Short-term trading strategies leveraging Forex Factory’s real-time data offer exciting opportunities but require a sharp understanding of market dynamics. This guide will walk you through leveraging Forex Factory’s powerful tools – from its economic calendar and news sentiment analysis to its order book data – to develop effective scalping and day trading strategies. We’ll explore how to interpret this real-time information, identify promising trades, and manage risk effectively for consistent profitability.

We’ll cover essential techniques for analyzing Forex Factory’s data, including interpreting economic calendar events, gauging market sentiment from news headlines, and using order book information for precise entry and exit points. We’ll also delve into specific strategies like scalping and day trading, comparing their effectiveness and outlining detailed steps for implementation. Crucially, we’ll emphasize robust risk management, including position sizing and stop-loss orders, to protect your capital and maximize your chances of success.

Introduction to Forex Factory and Short-Term Trading

Forex Factory is a popular website among forex traders, providing a wealth of real-time data and tools that can significantly impact short-term trading strategies. It’s a central hub for information, offering everything from economic calendars and news announcements to live forex charts and user-generated forums. Understanding how to effectively utilize its resources is key to successful short-term forex trading.Forex Factory’s real-time data offers several advantages for short-term traders.

The immediate access to economic news releases, for instance, allows traders to react swiftly to market-moving events. The live forex charts, coupled with various technical indicators readily available, enable rapid analysis and identification of potential trading opportunities. However, relying solely on Forex Factory also presents disadvantages. The sheer volume of information can be overwhelming, leading to analysis paralysis.

Furthermore, the platform’s reliance on user-generated content means that information accuracy needs careful verification. The speed of the market also means that even the most up-to-the-minute data can become outdated quickly, requiring constant vigilance and adaptability.

Forex Factory Functionalities Relevant to Short-Term Trading

Forex Factory’s economic calendar is a crucial tool for short-term traders. It provides precise timing for significant economic news releases, allowing traders to anticipate potential market volatility and position themselves accordingly. The forex calendar displays the expected impact of each event, helping traders prioritize their attention on high-impact news. The live forex charts, offering various timeframes, provide the visual representation needed for technical analysis.

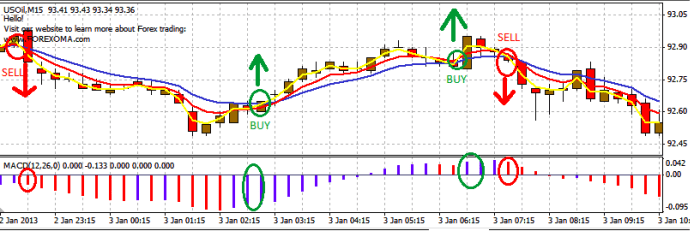

Traders can overlay different indicators like moving averages, RSI, or MACD to identify short-term price patterns and potential entry/exit points. Finally, the forum section offers insights from other traders, though this information should always be treated with caution and independently verified.

Advantages and Disadvantages of Using Forex Factory’s Real-Time Data for Short-Term Strategies, Short-term trading strategies leveraging Forex Factory’s real-time data

The primary advantage is the speed and accessibility of information. Traders gain a near real-time view of market movements and economic events, allowing for quick decision-making. This rapid response capability is crucial for short-term strategies that capitalize on fleeting price fluctuations. However, the constant influx of information can be a significant drawback. Information overload can lead to poor decision-making, especially for inexperienced traders.

Furthermore, the reliance on external data sources introduces a degree of risk; the accuracy and reliability of the information must be independently assessed. Finally, the dynamic nature of the forex market means that even real-time data can quickly become outdated, demanding constant monitoring and adaptation.

Types of Short-Term Trading Strategies Commonly Employed in Forex

Several short-term forex trading strategies leverage real-time data from platforms like Forex Factory. Scalping, for example, involves profiting from tiny price movements within seconds or minutes. Day trading focuses on holding positions for a single trading day, capitalizing on intraday price swings. Swing trading, while not strictly short-term, often uses short-term indicators and holds positions for a few days to a couple of weeks, aiming to capture larger price movements within a trend.

