Investigating the scalability challenges faced by various blockchain platforms. – Investigating the scalability challenges faced by various blockchain platforms is crucial for understanding the future of this technology. Blockchains, while revolutionary, face inherent limitations in processing transactions quickly and efficiently as they grow. This exploration delves into the core issues impacting popular platforms like Bitcoin, Ethereum, Solana, and Cardano, examining transaction throughput, latency, and the various scaling solutions being implemented.

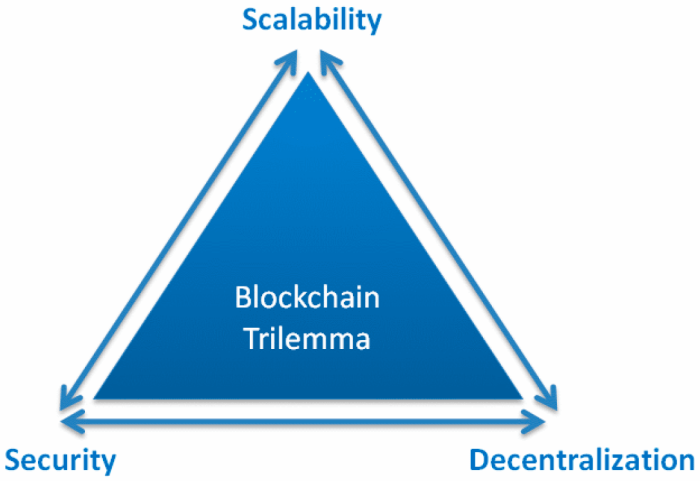

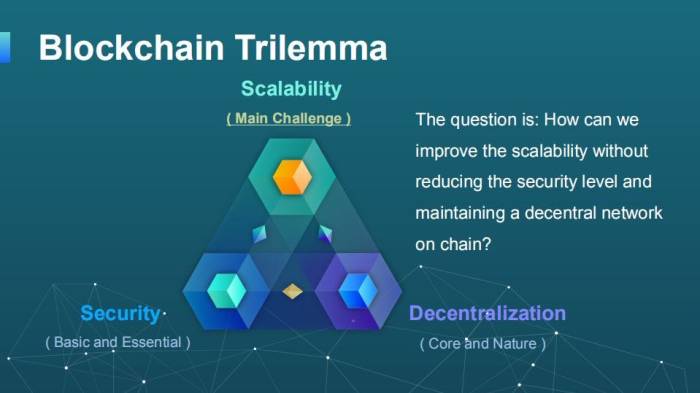

We’ll also consider the trade-offs between scalability, decentralization, and security, ultimately painting a clearer picture of the path towards a truly scalable blockchain ecosystem.

We’ll compare different consensus mechanisms, like Proof-of-Work and Proof-of-Stake, analyzing their impact on scalability and energy consumption. The role of Layer-2 solutions, sharding, and efficient data storage will also be examined, along with the challenges of implementing and maintaining these solutions. By the end, you’ll have a comprehensive understanding of the hurdles facing blockchain scalability and the innovative approaches being developed to overcome them.

Transaction Throughput and Latency

Understanding transaction throughput and latency is crucial for evaluating the scalability of a blockchain platform. High throughput allows for many transactions to be processed quickly, while low latency ensures transactions are confirmed rapidly. These two factors are interconnected and significantly impact the user experience and overall functionality of decentralized applications (dApps). Let’s examine these aspects for some prominent blockchain platforms.

Transaction Throughput Comparison

Transaction throughput, measured in transactions per second (TPS), varies greatly across different blockchain networks. This variation is influenced by factors such as block size, block time, consensus mechanism, and network congestion. The following table provides a general comparison of the TPS capabilities of Bitcoin, Ethereum, Solana, and Cardano under different network conditions. Note that these figures are estimates and can fluctuate significantly based on real-time network activity.

| Blockchain | Optimal TPS | Average TPS | Congested TPS |

|---|---|---|---|

| Bitcoin | 7 | 3-5 | 1-2 |

| Ethereum | 15-30 | 10-20 | 5-10 |

| Solana | 2000-5000+ | 1000-2000 | 500-1000 |

| Cardano | 250-500 | 100-200 | 50-100 |

Factors Contributing to Transaction Latency

Transaction latency, the time it takes for a transaction to be confirmed, is affected by several factors specific to each blockchain platform.

