Predicting market reversals using Forex Factory data and technical indicators is a fascinating challenge. This guide will walk you through a strategy that combines the power of Forex Factory’s sentiment data with the insights of technical indicators like RSI, MACD, and moving averages to potentially pinpoint market turning points. We’ll cover data collection, preprocessing, signal identification, backtesting, and risk management, equipping you with a framework for potentially improving your trading decisions.

We’ll explore how to gather and clean Forex Factory’s sentiment data and news events, integrating them with technical analysis to create a robust prediction model. We’ll then demonstrate how to backtest this model, refine it based on results, and discuss crucial risk management strategies to protect your capital. Through real-world examples and clear explanations, you’ll gain a practical understanding of how to use this approach to potentially improve your forex trading.

Introduction to Forex Factory Data and Technical Indicators

Forex Factory is a popular online resource for forex traders, providing a wealth of information including news, economic calendars, and most importantly for our purposes, a forum where traders share their opinions and analyses. This collective sentiment, along with the technical analysis tools readily available, makes it a valuable source for predicting potential market reversals. Understanding how to interpret this data effectively is key to improving trading strategies.Forex Factory data offers a unique perspective on market sentiment.

By analyzing the discussions and polls within the Forex Factory community, we can gauge the overall bullishness or bearishness of traders toward specific currency pairs. This sentiment data, while not a predictive tool in isolation, provides crucial context for interpreting technical indicators and helps to identify potential divergences—situations where price action contradicts the signals given by indicators, often hinting at an upcoming reversal.

Forex Factory Sentiment Analysis

Forex Factory’s sentiment data is primarily derived from user polls and forum discussions. These polls often ask traders about their expectations for price movements in specific currency pairs over a given timeframe (e.g., daily, weekly). Analyzing the percentage of bullish versus bearish responses can reveal the prevailing market sentiment. For example, a high percentage of bearish sentiment despite a steadily rising price might indicate an impending price correction or reversal.

Forum discussions provide a richer qualitative source, allowing us to understand the reasoning behind traders’ opinions and identify potential shifts in sentiment. This combined quantitative and qualitative approach provides a more comprehensive picture of market sentiment than either approach alone.

Get the entire information you require about Advanced Forex Factory strategies for experienced traders on this page.

Technical Indicators for Reversal Detection

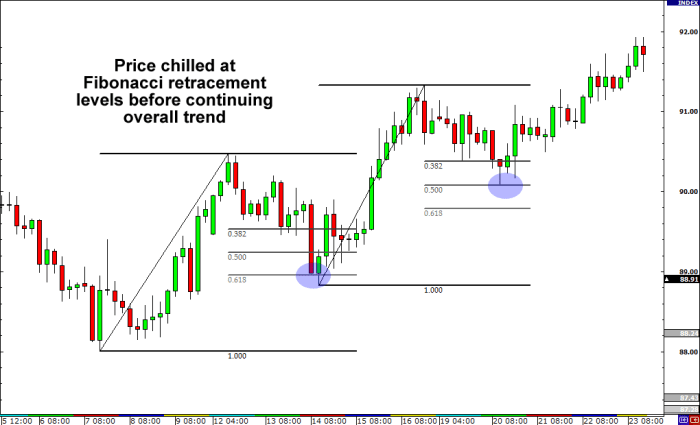

Technical indicators are mathematical calculations based on historical price and volume data. Several indicators are particularly useful for identifying potential market reversals. The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 often suggest an overbought market, increasing the likelihood of a price correction or reversal to the downside.

