The role of Forex Factory in managing emotional trading biases is crucial for forex traders. This platform offers a wealth of information, from economic calendars and news releases to lively forum discussions. However, this very abundance can fuel emotional reactions, leading to impulsive decisions and potentially disastrous outcomes. We’ll explore how Forex Factory’s tools can be used both constructively and destructively, and how to develop strategies to harness its power for better emotional control and improved trading performance.

Understanding how readily available information can trigger fear, greed, overconfidence, or confirmation bias is key. We’ll delve into specific examples, providing practical strategies for utilizing Forex Factory’s resources – like its economic calendar and forum – to build a robust trading plan that mitigates emotional decision-making. This includes identifying and managing emotional triggers, improving self-awareness, and challenging cognitive biases.

Forex Factory’s Information Resources and Emotional Trading

Forex Factory is a popular online resource for forex traders, offering a wealth of information that can significantly impact trading decisions. However, the readily available data, particularly economic news and calendar events, can also fuel emotional biases, leading to suboptimal trading outcomes. Understanding how Forex Factory’s information interacts with trader psychology is crucial for developing a disciplined and profitable trading strategy.Forex Factory’s economic calendar is a central hub for market-moving news.

Its impact on trader sentiment is substantial, often creating a ripple effect throughout the market. The anticipation and release of high-impact economic data, such as Non-Farm Payroll (NFP) reports or interest rate decisions, can cause significant volatility and emotional swings among traders.

The Economic Calendar’s Influence on Trader Sentiment

The Forex Factory economic calendar provides a comprehensive overview of upcoming economic events, allowing traders to anticipate potential market movements. This anticipation itself can trigger emotional biases. For example, the anticipation of a positive NFP report might lead to overly optimistic expectations, creating a bias towards buying, even if the actual numbers later prove less positive than expected. Conversely, the anticipation of negative data can lead to fear and premature selling, potentially missing out on opportunities.

The calendar’s detailed information, including past results and consensus forecasts, fuels this anticipation and subsequent emotional responses. The visual presentation of the calendar, with clear color-coding and impact ratings, further amplifies these feelings. A highly anticipated event shown in bold red creates a different emotional response than a low-impact event in muted grey.

News Releases and Emotional Reactions

Forex Factory’s news releases often trigger strong emotional reactions. For example, an unexpected rise in inflation could trigger fear among traders, leading to a rush to sell assets. This fear-driven response might lead to panic selling, causing losses that are disproportionate to the actual impact of the news. Conversely, positive news, such as a surprise interest rate cut, can fuel greed and excessive optimism.

This might result in over-leveraged positions and risky trades, exposing traders to significant losses if the market sentiment shifts. The immediate nature of the news updates on Forex Factory can exacerbate these emotional responses, making it harder for traders to react rationally.

Hypothetical Scenario: Overconfidence and Impulsive Decision-Making

Imagine a trader, let’s call him Mark, who consistently relies on Forex Factory’s news and analysis. Mark develops a system based on interpreting economic indicators, and for several weeks, his strategy proves successful. He consistently profits from analyzing data and news releases available on Forex Factory. This success fuels overconfidence. He starts ignoring risk management principles, believing his system is foolproof.

Then, a major unexpected geopolitical event occurs – not covered extensively in Forex Factory’s immediate news – causing significant market volatility. Mark, blinded by his recent success and relying solely on Forex Factory’s information, fails to adjust his positions. The market moves against him, and his overconfidence leads to substantial losses. His impulsive decisions, fueled by the readily available but incomplete information on Forex Factory, directly contribute to his negative outcome.

This highlights the importance of critical thinking and diversification of information sources beyond a single platform, even a useful one like Forex Factory.

Forum Discussions and Community Influence on Emotional Control: The Role Of Forex Factory In Managing Emotional Trading Biases

Forex Factory’s bustling forums offer a unique environment for forex traders, providing a platform for information exchange and community interaction. However, this very environment can significantly impact a trader’s emotional control, both positively and negatively, often in subtle and unexpected ways. The anonymity and collective nature of online discussions introduce specific challenges in managing emotional biases.The potential for confirmation bias within Forex Factory’s forum discussions is substantial.

Traders often gravitate towards information that confirms their pre-existing beliefs, whether about a specific currency pair, trading strategy, or market outlook. This can lead to a skewed perception of risk and reward, reinforcing overconfidence or ignoring crucial counterarguments. For example, a trader already bullish on EUR/USD might selectively focus on forum posts predicting further price increases, neglecting bearish viewpoints or warnings of potential corrections.

This selective absorption of information can fuel emotional trading decisions.