These strategies often rely heavily on technical analysis using charts and indicators found on platforms like Forex Factory to identify entry and exit points. Each strategy requires a different level of market awareness and risk tolerance. For example, scalping requires extremely quick reactions and a high tolerance for frequent trades, while swing trading demands a more patient approach.

Data Analysis Techniques using Forex Factory

Forex Factory is a powerful tool for short-term forex traders, offering a wealth of real-time data that can significantly enhance your trading strategies. Effectively utilizing this data requires understanding how to analyze the economic calendar, news sentiment, and order book information. This section will explore techniques to leverage these data points for identifying and capitalizing on short-term trading opportunities.

Economic Calendar Analysis for Trading Opportunities

The Forex Factory economic calendar provides a schedule of upcoming economic news releases, along with their expected impact. High-impact events, such as Non-Farm Payrolls (NFP) or interest rate decisions, often cause significant market volatility. By analyzing the calendar, traders can anticipate these events and adjust their positions accordingly. For example, if a high-impact event is expected to have a positive impact on a particular currency pair, a trader might consider a long position before the release, aiming to profit from the anticipated price increase.

Conversely, a negative impact might lead to a short position. It’s crucial to consider the potential volatility surrounding these announcements; a stop-loss order is highly recommended to manage risk. Remember that unexpected results can cause sharp and rapid price movements.

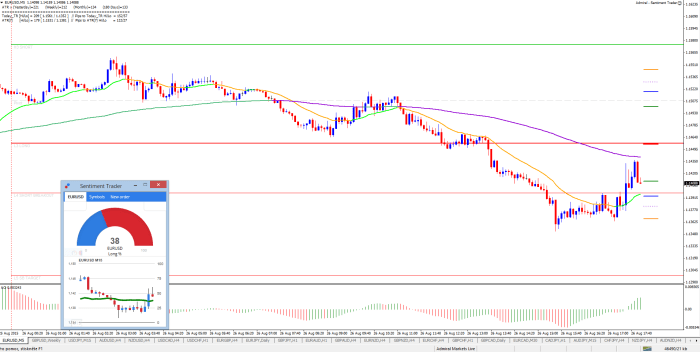

Interpreting Forex Factory’s News Sentiment

Forex Factory’s news section often includes user comments and sentiment analysis regarding recent economic releases. Analyzing this sentiment can provide valuable insights into the market’s immediate reaction to news events. A predominantly positive sentiment might suggest further upward price movement, while a negative sentiment could indicate a potential price decline. However, it’s vital to remember that this is not a foolproof method; market sentiment is often influenced by factors beyond the specific news release.

Consider combining sentiment analysis with other technical indicators for a more comprehensive perspective. For example, if positive news is released but the price action shows signs of weakness (e.g., bearish candlestick patterns), it might be prudent to remain cautious or even consider a short position.

Utilizing Forex Factory’s Order Book Data for Entry and Exit Points

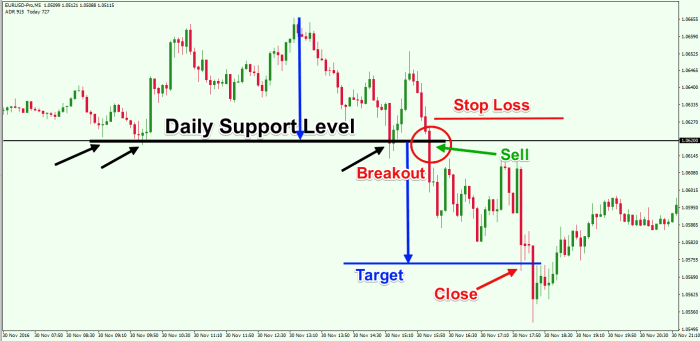

Forex Factory often displays order book data, showing the current bid and ask prices, along with the volume at each price level. This data can be particularly useful for short-term traders. A large volume of buy orders at a specific price level (strong bid) might suggest support, while a large volume of sell orders (strong ask) might indicate resistance.

