Understanding the concept of blockchain consensus algorithms. – Understanding the concept of blockchain consensus algorithms is crucial for grasping how cryptocurrencies and other blockchain applications function. These algorithms are the backbone of blockchain’s security and efficiency, ensuring that all participants agree on the state of the ledger. We’ll explore various consensus mechanisms, from the energy-intensive Proof-of-Work to the more efficient Proof-of-Stake and beyond, examining their strengths, weaknesses, and real-world applications.

Get ready to dive into the fascinating world of distributed consensus!

This exploration will cover the fundamental need for consensus, the challenges it addresses, and a detailed comparison of several prominent algorithms. We’ll delve into the mechanics of each, analyze their security and scalability, and discuss their energy consumption. By the end, you’ll have a solid understanding of how these algorithms shape the future of blockchain technology.

Introduction to Blockchain Consensus Mechanisms

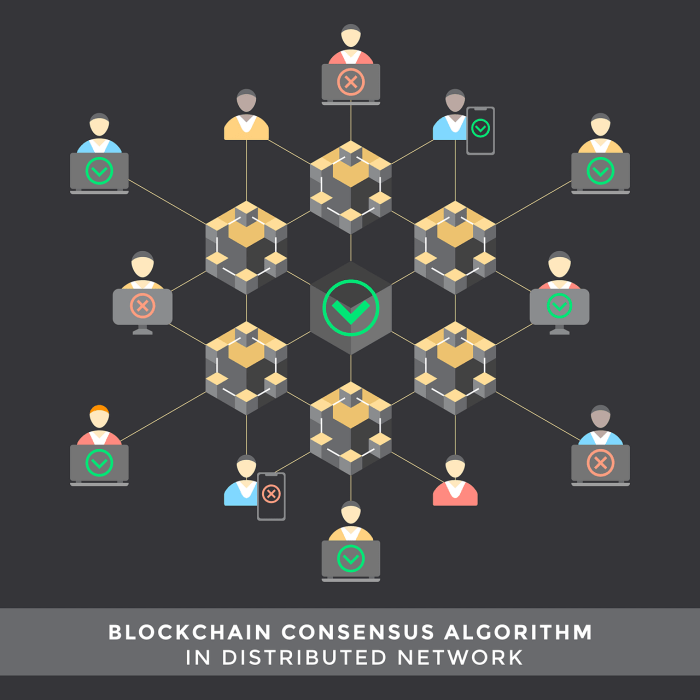

Blockchains, at their core, are distributed ledgers. This means many computers across a network hold a copy of the same data. However, to maintain data integrity and prevent manipulation, a system is needed to ensure everyone agrees on the valid state of the ledger. This is where consensus mechanisms come in. They’re the crucial glue that holds a blockchain together, ensuring its security and reliability.

The Fundamental Need for Consensus in Blockchain

The primary need for consensus stems from the decentralized and trustless nature of blockchains. Unlike traditional databases managed by a central authority, a blockchain has no single point of control. To add a new block of transactions to the chain, all (or a significant majority of) participants must agree that the block is valid. Without a consensus mechanism, the blockchain would be vulnerable to attacks like double-spending (spending the same digital asset twice) and would lose its integrity.

The process ensures that every node (computer) in the network agrees on the single, true version of the blockchain’s history.

Challenges Addressed by Consensus Mechanisms

Consensus mechanisms face several significant challenges:* Security: Protecting the blockchain from malicious actors who might try to alter the transaction history or introduce fraudulent blocks.

Scalability

Handling a large number of transactions efficiently without compromising speed or security. As more users join the network, the system needs to adapt to the increased load.

Energy Consumption

Some consensus mechanisms are computationally intensive and require significant energy resources, raising environmental concerns.

Fault Tolerance

The ability to continue functioning correctly even if some nodes in the network fail or act maliciously.

Overview of Consensus Mechanism Categories

Consensus mechanisms can be broadly categorized into several types, each with its own strengths and weaknesses. These categories aren’t mutually exclusive, and some mechanisms might blend features from multiple categories. Broadly, we can group them into:* Proof-of-Work (PoW)-based: These mechanisms require nodes to solve complex computational puzzles to validate transactions and add new blocks to the chain. This makes it computationally expensive for attackers to manipulate the blockchain.