Confirmation Bias in Forex Factory Forums, The role of Forex Factory in managing emotional trading biases

Confirmation bias manifests in several ways within the Forex Factory forum environment. Traders might actively seek out and engage with threads that support their existing trading positions, while ignoring or downplaying contradictory viewpoints. They might interpret ambiguous information in a way that reinforces their beliefs, even if the evidence is weak or circumstantial. The repetitive exposure to similar opinions within a thread can further amplify this effect, leading to a self-reinforcing cycle of biased information processing.

Browse the multiple elements of managing client relationships effectively in a digital marketing agency to gain a more broad understanding.

This isn’t necessarily malicious; it’s a cognitive bias that affects us all. The result, however, can be disastrous for trading performance.

Impact of Positive and Negative Sentiment on Trader Emotions

The prevailing sentiment within Forex Factory forums significantly influences a trader’s emotional state. Exposure to consistently positive sentiment can boost confidence and potentially lead to overtrading or riskier positions. Conversely, exposure to pervasive negativity and fear can induce panic selling or excessive caution, leading to missed opportunities or unnecessarily limiting profits. The intensity of these emotional swings can be amplified by the anonymity of the forum, where traders may feel less accountable for expressing extreme views.

For instance, a series of posts celebrating a successful trade on a specific strategy might embolden other traders to follow suit without fully understanding the risks, leading to emotional over-commitment. Similarly, a string of posts lamenting significant losses could trigger a wave of fear and panic selling amongst less experienced traders.

Anonymity and Unchecked Emotional Biases

The anonymity afforded by online forums like Forex Factory can contribute to the expression of unchecked emotional biases. Without the social constraints of face-to-face interaction, traders may feel more comfortable expressing extreme opinions, engaging in aggressive behavior, or spreading misinformation. This lack of accountability can create a toxic environment where emotional biases are amplified rather than moderated. For example, traders might vent their frustrations more freely, leading to impulsive and irrational trading decisions influenced by anger or disappointment.

The absence of personal responsibility can also encourage the spread of unsubstantiated claims and rumors, further exacerbating emotional volatility within the community.

Utilizing Forex Factory Data for Risk Management and Emotional Regulation

Forex Factory offers a wealth of data that, when strategically utilized, can significantly improve your risk management and help you regulate emotional responses during trading. By integrating Forex Factory’s resources into your trading plan, you can create a more disciplined and profitable approach, minimizing the impact of emotional biases. This involves proactively identifying potential emotional triggers and establishing clear rules to guide your actions.

Developing a robust trading plan that incorporates Forex Factory data is crucial for mitigating emotional decision-making. This plan acts as a safety net, guiding your actions even when market volatility triggers emotional responses. By pre-defining your entry and exit strategies, risk tolerance, and position sizing, you create a framework that minimizes impulsive trades driven by fear or greed.

Strategies for Utilizing Forex Factory Tools to Identify and Manage Emotional Triggers

Forex Factory’s economic calendar, news section, and forum discussions can be powerful tools for anticipating market events that might trigger emotional reactions. By proactively preparing for these events, you can minimize their negative impact on your trading decisions.

For example, the release of significant economic data, like Non-Farm Payroll (NFP) numbers, often causes sharp market swings. Knowing this, you can adjust your trading strategy accordingly. This might involve reducing your position size before the release or temporarily exiting the market altogether. By using Forex Factory’s economic calendar to anticipate these events, you can plan your response and avoid impulsive reactions based on fear or excitement during the volatile period.

Furthermore, the Forex Factory forums provide insights into the market sentiment. Observing the discussions can help you identify potential turning points and gauge the overall market mood. Understanding the collective sentiment allows you to adjust your expectations and avoid emotional overreactions to short-term market fluctuations. For instance, if the forum shows widespread fear, you might consider taking a cautious approach or even looking for opportunities to buy the dip, depending on your strategy.

Conversely, if exuberance is prevalent, you might take profits or reduce risk to avoid potential losses in a potential market correction.

Forex Factory Resources for Improving Self-Awareness Regarding Emotional Trading Biases

Understanding your emotional triggers and biases is the first step towards controlling them. Forex Factory offers various resources to enhance this self-awareness.

Regularly reviewing your trading journal, alongside the market data provided by Forex Factory, allows you to identify patterns in your emotional responses. By analyzing your past trades, you can pinpoint specific market events or situations that consistently lead to impulsive decisions. This analysis enables you to develop coping mechanisms and strategies for managing these triggers in the future.

| Resource Name | Resource Type | Use Case for Emotional Management | Example |

|---|---|---|---|

| Economic Calendar | Data Provider | Anticipating market-moving events to avoid impulsive reactions | Planning to reduce position size before NFP data release to mitigate the impact of potential volatility. |

| Forex Factory Forums | Community Discussion | Gauging market sentiment to avoid emotional overreactions to short-term fluctuations | Observing widespread fear in the forum and adjusting trading strategy to a more cautious approach. |

| News Section | News Aggregator | Understanding market-influencing news to prevent emotional trading based on misinformation | Reading credible news sources to avoid reacting to unsubstantiated rumors or speculation. |

| Trading Journal | Self-Monitoring Tool | Identifying patterns in emotional responses to specific market events or situations | Analyzing past trades to identify situations where fear or greed led to poor decisions. |

