The limitations and potential pitfalls of relying on Forex Factory data are significant for forex traders. While Forex Factory offers a wealth of information, including economic calendars, news announcements, and user-generated sentiment indicators, it’s crucial to understand its inherent weaknesses. Blindly trusting this data can lead to inaccurate market assessments, flawed trading strategies, and ultimately, financial losses. This guide explores these limitations, providing insights into responsible data usage and risk mitigation.

We’ll delve into issues like data accuracy, potential biases in user-submitted content, and the incomplete coverage of the forex market provided by Forex Factory. We’ll also examine how over-reliance on this single source can hinder effective risk management and strategy development. By the end, you’ll have a clearer understanding of how to incorporate Forex Factory data effectively while minimizing the risks associated with its inherent limitations.

Data Accuracy and Reliability

Forex Factory is a popular resource for forex traders, offering a wealth of data including economic calendars, news announcements, and trading signals. However, relying solely on this data without critical evaluation can be risky. The accuracy and reliability of Forex Factory’s information are not guaranteed, and traders need to understand the potential pitfalls before incorporating it into their trading strategies.Forex Factory’s data, while generally considered a useful starting point, is susceptible to inaccuracies stemming from several sources.

These inaccuracies can significantly impact trading decisions and overall risk management. Understanding these potential issues and developing strategies to mitigate them is crucial for responsible forex trading.

Delayed Updates and Erroneous Entries

Data on Forex Factory, like any real-time data feed, is subject to delays. Economic announcements, for example, might appear on the platform slightly after their official release, potentially impacting traders’ ability to react swiftly to market-moving events. Furthermore, human error can lead to erroneous entries in the data, such as incorrect figures for economic indicators or misreported news headlines.

These inaccuracies can cause traders to misinterpret market conditions and make poorly informed decisions. For instance, a trader might enter a long position based on a falsely reported positive economic indicator, only to see the market move against them once the correct data is released. The magnitude of such errors can vary, ranging from minor discrepancies to significantly misleading information.

Comparison with Other Data Sources

Forex Factory’s data should not be considered the sole source of truth. Comparing information from Forex Factory with other reputable sources, such as official government websites for economic data, major news agencies like Reuters and Bloomberg, and other financial data providers, is essential for verification. This cross-referencing helps identify potential inaccuracies and inconsistencies. For example, if Forex Factory reports a specific interest rate change, verifying this information with the central bank’s official announcement ensures accuracy.

Divergences between data sources should prompt further investigation before making trading decisions.

Impact of Data Inaccuracies on Trading Decisions and Risk Management

Inaccurate data can lead to a cascade of negative consequences. Misinterpreting market trends based on flawed data can result in losses. Poor risk management practices, often stemming from over-reliance on a single data source, can exacerbate these losses. For example, a trader might over-leverage their position based on what they believe to be a reliable market signal from Forex Factory, only to discover the signal was inaccurate, resulting in substantial financial losses.

Understand how the union of how to use SEO to improve your website’s ranking can improve efficiency and productivity.

Proper risk management involves diversifying data sources and implementing robust position sizing techniques, regardless of the apparent reliability of any single source.

Methodology for Validating Forex Factory Data

A robust validation process is crucial. This involves: (1) Cross-referencing data with at least two other reliable sources. (2) Checking the source and time stamp of the information to assess its recency and reliability. (3) Considering the reputation and track record of the source of the data, acknowledging that even reputable sources can occasionally make mistakes. (4) Understanding that Forex Factory is primarily a community-driven platform, and user-submitted information may not always be accurate or unbiased.

By systematically verifying data from multiple, independent sources, traders can significantly reduce their reliance on potentially inaccurate information and improve their trading decisions.

Data Bias and Interpretation

Forex Factory, while a popular resource, isn’t immune to biases. Understanding these biases is crucial for accurately interpreting the data and avoiding flawed trading decisions. The platform relies heavily on user-generated content and this introduces several potential sources of skewed information.The inherent subjectivity of user-generated content significantly impacts the reliability of Forex Factory’s data. This means that the information presented, whether it’s news sentiment, economic calendar events, or forum discussions, might not reflect a truly objective representation of the market.

Different users have varying levels of expertise, trading styles, and even personal agendas, which can inadvertently—or deliberately—skew the data.

Selective Reporting and Confirmation Bias

Selective reporting is a common bias where users might highlight information that confirms their pre-existing beliefs or trading strategies, while downplaying or ignoring contradictory evidence. For instance, a trader bullish on a particular currency pair might selectively focus on positive news and comments supporting their view, while neglecting bearish indicators. This leads to a skewed perception of market sentiment and can result in overly optimistic or pessimistic trading decisions.

