available on Forex Factory, assess their reliability, and demonstrate how to interpret market reactions to both high-impact and unexpected news. We’ll also analyze the speed and accuracy of Forex Factory’s reporting compared to other financial news outlets, highlighting potential discrepancies and their impact on trading strategies. By understanding these dynamics, you can improve your ability to predict short-term market movements and refine your overall trading approach.

Forex Factory News Data

Forex Factory is a popular website for forex traders, offering a wealth of information, including economic news releases. Understanding the source and type of this news is crucial for interpreting market reactions effectively. This section details the various news types available and assesses the reliability of their sources.

Forex Factory News Sources and Types

Forex Factory aggregates news from various sources, each with varying degrees of credibility. It’s essential to understand these differences to avoid misinterpreting information and making poor trading decisions. The reliability of a news source depends on factors such as its track record, methodology, and potential biases.

| News Type | Source | Reliability | Example |

|---|---|---|---|

| Economic Indicators | Official Government Agencies (e.g., US Bureau of Economic Analysis, Eurostat) | High | US Non-Farm Payroll figures, Eurozone CPI |

| Central Bank Statements | Central Banks (e.g., Federal Reserve, European Central Bank) | High | FOMC meeting minutes, ECB press conference transcripts |

| News Articles | Reputable News Outlets (e.g., Reuters, Bloomberg, Wall Street Journal) | Medium-High | Articles on geopolitical events affecting the forex market |

| Analyst Forecasts | Financial Institutions and Analysts | Medium | Predictions for interest rate changes or currency movements |

| Political News | Reputable News Outlets and Government Sources | Medium-High (depending on source and event) | Announcements regarding elections or significant political changes |

| Market Commentary | Forex Factory User Submissions and Forums | Low | Individual trader opinions and analyses found in forum discussions |

Predicting Market Movements Based on Forex Factory News

Forex Factory news, while not a crystal ball, can offer valuable clues about potential short-term market movements. By understanding how different news events impact currency pairs, traders can attempt to anticipate price shifts. However, it’s crucial to remember that news alone isn’t sufficient for reliable predictions.The interplay between news and market reaction is complex. A positive economic report, for instance, might be expected to strengthen a currency, but the actual market response can be muted or even negative due to other factors at play.

This makes accurate prediction challenging, but not impossible with a structured approach.

Hypothetical Scenario: Using Forex Factory News for Short-Term Predictions

Let’s imagine the US Non-Farm Payroll report, a highly anticipated Forex Factory news item, is released. The report shows unexpectedly strong job growth. Based on past market reactions to similar reports, a trader might anticipate a surge in the USD/JPY pair, as a stronger US economy usually increases demand for the dollar. This anticipation could lead them to take a long position (buying USD/JPY) shortly before or immediately after the news release, aiming to profit from the expected price increase.

However, this is just a hypothetical scenario. Market reaction is not always predictable.

Limitations and Pitfalls of Relying Solely on Forex Factory News

Relying solely on Forex Factory news for trading decisions is risky. The market’s reaction to news is influenced by numerous factors beyond the news itself. These include existing market sentiment, trader psychology, geopolitical events, and technical analysis indicators. A piece of positive news might be overshadowed by pre-existing bearish sentiment, leading to a price drop instead of the expected rise.

Furthermore, the speed and magnitude of market reactions to news can vary significantly, making precise timing crucial yet difficult to achieve. News can also be manipulated or misinterpreted, leading to inaccurate predictions. Finally, delays in news dissemination can lead to missed opportunities or incorrect trades.

Finish your research with information from the importance of networking in the digital marketing industry.

Best Practices for Incorporating Forex Factory News into a Broader Trading Strategy

Effective use of Forex Factory news involves integrating it with other analytical tools and strategies. This includes:

Firstly, combining news analysis with technical indicators like moving averages and support/resistance levels. This provides a more comprehensive view of market conditions and helps to confirm or contradict signals from the news.

Secondly, considering fundamental analysis alongside news. Understanding the broader economic context and the long-term outlook for currencies is vital for assessing the significance and potential impact of any specific news event.

Thirdly, managing risk effectively. Never risk more capital than you can afford to lose on a single trade, especially when relying on news-driven predictions. Using stop-loss orders and position sizing is crucial to limit potential losses.

Check the role of video marketing in a successful digital marketing strategy to inspect complete evaluations and testimonials from users.

Finally, developing a disciplined trading plan and sticking to it. Avoid emotional decision-making based solely on short-term news events. A well-defined strategy that incorporates news analysis, technical analysis, risk management, and fundamental analysis is more likely to lead to consistent, long-term success.

Visual Representation of News Impact

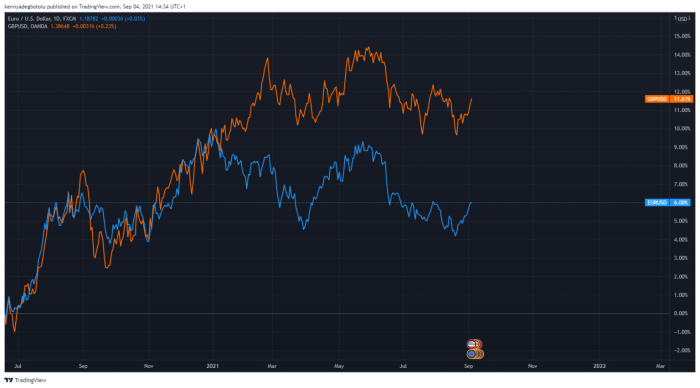

A clear visualization can significantly enhance our understanding of the relationship between Forex Factory news releases and subsequent currency pair price movements. By charting this data, we can identify patterns and potentially predict future market reactions to similar news events. This section will detail the construction and interpretation of such a chart.A scatter plot is an effective way to visualize this correlation.