Proof-of-Stake (PoS)-based

Instead of relying on computational power, PoS mechanisms use the amount of cryptocurrency a node holds as a measure of its stake in the network. Nodes with a larger stake have a higher probability of validating transactions and adding new blocks.

Practical Byzantine Fault Tolerance (PBFT)-based

PBFT is a family of algorithms designed to reach consensus in a distributed system even in the presence of malicious nodes. They often require a smaller number of nodes than PoW or PoS, making them more suitable for private blockchains.

Discover more by delving into The potential of blockchain technology to transform the real estate industry. further.

Hybrid Consensus Mechanisms

These mechanisms combine elements from different approaches, aiming to leverage the strengths of each while mitigating their weaknesses. This is a growing area of research and development.

Comparison of Consensus Mechanisms

| Algorithm | Security | Scalability | Energy Consumption |

|---|---|---|---|

| Proof-of-Work (PoW) | High (due to computational cost) | Low (limited transaction throughput) | Very High (significant energy usage) |

| Proof-of-Stake (PoS) | High (but potentially vulnerable to “staking attacks”) | Medium to High (higher throughput than PoW) | Low (significantly less energy than PoW) |

| Practical Byzantine Fault Tolerance (PBFT) | High (if implemented correctly) | Low (limited to a relatively small number of nodes) | Low |

| Delegated Proof-of-Stake (DPoS) | Medium (vulnerable to attacks if delegates are compromised) | Medium to High (can handle more transactions than PBFT) | Low |

Proof-of-Work (PoW): Understanding The Concept Of Blockchain Consensus Algorithms.

Proof-of-Work (PoW) is a consensus mechanism that secures a blockchain by requiring miners to expend computational power to solve complex cryptographic puzzles. The first miner to solve the puzzle gets to add the next block of transactions to the blockchain and is rewarded with newly minted cryptocurrency. This process ensures the integrity and security of the blockchain.The PoW algorithm operates through a competitive mining process.

Miners use specialized hardware to repeatedly guess solutions to a cryptographic hash function. This function takes the block’s data (transactions, timestamp, previous block’s hash) as input and produces a hash value. The goal is to find a hash that meets a specific target, which is determined by the network’s difficulty. The first miner to find a valid hash broadcasts it to the network, and if validated by other nodes, the block is added to the blockchain.

Mining Process Details

The mining process involves iteratively trying different inputs (nonce values) to the hash function until a valid hash is found. This is computationally intensive and requires significant energy consumption. The process is essentially a race, with the miner who has the most computational power having a higher probability of winning the race and adding the next block to the chain.

The reward for winning includes newly minted cryptocurrency and transaction fees. The difficulty of the puzzle dynamically adjusts to maintain a consistent block generation time, ensuring the network remains stable and secure.

Strengths and Weaknesses of PoW

PoW offers strong security due to the significant computational power required to alter the blockchain. Attacking a PoW blockchain would necessitate controlling a majority of the network’s hashing power, which is economically and practically infeasible for large, established networks. However, PoW’s significant energy consumption is a major drawback. The energy used for mining is substantial and raises environmental concerns.

This high energy consumption also leads to increased operational costs for miners.

Examples of PoW Blockchains

Bitcoin, the most well-known cryptocurrency, utilizes PoW. Other prominent examples include Litecoin, Ethereum (prior to the merge to PoS), and Dogecoin. These blockchains rely on a vast network of miners to maintain their security and operational integrity.

Mining Difficulty Adjustment

The mining difficulty is a measure of how difficult it is to find a valid hash. It is adjusted periodically based on the network’s hash rate (the total computational power of all miners). If the hash rate increases, the difficulty is adjusted upward, making it harder to find a valid hash and maintaining the target block generation time.

Conversely, if the hash rate decreases, the difficulty is adjusted downward, making it easier to find a valid hash. This dynamic adjustment ensures a consistent block generation time, typically around 10 minutes for Bitcoin, preventing network congestion or instability. This self-regulating mechanism is crucial for the long-term stability and scalability of PoW blockchains.

