The relationship between Forex Factory sentiment and price action is a fascinating area of forex trading. Understanding how market sentiment, as reflected on Forex Factory, influences price movements can provide valuable insights for traders. This exploration delves into the methods used to analyze this relationship, from data acquisition and preparation to correlation and regression analysis, ultimately aiming to help you better understand the interplay between sentiment and price.

We’ll examine various analytical techniques, including correlation and regression analysis, to uncover the strength and nature of this connection. We will also discuss the importance of considering different timeframes and potential limitations of relying solely on sentiment data for trading decisions. Case studies will illustrate real-world scenarios where Forex Factory sentiment significantly impacted price action, giving you practical examples to learn from.

Introduction to Forex Factory Sentiment and Price Action

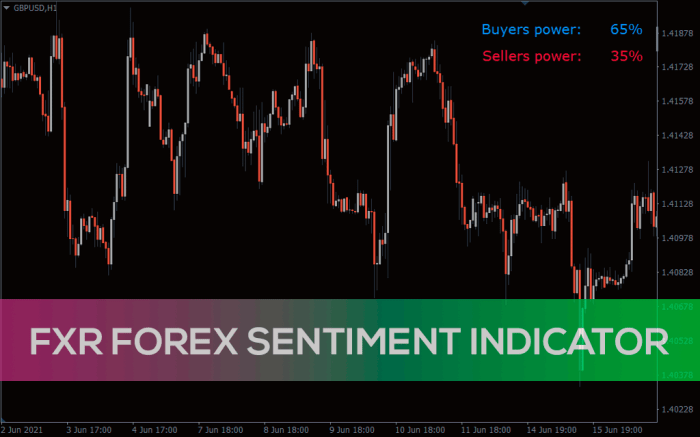

Forex trading involves navigating the complex interplay of various market forces. Understanding these forces is crucial for successful trading, and two key elements are Forex Factory sentiment and price action. This section will introduce both concepts and explore their potential relationship.Forex Factory sentiment data represents the collective opinions of traders regarding the future direction of currency pairs. It’s essentially a gauge of market psychology, aggregated from trader polls and other sentiment indicators available on the Forex Factory website.

This data doesn’t predict price movements definitively, but it can provide valuable insights into the prevailing market mood – whether traders are generally bullish (expecting price increases) or bearish (expecting price decreases). The data is usually presented as percentages, showing the proportion of traders who are long (buying) versus short (selling) a particular currency pair.Price action, on the other hand, refers to the actual movements of a currency pair’s price over time.