Traders can use this information to identify potential entry and exit points, aiming to buy near support and sell near resistance. For instance, observing a significant increase in buy orders at a specific support level could be a signal to enter a long position, expecting the price to bounce off that support. Conversely, a surge in sell orders at a resistance level might indicate an opportune moment to exit a long position or enter a short one.

Always remember that order book data is dynamic and can change rapidly.

Technical Indicator Application with Forex Factory Data

The following table compares three common technical indicators and their application in conjunction with Forex Factory data for short-term trading.

You also can investigate more thoroughly about using social media analytics to track campaign performance to enhance your awareness in the field of using social media analytics to track campaign performance.

| Indicator | Description | Forex Factory Data Integration | Short-Term Trading Application |

|---|---|---|---|

| RSI (Relative Strength Index) | Measures the magnitude of recent price changes to evaluate overbought or oversold conditions. | Combine RSI readings with order book data to identify potential reversal points. An overbought RSI (above 70) near resistance could signal a potential short entry. | Identify potential reversals; confirm signals from order book data. |

| MACD (Moving Average Convergence Divergence) | Shows the relationship between two moving averages to identify momentum changes. | Use MACD crossovers in conjunction with economic calendar events. A bullish crossover following positive news could signal a long entry. | Identify momentum changes; confirm signals from news sentiment and order book data. |

| Stochastic Oscillator | Compares a security’s closing price to its price range over a given period. | Use stochastic readings in conjunction with news sentiment. An oversold condition (below 20) following negative news could signal a potential long entry (contrarian strategy). | Identify overbought and oversold conditions; consider contrarian strategies. |

Specific Short-Term Strategies Leveraging Forex Factory

Forex Factory offers a wealth of real-time data, making it a powerful tool for short-term traders. By combining its live price feeds, order book information, news releases, and economic indicators, traders can develop robust strategies for scalping and day trading. This section details specific strategies and their application.

Examine how building a strong team culture in a digital marketing agency can boost performance in your area.

Scalping Strategy Using Forex Factory’s Live Price Feeds and Order Book Data

This scalping strategy focuses on exploiting small price movements within seconds or minutes. It relies heavily on Forex Factory’s live price charts and order book depth to identify high-probability, short-term trades. The strategy aims for small, consistent profits by taking advantage of minor price fluctuations.

Entry Rules: The entry signal is triggered when a significant increase in buy orders is observed on the order book, accompanied by a slight upward price movement. This suggests a surge in buying pressure, potentially pushing the price higher. We look for confirmation on the price chart, such as a break above a minor resistance level or a bullish candlestick pattern forming.

The trader must be quick and decisive to capitalize on these fleeting opportunities.

Exit Rules: The position is closed when either a predetermined profit target is reached (e.g., 5 pips) or a stop-loss order is triggered (e.g., 2 pips). The stop-loss protects against sudden adverse price movements. Trailing stop-losses can be implemented to lock in profits as the price moves favorably. The exit strategy emphasizes risk management to protect capital and ensure consistent profitability.

Risk Management: Risk management is paramount in scalping. Traders should only risk a small percentage of their account capital on each trade (e.g., 1-2%). Position sizing is crucial; it should be adjusted based on the trader’s risk tolerance and account balance. Utilizing tight stop-loss orders minimizes potential losses.

Expected Profit/Loss Scenarios: In a successful trade, a profit of 5 pips is achieved. In an unsuccessful trade, a loss of 2 pips is incurred. The success rate needs to be higher than 66% to achieve positive returns. This is just an example, and the actual profit/loss will vary based on market conditions and execution speed.

