Managing emotions while trading based on Forex Factory information is crucial for success. Forex Factory provides a wealth of data—news, economic calendars, sentiment indicators—that can easily trigger emotional responses like fear, greed, or overconfidence. These emotions can lead to impulsive decisions and poor trading outcomes. This guide will help you understand how Forex Factory data impacts your emotions, develop strategies for emotional regulation, and build a sustainable trading psychology.

We’ll explore practical techniques, risk management principles, and the importance of separating fact from speculation within the Forex Factory community.

We’ll delve into specific cognitive biases exacerbated by Forex Factory data, such as confirmation bias and anchoring bias, and provide concrete examples of how specific data points might lead to emotional trading pitfalls. You’ll learn how to use mindfulness, journaling, and pre-trade checklists to maintain control and make rational decisions. Finally, we’ll discuss the importance of community awareness and how to avoid being swayed by herd mentality within the Forex Factory forums.

The Impact of Community Sentiment on Forex Factory and Emotional Control: Managing Emotions While Trading Based On Forex Factory Information

Forex Factory, a popular online forum for forex traders, offers a wealth of information, but it also presents a significant challenge: managing the impact of community sentiment on your trading decisions. The collective opinions and experiences shared on the platform can powerfully influence individual emotions, potentially leading to impulsive trades and ultimately, financial losses. Understanding this influence and developing strategies to mitigate its effects is crucial for successful forex trading.The collective sentiment expressed on Forex Factory forums significantly impacts individual trader emotions.

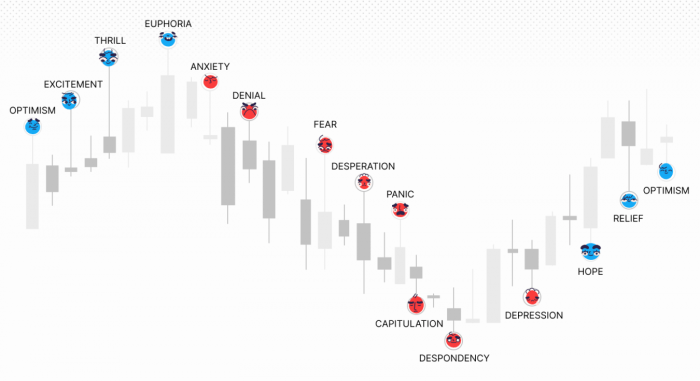

Reading numerous posts expressing extreme optimism or pessimism can create a powerful emotional contagion, swaying even experienced traders away from their carefully developed trading plans. This is especially true during periods of high market volatility, when fear and greed are amplified. The constant exposure to others’ opinions can lead to doubt in one’s own analysis, prompting traders to follow the crowd rather than their own judgment.

The Dangers of Herd Mentality and Emotional Contagion

Herd mentality and emotional contagion are significant risks within the Forex Factory community. The anonymity afforded by online forums can embolden individuals to express extreme views without accountability. This can lead to a cascade effect, where a single overly optimistic or pessimistic post triggers a chain reaction of similar opinions, creating a self-reinforcing feedback loop. Traders, caught up in this emotional tide, may abandon their rational trading strategies and make decisions based on fear or greed, rather than objective market analysis.

For example, a rumor circulating on the forum about a potential central bank intervention, even if unsubstantiated, could trigger a wave of panic selling, leading to losses for traders who succumb to the herd mentality.

Strategies for Filtering Noise and Focusing on Objective Data

Successfully navigating the Forex Factory forums requires a disciplined approach to filtering out noise and focusing on objective data. This involves critically evaluating the information presented, considering the source’s credibility, and verifying information with independent sources. For example, instead of blindly accepting a trader’s claim about a specific technical indicator’s predictive power, one should independently research the indicator’s historical performance and its limitations.

Prioritizing news from reputable financial sources, such as Reuters or Bloomberg, over anecdotal evidence from forum posts is also essential. Furthermore, actively seeking out dissenting opinions and alternative perspectives can help provide a more balanced view of the market situation.

Avoiding Sway from Overly Optimistic or Pessimistic Viewpoints, Managing emotions while trading based on Forex Factory information

To avoid being swayed by overly optimistic or pessimistic viewpoints, it’s crucial to maintain a healthy level of skepticism and emotional detachment. Remember that the forum is a collection of diverse opinions, not a reliable source of infallible predictions. Before making any trading decisions based on information gleaned from Forex Factory, it’s crucial to independently verify the information and analyze the market from your own perspective.

Developing a robust trading plan with clearly defined entry and exit strategies, risk management rules, and a consistent approach is vital in mitigating the impact of emotional biases. Regularly reviewing your trading journal and analyzing past successes and failures can help you identify patterns in your emotional responses and develop strategies to improve your emotional control during trading.

Finally, practicing mindfulness techniques and stress-reduction strategies can further enhance your ability to make rational trading decisions even amidst the emotional volatility of the Forex Factory community.

Mastering your emotions is the key to consistent profitability in Forex trading, especially when utilizing the vast amount of information available on Forex Factory. By understanding the emotional impact of various data points, implementing effective risk management strategies, and cultivating a resilient trading psychology, you can significantly improve your trading performance. Remember, consistent self-reflection, journaling, and a commitment to learning are vital for long-term success.

Don’t let your emotions control your trades; instead, learn to control your emotions and harness the power of Forex Factory data responsibly.

Do not overlook the opportunity to discover more about the subject of building a profitable digital marketing business in a competitive market.

Finish your research with information from managing your time effectively as a digital marketing professional.