Proof-of-Stake (PoS)

Proof-of-Stake (PoS) is a consensus mechanism that offers a more energy-efficient alternative to Proof-of-Work. Instead of relying on miners competing to solve complex mathematical problems, PoS selects validators based on the amount of cryptocurrency they “stake,” essentially locking up as collateral. This staked cryptocurrency acts as a guarantee of their honest participation in the network. The more cryptocurrency a validator stakes, the higher their chance of being selected to validate transactions and create new blocks.

Core Principles of PoS

PoS operates on the principle that validators with a larger stake have a proportionally greater influence on the network’s validation process. This is achieved through stake weighting, where the probability of a validator being selected is directly proportional to the amount of cryptocurrency they have staked. Validator selection is typically randomized but weighted to favor those with larger stakes.

This incentivizes validators to act honestly, as losing their stake would be a significant penalty for malicious behavior. The system relies on the assumption that validators will act in the best interest of the network to protect their investment.

Comparison of PoS and PoW

PoW and PoS differ significantly in their energy consumption and security models. PoW, as we’ve seen, relies on computationally intensive mining, leading to substantial energy expenditure. PoS, on the other hand, requires significantly less energy because it eliminates the need for this competitive mining process. Regarding security, both mechanisms offer a degree of security. PoW’s security relies on the massive computational power required to attack the network, while PoS’s security depends on the economic incentive for validators to act honestly; losing their stake is a significant deterrent.

The relative security of each mechanism is a subject of ongoing debate and research.

Variations of PoS

Several variations of PoS exist, each with its own approach to validator selection and reward distribution. Delegated Proof-of-Stake (DPoS) allows users to delegate their staking power to chosen validators, effectively increasing the influence of those chosen representatives. Liquid Proof-of-Stake (LPoS) aims to improve liquidity by allowing staked tokens to be used in other applications, while still maintaining their role in securing the network.

These variations represent attempts to address limitations or improve the efficiency and usability of the basic PoS model.

Illustrative Example of PoS Transaction Processing, Understanding the concept of blockchain consensus algorithms.

Imagine a simplified PoS system with three validators: Alice, Bob, and Carol. Alice has staked 100 coins, Bob 50 coins, and Carol 25 coins. A transaction needs to be validated. The system randomly selects a validator, but the probability is weighted by the stake. Alice has a 50% chance (100/200), Bob a 25% chance (50/200), and Carol a 25% chance (25/200).

Let’s say Alice is selected. She validates the transaction, adds it to a new block, and broadcasts the block to the network. Other validators verify the block’s validity and add it to their respective copies of the blockchain. Alice receives a reward for successfully validating the transaction and creating the block, further incentivizing her honest participation. If Alice were to attempt a malicious action, she risks losing her staked 100 coins.

Practical Byzantine Fault Tolerance (PBFT)

PBFT is a state machine replication algorithm designed to achieve consensus in a distributed system even in the presence of malicious or faulty nodes. Unlike PoW and PoS, which rely on probabilistic approaches to ensure consensus, PBFT uses a deterministic approach, making it highly reliable in achieving agreement among honest nodes. It’s particularly well-suited for situations requiring high levels of fault tolerance and deterministic finality, although it does come with some significant trade-offs.PBFT operates by having a designated primary node that proposes new transactions or blocks.

All other nodes, known as replicas, verify the proposal and then vote on its acceptance. The algorithm ensures that only valid transactions are committed, even if a significant portion of the nodes are Byzantine (i.e., malicious or faulty). Its fault tolerance is remarkable; it can withstand up to ⅓ of the nodes being faulty and still reach consensus.

This is achieved through a rigorous process of message passing and voting, ensuring that honest nodes can identify and ignore malicious input.

PBFT Algorithm Operation

PBFT’s core functionality centers around three phases: request, pre-prepare, and commit. A client initiates a request, which is then processed by the primary node. The primary node broadcasts a pre-prepare message containing the request and a sequence number. Replicas then verify the message and broadcast prepare messages if the request is valid. Finally, if a sufficient number of prepare messages are received, the replicas broadcast commit messages, and the transaction is considered committed.

The system maintains a state machine, ensuring that all honest nodes have a consistent view of the system’s state after each consensus round. This deterministic approach ensures that all honest nodes agree on the same transaction order.