The Role of Forex Factory in Identifying and Addressing Cognitive Biases

Forex Factory, while a valuable resource for forex traders, can inadvertently contribute to the development of cognitive biases that negatively impact trading decisions. The sheer volume of information, the constant stream of news, and the interactive nature of its forums create an environment where these biases can easily take root and influence trading strategies. Understanding these biases and how Forex Factory’s structure might exacerbate them is crucial for developing a more disciplined and profitable approach to forex trading.Forex Factory’s presentation of data can subtly influence the formation of cognitive biases.

The way information is organized, highlighted, and discussed within the platform can lead traders down certain paths, potentially reinforcing pre-existing biases or creating new ones. This section will explore some key cognitive biases and how Forex Factory’s features might contribute to their development.

Anchoring Bias and Forex Factory Data

Anchoring bias is the tendency to rely too heavily on the first piece of information offered (the “anchor”) when making decisions. On Forex Factory, this might manifest as over-reliance on the opening price of a currency pair, a recent news headline, or even a particularly vocal forum member’s opinion. For example, if a trader sees a significant price movement early in the day and anchors to that initial movement, they may misinterpret subsequent smaller price fluctuations, leading to premature entry or exit decisions.

To mitigate this, traders should actively seek out diverse perspectives and data points, rather than anchoring to a single initial observation from Forex Factory. They should also focus on utilizing technical analysis indicators to confirm potential trading opportunities, rather than relying solely on initial price movements or forum opinions.

Obtain access to Forex Factory and its application in different trading platforms to private resources that are additional.

Availability Heuristic and Forum Discussions

The availability heuristic describes our tendency to overestimate the likelihood of events that are easily recalled. Forex Factory’s forums, with their often dramatic accounts of trading wins and losses, can easily distort a trader’s perception of probability. Highly publicized successful trades might lead a trader to overestimate the likelihood of similar outcomes, while frequent discussions of losses could create an overly pessimistic outlook.

To counter this, traders should focus on objective data and statistical analysis, rather than relying on anecdotal evidence from the forums. They can use Forex Factory’s economic calendar and historical data to develop a more realistic understanding of market probabilities. By consciously seeking out data that challenges their initial impressions, they can develop a more balanced perspective.

Confirmation Bias and Economic Calendar Data

Confirmation bias is the tendency to search for, interpret, favor, and recall information in a way that confirms or supports one’s prior beliefs or values. Forex Factory’s economic calendar, while useful, can contribute to confirmation bias if traders only focus on data points that support their existing trading strategy. For example, a trader bullish on a particular currency might selectively focus on positive economic indicators while ignoring negative ones.

To counteract this, traders should make a conscious effort to actively seek out data that challenges their pre-existing beliefs. They should critically evaluate all economic data, considering both positive and negative implications for their trading strategies. A balanced approach, considering various perspectives and contradictory information, can help reduce the influence of confirmation bias.

Forex Factory and the Development of a Healthy Trading Mindset

Developing a healthy trading mindset is crucial for success in the forex market. It’s about cultivating emotional resilience and objectivity, allowing you to make rational decisions even under pressure. This isn’t about eliminating emotions entirely—that’s impossible—but about managing them effectively so they don’t sabotage your trading strategy. Forex Factory, with its wealth of resources and community interaction, can be a powerful tool in this process.A healthy trading mindset is characterized by self-awareness, discipline, and a realistic outlook.

Traders with this mindset understand their own emotional triggers, have a well-defined trading plan, and are able to stick to it even when faced with losses. They also accept that losses are a part of trading and don’t let them derail their overall strategy. They view trading as a long-term game, not a get-rich-quick scheme. They continuously learn and adapt, always striving for improvement.

Forex Factory as a Tool for Self-Reflection and Continuous Improvement

Forex Factory offers several avenues for self-reflection and improvement. The forum, for instance, provides a space to analyze past trades, identify recurring emotional biases, and learn from both successes and failures. By engaging in discussions with other traders, you can gain new perspectives and insights into your own trading behavior. The economic calendar and news sections allow you to track market events and assess how your emotional responses aligned with actual market movements.

Did you overreact to news events? Did fear or greed cloud your judgment? Analyzing these situations within the context of Forex Factory’s data can reveal patterns and areas for improvement. Keeping a trading journal, which can be easily referenced alongside Forex Factory data, can significantly enhance this self-reflective process. The journal provides a concrete record of your emotions and trading decisions, allowing you to pinpoint connections between the two.