Understanding these factors is key to optimizing transaction speeds and improving the user experience.

- Bitcoin: Bitcoin’s relatively large block size and slow block time (approximately 10 minutes) contribute to high latency. The Proof-of-Work consensus mechanism, while secure, is computationally intensive and adds to processing time.

- Ethereum: Ethereum’s latency is influenced by its block time (around 15 seconds) and network congestion. The Proof-of-Work mechanism (before the merge to Proof-of-Stake) and increasing transaction volume can lead to delays. The transition to Proof-of-Stake has improved latency but congestion remains a factor.

- Solana: Solana utilizes a unique Proof-of-History and Proof-of-Stake consensus mechanism, aiming for high throughput and low latency. However, network congestion and occasional outages can still impact latency.

- Cardano: Cardano employs a Proof-of-Stake consensus mechanism, which generally leads to lower latency compared to Proof-of-Work. However, network congestion and the complexity of its Ouroboros protocol can contribute to some delays.

Hypothetical Scenario: High Latency Impact on a Decentralized Application

Imagine a decentralized exchange (DEX) built on Ethereum experiencing high transaction latency during a period of intense trading activity. Users attempting to execute trades might face significant delays, potentially resulting in missed opportunities due to price fluctuations. For instance, a user trying to swap tokens might experience a delay of several minutes, causing them to lose out on a favorable price change that occurred during the processing time.

You also will receive the benefits of visiting The potential impact of regulatory changes on the cryptocurrency market. today.

This high latency would negatively impact the user experience, leading to frustration and potentially driving users to alternative platforms with faster transaction times. The overall functionality of the DEX would be compromised, potentially affecting its liquidity and trading volume.

Scalability Solutions: Investigating The Scalability Challenges Faced By Various Blockchain Platforms.

Blockchain scalability is a crucial aspect impacting its widespread adoption. High transaction throughput and low latency are essential for a truly decentralized and efficient system. Addressing this requires innovative solutions that improve the network’s capacity to handle a growing number of transactions without compromising security or decentralization. Two primary approaches stand out: sharding and Layer-2 protocols.

Sharding

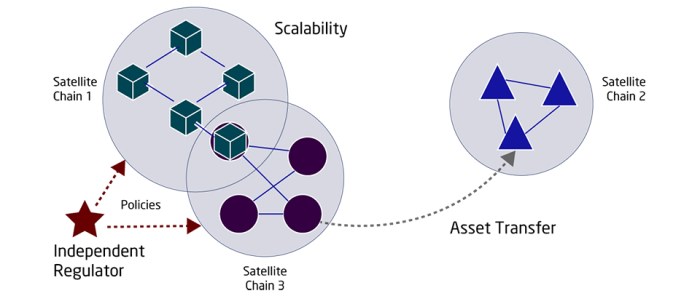

Sharding is a database partitioning technique applied to blockchain networks to enhance scalability. It works by dividing the entire blockchain into smaller, more manageable fragments called “shards.” Each shard processes a subset of transactions and maintains its own state. This parallel processing significantly increases the network’s overall throughput. Ethereum, for example, is implementing sharding through its Ethereum 2.0 upgrade.

This upgrade involves a transition to a proof-of-stake consensus mechanism and a sharded architecture, aiming to boost transaction throughput substantially. Another example is Zilliqa, which has implemented sharding from its inception, allowing for a high degree of parallelism in transaction processing. The implementation details vary across platforms, but the core concept remains consistent: distributing the workload across multiple shards to alleviate pressure on the main chain.