Discover how leveraging the power of data-driven decision making in digital marketing has transformed methods in this topic.

Similarly, confirmation bias can lead traders to interpret ambiguous data in a way that supports their existing beliefs, reinforcing their biases rather than objectively evaluating the market situation. A trader might see a slight price increase as a strong confirmation of their bullish prediction, ignoring other factors that suggest a temporary fluctuation.

Impact on Market Trend Interpretation and Sentiment Analysis

The presence of biases in Forex Factory data can significantly distort the interpretation of market trends and sentiment. For example, if a large number of users express strong bullish sentiment on a particular currency pair, it might not necessarily reflect the actual market sentiment. This is because the user base itself may not be representative of the entire market, and their opinions might be heavily influenced by confirmation bias or other subjective factors.

This misinterpretation can lead traders to enter positions based on flawed assumptions, potentially resulting in significant losses. Conversely, an overrepresentation of negative sentiment could lead to unwarranted pessimism and missed opportunities.

Examples of Biased Data Leading to Poor Trading Outcomes

Imagine a scenario where a significant portion of Forex Factory’s news section focuses on positive economic data for a specific country, leading to a surge in bullish sentiment. However, if this positive news is later contradicted by more comprehensive data or if geopolitical factors negatively impact the country’s economy, traders who solely relied on the initially biased information from Forex Factory could experience substantial losses.

Similarly, if a significant number of users post comments expressing extreme fear about a particular event, it could lead to a panic sell-off even if the actual market impact is minimal. This illustrates how biased data can amplify market volatility and lead to irrational trading decisions.

Framework for Critically Evaluating Forex Factory Data

To mitigate the risks associated with biased data, traders should develop a robust framework for critical evaluation. This involves:

- Diversify Data Sources: Don’t rely solely on Forex Factory. Cross-reference information with other reputable sources like financial news websites, economic reports, and independent market analysis.

- Consider the Source: Evaluate the credibility and potential biases of the users contributing to the platform. Look for evidence of expertise and objectivity.

- Analyze the Context: Consider the broader market context when interpreting data. Don’t isolate individual pieces of information; look for patterns and correlations.

- Question Assumptions: Challenge your own assumptions and biases. Actively seek out contradictory evidence to ensure a balanced perspective.

- Employ Technical Analysis: Combine Forex Factory’s sentiment data with technical analysis to form a more comprehensive trading strategy.

By adopting this critical approach, traders can significantly reduce the impact of biased data and make more informed trading decisions.

Limitations in Data Scope and Coverage

Forex Factory, while a valuable resource for forex traders, doesn’t provide a completely comprehensive view of the forex market. Its data limitations stem from its focus on specific aspects and the inherent challenges in capturing the entirety of a decentralized, 24/5 market. Understanding these limitations is crucial for accurate analysis and informed trading decisions.Forex Factory primarily focuses on providing economic news calendars, technical indicators, and some sentiment data.

However, its coverage is not exhaustive, and relying solely on this platform for trading decisions can lead to incomplete or potentially misleading interpretations.

Excluded Market Segments

The forex market is vast and diverse, encompassing various instruments and trading styles. Forex Factory’s data primarily focuses on major currency pairs and some minor pairs, leaving out a significant portion of the market. For instance, it generally lacks detailed information on emerging market currencies, exotic pairs (like USD/TRY or GBP/ZAR), and the over-the-counter (OTC) derivatives market, which accounts for a substantial portion of forex trading volume.

This omission limits the analysis for traders interested in these less-liquid or more volatile markets. Furthermore, information on less-traded currency crosses or specific contract specifications might be missing or incomplete.

Missing Data Points

Beyond specific instruments, Forex Factory also lacks data points crucial for comprehensive market analysis. For example, it doesn’t typically offer real-time order book depth, high-frequency tick data, or detailed information on trading volume across various platforms. This absence of granular data restricts the ability to perform sophisticated analyses, such as identifying market microstructure features or predicting short-term price movements based on order flow.

Additionally, information on specific trading strategies employed by other market participants is absent. This limits the possibility of understanding market sentiment from a more nuanced perspective.