Visual Representation of Forex Factory’s Impact on Trading Performance

Imagine a three-sided pyramid. The base represents Forex Factory’s resources – the economic calendar, news, forums, and educational materials. The second level shows the resulting increase in emotional awareness. This is depicted as a steadily widening band circling the base, symbolizing the growing understanding of one’s emotional responses to market events, as gleaned from Forex Factory’s tools and community discussions.

The top of the pyramid represents improved trading performance, a sharp peak reflecting consistent profitability and reduced emotional trading biases. The lines connecting the levels are thick and strong, illustrating the direct and positive correlation between using Forex Factory’s resources, developing emotional awareness, and achieving better trading results. The pyramid’s overall structure emphasizes the cumulative and reinforcing nature of this process – the stronger the base, the higher and more stable the peak of improved performance.

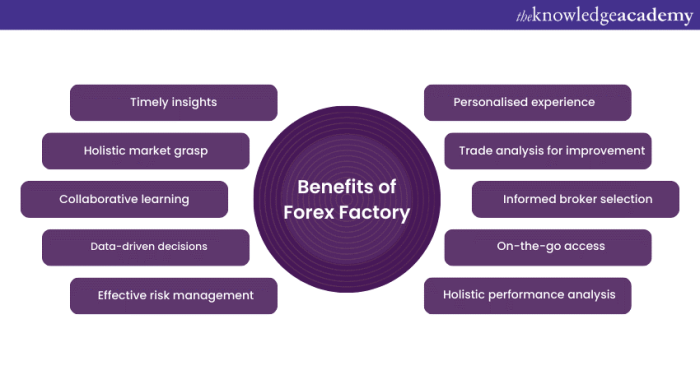

Comparing Forex Factory with Other Resources for Emotional Trading Management

Forex Factory offers a unique blend of community interaction and data-driven resources, setting it apart from other platforms focusing on emotional trading management. While some platforms concentrate solely on educational courses or psychological coaching, Forex Factory integrates these aspects within a vibrant trading community, creating a dynamic learning environment. This comparison will highlight Forex Factory’s strengths and weaknesses against alternative approaches, providing a balanced perspective.Forex Factory’s Strengths and Weaknesses in Addressing Emotional Trading ChallengesForex Factory’s strength lies in its vast, active community.

The forum allows traders to share experiences, strategies for managing emotional responses to market fluctuations, and coping mechanisms for stress. This peer-to-peer support can be incredibly valuable, offering a sense of camaraderie and validation during challenging times. However, relying solely on community input has its drawbacks. Unverified information or biased opinions can be prevalent, requiring critical evaluation of any advice received.

Furthermore, the lack of structured, professionally-led emotional intelligence training is a significant weakness compared to dedicated courses or coaching programs. While experienced traders offer valuable insights, they may not always possess the formal training to provide effective psychological guidance.

Comparison with Dedicated Educational Platforms

Dedicated emotional trading courses offered by institutions or individual experts often provide a more structured approach to emotional intelligence training. These platforms typically offer curriculum-based learning, covering topics such as cognitive biases, risk management strategies, and stress management techniques in a systematic manner. Unlike Forex Factory’s organic, community-driven approach, these courses often involve assessments, personalized feedback, and potentially, ongoing coaching support.

This structured approach can be highly beneficial for traders seeking a more formal and comprehensive learning experience. However, the cost of these programs can be significantly higher than accessing Forex Factory’s free resources, and the level of community interaction might be limited.

A Checklist for Evaluating Emotional Trading Resources

Choosing the right resource for managing emotional biases requires careful consideration of individual needs and learning styles. The following checklist can assist traders in evaluating the suitability of different platforms and materials:

Before using any resource, consider these points:

- Credibility of the source: Does the resource come from a reputable source with expertise in trading psychology or financial markets? Are claims backed by evidence or research?

- Relevance to your trading style: Does the resource address the specific emotional challenges you face as a trader? Does it provide strategies tailored to your approach to trading?

- Practical application: Does the resource provide actionable strategies and tools that you can implement in your trading routine? Does it offer opportunities for practice and feedback?

- Community support: Does the resource offer a supportive community or forum where you can connect with other traders and share experiences?

- Cost-effectiveness: Does the cost of the resource align with your budget and perceived value?

- Structured learning: Does the resource provide a structured learning path with clear objectives and assessments?

Ultimately, mastering emotional trading isn’t about avoiding Forex Factory; it’s about learning to use it wisely. By understanding how its various features can influence your trading psychology, you can leverage its strengths while mitigating its potential pitfalls. Developing a healthy trading mindset, incorporating self-reflection, and continuously refining your strategies using Forex Factory’s tools are essential steps towards consistent and profitable trading.

Remember, the key is to use the platform’s resources to inform your decisions, not dictate them.