Improving trading accuracy using Forex Factory’s historical data is key to consistent profitability. This guide walks you through leveraging Forex Factory’s wealth of historical forex data to refine your trading strategies. We’ll cover everything from data acquisition and cleaning to developing and backtesting algorithms, incorporating fundamental analysis, and implementing robust risk management techniques. Get ready to transform your trading approach!

We’ll explore practical techniques for identifying trading signals using various technical indicators, comparing their strengths and weaknesses. You’ll learn how to build a simple trading algorithm, visualize your results, and critically evaluate your strategies for ongoing improvement. By the end, you’ll have a solid framework for making more informed trading decisions.

Improving Trading Accuracy through Data Analysis: Improving Trading Accuracy Using Forex Factory’s Historical Data

Forex trading success hinges on accurate predictions of price movements. While technical analysis provides valuable insights into chart patterns and price action, incorporating fundamental analysis significantly enhances predictive power. This section explores how combining these approaches, alongside algorithmic trading, can improve your trading accuracy.

Fundamental Analysis and its Role in Enhancing Trading Accuracy

Fundamental analysis examines the underlying economic factors influencing asset prices. By considering these factors alongside technical indicators, traders gain a more comprehensive understanding of market dynamics. For example, positive economic news, such as a surprise increase in GDP growth, might signal a bullish trend, even if technical indicators are initially neutral or bearish. Conversely, a negative earnings report for a specific company could lead to a price drop regardless of positive technical signals.

Incorporating fundamental data points, such as interest rate changes, inflation figures, employment data, geopolitical events, and company earnings reports, allows traders to contextualize technical signals and make more informed decisions. These fundamental data points can act as confirmation or contradiction to technical signals, leading to improved trade entry and exit points.

Creating a Simple Trading Algorithm Based on Trading Signals

Let’s consider a simplified algorithm that combines both fundamental and technical analysis. This algorithm will use a moving average crossover as the technical indicator and a positive economic indicator (e.g., positive GDP growth) as the fundamental filter.The algorithm logic is as follows:

1. Technical Signal

A buy signal is generated when the short-term moving average (e.g., 50-day) crosses above the long-term moving average (e.g., 200-day). A sell signal is generated when the short-term moving average crosses below the long-term moving average.

2. Fundamental Filter

The buy signal is only activated if positive GDP growth is reported in the preceding quarter. The sell signal is unaffected by the fundamental filter in this simplified example.

3. Decision-Making

If both a buy signal and positive GDP growth are present, the algorithm executes a long position. If only a sell signal is present, the algorithm executes a short position. Otherwise, no trade is executed.This simplified algorithm demonstrates how combining technical and fundamental analysis can refine trading decisions. More sophisticated algorithms can incorporate multiple technical indicators and a wider range of fundamental data points, further improving accuracy.

Visual Representation of Trading Signals and Price Movements, Improving trading accuracy using Forex Factory’s historical data

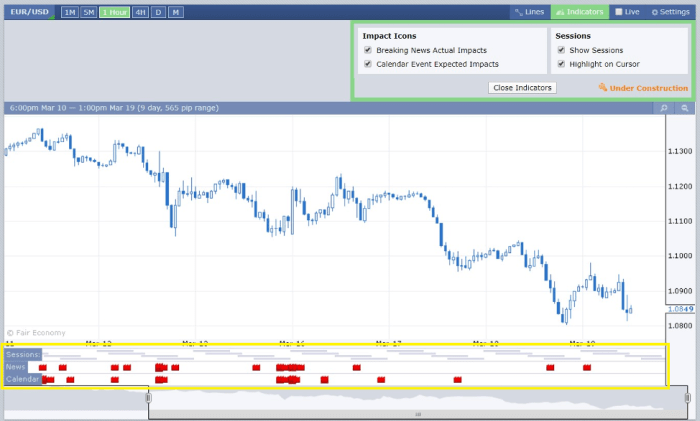

Imagine a chart with time on the x-axis and price on the y-axis. The chart displays the price of a currency pair (e.g., EUR/USD). Two moving averages are plotted on the same chart: a 50-day moving average (shorter, faster line) and a 200-day moving average (longer, slower line). Points where the 50-day MA crosses above the 200-day MA are marked with upward-pointing green arrows (buy signals).