Day Trading Strategy Based on Forex Factory’s News Releases and Economic Indicators

This strategy leverages the impact of news releases and economic indicators on currency prices. Forex Factory provides real-time updates on these events, allowing traders to anticipate market reactions and capitalize on price swings. Careful analysis of the news and indicators is crucial for success.

The steps involved in this strategy are:

- Identify High-Impact News Events: Review the Forex Factory calendar for scheduled news releases and economic indicators with potential for significant market impact. Prioritize events that historically cause substantial price movements.

- Analyze Market Sentiment Before the News: Observe price action and market sentiment leading up to the news release. This helps anticipate the potential direction of the price movement after the news is released.

- Place Trades Based on News Reaction: Execute trades based on the immediate market reaction to the news. This requires quick decision-making and the ability to interpret the market’s response to the information.

- Manage Risk with Stop-Loss Orders: Implement stop-loss orders to limit potential losses. The stop-loss level should be determined based on the volatility of the currency pair and the trader’s risk tolerance.

- Set Profit Targets: Define realistic profit targets based on the anticipated price movement after the news event. These targets should be adjusted based on the volatility of the market and the trader’s risk profile.

Comparison of News-Based and Technical Analysis-Based Strategies

Both news-based and technical analysis-based strategies, when used with Forex Factory data, offer unique advantages and disadvantages. News-based strategies capitalize on significant price movements triggered by economic events, but require precise timing and a high degree of market awareness. Technical analysis strategies, relying on chart patterns and indicators, provide more consistent trading opportunities but may miss out on the large price swings associated with major news events.

The effectiveness of each approach depends heavily on the trader’s skill, risk tolerance, and market conditions. A hybrid approach, combining both news analysis and technical analysis, can often yield the best results.

Risk Management and Trade Execution: Short-term Trading Strategies Leveraging Forex Factory’s Real-time Data

Short-term Forex trading, especially when leveraging real-time data from Forex Factory, demands a robust risk management strategy. Without it, even the most accurate signals can lead to significant losses. This section details crucial risk management techniques and a step-by-step guide to executing trades based on Forex Factory data, minimizing potential pitfalls.The foundation of successful short-term Forex trading lies in carefully controlling risk.

This involves not only identifying profitable opportunities but also limiting potential losses. Forex Factory’s data, while valuable, doesn’t eliminate market volatility; therefore, a disciplined approach to risk management is paramount.

Position Sizing and Stop-Loss Orders

Position sizing determines the amount of capital allocated to each trade. A common approach is to risk a fixed percentage of your trading account on any single trade, regardless of the potential profit. For example, risking 1% to 2% per trade is a popular strategy among many traders. Stop-loss orders automatically close a position when the price moves against you by a predetermined amount, limiting potential losses.

Using Forex Factory’s data to identify support and resistance levels can help you set appropriate stop-loss levels. For instance, if you enter a long position at 1.1000 and identify the nearest support at 1.0980, a stop-loss order at 1.0975 would limit your potential loss to a manageable level. Remember to adjust your stop-loss based on volatility; during periods of high volatility, wider stop-losses might be necessary.

Risk Management Techniques for High-Frequency Trading

High-frequency trading (HFT) strategies, using Forex Factory’s rapid updates, require even stricter risk management. Techniques like scaling in and out (gradually entering and exiting a position) and using trailing stop-losses (automatically adjusting the stop-loss as the price moves in your favor) can help mitigate risk. Furthermore, diversification across multiple currency pairs and the implementation of strict position limits are crucial.

For example, an HFT strategy might limit its exposure to any single currency pair to 5% of the total trading capital, thereby mitigating the impact of adverse price movements in one specific market. Regular monitoring of overall portfolio risk and employing sophisticated risk models can provide an additional layer of protection.

Executing Trades Based on Forex Factory Signals

Executing trades based on signals derived from Forex Factory data requires a precise and methodical approach to minimize slippage and commissions. Slippage refers to the difference between the expected execution price and the actual execution price, while commissions are the fees charged by your broker for executing trades.