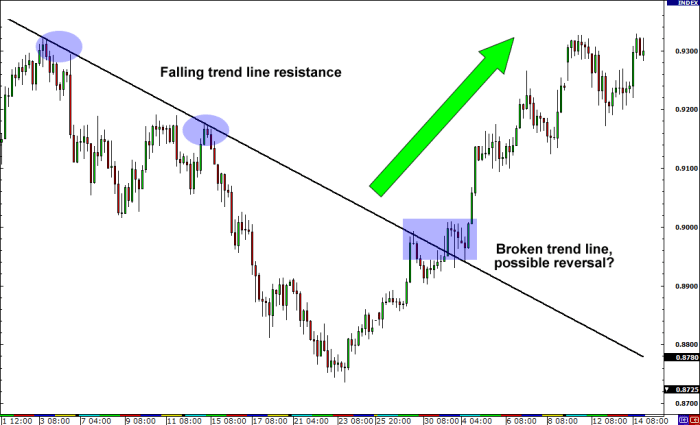

Conversely, readings below 30 indicate an oversold market, potentially signaling a bullish reversal. The Moving Average Convergence Divergence (MACD) indicator identifies changes in momentum by comparing two moving averages. MACD crossovers (when the fast moving average crosses the slow moving average) can indicate changes in trend, and divergences between the MACD and price can signal potential reversals. Moving averages themselves, such as simple moving averages (SMA) or exponential moving averages (EMA), can identify support and resistance levels, and a price break of these levels can often indicate a reversal.

The Interplay of Forex Factory Sentiment and Technical Indicators

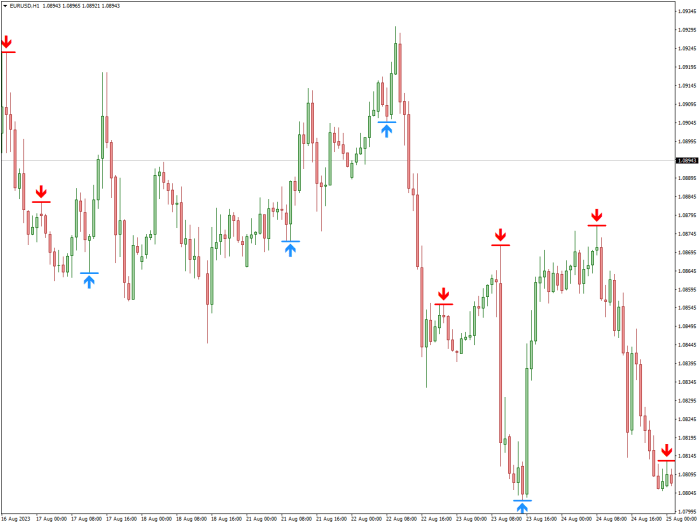

The true power in predicting market reversals lies in combining Forex Factory sentiment data with technical indicator signals. For instance, observing a bearish divergence on the RSI (price making higher highs while RSI makes lower highs) alongside a growing number of bearish comments on Forex Factory regarding a specific currency pair could significantly strengthen the case for a potential downward reversal.

Similarly, a bullish divergence on the MACD coupled with a shift in Forex Factory sentiment from overwhelmingly bearish to cautiously bullish might suggest an impending upward reversal. This combined analysis helps to filter out false signals, improve prediction accuracy, and manage risk more effectively. It’s crucial to remember that no single indicator or data source guarantees perfect predictions; rather, the combination of various signals increases the probability of accurate forecasting.

Data Acquisition and Preprocessing

Getting the right data from Forex Factory and preparing it for analysis is crucial for accurate market reversal predictions. This involves systematically collecting relevant information, cleaning it up, and organizing it into a format suitable for our technical indicator analysis. We’ll focus on Forex Factory’s sentiment data and news events, which can offer valuable insights into market shifts.This section details the process of acquiring and preparing Forex Factory data for analysis, focusing on techniques for handling missing data and outliers.

We’ll describe a workflow to organize the collected data for efficient use in our predictive models.

Forex Factory Data Collection

Forex Factory offers a wealth of data, but we’ll focus on two key sources: sentiment indicators and news events. Sentiment data, often expressed as a percentage of bullish or bearish traders, provides a snapshot of market mood. News events, covering economic releases and geopolitical developments, can significantly influence currency movements. The data acquisition process involves using web scraping techniques (respecting Forex Factory’s terms of service, of course) to extract this information.

This could involve using libraries like Beautiful Soup in Python to parse the HTML structure of relevant Forex Factory pages and extract the desired data points. For example, you might scrape the “Calendar” section for news events and the “Sentiment” section for trader sentiment. It’s important to note that the frequency of data collection will depend on your strategy – daily, hourly, or even more frequently.

