Understanding the biases present in Forex Factory data is crucial for anyone relying on its information for forex trading decisions. Forex Factory, while a popular resource, isn’t immune to the inherent biases found in any data collection and presentation system. This exploration dives into the various sources of bias, from user-generated content and data visualization choices to algorithmic processes and geopolitical influences, equipping you to critically assess the information you find there.

We’ll examine how Forex Factory’s data collection methods, user contributions, and data presentation techniques can shape the overall narrative, potentially leading to skewed perceptions of market trends. By understanding these biases, you can make more informed trading choices and avoid costly mistakes based on misinterpreted information.

Presentation and Interpretation of Data: Understanding The Biases Present In Forex Factory Data

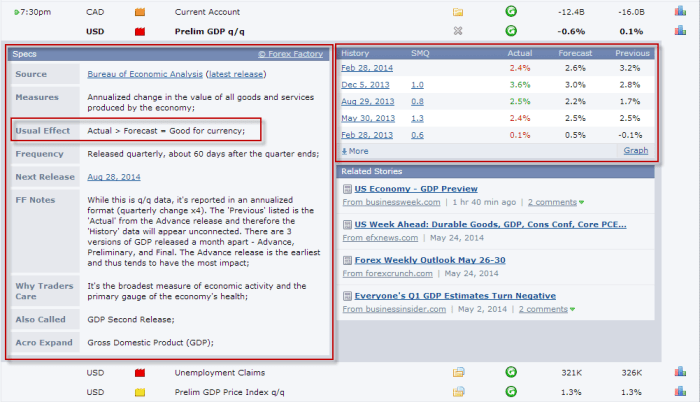

Forex Factory, while a valuable resource for forex traders, presents data in ways that can subtly influence how users interpret market trends and conditions. Understanding these potential biases is crucial for making informed trading decisions. The way data is visually presented, the indicators chosen, and the timeframes selected all play a significant role in shaping perceptions.

Visual Biases in Charts and Graphs

The visual representation of data on Forex Factory, primarily through charts and graphs, can lead to misinterpretations. For example, the use of different scales on the y-axis can exaggerate or minimize price movements. A chart showing a small price range with a large y-axis scale will make price fluctuations appear less significant than they actually are, while the opposite is true for a chart with a small y-axis scale showing a large price range.

Similarly, the choice of colors and line thicknesses can unconsciously influence viewers’ perceptions of trends. Bright, bold lines might draw more attention to seemingly significant movements, while subtle changes might be overlooked. The use of logarithmic versus linear scales also significantly impacts the visual representation of price changes, particularly over longer time periods. A logarithmic scale compresses large price movements, making smaller fluctuations appear more significant, whereas a linear scale gives equal visual weight to all price changes.

Influence of Indicators and Timeframes

The selection of indicators displayed on Forex Factory charts introduces further potential biases. Different indicators highlight different aspects of price action, and using a limited set of indicators can create a skewed view of the market. For instance, relying solely on moving averages might lead to a lag in identifying trend reversals, while focusing exclusively on oscillators might cause overreaction to short-term price fluctuations.

You also can understand valuable knowledge by exploring how to use email marketing to increase sales.

The choice of timeframe also plays a crucial role. A short timeframe, like a 5-minute chart, will highlight noise and short-term volatility, potentially leading to impulsive trading decisions. Conversely, a longer timeframe, like a daily or weekly chart, might mask important short-term opportunities. The user’s selection of indicators and timeframe effectively acts as a filter, influencing what aspects of the data are emphasized and what is downplayed.

Alternative Data Visualization Method: Multi-Panel Chart with Comparative Indicators

To mitigate these biases, an alternative visualization method could be employed. A multi-panel chart displaying various indicators and timeframes simultaneously could provide a more comprehensive view. For example, one panel could show a daily candlestick chart with a 200-day moving average, another could display a 1-hour chart with RSI and MACD indicators, and a third could present a weekly chart with volume data.

Find out about how the impact of big data on digital marketing strategies can deliver the best answers for your issues.

This approach allows for a more holistic understanding of price action, reducing the potential for misinterpretations stemming from a single perspective. The advantage of this method lies in its ability to provide context across multiple timeframes and using various analytical tools, reducing the risk of drawing conclusions based on limited information or a specific indicator’s inherent biases. The inclusion of different indicators and timeframes allows for cross-referencing and a more balanced perspective on market dynamics, minimizing the influence of individual indicator biases.

Economic and Geopolitical Influences

Forex Factory, while a valuable resource, doesn’t exist in a vacuum. Its data reflects the complex interplay of global economic conditions and geopolitical events, introducing potential biases that traders need to understand. These external factors can significantly skew sentiment, trading activity, and the very information presented on the platform. Failing to account for these influences can lead to flawed trading decisions.The inherent nature of Forex Factory as a forum for traders means that its data is influenced by the collective opinions and actions of its users.

These opinions are, in turn, heavily shaped by macroeconomic trends and geopolitical developments. Major news events, for example, can trigger rapid shifts in market sentiment, leading to a surge in posts and discussions focused on a particular currency pair or trading strategy. This concentration of activity can create a biased snapshot of market dynamics, potentially overrepresenting the impact of the event and underrepresenting other, less immediately dramatic, market forces.

Impact of Macroeconomic Factors

Macroeconomic indicators, such as inflation rates, interest rate decisions, and GDP growth figures, significantly influence currency valuations. A surprise interest rate hike by a central bank, for instance, might lead to a rapid appreciation of that country’s currency. Forex Factory discussions would likely reflect this immediate reaction, showcasing a surge in bullish sentiment and trading strategies focused on profiting from the currency’s appreciation.