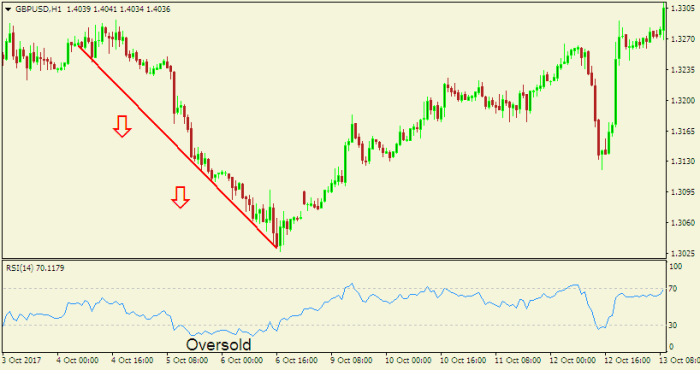

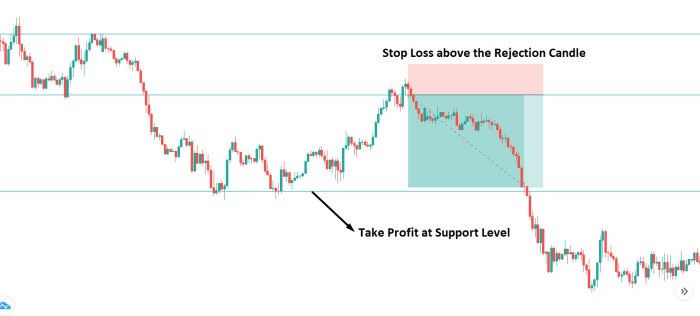

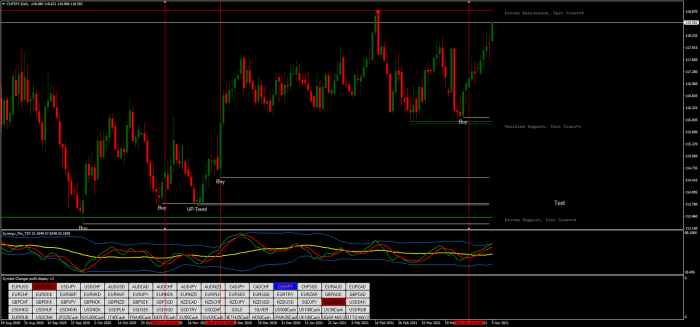

It’s observed by analyzing candlestick charts, which visually represent price fluctuations over specific intervals (e.g., 1-hour, 4-hour, daily). Traders analyze price action patterns – such as candlesticks, support and resistance levels, trendlines, and chart formations – to identify potential trading opportunities. These patterns help traders gauge the strength of a trend, anticipate potential reversals, and manage risk.

Measurements are primarily based on price levels (highs, lows, closes) and the visual characteristics of the price chart.

Forex Factory Sentiment as a Leading Indicator

The potential relationship between Forex Factory sentiment and price action is often debated. Some traders believe that extreme sentiment readings (e.g., an overwhelmingly bullish or bearish sentiment) can act as a contrarian indicator. The logic is that when sentiment is extremely bullish, the market might be overbought and due for a correction, and vice-versa. This isn’t always the case, however.

Sometimes, extreme sentiment simply reflects the market’s prevailing trend, acting as confirmation rather than a contrarian signal. For example, if 90% of traders are bullish on EUR/USD and the price continues to rise, it confirms the strong bullish sentiment. Conversely, if the price starts to fall despite the bullish sentiment, it might suggest a potential reversal.

Analyzing Price Action in Conjunction with Sentiment

Effective trading often involves combining sentiment analysis with a thorough assessment of price action. While sentiment can offer a glimpse into market psychology, price action provides a concrete record of actual price movements. A strong bullish sentiment coupled with a clear uptrend on the price chart could strengthen a bullish trading signal. Conversely, a bearish sentiment combined with a significant price drop might reinforce a bearish trade setup.

Obtain access to Forex Factory’s role in backtesting trading strategies to private resources that are additional.

However, it’s crucial to remember that sentiment is just one piece of the puzzle; it shouldn’t be relied upon solely for making trading decisions. Other factors, such as economic news, geopolitical events, and technical analysis indicators, should also be considered.

Data Acquisition and Preparation

Gathering and preparing Forex Factory sentiment data for analysis is crucial for understanding its relationship with price action. This process involves obtaining the raw sentiment data, cleaning it to remove inconsistencies, and finally, aligning it precisely with the corresponding forex price data. Effective data preparation significantly impacts the accuracy and reliability of any subsequent analysis.Data acquisition primarily involves accessing the Forex Factory website and its various sentiment indicators.

Check building a successful digital marketing business with a remote team to inspect complete evaluations and testimonials from users.

While Forex Factory doesn’t provide a direct API for automated data extraction, several methods exist. One common approach is to use web scraping techniques. This involves using programming languages like Python, along with libraries such as Beautiful Soup and Selenium, to extract the relevant sentiment data from the website’s HTML structure. Another method, though more resource-intensive, is to manually download and record the data.

This approach is less efficient for large datasets but guarantees accurate data capture for smaller periods. Regardless of the chosen method, ethical considerations should always be paramount, respecting the website’s terms of service and avoiding actions that could overload their servers.

Forex Factory Sentiment Data Acquisition Methods

Obtaining Forex Factory sentiment data requires a structured approach. Web scraping offers an automated solution, leveraging programming libraries to extract data directly from the website. Manual data entry, while less efficient, offers greater control and accuracy for smaller datasets. The choice of method depends on the scale of the analysis and available resources. Both approaches necessitate careful consideration of Forex Factory’s terms of service to ensure responsible data acquisition.

Data Cleaning and Preparation Techniques, The relationship between Forex Factory sentiment and price action

Raw Forex Factory sentiment data often contains inconsistencies and requires cleaning before analysis. This typically involves handling missing values, outliers, and inconsistencies in data formatting. Missing data points can be addressed through various imputation techniques, such as using the previous or next valid data point, or employing more sophisticated statistical methods like mean or median imputation. Outliers, which are data points significantly different from the rest, should be carefully examined; they may represent genuine market events or errors.