Implications of Incomplete Data

Using incomplete data from Forex Factory for forecasting and trading decisions can lead to several significant problems. Firstly, it can result in inaccurate market assessments. Over-reliance on a limited dataset might lead to ignoring crucial market dynamics occurring outside of Forex Factory’s scope, potentially resulting in missed opportunities or significant losses. Secondly, backtesting trading strategies using only Forex Factory data might produce biased results, as the strategy’s performance might be significantly different when exposed to the full spectrum of market conditions.

For example, a strategy that performs well on major pairs during periods of low volatility might fail dramatically when applied to emerging market currencies during periods of high volatility.

Comparative Analysis of Data Coverage

Comparing Forex Factory’s data coverage to other market data sources reveals its limitations more clearly. While Forex Factory offers a convenient overview of economic news and sentiment, platforms like Bloomberg Terminal, Refinitiv Eikon, or dedicated forex brokers’ platforms provide far more comprehensive data, including real-time quotes, order book depth, historical data on a wider range of instruments, and advanced analytical tools.

These professional platforms often integrate news feeds from multiple sources, providing a more holistic view of the market than Forex Factory can offer. For example, Bloomberg Terminal provides access to a vast array of economic indicators, detailed news analysis, and sophisticated charting tools, offering a much richer data environment than Forex Factory.

Dependence and Over-reliance on Forex Factory Data

Forex Factory is a valuable resource for forex traders, offering a wealth of information including economic calendars, news feeds, and forum discussions. However, relying too heavily on this single source can be detrimental to your trading success. Over-dependence can lead to a skewed perspective, missed opportunities, and ultimately, financial losses. Understanding the limitations and potential pitfalls is crucial for responsible and effective utilization of this platform.The risks associated with excessive reliance on Forex Factory data stem from several factors.

Firstly, the information presented, while often timely, is not always verified or independently analyzed. Secondly, the forum discussions, while offering diverse opinions, can be heavily influenced by biases, emotions, and even misinformation spread by experienced or inexperienced traders alike. Over-reliance on such a dynamic and potentially unreliable source without critical evaluation can lead to poorly informed decisions and ultimately, unsuccessful trades.

Think of it like this: relying solely on one weather report to plan a major outdoor event – while it might be helpful, ignoring other forecasts or ground-level observations significantly increases the risk of disruption.

Forex Factory Data as a Sole Source Versus Integration with Other Sources

Using Forex Factory data exclusively creates a significant vulnerability in your trading strategy. This approach limits your exposure to different perspectives, analysis methodologies, and potentially crucial data points. Integrating Forex Factory data with other reputable sources, such as technical analysis platforms, fundamental economic reports from official government sources (e.g., central bank websites), and independent financial news outlets, offers a more holistic and well-rounded perspective.

For example, while Forex Factory’s economic calendar might highlight an upcoming interest rate announcement, cross-referencing this with analysis from a reputable financial news source provides context and potentially different interpretations of the potential market impact. A balanced approach considers various viewpoints, leading to more informed and robust trading decisions.

Diversifying Information Sources for Informed Decision-Making

Diversifying your information sources is paramount for success in forex trading. It reduces your dependence on any single source’s potential biases or inaccuracies. By consulting multiple sources, you can cross-reference information, identify potential inconsistencies, and build a more comprehensive understanding of market dynamics. This approach helps you develop a more nuanced perspective, reducing the risk of impulsive decisions based on incomplete or misleading data.

Consider it like assembling a puzzle – each piece (information source) contributes to the bigger picture (market understanding), and relying on only a few pieces significantly limits your ability to see the whole picture clearly.

A Strategy for Responsible Incorporation of Forex Factory Data

To utilize Forex Factory data responsibly, adopt a multi-faceted approach. First, treat all information obtained from Forex Factory as a starting point, not the final answer. Second, always cross-reference data with at least two other credible sources. Third, critically evaluate the information, considering the source’s potential biases and the overall market context. Fourth, develop a robust trading plan that incorporates multiple indicators and strategies, not solely relying on information gleaned from Forex Factory’s news or forum discussions.

Fifth, maintain a trading journal to track your decisions, their rationale, and the outcomes, allowing for continuous improvement and refinement of your approach. This disciplined approach minimizes the risks associated with over-reliance on any single data source, while still leveraging the valuable information Forex Factory can provide.

Impact on Trading Strategies and Risk Management

Forex Factory data, while a popular resource, presents limitations that significantly impact the development and execution of trading strategies and, crucially, risk management. Over-reliance on this data can lead to flawed strategies and inadequate risk mitigation, potentially resulting in substantial financial losses. Understanding these limitations is paramount for responsible forex trading.The inherent inaccuracies and biases within Forex Factory data can directly affect the effectiveness of trading strategies.