Conversely, negative economic news could create a disproportionate focus on bearish sentiment and strategies designed to capitalize on a currency’s decline. This concentration on short-term reactions to major economic news might obscure underlying, longer-term trends.

Influence of Geopolitical Events

Geopolitical events, ranging from political instability to international conflicts, can dramatically impact currency markets. For example, escalating tensions between two nations might cause investors to flee one currency in favor of another perceived as safer haven. Forex Factory discussions would then reflect this shift, with an increased focus on the affected currency pairs and related trading strategies. The platform’s data might overemphasize the immediate market reaction to the event, potentially overshadowing the gradual return to equilibrium that might occur later.

Furthermore, the platform’s user base might not be uniformly geographically distributed, resulting in biased reporting on events that disproportionately affect certain regions.

Regional and Sectoral Biases, Understanding the biases present in Forex Factory data

Forex Factory’s user base is not evenly distributed across all geographical regions or economic sectors. This uneven distribution can create biases in the data. For example, if a significant portion of the user base is located in a specific region, the platform’s discussions might overrepresent the perspectives and trading strategies prevalent in that area. Similarly, if a particular economic sector is heavily represented among the users, the platform’s data might disproportionately reflect the trends and sentiments within that sector, potentially overlooking important developments in other sectors.

This localized perspective can limit the overall accuracy and representativeness of the data.

Economic Indicators and Geopolitical Events Influencing Forex Factory Data

The following list illustrates economic indicators and geopolitical events that frequently influence Forex Factory data and their potential biases:

- Interest Rate Decisions: Central bank announcements can create short-term volatility and a focus on specific currency pairs, potentially overshadowing longer-term trends.

- Inflation Data: Unexpected inflation figures can significantly impact currency valuations and trading strategies, leading to a surge in related discussions on Forex Factory.

- GDP Growth: Strong or weak GDP growth figures can influence investor sentiment and trading activity, potentially biasing the data towards a particular outlook.

- Political Instability: Political unrest in a country can cause investors to flee its currency, creating a bias towards bearish sentiment and related trading strategies on Forex Factory.

- International Conflicts: Geopolitical conflicts can trigger significant currency fluctuations and shifts in investor sentiment, resulting in biased discussions on Forex Factory.

- Trade Wars: Trade disputes between nations can impact currency values and trading strategies, creating biases in the data reflected on Forex Factory.

- Natural Disasters: Major natural disasters can significantly affect a country’s economy and currency, leading to skewed sentiment and trading activity on Forex Factory.

Algorithmic and Technical Biases

Forex Factory, while a valuable resource for forex traders, isn’t immune to biases stemming from its underlying algorithms and technical limitations. Understanding these biases is crucial for interpreting data accurately and avoiding flawed trading decisions. This section will delve into the potential sources of bias inherent in the platform’s data processing and presentation.

The algorithms used by Forex Factory to collect, process, and display data can introduce various biases. For example, the way news is categorized and prioritized could reflect pre-existing biases within the algorithm’s design or the data it’s trained on. Similarly, any filtering mechanisms employed to remove “noisy” data might inadvertently eliminate valuable information or disproportionately affect certain data points. The impact of these algorithmic biases can subtly, yet significantly, alter the perceived market sentiment and trends.

Data Latency and its Impact on Accuracy

Data latency, the delay between the actual market event and its appearance on Forex Factory, is a significant source of bias. Because forex markets move incredibly quickly, even small delays can lead to inaccurate representations of price movements and trading volume. For example, a significant news event might cause a sharp price spike, but if Forex Factory’s data reflects this only after a delay, traders relying on this information might miss crucial opportunities or enter trades based on outdated information.

This latency bias is particularly problematic during high-volatility periods or when dealing with fast-moving assets. The resulting distortion can lead to incorrect interpretations of market trends and potentially poor trading decisions.

Data Sampling and Aggregation Techniques

The methods used to sample and aggregate data on Forex Factory can introduce biases that skew the overall picture. For instance, if the platform primarily focuses on data from major currency pairs, it might underrepresent the dynamics of smaller, less-traded pairs. Similarly, the aggregation techniques used (e.g., averaging price movements over different time intervals) can smooth out important short-term fluctuations, masking important volatility information.

This can lead to an incomplete or misleading representation of market behavior. Consider, for instance, the difference between daily average price movements versus hourly movements – the former might mask significant intraday volatility that is crucial for some trading strategies.

Several technical aspects of Forex Factory can contribute to biases in the data presented. It’s crucial to be aware of these limitations to avoid misinterpretations.

- Data Source Limitations: Forex Factory relies on various data providers, each with its own methodologies and potential biases. Inconsistent data quality across sources can lead to inaccuracies.

- Data Filtering and Cleaning: The algorithms used to filter and clean data might inadvertently remove relevant information or introduce systematic errors. This is especially relevant for outlier detection, where legitimate but extreme data points might be discarded.

- Presentation Biases: The way data is presented, such as through charts and graphs, can influence interpretation. For example, the choice of time scale or the use of specific indicators can highlight certain trends while obscuring others.

- User-Generated Content Bias: Forex Factory includes user-submitted comments and forecasts. This data is inherently subjective and may reflect individual biases or agendas, potentially influencing the overall perception of market sentiment.

- Technical Glitches and Errors: Like any online platform, Forex Factory can experience technical glitches and errors that might affect data accuracy. These can range from minor display issues to more significant data corruption.

Ultimately, while Forex Factory offers valuable insights into the forex market, a critical understanding of its inherent biases is essential for responsible trading. By recognizing the potential for skewed data due to user contributions, data visualization, algorithmic processes, and external factors, traders can develop a more nuanced and accurate perspective of market dynamics. Don’t let bias cloud your judgment – learn to navigate Forex Factory’s data intelligently.