Inconsistencies in formatting, such as differing time zones or inconsistent data types, need to be standardized to ensure data integrity. Data transformation might be necessary to improve the suitability of the data for specific analytical methods. For instance, converting sentiment percentages to numerical values allows for more robust statistical analysis.

Aligning Sentiment and Price Data

Precise alignment of Forex Factory sentiment data with corresponding price data is essential for accurate analysis. This typically involves matching the timestamps of the sentiment data with the timestamps of the price data. Since the sentiment data is usually recorded at specific intervals (e.g., hourly or daily), while price data is often available at much higher frequencies (e.g., every minute or even second), careful consideration is needed.

One approach is to aggregate the high-frequency price data to match the frequency of the sentiment data (e.g., calculate the daily average price). Conversely, one can interpolate the sentiment data to match the higher frequency of the price data, though this approach might introduce some inaccuracies. Choosing the appropriate alignment method depends on the specific research question and the desired level of detail.

Accurate alignment ensures that any observed relationship between sentiment and price is not an artifact of mismatched data. Using a consistent time zone across all datasets is critical for preventing time-related errors.

Correlation Analysis

Understanding the relationship between Forex Factory sentiment and price movements requires a robust correlation analysis. This involves exploring various statistical methods to quantify the strength and direction of this association, acknowledging potential confounding factors, and recognizing the limitations of correlation in establishing causality.Different methods exist for measuring the correlation between Forex Factory sentiment and price action. These methods offer different perspectives and sensitivities to the data’s characteristics.

Choosing the appropriate method depends on the specific research question and the nature of the data.

Correlation Methods Comparison

We can use several methods to assess the correlation between Forex Factory sentiment and price changes. Pearson’s correlation coefficient is a common choice for linear relationships between two continuous variables. However, if the relationship is non-linear, Spearman’s rank correlation or Kendall’s tau might be more appropriate. These non-parametric methods are less sensitive to outliers and don’t assume a normal distribution of the data.

Confounding Factors

Several factors can confound the observed relationship between Forex Factory sentiment and price action. News events, economic indicators, and central bank announcements can significantly influence both sentiment and price, making it difficult to isolate the direct effect of sentiment. Furthermore, the time lag between sentiment shifts and price changes needs careful consideration. Sentiment might precede price movements, follow them, or be completely unrelated.

Additionally, the specific market conditions (high volatility vs. low volatility) can influence the strength of the correlation. Finally, the sample size and data frequency can impact the results.

Limitations of Correlation Analysis

Correlation analysis demonstrates an association between two variables, but it doesn’t imply causation. Even a strong correlation doesn’t prove that changes in sentiment directly cause price movements. Other factors might be responsible for the observed relationship, or the relationship could be entirely coincidental. Establishing causality requires more sophisticated methods, such as regression analysis, which can control for confounding factors and test for a direct causal link.

Moreover, the interpretation of correlation coefficients should always consider the context of the data and the limitations of the chosen method.

Correlation Coefficient Results

The following table summarizes hypothetical correlation coefficients obtained using different methods, highlighting the importance of method selection and interpretation. Note that these are illustrative examples and would vary depending on the specific dataset and analysis.

| Method | Coefficient | p-value | Interpretation |

|---|---|---|---|

| Pearson’s Correlation | 0.65 | 0.001 | Moderate positive correlation; statistically significant. |

| Spearman’s Rank Correlation | 0.58 | 0.005 | Moderate positive correlation; statistically significant. |

| Kendall’s Tau | 0.42 | 0.01 | Moderate positive correlation; statistically significant. |

Regression Analysis

Regression analysis is a powerful statistical tool we can use to investigate the relationship between Forex Factory sentiment and price movements. Essentially, it helps us build a mathematical model that predicts price changes based on the sentiment data. This allows us to quantify the strength and direction of the relationship, going beyond simple correlation analysis.Regression analysis helps us understand how changes in sentiment translate into price changes, allowing for potentially more accurate trading strategies.

By identifying the significant predictors of price movement, we can gain a clearer picture of market dynamics and potentially improve our trading decisions.

Model Selection

Choosing the right regression model is crucial for accurate results. The nature of Forex data, often exhibiting non-linearity and heteroskedasticity (unequal variance of errors), necessitates careful consideration. Linear regression, while simple, might not capture the complexities of the relationship. More advanced models, such as polynomial regression or generalized additive models (GAMs), may be more suitable to account for non-linear patterns.