PBFT Scalability Limitations

The major drawback of PBFT is its poor scalability. The number of messages exchanged in each consensus round grows quadratically with the number of nodes in the system. This means that as the network grows, the communication overhead becomes incredibly high, leading to significant performance degradation. This quadratic growth makes it impractical for large-scale systems like public blockchains where thousands or millions of nodes are involved.

In contrast, PoW and PoS scale better, albeit with different trade-offs in terms of security and energy consumption.

PBFT Performance Compared to PoW and PoS

Compared to PoW and PoS, PBFT exhibits significantly lower transaction throughput and higher latency. PoW and PoS, while susceptible to different types of attacks, can handle a much larger number of transactions per second. The deterministic nature of PBFT, while providing high reliability, introduces a significant performance bottleneck. The need for every node to communicate with every other node during each round severely restricts its ability to scale.

When investigating detailed guidance, check out The potential use of blockchain technology in healthcare data management. now.

Real-world implementations of PBFT are generally limited to systems with a relatively small number of nodes, often in private or permissioned blockchain networks. Public blockchains, with their vast number of nodes, require the more scalable, albeit less deterministic, approaches of PoW and PoS.

Step-by-Step Description of a PBFT Consensus Round

Let’s illustrate a single PBFT consensus round with four nodes (N1, N2, N3, N4), where N1 is the primary node. Assume a client submits a transaction request.

1. Request

The client sends a transaction request to the primary node (N1).

2. Pre-prepare

N1 assigns a sequence number to the transaction and broadcasts a pre-prepare message to all replicas (N2, N3, N4) including the transaction and sequence number.

3. Prepare

N2, N3, and N4 independently verify the pre-prepare message (checking the sequence number and the transaction’s validity). If valid, they broadcast a prepare message to all other nodes.

4. Commit

If N1 receives at least 2f+1 prepare messages (where f is the maximum number of faulty nodes, in this case, f=1, so 2f+1 = 3), it broadcasts a commit message to all replicas.

5. Reply

N2, N3, and N4, upon receiving at least 2f+1 commit messages, apply the transaction to their local state machine and send a reply to the client.This process ensures that even if one node is Byzantine, the honest nodes will still reach consensus and commit the valid transaction. The system’s resilience stems from the requirement for a supermajority (2f+1) of nodes to agree before a transaction is finalized.

Delegated Proof-of-Stake (DPoS)

Delegated Proof-of-Stake (DPoS) is a consensus mechanism that aims to improve upon the efficiency and scalability of Proof-of-Stake (PoS) by introducing a layer of delegation. Instead of all token holders validating transactions, DPoS allows token holders to vote for delegates who will validate transactions on their behalf. This system aims to create a more democratic and efficient blockchain network.DPoS works by allowing token holders to vote for a set number of delegates.

These delegates are responsible for validating transactions and proposing new blocks. The delegates with the most votes are selected to become block producers, and they receive rewards for their work. The voting mechanism typically involves locking up a certain amount of tokens to cast a vote, weighting votes proportionally to the number of tokens held. This incentivizes participation and ensures that delegates are accountable to the token holders.

DPoS Voting Mechanisms

The voting process in DPoS varies across different implementations, but generally involves token holders locking up their tokens to vote for their preferred delegates. The weight of a vote is usually proportional to the number of tokens locked. Some systems allow for ranked-choice voting, enabling more nuanced expression of preferences. Regular voting rounds allow token holders to change their votes, ensuring that the delegates remain accountable to the community.

This dynamic system aims to prevent the concentration of power in the hands of a few delegates.

Advantages and Disadvantages of DPoS

DPoS offers several advantages over other consensus mechanisms. It is generally considered more efficient and scalable than PoW, requiring less computational power. It also tends to be more energy-efficient. The delegated nature of the system can also lead to greater participation from the community, as token holders can influence the network’s governance without needing to run a node.However, DPoS also has its drawbacks.

The concentration of power in the hands of a relatively small number of delegates raises concerns about centralization and potential for collusion. The possibility of a small group of powerful delegates dominating the network poses a risk to the decentralization and security of the system. Furthermore, the voting process itself can be susceptible to manipulation if not carefully designed.