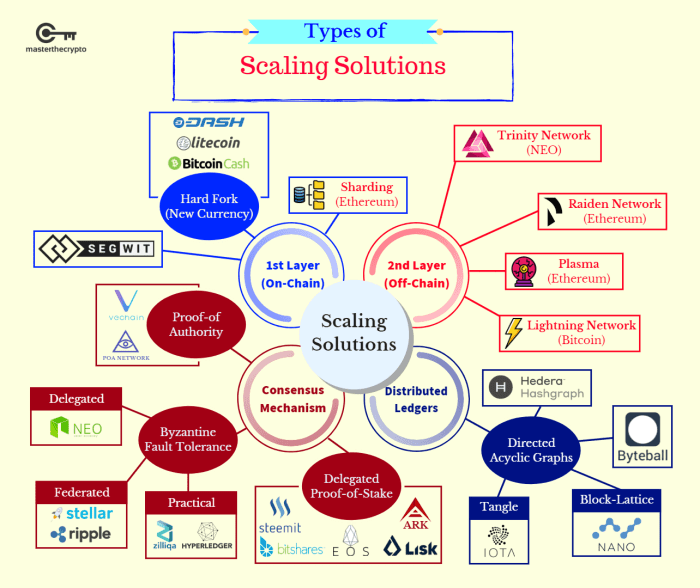

Layer-2 Scaling Solutions

Layer-2 scaling solutions aim to offload transaction processing from the main blockchain (Layer-1) to secondary networks, thereby increasing capacity without altering the core protocol. Several Layer-2 solutions exist, each with its own strengths and weaknesses.

Comparison of Layer-2 Scaling Solutions

The following table compares three prominent Layer-2 solutions: state channels, sidechains, and rollups.

| Solution | Throughput | Security | Complexity |

|---|---|---|---|

| State Channels | Very High | Relatively High (secured by Layer-1) | Medium |

| Sidechains | High | Medium (depends on sidechain security) | High |

| Rollups (Optimistic & ZK) | High | High (secured by Layer-1) | High |

State channels allow participants to transact off-chain, only submitting the final state to the main blockchain. This drastically reduces the number of on-chain transactions. Sidechains operate as independent blockchains pegged to the main chain, offering greater flexibility but potentially compromising security if not carefully designed. Rollups bundle multiple transactions into a single transaction on the main chain, significantly reducing on-chain data.

Optimistic rollups rely on fraud proofs to challenge invalid transactions, while zero-knowledge (ZK) rollups use cryptographic proofs to guarantee transaction validity without revealing transaction details.

Finish your research with information from A beginner’s guide to understanding blockchain technology and its applications..

Challenges in Implementing and Maintaining Layer-2 Protocols

Implementing and maintaining Layer-2 protocols present significant challenges. Security risks include vulnerabilities in the Layer-2 protocol itself or malicious actors attempting to exploit weaknesses in the connection between Layer-1 and Layer-2. Interoperability issues arise from the need for seamless communication and data transfer between different Layer-2 solutions and the main blockchain. Ensuring compatibility and avoiding fragmentation across different Layer-2 systems is crucial for a cohesive and scalable blockchain ecosystem.

Furthermore, the complexity of designing, deploying, and managing these systems requires significant technical expertise and resources.

Consensus Mechanisms and Scalability

The choice of consensus mechanism is a critical factor determining a blockchain’s scalability. Different mechanisms offer varying trade-offs between speed, security, and energy efficiency, directly impacting the number of transactions a network can process per second and the latency experienced by users. Understanding these trade-offs is crucial for designing and evaluating blockchain platforms.

Proof-of-Work, Proof-of-Stake, and Other Consensus Mechanisms Compared

The scalability of a blockchain is heavily influenced by its consensus mechanism. Let’s compare three prominent mechanisms: Proof-of-Work (PoW), Proof-of-Stake (PoS), and a representative of alternative mechanisms, Practical Byzantine Fault Tolerance (PBFT). The following table summarizes key characteristics:

| Consensus Mechanism | Energy Consumption | Transaction Speed (TPS) | Security |

|---|---|---|---|

| Proof-of-Work (PoW) | Very High (e.g., Bitcoin’s energy consumption is comparable to a small country) | Relatively Low (e.g., Bitcoin processes around 7 transactions per second) | High, due to the significant computational power required to attack the network |

| Proof-of-Stake (PoS) | Low to Moderate (significantly less than PoW) | Moderate to High (e.g., Solana boasts thousands of TPS, but this can vary greatly) | High, though potentially vulnerable to attacks targeting large stake holders |

| Practical Byzantine Fault Tolerance (PBFT) | Low | Low to Moderate (limited by the number of nodes participating in consensus) | High for a smaller number of nodes; scalability challenges arise with increased node count. |

Note: TPS (Transactions Per Second) values are approximate and vary depending on network conditions and implementation.

