The importance of news filtering techniques when using Forex Factory cannot be overstated. Forex Factory, while a treasure trove of market information, is also a chaotic landscape of opinions, rumors, and potentially misleading data. Navigating this information overload effectively is crucial for successful forex trading. This guide will equip you with the skills to sift through the noise and identify reliable insights, ultimately improving your trading decisions.

We’ll explore practical strategies for evaluating sources, identifying expert opinions, and utilizing search operators to refine your Forex Factory searches. You’ll learn how to analyze market sentiment without falling prey to common biases, and we’ll show you how visualizing this information can significantly improve your understanding of market dynamics. Ultimately, mastering news filtering on Forex Factory is key to transforming raw data into actionable trading intelligence.

Understanding Forex Factory’s Information Landscape

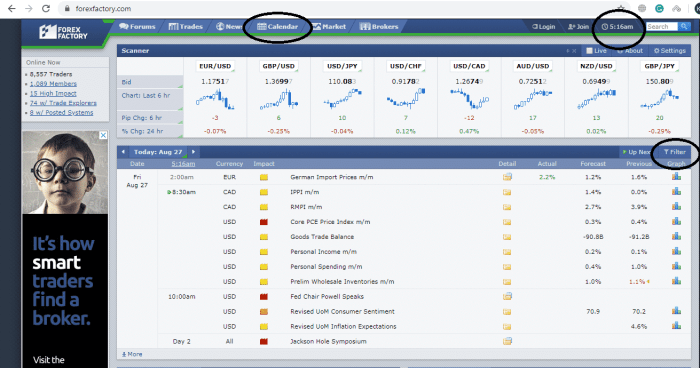

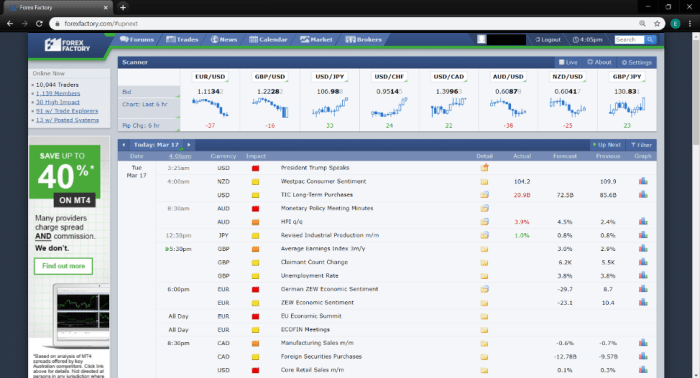

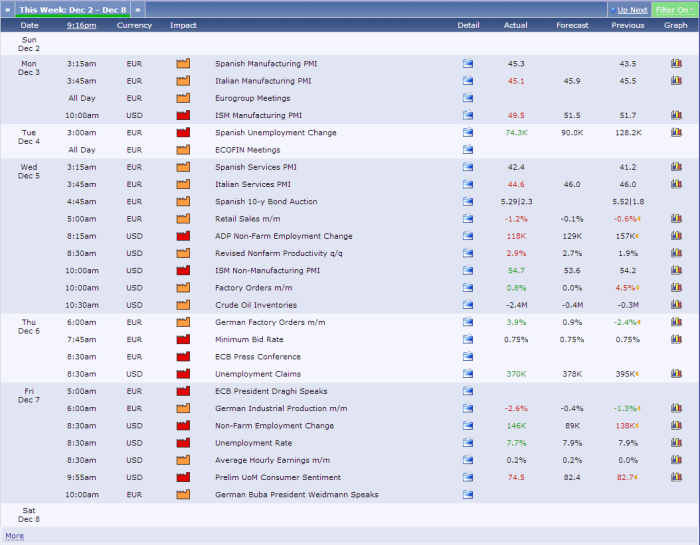

Forex Factory is a bustling hub for forex traders, offering a vast array of information. This abundance, however, presents both opportunities and significant challenges. Navigating this complex landscape requires a discerning eye and a robust understanding of how to filter information effectively.The sheer volume and diversity of information available on Forex Factory can be overwhelming. The platform hosts news articles, economic calendars, technical analysis charts, forum discussions, and expert opinions, all vying for your attention.

This mixture creates a rich source of potential insights but also increases the risk of encountering misinformation or unreliable data.

Diverse Information Sources on Forex Factory, The importance of news filtering techniques when using Forex Factory

Forex Factory aggregates data from numerous sources, including news agencies, central banks, and individual traders. This broad range provides access to a wide spectrum of perspectives and data points. However, it’s crucial to remember that the quality and reliability of this information can vary drastically. Some sources may be reputable and well-vetted, while others might be biased, outdated, or even intentionally misleading.