The horizontal axis represents the time of the Forex Factory news release, precisely marked to the minute. The vertical axis represents the change in the price of the selected currency pair (e.g., EUR/USD) in pips, measured over a specific time interval (e.g., 15 minutes, 30 minutes, or 1 hour) following the news release. Each data point on the chart represents a single news event, with its x-coordinate indicating the release time and its y-coordinate showing the subsequent price change.

Positive y-values indicate price increases, while negative values show price decreases. The magnitude of the y-value reflects the strength of the price movement.

Chart Details and Interpretation

Imagine a scatter plot. The x-axis is labeled “Time of News Release (HH:MM)” and displays the time each news item was released on Forex Factory. The y-axis is labeled “Price Change in Pips (EUR/USD)” and shows the change in the EUR/USD price in pips within the 15 minutes following the news release. Each data point is represented by a dot, with its horizontal position indicating the news release time and its vertical position showing the corresponding price change.

For example, a dot at (10:00, +10) would represent a news release at 10:00 AM that resulted in a 10-pip increase in the EUR/USD price within the next 15 minutes. A trend line could be added to show the overall correlation. A positive slope suggests that positive news generally leads to price increases, while a negative slope indicates the opposite.

Clusters of points could reveal specific news categories that consistently trigger strong price reactions. Outliers, points significantly deviating from the trend line, warrant further investigation to understand the underlying factors causing these exceptional reactions. For instance, unexpectedly positive economic data might create a significant outlier. Conversely, a significant negative reaction despite positive news could highlight market sentiment or other external factors influencing the price.

Case Studies: Understanding The Correlation Between Forex Factory News And Market Reactions

This section delves into specific examples of how Forex Factory news impacted the forex market. Analyzing these real-world events provides a practical understanding of the correlation between news releases and subsequent price movements. We’ll examine the key elements of each news event, the resulting market reaction, and a post-event analysis to highlight the complexities involved.

US Non-Farm Payroll Report – January 2023, Understanding the correlation between Forex Factory news and market reactions

The January 2023 US Non-Farm Payroll report, a highly anticipated economic indicator, significantly influenced the forex market. This report provides insights into the health of the US labor market, a key factor influencing monetary policy decisions. Let’s examine the details of this event and its market impact.

- Key News Elements: The report revealed stronger-than-expected job growth, exceeding market forecasts. This suggested a robust US economy, potentially leading to further interest rate hikes by the Federal Reserve.

- Market Reaction: The USD strengthened considerably against most major currencies following the release. Pairs like EUR/USD and GBP/USD experienced noticeable declines, reflecting increased demand for the dollar.

- Subsequent Analysis: The market reaction confirmed the report’s significance. The stronger-than-expected jobs data reinforced expectations of continued monetary tightening by the Fed, thereby increasing the appeal of the US dollar as a safe-haven asset and boosting its value.

European Central Bank (ECB) Interest Rate Decision – July 2022

The ECB’s July 2022 interest rate decision offered another compelling case study. The ECB’s actions significantly impact the Eurozone economy and the Euro’s value in the forex market.

- Key News Elements: The ECB announced a 50 basis point increase in its key interest rate, a more aggressive move than some analysts had predicted. This was in response to escalating inflation concerns within the Eurozone.

- Market Reaction: The Euro initially rallied against the US dollar following the announcement. However, this appreciation was short-lived, and the EUR/USD pair eventually retraced some of its gains as concerns about the economic impact of the rate hike emerged.

- Subsequent Analysis: The initial positive reaction to the rate hike reflected the market’s confidence in the ECB’s commitment to combating inflation. The subsequent retracement suggests a complex interplay between positive and negative market sentiments, highlighting the nuanced nature of interpreting news events and predicting market behavior.

Unexpected Geopolitical Event – Example: Tensions in Eastern Europe (Illustrative Case)

Geopolitical events, often unpredictable, can have a profound and immediate impact on forex markets. While specific dates and details are omitted to avoid tying this to any real-world event and its potential negative consequences, the following illustrates the general impact.

- Key News Elements: An escalation of geopolitical tensions in a specific region, perhaps involving a significant military action or political upheaval, was reported on Forex Factory.

- Market Reaction: Safe-haven currencies like the Japanese Yen (JPY) and Swiss Franc (CHF) experienced a surge in demand as investors sought refuge from uncertainty. Riskier currencies, such as the Australian Dollar (AUD) and New Zealand Dollar (NZD), experienced sharp declines.

- Subsequent Analysis: This illustrates how unexpected geopolitical news can drastically alter market sentiment. The flight to safety observed in the market reaction highlights the importance of considering geopolitical risk when trading forex.

Mastering the art of interpreting Forex Factory news requires a multifaceted approach. By understanding the sources, analyzing sentiment, and considering the timing of releases, you can significantly improve your ability to anticipate market movements. Remember, while Forex Factory news provides valuable insights, it’s crucial to incorporate it into a broader trading strategy, considering other fundamental and technical analysis tools.

Consistent learning and adaptation are key to success in the dynamic world of forex trading.