For instance, a strategy built solely on news sentiment derived from Forex Factory comments might fail to account for market-moving events not reflected in the platform’s discussions, leading to missed opportunities or incorrect trade entries. Similarly, relying on the platform’s economic calendar for trade signals without cross-referencing with other reliable sources could expose traders to unexpected market volatility and losses.

Strategies relying heavily on the perceived consensus of Forex Factory users, without independent verification, are particularly vulnerable.

Stop-Loss Order and Position Sizing Considerations

The limitations of Forex Factory data necessitate a cautious approach to stop-loss orders and position sizing. Stop-loss orders, designed to limit potential losses, become less effective if the underlying data used to determine their placement is unreliable or biased. For example, a trader might place a stop-loss based on a perceived support level derived from Forex Factory chart analysis, only to find that the actual market price breaks through that level unexpectedly due to factors not reflected on the platform.

Similarly, position sizing, calculated based on perceived risk levels gleaned from Forex Factory data, might be inaccurate, leading to excessive risk exposure. A trader might overestimate their potential profit based on optimistic sentiment expressed on the platform, leading to larger positions than justified by their risk tolerance.

Risk Management Framework for Forex Factory Data

A robust risk management framework should explicitly acknowledge the potential inaccuracies and biases present in Forex Factory data. This framework should incorporate several key elements. First, it’s crucial to diversify data sources. Don’t rely solely on Forex Factory; cross-reference information with other reputable sources such as reputable news outlets, economic calendars from central banks, and independent market analysis. Second, implement rigorous backtesting of any strategy relying on Forex Factory data.

This helps to identify potential weaknesses and vulnerabilities before deploying the strategy with real capital. Third, always use conservative position sizing. Never risk more capital than you can afford to lose, and factor in a margin of error to account for potential data inaccuracies. Fourth, maintain a detailed trading journal to track performance and identify areas where Forex Factory data may have led to poor decisions.

Finally, regularly review and adapt your trading strategy based on market conditions and your analysis of the reliability of Forex Factory information. This iterative approach allows for continuous improvement and reduces reliance on potentially flawed data.

Visual Representation of Data Limitations: The Limitations And Potential Pitfalls Of Relying On Forex Factory Data

Forex Factory, while a valuable resource for forex traders, isn’t without its limitations. Understanding these limitations visually can help traders better interpret the data and avoid potential pitfalls in their trading strategies. The following table provides a clear representation of some key areas where Forex Factory data might fall short.

| Data Accuracy | Timeliness | Bias | Scope |

|---|---|---|---|

| Reported economic data might contain minor discrepancies compared to official releases from central banks or statistical agencies. For example, a reported inflation figure on Forex Factory could differ slightly from the official government announcement, leading to misinterpreted market sentiment. | There’s a time lag between the actual event (e.g., news release) and its appearance on Forex Factory. This delay, even if only a few minutes, can significantly impact short-term trading strategies relying on immediate reactions to news. For instance, a trader relying on Forex Factory news might miss a fleeting opportunity if the platform updates slower than other news sources. | Forex Factory’s data is contributed by various users and sources. This can lead to a potential bias, especially in sentiment indicators or forum discussions. For example, a highly active user with a bearish outlook might disproportionately influence the overall sentiment reflected on the platform, potentially misleading other users. | Forex Factory primarily focuses on major currency pairs and some significant economic indicators. It may lack comprehensive coverage of less-traded currencies, emerging markets data, or specific niche financial instruments. A trader relying solely on Forex Factory might miss crucial information on less-liquid markets, affecting their diversification strategy. |

Data Accuracy Issues and Examples

Inaccurate data can stem from various sources, including reporting errors, typos, or delays in updating information. Consider the scenario where Forex Factory reports an unemployment rate that differs from the official government statistic. This discrepancy, however small, could lead a trader to misinterpret the market’s response to the news and make an incorrect trading decision. The impact is magnified when dealing with high-leverage forex trading, where even small inaccuracies can result in substantial losses.

Timeliness and its Impact on Trading Decisions

The time it takes for information to be posted on Forex Factory can influence trading outcomes. For example, a significant economic announcement might trigger an immediate market reaction that a trader using Forex Factory misses due to the platform’s update delay. This delay can lead to missed opportunities or entering trades at less favorable prices.

Bias in User-Generated Content and Sentiment Indicators

Forex Factory’s forum and sentiment indicators are user-generated. This can lead to a bias based on the collective opinions of users. For example, a strong bullish sentiment expressed by a large group of users might not accurately reflect the overall market sentiment or future price movements. Over-reliance on such user-generated data can lead to flawed trading decisions.

