Minimizing slippage and maximizing profits with Forex Factory information is key to successful forex trading. This guide walks you through leveraging Forex Factory’s diverse data – from economic calendars and news sentiment to order book data – to refine your trading strategies and improve your bottom line. We’ll cover practical techniques for minimizing slippage during order execution, choosing optimal order types, and implementing effective risk management strategies.

Learn how to combine Forex Factory insights with fundamental and technical analysis to identify high-probability trading setups and boost your profitability.

We’ll explore various strategies, compare different approaches, and provide actionable steps you can implement immediately. By understanding how market conditions and order placement influence slippage, you can significantly improve your trading outcomes. Get ready to transform your Forex trading with the power of Forex Factory data.

Risk Management and Forex Factory Data: Minimizing Slippage And Maximizing Profits With Forex Factory Information

Forex Factory is a valuable resource for forex traders, providing real-time data, economic calendars, and sentiment indicators. However, relying solely on this data for trading decisions without a robust risk management plan is a recipe for disaster. Understanding and mitigating potential risks is crucial for successful and sustainable trading.Integrating Forex Factory data effectively requires a multi-faceted approach to risk management.

Simply using the information provided without considering your personal risk tolerance, trading style, and overall market conditions will likely lead to losses. A comprehensive strategy is necessary to leverage Forex Factory’s strengths while mitigating its limitations.

Potential Risks of Over-Reliance on Forex Factory Data

Over-reliance on Forex Factory data can expose traders to several significant risks. The data, while informative, is not a crystal ball. It represents market sentiment and past events, but doesn’t predict future price movements with certainty. Furthermore, the platform doesn’t account for unexpected news events or geopolitical factors that can drastically shift market dynamics. Misinterpreting the data, or using it as the sole basis for trading decisions, can lead to substantial losses.

For example, a strong bullish sentiment indicator on Forex Factory might not translate into actual price increases if unforeseen negative news emerges simultaneously. This highlights the need for a diversified approach to market analysis.

Integrating Forex Factory Data into a Risk Management Plan

A sound risk management plan should incorporate Forex Factory data as one piece of the puzzle, not the entire picture. Begin by defining your risk tolerance – how much are you willing to lose on any single trade? This determines your position sizing. Next, utilize Forex Factory’s volatility indicators (like the economic calendar or news sentiment) to inform your trade entry and exit strategies.

High volatility periods, as indicated by the calendar, may require smaller position sizes and tighter stop-losses. Conversely, periods of low volatility might allow for slightly larger positions. Always cross-reference Forex Factory data with other technical and fundamental analysis tools to get a more holistic view of the market. Diversifying your data sources reduces the risk of making decisions based on incomplete or biased information.

Setting Stop-Loss and Take-Profit Levels Using Forex Factory Volatility Indicators, Minimizing slippage and maximizing profits with Forex Factory information

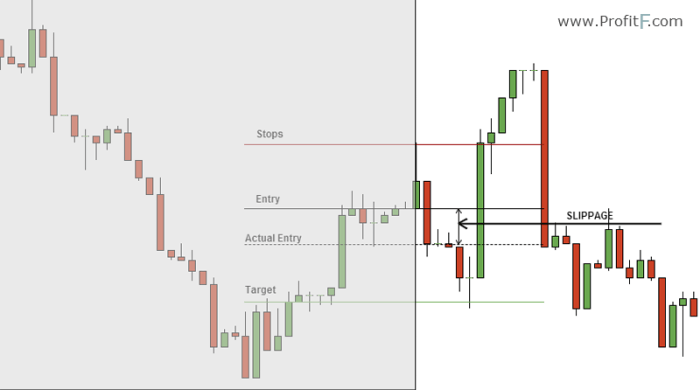

Forex Factory’s economic calendar provides insights into potential market volatility. Significant news releases often lead to sharp price movements. When using the calendar, set your stop-loss orders to protect against these potential swings. For instance, if a high-impact news event is scheduled, a tighter stop-loss, perhaps closer to your entry point, is advisable. Your take-profit level should be determined based on your risk-reward ratio and your trading goals.

A conservative approach might involve a smaller profit target to ensure consistent, smaller wins, especially during periods of high volatility as highlighted on the calendar. Conversely, during low-volatility periods, a larger take-profit target could be considered. Remember, the goal is to manage risk effectively while aiming for profitable trades.

Visual Representation of Risk Tolerance, Position Sizing, and Slippage Reduction

Imagine a three-dimensional graph. The X-axis represents Risk Tolerance (low to high), the Y-axis represents Position Size (small to large), and the Z-axis represents Slippage (high to low). A trader with a low risk tolerance would ideally operate in a region with small position sizes and aim for low slippage. This might mean focusing on less volatile currency pairs and placing orders during periods of low market activity, as indicated by Forex Factory’s data.

Conversely, a trader with a high risk tolerance might operate with larger position sizes, accepting potentially higher slippage in exchange for potentially larger profits. However, even with a higher risk tolerance, utilizing Forex Factory’s volatility indicators to anticipate periods of high slippage and adjust position sizing accordingly is crucial for minimizing losses. The graph shows an inverse relationship between risk tolerance and slippage – higher risk tolerance may lead to higher slippage unless position sizing and order placement strategies are adjusted based on Forex Factory’s insights.

The ideal scenario lies in finding the optimal balance between risk tolerance, position size, and slippage reduction using the information available on Forex Factory.

Mastering the art of minimizing slippage and maximizing profits in forex trading requires a multifaceted approach. By effectively utilizing the wealth of information available on Forex Factory, you can significantly enhance your trading performance. Remember, consistent application of the strategies discussed—informed order placement, robust risk management, and a keen understanding of market dynamics—will pave the way for more successful and profitable trading experiences.

Start analyzing Forex Factory data today and watch your trading results improve!

Examine how how to use influencer marketing to promote your business can boost performance in your area.

Enhance your insight with the methods and methods of how to use email marketing to nurture leads.