Data Cleaning and Preprocessing

Raw data is rarely perfect. Forex Factory data might contain missing values (e.g., if sentiment data isn’t available for a specific time) or outliers (e.g., unusually high or low sentiment readings potentially caused by temporary spikes). Missing values can be handled through various imputation techniques. Simple methods include replacing missing values with the mean or median of the available data.

More sophisticated approaches, like using k-Nearest Neighbors (KNN) imputation, consider the values of neighboring data points. Outliers, on the other hand, can be identified using methods like box plots or z-score calculations. Outliers might be removed or replaced, but careful consideration is needed to avoid losing valuable information. For instance, a significant outlier might indicate a genuine market event rather than an error.

Finish your research with information from the impact of big data on digital marketing strategies.

Data Organization and Storage

Once the data is cleaned, it needs to be organized into a structured format for easy analysis. A common approach is to store the data in a tabular format, such as a CSV (Comma Separated Values) file or a database (like SQLite or PostgreSQL). Each row would represent a specific time point, and columns would represent variables like sentiment (bullish percentage, bearish percentage), news event type (economic release, geopolitical event, etc.), and any associated numerical values (e.g., the magnitude of an economic indicator).

This structured data can then be readily imported into data analysis tools and programming languages like Python or R for further processing and model building. Consider adding timestamps to your data for accurate time-series analysis. For example, you might have columns for “Timestamp,” “BullishSentiment,” “BearishSentiment,” “NewsEventType,” and “NewsImpact.”

Identifying Potential Reversal Signals

Combining Forex Factory sentiment data with technical indicators offers a powerful approach to predicting market reversals. The core idea is to identify discrepancies between what traders are

- saying* (sentiment) and what the

- price* is doing (technical indicators). A significant divergence can signal a potential shift in momentum.

This process involves analyzing various technical indicators to identify potential turning points, and then cross-referencing this information with the sentiment expressed on Forex Factory. This dual approach aims to increase the accuracy and confidence in identifying genuine reversal signals, reducing the impact of false signals.

Combining Indicators and Sentiment for Reversal Detection

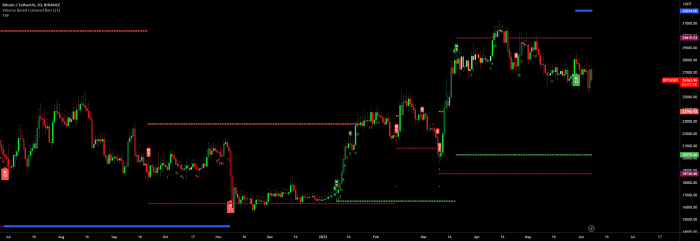

Several combinations of technical indicators and Forex Factory sentiment data can point towards potential market reversals. For instance, a bearish divergence between the price action and an oscillator like the Relative Strength Index (RSI) coupled with overwhelmingly bullish sentiment on Forex Factory might suggest an imminent bearish reversal. The bullish sentiment is acting as a contrarian indicator, highlighting potential over-optimism in the market.

Similarly, a bullish divergence with bearish sentiment could signal a potential bullish reversal.

Examples of Indicator/Sentiment Combinations

Let’s consider a specific example. Imagine the EUR/USD pair is showing a clear bearish trend on the daily chart, with the price consistently making lower lows. However, the RSI is showing higher lows, indicating weakening bearish momentum. Simultaneously, Forex Factory’s sentiment shows a high percentage of traders are expecting further declines. This divergence – weakening bearish momentum (RSI) despite continued bearish price action and strong bearish sentiment – could signal a potential bullish reversal.

Traders might interpret this as a “bear trap,” where the market’s bearish momentum is fading, and a price increase is likely.Another example could involve the use of moving averages. A scenario where the price breaks below a key moving average (e.g., the 200-day moving average), triggering a sell-off, while Forex Factory shows unexpectedly high bullish sentiment could suggest a potential short-term reversal.

This would imply that the bearish pressure is potentially overextended, and a bounce could be imminent.