Limitations in Data Scope and Coverage

Forex Factory’s data coverage is not exhaustive. It mainly focuses on major currency pairs and popular economic indicators. Traders focusing on emerging markets or less-traded currencies might find the data insufficient for informed decision-making. This limited scope restricts a trader’s ability to conduct thorough market analysis and diversify their portfolio effectively.

Illustrative Examples of Pitfalls

Relying solely on Forex Factory data, while seemingly convenient, can lead to significant trading losses if not used cautiously alongside other forms of analysis. The following scenarios illustrate how misinterpreting or over-relying on this data can negatively impact trading decisions.

Scenario 1: Misinterpreting Sentiment Data

This scenario highlights the danger of relying solely on Forex Factory’s sentiment indicators. Imagine a trader observes a strong bullish sentiment for the EUR/USD pair on Forex Factory’s poll, with 80% of participants predicting a price increase. Based on this, the trader enters a long position with a significant amount of capital. However, this strong bullish sentiment is not corroborated by other technical or fundamental analysis.

For example, macroeconomic news releases later that day reveal unexpectedly weak Eurozone economic data, causing the EUR/USD to sharply decline. The trader experiences substantial losses because they failed to consider information beyond the Forex Factory sentiment poll. The overconfidence induced by the seemingly unanimous bullish sentiment blinded the trader to other crucial market factors.

Scenario 2: Overreaction to News Events

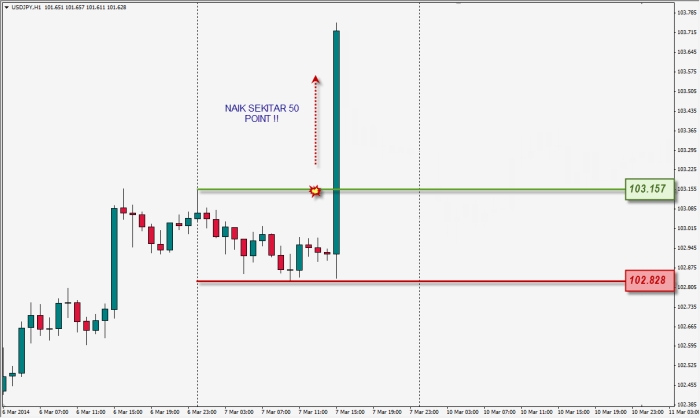

Forex Factory provides a calendar of upcoming economic news releases, and traders often use this to anticipate market movements. In this scenario, a trader sees that the upcoming Non-Farm Payroll (NFP) report is expected to significantly impact the USD. Based on the anticipated positive NFP numbers and the subsequent anticipated USD strength shown on Forex Factory’s forum discussions, the trader takes a large long position on USD/JPY.

However, the actual NFP report comes in weaker than expected, causing the USD to weaken against the JPY. The trader’s position, based solely on the pre-release speculation and discussions on Forex Factory, results in a significant loss. The overreaction to the anticipated news, fueled by the discussions on Forex Factory, without a proper risk management plan, led to this outcome.

The trader failed to account for the possibility of the NFP report being less impactful than anticipated or even being negative.

Scenario 3: False Signals from Price Action Discussion Forums, The limitations and potential pitfalls of relying on Forex Factory data

Forex Factory hosts forums where traders discuss price action and potential trading opportunities. In this scenario, a trader observes a discussion thread where several users claim a specific candlestick pattern indicates an imminent price reversal in the GBP/USD pair. Based on this, and without verifying this with other technical indicators or fundamental analysis, the trader enters a short position.

However, the price continues its upward trend, leading to losses. The “signal” from the forum discussion, lacking independent verification, proved to be inaccurate. The trader’s over-reliance on the opinions expressed in the forum, without critical evaluation, resulted in a losing trade. The subjective nature of price action interpretation, coupled with the lack of confirmation from other sources, caused the trader to misinterpret the market signals.

Successfully navigating the forex market requires a multifaceted approach to information gathering. While Forex Factory offers valuable insights, it’s essential to acknowledge its limitations and avoid over-reliance. By critically evaluating data, diversifying your information sources, and implementing robust risk management strategies, you can significantly improve your trading outcomes. Remember that informed decision-making, based on a comprehensive understanding of market dynamics, is paramount to long-term success in forex trading.

Don’t let the allure of readily available data overshadow the importance of critical thinking and a well-defined trading plan.