The choice depends on the specific characteristics of the data and the nature of the relationship being investigated. A thorough diagnostic check of model assumptions is essential after model fitting to ensure reliability.

Interpreting Regression Coefficients

The regression coefficients represent the change in price associated with a one-unit change in sentiment, holding other factors constant. For example, a positive coefficient for a bullish sentiment indicator suggests that an increase in bullish sentiment is associated with a rise in price. The magnitude of the coefficient indicates the strength of the relationship. A larger coefficient suggests a stronger impact of sentiment on price.

Statistical significance testing (p-values) helps determine whether the relationship is likely to be real or due to chance. Confidence intervals provide a range of plausible values for the coefficients.

Step-by-Step Regression Analysis

This procedure Artikels a practical approach to performing a regression analysis on Forex Factory sentiment and price data.

- Data Acquisition and Cleaning: Gather historical Forex price data and corresponding Forex Factory sentiment data. Ensure both datasets cover the same time period and are aligned. Clean the data, handling missing values appropriately (e.g., imputation or removal). Outliers should be carefully investigated and treated as needed, possibly through transformation or removal.

- Data Transformation (if necessary): If the data exhibits non-linearity or violates regression assumptions (e.g., non-normality of errors, heteroskedasticity), consider transformations. Common transformations include logarithmic transformations (log(x)) to address skewness or Box-Cox transformations for stabilizing variance. Visual inspection of data plots is crucial in guiding the choice of transformations.

- Model Selection and Estimation: Based on the data characteristics, select an appropriate regression model (linear, polynomial, GAM, etc.). Use statistical software (like R or Python) to estimate the model parameters. This involves fitting the chosen model to the data and obtaining estimates for the regression coefficients.

- Model Diagnostics: Assess the model’s goodness of fit and validity of assumptions. Examine residual plots to check for patterns, indicating potential model misspecification. Tests for heteroskedasticity and normality of errors should be conducted. Adjusted R-squared provides a measure of the model’s power, considering the number of predictors.

- Interpretation and Forecasting: Interpret the estimated regression coefficients, focusing on their statistical significance and practical meaning in the context of Forex trading. Use the fitted model to generate predictions of price changes based on different sentiment levels. Remember that these are predictions, not guarantees, and should be used cautiously.

For example, if we find a significant positive coefficient for a bullish sentiment indicator in a linear regression model, we might conclude that increases in bullish sentiment are associated with increases in price. However, the model’s accuracy should be validated using out-of-sample data before relying on it for trading decisions. Furthermore, the model should be regularly updated and re-evaluated as market conditions change.

Case Studies

This section presents real-world examples illustrating the relationship between Forex Factory sentiment and subsequent price movements. Analyzing these scenarios helps to understand how sentiment can act as a leading indicator, though it’s crucial to remember that sentiment is not a foolproof predictor and should be used in conjunction with other technical and fundamental analysis tools. These examples are not exhaustive but serve to demonstrate the potential influence of Forex Factory sentiment.

EUR/USD Sentiment Shift and Subsequent Price Drop

This case study examines a period where bullish sentiment on the EUR/USD pair on Forex Factory was significantly high, despite underlying economic indicators suggesting a weakening Euro. The chart showed a clear divergence: while the sentiment gauge indicated strong buying pressure, the price was consolidating near resistance. Over the following 24-48 hours, a significant sell-off occurred, with the price dropping by approximately 100 pips.

This drop can be attributed to a market correction as traders, influenced by the overbought sentiment and underlying economic realities, began to take profits and short the pair. The high sentiment acted as a contrarian indicator in this instance. A visual representation would show a steadily rising Forex Factory bullish sentiment indicator alongside a EUR/USD chart showing price consolidation near resistance, followed by a sharp decline.

The divergence between the sentiment and price action highlighted the risk of relying solely on sentiment data.

GBP/USD Sentiment and Breakout Confirmation

In contrast to the previous example, this case study demonstrates a scenario where Forex Factory sentiment aligned with price action to confirm a breakout. High bullish sentiment on the GBP/USD pair coincided with the price approaching a key resistance level. The chart displayed a period of consolidation followed by a decisive breakout above the resistance, accompanied by a surge in trading volume.