For example, news articles from established financial news outlets generally hold more weight than comments posted by anonymous users on the forum.

Potential for Misinformation and Unreliable Data

The open nature of Forex Factory’s forums and comment sections means anyone can contribute, leading to a significant risk of misinformation. Unsubstantiated claims, biased opinions, and outright scams can easily spread. Furthermore, the speed at which information is disseminated online can outpace verification processes, meaning inaccurate data can quickly gain traction before being corrected. A prime example would be a rumour circulating on the forum about a major policy change by a central bank – this could drastically affect market movements before official confirmation disproves the rumour.

Therefore, critical evaluation of all information is paramount.

Challenges Posed by Information Volume

The sheer volume of information available on Forex Factory poses its own set of challenges. Sifting through countless posts, news articles, and analyses to identify relevant and reliable information can be incredibly time-consuming. Furthermore, the constant influx of new data can make it difficult to stay on top of the latest developments and maintain a clear perspective. This information overload can lead to analysis paralysis, hindering effective trading decisions.

Developing efficient filtering techniques, prioritizing reputable sources, and focusing on information relevant to your specific trading strategy are crucial for managing this challenge.

Identifying Reliable Sources on Forex Factory

Forex Factory is a bustling online forum, a treasure trove of information for forex traders, but also a potential minefield of misinformation. Sifting through the sheer volume of posts requires a discerning eye and a robust methodology for identifying reliable sources. This section will equip you with the tools to navigate this complex information landscape effectively and make informed trading decisions.Evaluating the credibility of Forex Factory forum posts requires a multi-faceted approach.

It’s not simply about looking for posts with high numbers of “likes” or responses, as popularity doesn’t always equate to accuracy.

Check The relationship between Forex Factory sentiment and price action to inspect complete evaluations and testimonials from users.

Credibility Assessment Methodology

A comprehensive assessment of a post’s credibility involves examining several key aspects. First, consider the author’s posting history. A user with a long history of insightful and well-reasoned contributions is generally more trustworthy than a newcomer with limited engagement. Look for consistency in their analysis and a track record of providing valuable information. Second, evaluate the content itself.

Does the post provide concrete evidence to support its claims? Are sources cited? Does the analysis demonstrate a clear understanding of fundamental and technical analysis principles? Beware of posts that rely heavily on unsubstantiated claims, emotional appeals, or overly simplistic explanations. Finally, consider the context.

Is the post responding to a specific market event or news item? If so, does the analysis align with the broader market consensus and verifiable data?

Distinguishing Expert Opinions from Speculative Comments

Identifying expert opinions within the noise of speculative comments requires careful observation. Expert opinions often demonstrate a deep understanding of market dynamics, technical indicators, and fundamental economic factors. They usually present a well-structured argument, supported by data and logical reasoning, rather than relying on gut feelings or unsubstantiated predictions. Speculative comments, on the other hand, tend to be based on conjecture, rumors, or emotional reactions to market movements.

Do not overlook explore the latest data about Effective position sizing strategies using Forex Factory data.

They often lack concrete evidence and may exhibit a high degree of uncertainty. For example, a post claiming “EUR/USD will definitely hit 1.15 next week” is purely speculative, while a post analyzing the impact of recent ECB policy changes on the EUR/USD exchange rate, supported by relevant economic data, is more likely to represent an expert opinion.

Verifying Information from Multiple Sources

Never rely on a single source, especially on a platform like Forex Factory where opinions can vary widely. Cross-referencing information from multiple reputable sources is crucial for validating claims and gaining a more holistic understanding of the market situation. Compare different analyses, identify common themes, and look for discrepancies that may indicate inaccuracies or biases. For example, if a Forex Factory post claims a specific economic indicator will have a significant impact on a currency pair, verify this claim by consulting reputable news sources such as Reuters, Bloomberg, or the official websites of central banks.

This multi-source approach significantly reduces the risk of basing your trading decisions on unreliable or misleading information.

Techniques for Filtering Information Effectively

Forex Factory is a treasure trove of forex-related information, but navigating its vast landscape can be overwhelming. Effective filtering techniques are crucial to separate the wheat from the chaff and focus on data that truly benefits your trading strategy. This section Artikels practical steps and criteria to help you efficiently process the information available on Forex Factory.

