Understanding Forex Factory sentiment analysis for better trading decisions is crucial for navigating the forex market’s complexities. This guide explores how to interpret Forex Factory’s sentiment indicators, spot potential biases, and integrate this data into your trading strategies. We’ll cover everything from basic interpretation to advanced techniques, including risk management and combining sentiment analysis with other technical indicators to make more informed decisions.

Get ready to level up your forex trading game!

We’ll delve into practical examples, showcasing both successful and unsuccessful applications of Forex Factory sentiment analysis. You’ll learn to identify key trends and patterns, understand the psychological aspects of crowd behavior, and ultimately, make more confident and profitable trades. This isn’t just about reading numbers; it’s about understanding the collective market psychology and using that knowledge to your advantage.

Introduction to Forex Factory Sentiment

Forex Factory is a popular website among forex traders, offering a wealth of information, including real-time market data, economic calendars, and crucially, sentiment indicators. Understanding the sentiment expressed on Forex Factory can provide valuable insights into the collective market psychology, potentially helping traders make more informed decisions. It acts as a kind of crowdsourced gauge of trader expectations and positioning.Forex Factory’s significance stems from its large and active user base.

The platform’s various sentiment tools aggregate data from numerous traders, offering a snapshot of prevailing market biases. This collective wisdom, while not a perfect predictor, can be a helpful tool when combined with other forms of technical and fundamental analysis. The sheer volume of traders participating contributes to the reliability of the aggregated sentiment data, offering a broader perspective than individual trader opinions.

Types of Sentiment Indicators on Forex Factory

Forex Factory offers several sentiment indicators, each providing a slightly different perspective on market sentiment. These tools usually display the percentage of traders who are currently long (bullish) or short (bearish) on a specific currency pair. Some indicators also show the net percentage, representing the difference between long and short positions. This data is often presented graphically, making it easier to visualize trends and shifts in market sentiment.

Understanding the nuances of each indicator is key to effective interpretation. For example, a high percentage of long positions might suggest an overbought market, potentially indicating a higher probability of a price correction.

Obtain direct knowledge about the efficiency of how to choose the right digital marketing tools for your business through case studies.

Utilizing Forex Factory Sentiment Data

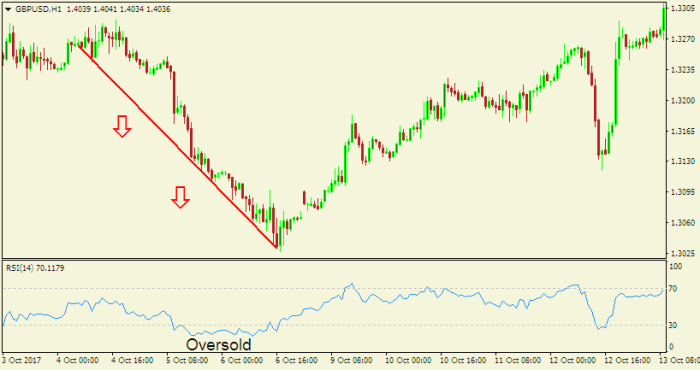

Traders employ Forex Factory sentiment data in various ways to inform their trading strategies. Some traders use it as a confirmation tool, combining sentiment readings with other technical indicators like moving averages or RSI. For instance, a bullish sentiment reading might reinforce a buy signal generated by a technical indicator, increasing the trader’s confidence in the trade. Others might use it as a contrarian indicator, betting against the majority sentiment.

The logic here is that if a large percentage of traders are bullish, the market might be overbought and due for a correction. This approach requires careful risk management, as contrarian trading can be risky.A common example involves observing sentiment shifts around major economic news releases. If sentiment dramatically shifts after a positive economic report, a trader might interpret this as an opportunity to enter a long position, anticipating further price increases.

Explore the different advantages of the use of automation in digital marketing campaigns that can change the way you view this issue.

Conversely, a sharp negative shift in sentiment could suggest a potential shorting opportunity. It’s crucial to remember that Forex Factory sentiment is just one piece of the puzzle. Successful traders typically integrate it with other forms of analysis to make well-rounded trading decisions.

Advanced Techniques and Considerations: Understanding Forex Factory Sentiment Analysis For Better Trading Decisions

While Forex Factory sentiment can be a valuable tool in your trading arsenal, it’s crucial to understand its limitations and avoid relying on it exclusively for making trading decisions. Over-reliance can lead to significant losses, as market movements are influenced by a multitude of factors beyond simple crowd sentiment.Understanding the pitfalls and biases inherent in interpreting crowd sentiment is key to effective usage.