Examples of Blockchains Using DPoS

Several prominent blockchains utilize the DPoS consensus mechanism. EOS, a blockchain platform focused on decentralized applications (dApps), is a notable example. Lisk, another blockchain platform, also employs DPoS. These examples demonstrate the practical application of DPoS in real-world blockchain projects. It’s important to note that the specific implementation and parameters of DPoS can vary significantly between different blockchains.

Key Steps in a DPoS Consensus Round

The following steps Artikel a typical DPoS consensus round:

- Token Holders Vote: Token holders stake their tokens to vote for delegates they wish to represent them.

- Delegate Selection: Delegates with the most votes are selected as block producers. The number of selected delegates varies depending on the specific DPoS implementation.

- Block Production: Selected delegates take turns producing blocks, adding validated transactions to the blockchain.

- Block Validation: Other delegates verify the validity of the proposed blocks. This helps to maintain the integrity of the blockchain.

- Reward Distribution: Block producers receive rewards for their work, typically in the form of newly minted tokens or transaction fees.

- Regular Voting Rounds: The voting process is repeated at regular intervals, allowing token holders to change their votes and ensuring the accountability of delegates.

Other Consensus Mechanisms

Beyond the widely-used Proof-of-Work and Proof-of-Stake, several other consensus mechanisms offer unique approaches to securing and validating blockchain transactions. These alternatives often cater to specific needs or address limitations present in the more established methods. Understanding these variations is crucial for appreciating the breadth of blockchain technology and its adaptability to diverse applications.

Proof-of-Authority (PoA)

Proof-of-Authority relies on the identity and reputation of validators rather than computational power or staked tokens. In a PoA system, pre-selected validators, often organizations or individuals with established credibility, are responsible for verifying and adding new blocks to the blockchain. This approach prioritizes trust and efficiency, reducing the energy consumption associated with PoW. The key characteristic of PoA is its reliance on a trusted set of validators.

This makes it suitable for private or permissioned blockchains where identity verification is straightforward and a smaller, more controlled network is desired. For example, a supply chain management blockchain might leverage PoA to ensure only authorized participants can validate transactions, maintaining data integrity and confidentiality. The choice of PoA impacts the overall design by simplifying the validation process and potentially reducing transaction fees, but it introduces a centralization risk if the authority is compromised.

Proof-of-History (PoH)

Proof-of-History uses a verifiable, chronologically ordered sequence of events as the basis for consensus. Instead of relying on a distributed network to agree on the order of transactions, PoH utilizes a cryptographic hash function to create a chain of timestamps, proving the order of events without the need for extensive communication between nodes. This makes it exceptionally efficient and highly scalable.

A key characteristic is its ability to generate a verifiable, sequential record of events, making it ideal for applications requiring high throughput and low latency, such as microtransaction systems or IoT data logging. In comparison to PoW or PoS, PoH simplifies consensus, reducing the complexity and energy consumption of the network. The impact on blockchain design is significant, as it allows for the creation of highly performant systems that can handle a large volume of transactions quickly and efficiently.

Raft

Raft is a consensus algorithm designed for distributed systems, focusing on simplicity and ease of implementation compared to more complex protocols. It elects a leader node responsible for coordinating the replication of log entries across the network. This leader manages the addition of new blocks to the blockchain, ensuring consistency and fault tolerance. The key characteristics of Raft are its relative simplicity and focus on leader election and log replication.

It’s well-suited for applications requiring strong consistency and fault tolerance in a distributed environment. While not explicitly a blockchain consensus mechanism, Raft’s principles can be adapted and applied within blockchain architectures, particularly in scenarios where a high level of reliability and ease of implementation are prioritized over decentralization. The choice of Raft can influence the network’s design by simplifying the implementation of consensus and improving the overall resilience to node failures.

However, it might be less suitable for highly decentralized applications where the leader’s authority could become a single point of failure.

Blockchain consensus algorithms are the unsung heroes of the decentralized world. From the computationally expensive Proof-of-Work to the more energy-efficient Proof-of-Stake and its variations, each mechanism offers a unique approach to achieving consensus and securing the blockchain. Understanding these algorithms is key to comprehending the strengths and limitations of different blockchain platforms, and anticipating the innovative solutions that will undoubtedly emerge in the future of this rapidly evolving field.

The journey into the heart of blockchain’s consensus mechanisms is just the beginning of a deeper understanding of this revolutionary technology.