A Step-by-Step Guide to Filtering Relevant Information

Successfully filtering information on Forex Factory involves a systematic approach. This guide breaks down the process into manageable steps, ensuring you extract the most valuable insights.

- Define Your Needs: Before diving into Forex Factory, clearly identify your information needs. Are you looking for economic news impacting a specific currency pair? Are you researching technical indicators? Knowing your objective focuses your search and prevents information overload.

- Utilize Forex Factory’s Search Function: Forex Factory’s search bar is your primary tool. Use precise s related to your needs. For example, instead of searching “EURUSD,” try “EURUSD daily chart analysis” for more specific results.

- Leverage Forums’ Filtering Options: Forex Factory’s forums allow filtering by thread title, author, and date. Use these options to narrow down discussions to those most relevant to your current research. For example, you could filter for threads posted in the last week on a specific technical indicator.

- Assess Information Quality: Once you’ve gathered potential sources, critically evaluate their credibility. Look for posts with well-reasoned arguments, supporting evidence (charts, data), and a history of accurate predictions or insightful analysis. Avoid threads dominated by unsubstantiated opinions or emotional outbursts.

- Cross-Reference Information: Don’t rely on a single source. Compare information from multiple threads and posts to get a well-rounded perspective. Consistency across multiple credible sources strengthens the validity of the information.

Criteria for Prioritizing Information on Forex Factory

Not all information on Forex Factory holds equal value. Prioritizing information based on specific criteria improves the efficiency of your research.

Consider these factors when evaluating the importance of a piece of information:

- Source Credibility: Established traders with a proven track record or reputable analysts often provide more reliable information.

- Data Support: Information backed by charts, economic data, or historical evidence carries more weight than unsubstantiated claims.

- Relevance to Your Strategy: Focus on information directly applicable to your trading style and current market conditions.

- Timeliness: For news and economic data, recency is critical. Older information may be outdated and irrelevant.

- Consensus Among Sources: Agreement among multiple reliable sources strengthens the credibility of the information.

Using Search Operators and Filters to Refine Results

Forex Factory’s search functionality can be significantly enhanced by using advanced search operators and filters. This allows you to target specific information with greater precision.

Examples of effective search strategies:

- Using quotation marks: Searching for “EUR/USD technical analysis” will only return results containing that exact phrase, filtering out less relevant results.

- Using the minus sign (-): To exclude certain words, use a minus sign. For example, searching “forex trading -scalping” will exclude results related to scalping strategies.

- Using the asterisk (*): The asterisk acts as a wildcard. Searching “EUR*USD” will find results containing variations like EURUSD, EUR/USD, or Euro/USD.

- Combining s: Combining multiple s increases specificity. For example, “GBPUSD support resistance levels” will provide results focused on that particular topic.

The Role of Sentiment Analysis in Forex Trading Decisions: The Importance Of News Filtering Techniques When Using Forex Factory

Forex Factory, with its bustling forums and threads, offers a rich tapestry of trader opinions and market perspectives. Analyzing this collective sentiment can provide valuable insights into the prevailing market mood, potentially influencing your trading strategy. However, it’s crucial to understand both the power and the limitations of sentiment analysis within the Forex Factory context.Interpreting market sentiment from Forex Factory discussions requires a keen eye and a nuanced approach.

Look for recurring themes and s within posts. A preponderance of comments expressing bullish expectations about a particular currency pair, for example, might suggest a positive sentiment. Conversely, an abundance of bearish predictions could indicate a negative outlook. Pay close attention to the tone of the posts; are traders expressing confidence or uncertainty? Are they providing reasoned arguments or simply emotional outbursts?

The strength and consistency of the sentiment are key indicators of its potential impact on price movements.

Identifying and Interpreting Market Sentiment from Forex Factory Discussions

Effective sentiment analysis on Forex Factory involves more than just counting positive and negative comments. Consider the source: are the comments coming from experienced traders with proven track records, or are they from novice traders whose opinions may be less reliable? The context of the discussions is also vital. A strong bullish sentiment might be tempered if it’s occurring during a period of overall market uncertainty or negative economic news.

Furthermore, consider the volume of posts. A significant surge in bearish comments could signal a shift in market sentiment, warranting closer attention. Analyzing the evolution of sentiment over time—tracking shifts in optimism or pessimism—can also be highly informative.