- Identify the Signal: Analyze Forex Factory data (news, economic calendar, sentiment indicators) to identify a potential trading opportunity.

- Determine Entry and Exit Points: Based on your chosen strategy and the Forex Factory data, define precise entry and exit points, including stop-loss and take-profit levels.

- Set Order Type: Choose between market orders (executed immediately at the current market price) or limit orders (executed only at a specified price or better).

- Place the Order: Enter the order details (currency pair, volume, entry price, stop-loss, take-profit) in your trading platform.

- Monitor and Manage: Continuously monitor the trade’s progress and adjust stop-losses or take-profits as needed, based on market developments and Forex Factory updates.

- Close the Position: Close the position when your predetermined exit criteria are met, or if the trade moves significantly against you and hits your stop-loss order.

Careful attention to these steps will help minimize the impact of slippage and commissions on your overall trading performance. Remember to choose a broker with competitive fees and reliable execution speeds, especially crucial for HFT strategies.

Backtesting and Optimization

Backtesting is crucial for evaluating the robustness of any short-term Forex trading strategy. It allows you to test your strategy on historical data, identify potential weaknesses, and optimize parameters before risking real capital. Forex Factory’s historical data, while not perfectly representative of future market behavior, provides a valuable resource for this process. Remember, backtesting is not a guarantee of future success, but it significantly improves your chances.This section details methods for backtesting your strategies using historical Forex Factory data, optimizing key parameters like stop-loss and take-profit levels, and adapting your strategy to real-time market dynamics.

We will explore practical examples to illustrate these concepts.

Backtesting Methods Using Forex Factory Data

To backtest effectively, you’ll need to download historical Forex data from Forex Factory or a similar provider. This data typically includes open, high, low, and close (OHLC) prices, along with potentially other relevant information like volume. You can then use spreadsheet software like Excel or specialized trading platforms with backtesting capabilities to run your strategy against this historical data. This involves inputting your trading rules (e.g., entry and exit signals based on indicators derived from Forex Factory’s data) and observing the simulated results, including profitability, win rate, maximum drawdown, and other key performance indicators.

You might consider using a programming language like Python with libraries such as pandas and backtrader for more sophisticated backtesting and automation.

Optimizing Trading Parameters

Optimization involves fine-tuning your strategy’s parameters to maximize profitability and minimize risk. Let’s say your strategy uses a moving average crossover to generate buy/sell signals. Through backtesting, you might discover that using a 20-period moving average and a 50-period moving average yields better results than using 10 and 20 periods, respectively. Similarly, you can optimize stop-loss and take-profit levels.

For example, you might find that a stop-loss of 10 pips and a take-profit of 20 pips results in a higher risk-adjusted return compared to a stop-loss of 5 pips and a take-profit of 10 pips. This optimization process often involves testing various parameter combinations and selecting the combination that performs best based on chosen metrics. Consider using walk-forward analysis to further validate your optimized parameters.

Adapting Strategies to Real-Time Market Conditions

While backtesting provides a foundation, real-time market conditions constantly change. Forex Factory’s real-time data, including news events, economic announcements, and sentiment indicators, can help you adjust your strategy accordingly. For example, during periods of high volatility, you might widen your stop-loss levels to protect against sudden price swings. Conversely, during periods of low volatility, you might tighten your stop-loss and potentially increase your position size.

Always be mindful of the current market context and react accordingly. For instance, if Forex Factory news indicates a significant upcoming economic announcement, you may choose to temporarily pause your trading or adjust your strategy to account for the anticipated market reaction.

Mastering short-term forex trading with Forex Factory’s real-time data requires discipline, skill, and a well-defined strategy. By combining insightful data analysis with effective risk management, you can significantly improve your trading performance. Remember that consistent learning and adaptation are key to long-term success in this dynamic market. This guide provides a solid foundation, but continuous practice and refinement of your approach are essential to navigating the complexities of short-term trading.