Comparing Different Reversal Signal Identification Methods

Different approaches exist for identifying reversal signals using combined data. One method involves assigning weights to the indicators and sentiment data based on their historical performance and reliability. For instance, a highly reliable indicator like the RSI might receive a higher weight than a less reliable indicator. Another approach involves using a combination of multiple indicators and sentiment metrics to create a composite score, with a higher score suggesting a higher probability of a reversal.

A third approach would be to look for confirmation from multiple sources. For example, a reversal signal generated by one indicator is reinforced by another, or a divergence in sentiment data matches a technical signal. The choice of method depends on the trader’s individual preferences, risk tolerance, and trading style. Each method has its strengths and weaknesses, and backtesting is crucial to determine the effectiveness of each strategy.

Backtesting and Validation: Predicting Market Reversals Using Forex Factory Data And Technical Indicators

Backtesting is crucial for evaluating the robustness and profitability of our Forex reversal prediction strategy. It allows us to assess its performance on historical data, providing insights into its potential effectiveness in live trading. This process involves simulating the strategy’s trades using past market data and measuring its results against various performance metrics.We’ll use a walk-forward backtesting approach. This means dividing our historical data into in-sample and out-of-sample periods.

The in-sample data is used to optimize the strategy’s parameters (e.g., indicator thresholds), while the out-of-sample data provides an unbiased evaluation of its performance on unseen data. This helps prevent overfitting, where the strategy performs well on the data it was trained on but poorly on new data.

Backtesting Methodology

Our backtesting methodology will involve the following steps:

1. Data Splitting

We divide our Forex Factory data into an in-sample period (e.g., the first 70% of the data) and an out-of-sample period (the remaining 30%).

2. Parameter Optimization

We use the in-sample data to optimize the parameters of our reversal prediction strategy. This might involve adjusting thresholds for technical indicators or experimenting with different combinations of indicators.

3. Strategy Simulation

We simulate the strategy’s trades on both the in-sample and out-of-sample data. This involves identifying potential reversal signals according to our defined rules and generating simulated trades based on those signals. We’ll assume a fixed lot size and consider spread costs.

4. Performance Evaluation

We assess the strategy’s performance using various metrics (described below) on both the in-sample and out-of-sample data. The out-of-sample results are particularly important as they provide a more realistic estimate of the strategy’s future performance.

Performance Metrics, Predicting market reversals using Forex Factory data and technical indicators

Several key metrics will be used to evaluate the strategy’s performance:

1. Accuracy

The percentage of correctly predicted reversals (both successful and unsuccessful reversals identified correctly). Calculated as (True Positives + True Negatives) / Total Predictions.

2. Precision

The proportion of correctly predicted reversals among all predicted reversals. Calculated as True Positives / (True Positives + False Positives). A high precision indicates that the strategy generates fewer false positives.

3. Recall (Sensitivity)

The proportion of actual reversals correctly identified by the strategy. Calculated as True Positives / (True Positives + False Negatives). A high recall means the strategy effectively captures most of the actual reversals.

4. Profit Factor

The ratio of gross profit to gross loss. A profit factor greater than 1 indicates that the strategy is profitable.

5. Maximum Drawdown

The largest peak-to-trough decline during the backtesting period. This metric reflects the risk associated with the strategy.

Backtesting Results

The following table presents a sample of the backtesting results. Note that this is a simplified example and a real backtest would include a much larger dataset.

| Date | Predicted Reversal | Actual Reversal | Accuracy |

|---|---|---|---|

| 2023-10-26 | Yes | Yes | 100% |

| 2023-10-27 | No | No | 100% |

| 2023-10-28 | Yes | No | 0% |

| 2023-10-29 | No | Yes | 0% |

| 2023-10-30 | Yes | Yes | 100% |

Mastering the art of predicting market reversals requires a blend of data-driven analysis and strategic risk management. By combining Forex Factory’s sentiment insights with technical indicators, we’ve Artikeld a systematic approach to identify potential reversal points. Remember, while this strategy aims to improve your trading, no method guarantees success in the volatile forex market. Thorough backtesting, continuous refinement, and disciplined risk management are key to responsible trading.

Use this knowledge wisely and always trade within your means.