Potential Pitfalls of Relying Solely on Sentiment Analysis for Trading Decisions

While sentiment analysis can be a valuable tool, relying on it exclusively for trading decisions is inherently risky. Forex Factory discussions are, by their nature, subjective and prone to biases. Herding behavior, where traders follow the crowd without independent analysis, is a common phenomenon and can lead to inflated or inaccurate sentiment readings. Furthermore, the information on Forex Factory is not vetted; misinformation and manipulation can easily spread, potentially leading to flawed trading decisions.

Successful trading requires a multi-faceted approach, incorporating fundamental and technical analysis alongside sentiment analysis, rather than relying solely on the latter.

Comparing and Contrasting Different Methods for Gauging Market Sentiment from Forex Factory Data

Several methods exist for gauging market sentiment from Forex Factory data. A simple approach involves manually reading and categorizing posts as bullish, bearish, or neutral. However, this method is time-consuming and prone to subjective bias. More sophisticated approaches involve using natural language processing (NLP) techniques to automatically analyze the text of posts and quantify sentiment. This can be achieved through the use of sentiment analysis APIs or custom-built algorithms.

While NLP offers the advantage of speed and scalability, it’s not without its limitations. The accuracy of NLP algorithms can vary depending on the complexity of the language used and the nuances of the text. Ultimately, a combination of manual review and automated analysis often provides the most comprehensive and reliable picture of market sentiment.

Managing Information Overload and Avoiding Bias

Forex Factory is a treasure trove of information for forex traders, but the sheer volume can be overwhelming. Successfully navigating this landscape requires a structured approach to manage the influx of data and a keen awareness of the cognitive biases that can distort our interpretations. Failing to do so can lead to poor trading decisions and ultimately, financial losses.The constant stream of news, opinions, and analysis on Forex Factory can easily lead to information overload.

This, coupled with inherent cognitive biases, creates a significant challenge for traders aiming for rational decision-making. Effectively managing this requires a multi-pronged strategy focusing on organization, critical evaluation, and conscious bias mitigation.

Strategies for Organizing Forex Factory Information

To combat information overload, a structured approach is crucial. Instead of passively absorbing every post and thread, actively curate your information intake. This involves focusing on specific, relevant information sources and utilizing tools to organize and filter the data. Consider creating a system where you categorize information by topic (e.g., economic news, technical analysis, market sentiment) and source reliability.

Regularly review and refine this system to ensure it remains effective and relevant to your trading strategy. Using a dedicated notebook, spreadsheet, or even a simple folder system on your computer can help you keep track of key information and avoid feeling overwhelmed by the sheer volume of data.

Common Cognitive Biases in Forex Trading

Several cognitive biases can significantly impact how we interpret information from Forex Factory. Confirmation bias, where we favor information confirming our pre-existing beliefs, is particularly prevalent. This can lead to ignoring contradictory evidence and making irrational trading decisions based on biased interpretations. Other biases, such as anchoring bias (over-relying on the first piece of information received), availability heuristic (overestimating the likelihood of events easily recalled), and overconfidence bias, can also skew our judgment.

Recognizing these biases is the first step towards mitigating their influence.

Mitigating Confirmation Bias

Confirmation bias is a powerful force, and actively combating it is essential for successful forex trading. One effective strategy is to actively seek out information that contradicts your existing beliefs. For example, if you believe a particular currency pair is about to appreciate, actively search for analysis suggesting the opposite. This doesn’t mean you should blindly change your opinion, but rather, it forces you to critically evaluate your reasoning and consider alternative perspectives.

Another useful technique is to regularly review your trading journal, paying attention to instances where your biases might have led to poor decisions. This self-reflection helps to identify patterns and develop strategies for avoiding similar mistakes in the future. Finally, engaging in discussions with other traders who hold differing views can provide valuable insights and challenge your assumptions.

Remember, a diverse range of perspectives can lead to a more balanced and informed understanding of the market.

Visualizing Forex Factory Data for Improved Understanding

Forex Factory offers a wealth of information, but raw data can be overwhelming. Visualizing this data is crucial for effective analysis and informed trading decisions. By transforming numerical data and textual sentiment into charts and graphs, you can quickly identify trends, patterns, and potential biases, leading to a more comprehensive understanding of market sentiment and potential trading opportunities.

Effectively visualizing Forex Factory data involves choosing the right data type for your needs and understanding its inherent limitations. Different data types offer unique perspectives, but each comes with its own strengths and weaknesses in terms of reliability and potential bias. Understanding these nuances is key to using Forex Factory data effectively.