Influence of Consensus Mechanism on Scalability, Investigating the scalability challenges faced by various blockchain platforms.

The consensus mechanism directly impacts scalability in several ways. PoW’s reliance on computationally intensive mining limits transaction throughput and increases energy consumption. The high energy cost is a major barrier to scalability, both environmentally and economically. In contrast, PoS significantly reduces energy consumption by rewarding validators based on their stake rather than computational power, allowing for higher transaction throughput.

However, PoS can face its own scalability challenges, particularly concerning network congestion and the potential for centralization if a few large stakeholders control a significant portion of the stake. PBFT, while energy-efficient and offering high security for smaller networks, struggles with scalability as the number of nodes increases, due to the communication overhead required for consensus.

Optimizing Consensus Mechanisms for Enhanced Scalability

Various techniques can optimize consensus mechanisms for improved scalability. For example, sharding, a technique used in several PoS blockchains, partitions the network into smaller groups (shards) that process transactions concurrently. This allows for a significant increase in throughput. Layer-2 solutions, such as state channels and rollups, operate on top of the main blockchain, handling many transactions off-chain before submitting a summary to the main chain.

This reduces the load on the main chain, enhancing scalability without sacrificing security. Furthermore, advancements in consensus algorithms, such as improvements to the efficiency of PoS protocols or exploring hybrid approaches combining aspects of different mechanisms, continually push the boundaries of blockchain scalability. For instance, some blockchains are exploring ways to incorporate aspects of directed acyclic graphs (DAGs) to achieve higher throughput.

These techniques aim to balance the need for speed with the importance of maintaining the security and decentralization that are fundamental to blockchain technology.

Network Effects and Decentralization

The scalability of a blockchain platform is intricately linked to its network effects. Essentially, the more users a blockchain has, the more valuable it becomes, creating a positive feedback loop. However, this growth presents challenges, particularly regarding maintaining decentralization and efficient performance. A larger network can lead to improved security and resilience, but also increased transaction processing times and complexities.Network effects and decentralization often exist in a delicate balance.

Increased network size, while beneficial in some aspects, can create vulnerabilities. A larger network requires more bandwidth and processing power, potentially concentrating resources in the hands of powerful nodes and compromising the decentralized nature of the system. This creates a trade-off: more users enhance security but also increase the risk of centralization unless specific mechanisms are implemented to counteract this effect.

The Interplay of Network Size, Performance, and Decentralization

Increasing the number of nodes in a blockchain network theoretically enhances security and resilience. More nodes make it harder for a malicious actor to control the network and manipulate transactions. However, this increase also leads to higher communication overhead. Each node needs to communicate with every other node, or at least a significant portion, to validate transactions. This communication overhead directly impacts transaction throughput and latency.

As the network grows exponentially, the communication burden can become overwhelming, resulting in slower transaction speeds and increased congestion. This illustrates a key tension: while a larger, more decentralized network offers stronger security, it also faces inherent scalability limitations unless carefully managed.

Trade-offs Between Scalability and Decentralization

Blockchain designers often face difficult choices when balancing scalability and decentralization. Solutions prioritizing scalability might employ techniques that inadvertently centralize control, such as sharding or delegated proof-of-stake. Sharding, for example, divides the network into smaller, more manageable shards, improving transaction throughput. However, this can lead to a situation where certain shards become more influential than others, potentially creating points of vulnerability.

Similarly, delegated proof-of-stake, while increasing transaction speeds, concentrates validation power in the hands of a smaller set of validators. This reduces the overall decentralization of the network. The ideal solution involves finding a balance, employing techniques that enhance scalability without significantly compromising decentralization.

Hypothetical Scenario: Centralized Scalability, Decentralization Compromise

Imagine a hypothetical blockchain designed for high-frequency trading. To achieve extreme scalability, the developers decide to implement a highly centralized architecture, with a small number of powerful nodes responsible for processing the vast majority of transactions. This system achieves incredibly fast transaction speeds and low latency, meeting the demands of high-frequency trading. However, the concentration of power in the hands of a few nodes significantly compromises decentralization.

These few nodes could potentially collude to manipulate transactions, censor information, or even seize control of the entire network. While scalability is dramatically improved, the security and trust inherent in a decentralized system are severely weakened. This illustrates a stark example of the trade-offs involved in prioritizing scalability over decentralization. Real-world examples of this tension can be seen in the debate surrounding the centralization of certain large-scale blockchain networks.