Simply observing a bullish or bearish majority doesn’t guarantee future price movements. The sentiment itself can be manipulated, lagging behind actual market changes, or simply incorrect. Sophisticated traders often use sentiment indicators as one piece of a much larger puzzle.

Limitations of Forex Factory Sentiment, Understanding Forex Factory sentiment analysis for better trading decisions

Blindly following Forex Factory sentiment can be disastrous. Market movements are driven by a complex interplay of economic indicators, geopolitical events, algorithmic trading, and individual investor behavior. Sentiment, while offering a snapshot of collective opinion, fails to account for these other influential factors. For example, a strongly bullish sentiment might be completely overridden by an unexpected negative economic report, leading to a sharp price drop despite the positive sentiment.

Relying solely on sentiment in such a scenario would result in significant losses. Successful traders integrate sentiment analysis with technical and fundamental analysis for a more holistic perspective.

Potential Pitfalls and Biases in Sentiment Interpretation

Several biases can skew the interpretation of Forex Factory sentiment. Confirmation bias, for instance, leads traders to selectively focus on information that confirms their pre-existing beliefs, ignoring contradictory signals. Herd mentality, another significant pitfall, can cause traders to follow the crowd even when it contradicts their own analysis, leading to potentially disastrous outcomes. Furthermore, the data itself might be subject to manipulation, either accidentally through inaccurate reporting or deliberately by market participants trying to influence others.

A deep understanding of these biases is necessary to avoid being misled.

Psychological Aspects of Crowd Behavior and Market Movements

Crowd psychology plays a significant role in Forex market dynamics. Fear and greed are powerful emotions that drive market volatility. During periods of extreme fear (e.g., a sudden geopolitical crisis), traders may panic-sell, leading to sharp price drops regardless of underlying fundamentals. Conversely, periods of excessive greed can fuel speculative bubbles, resulting in unsustainable price increases. Understanding these psychological factors allows traders to anticipate potential market reactions and adjust their strategies accordingly.

For example, observing a sudden surge in bullish sentiment alongside increasing market volatility could indicate an overbought condition, potentially signaling a future price correction. Experienced traders use this understanding to mitigate risks associated with extreme market sentiment.

Visualizing Forex Factory Sentiment Data

Visualizing Forex Factory sentiment data effectively can significantly enhance your understanding of market sentiment and improve your trading decisions. By representing the data graphically, you can quickly identify key trends and patterns that might otherwise be missed when looking at raw numbers. This section explores different visualization methods for Forex Factory sentiment data.Forex Factory sentiment is typically expressed as a percentage of traders who are bullish, bearish, or neutral on a particular currency pair.

We can leverage this data to create insightful visualizations.

A Line Chart Showing Sentiment Over Time

This visualization would use a line chart to display the percentage of bullish traders over a chosen time period, say, the last month. The x-axis represents time (e.g., days), and the y-axis represents the percentage of bullish traders. A second line could represent the percentage of bearish traders, allowing for a direct comparison of bullish versus bearish sentiment. The chart’s color scheme would use distinct colors for bullish and bearish lines, perhaps green for bullish and red for bearish, to enhance readability.

Key inflection points, such as significant shifts in sentiment, could be highlighted with annotations or markers on the chart. The overall trend of the lines would indicate the dominant sentiment over the period. For example, a consistently upward trending bullish line suggests strengthening bullish sentiment.

Comparing Forex Factory Sentiment to Price Action

This visualization would overlay Forex Factory sentiment data onto a price chart of a specific currency pair, such as EUR/USD. The price chart would be the primary element, showing the price movement over the chosen time frame. The Forex Factory sentiment data could be represented as a secondary indicator, perhaps as a histogram or a separate line graph positioned below the price chart.

The histogram could display the bullish/bearish percentage for each period (e.g., each day), with higher bars representing stronger sentiment. The color of the bars would correspond to the sentiment (e.g., green for bullish, red for bearish). The alignment of the sentiment indicator with price movements would be crucial. For example, periods of strong bullish sentiment preceding a price increase would be visually highlighted, suggesting a potential correlation between sentiment and price action.

Discrepancies between sentiment and price action (e.g., strong bullish sentiment despite a falling price) would also be readily apparent, potentially indicating a divergence that could signal a price reversal.

Mastering Forex Factory sentiment analysis empowers you to leverage the wisdom of the crowds, but remember it’s just one piece of the puzzle. By combining this powerful tool with sound risk management and other technical indicators, you can significantly enhance your trading strategy. Remember to always critically evaluate the data, understand its limitations, and develop a robust trading plan.

Consistent practice and adaptation are key to successfully navigating the dynamic world of forex trading. So, go forth and trade smarter!