Forex Factory Data Types: A Comparative Analysis

The following table compares different Forex Factory data types, highlighting their reliability, usefulness, and potential biases. Remember that no single data type provides a complete picture; combining different sources offers the most robust analysis.

| Data Type | Reliability | Usefulness | Potential Bias |

|---|---|---|---|

| Calendar Events | High (for scheduled events); Moderate (for market rumors) | Identifying potential volatility periods; gauging market anticipation | Potential for misinterpretations of event impact; rumors may be inaccurate or manipulated |

| Forex Forums | Low to Moderate (depending on poster credibility) | Gathering diverse opinions; understanding market sentiment | High; subjective opinions, emotional biases, potential for misinformation and manipulation |

| Economic News | High (from reputable sources); Moderate (from less known sources) | Understanding fundamental factors influencing currency pairs | Potential for delayed updates; interpretations of economic data can vary |

| Order Book Data | High (reflects real-time market activity) | Assessing liquidity and potential price movements | Can be misleading if not interpreted in context with other data; susceptible to manipulation |

Visualizing the Forex Factory Information Filtering Workflow

A clear workflow is essential for effective filtering. The following description Artikels a visual representation of this process. Imagine a flowchart, beginning with the broad range of information available on Forex Factory and narrowing down to actionable insights.

The flowchart starts with a large circle representing the “Forex Factory Information Landscape,” encompassing all available data: calendar events, news articles, forum discussions, and order book data. Arrows then branch out to represent the filtering stages. The first stage, “Source Identification and Assessment,” is depicted as a filter separating reliable sources (e.g., official central bank announcements) from less reliable ones (e.g., unverified forum posts).

This leads to a smaller circle representing “Filtered Data.” The next stage, “Data Type Selection,” is shown as a decision point, where users choose specific data types relevant to their trading strategy (e.g., economic news for fundamental analysis, forum sentiment for technical analysis). This results in an even smaller circle of “Selected Data.” The final stage, “Sentiment Analysis and Visualization,” involves using tools or techniques to analyze sentiment within the selected data and present it visually through charts or graphs (e.g., a sentiment gauge for forum posts or a line chart for price movements correlated with news events).

This concludes with a small circle representing “Actionable Insights,” ready for use in trading decisions. The overall visual emphasizes the progressive reduction of information, leading to a concise and useful set of data for trading.

The Impact of Filtering on Trading Performance

Effective news filtering on Forex Factory is crucial for successful trading. The sheer volume of information available can easily overwhelm traders, leading to poor decisions if not managed properly. Filtering allows traders to focus on high-quality, relevant data, ultimately improving their trading outcomes.The quality of information directly impacts trading success. Access to reliable and timely data allows for more informed decisions, potentially leading to higher profitability and reduced risk.

Conversely, relying on unreliable or irrelevant information can lead to significant losses. Effective filtering acts as a crucial gatekeeper, separating the signal from the noise.

Benefits of Effective News Filtering

Effective news filtering significantly enhances trading performance by reducing noise and focusing on relevant information. This allows traders to make faster, more informed decisions based on reliable data, potentially improving trade accuracy and minimizing losses. For example, a trader focusing solely on reputable news sources and filtering out speculative rumors might avoid entering a trade based on false information leading to a loss.

Conversely, identifying a genuine market-moving event early through effective filtering could enable them to capitalize on profitable opportunities others miss.

Negative Impacts of Poor Information Filtering

Poor information filtering can have detrimental effects on trading outcomes. Exposure to misleading or biased information can lead to incorrect market assessments and poor trading decisions. For example, a trader overwhelmed by conflicting news reports from unreliable sources on Forex Factory might hesitate to enter a potentially profitable trade, missing out on significant gains. Alternatively, acting on false information could result in substantial losses.

Imagine a trader basing a trade solely on a rumour spread on a less credible forum section of Forex Factory, only to see the market move against their position due to the inaccuracy of the information.

Information Quality and Trading Success

The correlation between information quality and trading success is undeniable. High-quality information, obtained through effective filtering, enables traders to better predict market movements, manage risk effectively, and ultimately increase their profitability. A trader who consistently relies on verified data from trusted sources on Forex Factory will likely make better trading decisions compared to one who relies on unverified or biased information.

This difference in information quality translates directly to a difference in trading performance, with the former potentially achieving higher returns and lower risk.

Successfully navigating the Forex Factory information landscape requires a disciplined approach to news filtering. By mastering the techniques Artikeld in this guide – from critically evaluating sources to managing information overload and mitigating bias – you can significantly improve the quality of your market analysis. Remember, informed trading decisions are built on reliable data and a clear understanding of market sentiment.

Sharpen your filtering skills, and watch your trading performance improve.