Data Storage and Retrieval

Storing and retrieving vast amounts of data on a blockchain presents significant scalability challenges. The inherent immutability and distributed nature of blockchains mean that every node must maintain a copy of the entire blockchain, leading to storage limitations and slow retrieval times as the blockchain grows. This becomes particularly problematic for platforms handling high transaction volumes or storing large amounts of off-chain data.The challenges are multifaceted.

Firstly, the sheer volume of data necessitates significant storage capacity on each node, impacting both cost and infrastructure requirements. Secondly, data retrieval can be slow, especially for specific pieces of information within a large blockchain. Thirdly, the need for data consistency across all nodes introduces complexities in updating and synchronizing data efficiently. Finally, the energy consumption associated with storing and replicating data across numerous nodes raises environmental concerns.

Data Storage Mechanisms in Blockchain Platforms

Different blockchain platforms employ various strategies to manage data storage. Understanding these approaches is crucial for assessing their scalability potential.

- Simple Data Storage: Some platforms directly store all transaction data within each block. This approach is straightforward but quickly becomes impractical for large blockchains due to the increasing storage requirements on each node. Bitcoin, in its basic form, exemplifies this. Every node must store every transaction ever recorded.

- Sharding: This technique divides the blockchain into smaller, more manageable shards, each handled by a subset of nodes. This reduces the storage burden on individual nodes and improves data retrieval speed by allowing queries to focus on specific shards. Ethereum 2.0 uses sharding to enhance scalability.

- Data Merkleization: This involves using Merkle trees to create a concise summary of the data stored within a block. Nodes only need to store the Merkle root, allowing for efficient verification of data integrity without storing the entire dataset. Many blockchains use Merkle trees to optimize data handling.

- Off-Chain Storage: This method stores large datasets off the main blockchain, using technologies like IPFS (InterPlanetary File System) or Arweave. Only hashes or pointers to the off-chain data are stored on the blockchain, reducing its size and improving transaction throughput. Many decentralized applications leverage off-chain storage to manage data efficiently.

Comparison of Data Storage Efficiency

The efficiency of different data storage mechanisms varies significantly depending on factors such as transaction volume, data size, and network topology.

- Simple data storage offers low efficiency for large datasets due to its linear scaling nature, making it unsuitable for high-volume applications. Storage and retrieval times increase proportionally with data size.

- Sharding significantly improves efficiency by distributing the storage burden and enabling parallel processing. The efficiency gain is directly related to the number of shards and the distribution of data across them.

- Data Merkleization offers high efficiency in terms of storage space but may introduce some overhead for data retrieval, depending on the tree structure and search algorithms used.

- Off-chain storage offers potentially the highest efficiency for large datasets by separating data storage from the main blockchain. However, it introduces complexities in data management and security.

Optimizing Data Storage and Retrieval

A multifaceted approach is necessary to optimize data storage and retrieval for improved scalability. One potential method involves a hybrid approach, combining sharding with off-chain storage and data Merkleization.This approach would partition the blockchain into shards, storing frequently accessed data within the shards and less frequently accessed data off-chain. Merkle trees would provide efficient verification of data integrity for both on-chain and off-chain data.

This would minimize storage requirements on individual nodes while maintaining data integrity and enabling efficient data retrieval. The choice of which data is stored on-chain versus off-chain could be dynamically adjusted based on usage patterns, further enhancing efficiency. This system requires a robust mechanism for managing the mapping between on-chain pointers and off-chain data, ensuring data consistency and availability.

Further research into efficient data indexing and retrieval techniques within the shards and off-chain storage systems would be crucial to realizing the full potential of this hybrid approach.

Ultimately, the scalability of blockchain technology is not a single problem with a single solution. It’s a multifaceted challenge requiring a nuanced approach that balances transaction speed, security, decentralization, and energy efficiency. While significant progress has been made with Layer-2 solutions and innovative consensus mechanisms, ongoing research and development are essential to ensure that blockchain technology can handle the increasing demands of a growing user base and diverse applications.

The journey towards a truly scalable blockchain future is an ongoing process of innovation and adaptation.