The high sentiment gauge, combined with the price breakout and increased volume, provided strong confirmation for long positions. A visual representation would illustrate a rising bullish sentiment indicator on Forex Factory correlating with the GBP/USD price approaching and breaking through a key resistance level, with a noticeable increase in trading volume accompanying the breakout. This scenario highlights how sentiment can act as a confirmation tool, strengthening the confidence in a trade setup.

USD/JPY Sentiment and False Breakout

This example illustrates the limitations of using sentiment alone. High bearish sentiment on the USD/JPY pair was observed on Forex Factory just before a significant price spike upward. The chart displayed a false breakout below support. Despite the strong bearish sentiment, the price ultimately reversed sharply upwards, catching many traders who relied solely on the negative sentiment off guard.

A visual representation would show a steeply falling bearish sentiment indicator on Forex Factory alongside a USD/JPY chart showing a price drop below support, followed by a strong upward reversal. This situation emphasizes the importance of considering other factors like technical indicators and fundamental news before acting solely on sentiment data. Relying on sentiment alone can lead to significant losses, as seen in this false breakout scenario.

Impact of Timeframes: The Relationship Between Forex Factory Sentiment And Price Action

The relationship between Forex Factory sentiment and price action isn’t static; it significantly changes depending on the timeframe considered. Short-term observations might reveal a strong correlation, while long-term analysis could show a weaker or even inverse relationship. Understanding these variations is crucial for effective trading strategy development. This section will explore how sentiment’s predictive power shifts across different time horizons.The interplay between sentiment and price action is heavily influenced by the timeframe used for analysis.

On shorter timeframes, such as 15-minute or hourly charts, sentiment can be a more powerful predictor of short-term price movements. This is because shorter-term price fluctuations are often driven by rapid shifts in trader psychology and immediate market reactions to news events. However, on longer timeframes, like daily or weekly charts, the influence of sentiment might be diluted by the impact of fundamental factors, long-term trends, and other macro-economic influences.

Short-Term Timeframe Sentiment Analysis

On short-term charts, Forex Factory sentiment can often reflect immediate market momentum. For example, a sudden surge in bullish sentiment on a 15-minute chart might precede a short-term price increase as more traders jump onto the bandwagon. Conversely, a rapid drop in bullish sentiment might indicate a potential short-term price reversal. The correlation between sentiment and price is typically stronger in these short-term periods because the emotional responses of traders are quicker to manifest in price movements.

However, this correlation is prone to high volatility and false signals due to noise from short-term market fluctuations.

Long-Term Timeframe Sentiment Analysis

In contrast, on longer timeframes, the relationship between sentiment and price action often becomes less direct. While sentiment might still provide some insights, its predictive power diminishes. This is because longer-term price movements are influenced by broader economic trends, geopolitical events, and fundamental analysis, which are not always reflected immediately in short-term sentiment shifts. For instance, a consistently high bullish sentiment over several months might not necessarily guarantee a continuous upward price trend.

Other factors, such as a sudden economic downturn, could easily override the positive sentiment and cause a significant price drop.

Visual Representation of Timeframe Impact

A useful visual representation would be a series of scatter plots, each representing a different timeframe (e.g., 15-minute, hourly, daily, weekly). The x-axis of each plot would represent the Forex Factory sentiment index (ranging from 0 to 100, for example, with 50 being neutral), and the y-axis would represent the percentage price change over that specific timeframe. The plots would clearly show the difference in the correlation strength (visualized by the clustering of points) across various timeframes.

A stronger correlation would be indicated by a tighter clustering of points around a line of best fit, while a weaker correlation would be shown by a more scattered distribution. Adding lines of best fit to each scatter plot would further illustrate the relationship’s strength and direction at each timeframe. The slope of the line would indicate the direction and strength of the relationship, while the R-squared value would quantitatively measure the correlation’s strength.

The comparison of these plots would clearly highlight how the predictive power of Forex Factory sentiment diminishes as the timeframe increases.

Ultimately, mastering the relationship between Forex Factory sentiment and price action requires a multifaceted approach. While sentiment analysis can offer valuable insights, it’s crucial to combine it with other technical and fundamental analysis methods for a more comprehensive trading strategy. By understanding the strengths and limitations of using Forex Factory sentiment, traders can improve their decision-making process and potentially enhance their trading performance.

Remember, consistent practice and careful risk management remain key to success in the forex market.