Points where the 50-day MA crosses below the 200-day MA are marked with downward-pointing red arrows (sell signals). However, only the green arrows corresponding to quarters with positive GDP growth are highlighted in a bolder, brighter green. The chart also shows the actual price movements following each signal. Ideally, buy signals (highlighted green arrows) should be followed by price increases, and sell signals (red arrows) should be followed by price decreases.

The chart visually demonstrates the relationship between the combined signals and the subsequent price action, allowing for an assessment of the algorithm’s accuracy. Areas where the algorithm’s predictions align with actual price movements represent successful trades, while discrepancies highlight areas for potential algorithm refinement or further data analysis.

Risk Management and Position Sizing

Effective risk management and precise position sizing are crucial for consistent profitability in Forex trading. Ignoring these aspects can quickly lead to significant losses, even with accurate market predictions. This section details strategies to integrate these elements into your trading approach using Forex Factory’s historical data.

Stop-Loss and Take-Profit Levels Based on Historical Volatility

Determining appropriate stop-loss and take-profit levels is paramount. Using Forex Factory’s historical data, we can analyze the average true range (ATR) of a currency pair over a specific period (e.g., the last 20 days). The ATR provides a measure of price volatility. A conservative approach would set a stop-loss order slightly beyond the average ATR value, protecting against typical daily fluctuations.

Similarly, take-profit levels can be set at multiples of the ATR, aiming for a risk-reward ratio (e.g., 1:2 or 1:3). Analyzing historical price action around support and resistance levels, also available on Forex Factory, can further refine these levels. For instance, if the ATR is 0.0050 and a trader wants a 1:2 risk-reward, a stop-loss of 0.0050 might be used with a take-profit of 0.0100.

Adjusting these levels based on market conditions and individual trading style is essential.

Position Sizing Based on Risk Tolerance and Potential Reward

Position sizing determines the amount of capital allocated to each trade. A common method is the fixed fractional position sizing, where a fixed percentage of your trading capital is risked on each trade (e.g., 1% or 2%). This approach limits potential losses to a manageable level, regardless of the trade size. Another method is the fixed monetary position sizing, where a fixed amount of capital is risked per trade.

This is less flexible than fractional sizing but can be suitable for traders with a consistent risk appetite. A more advanced technique is the volatility-based position sizing, where the position size is adjusted based on the current market volatility, as measured by the ATR. In times of high volatility, smaller positions are taken to reduce risk. For example, if a trader has $10,000 and uses a 1% risk per trade, the maximum loss they are willing to accept is $If the stop-loss is 50 pips, the position size would be calculated as follows: ($100/50 pips) = 2 units per pip.

This translates into a specific lot size depending on the currency pair.

Structured Risk Management and Position Sizing Rules

- Risk Tolerance: Define a maximum percentage of trading capital to risk per trade (e.g., 1-2%).

- Stop-Loss Order Placement: Set stop-loss orders based on historical ATR and support/resistance levels, aiming for a defined risk level.

- Take-Profit Order Placement: Set take-profit orders based on historical ATR and price targets, aiming for a favorable risk-reward ratio (e.g., 1:2 or 1:3).

- Position Sizing Methodology: Choose a position sizing method (fixed fractional, fixed monetary, or volatility-based) and calculate the appropriate lot size for each trade based on the chosen method and risk tolerance.

- Regular Review: Regularly review your risk management and position sizing strategy to ensure it remains appropriate for current market conditions and your trading style.

Mastering the art of forex trading requires a blend of technical skill and disciplined strategy. By harnessing the power of Forex Factory’s historical data, as Artikeld in this guide, you can significantly improve your trading accuracy and increase your chances of success. Remember that consistent refinement and adaptation are crucial for long-term profitability in the dynamic forex market. Start analyzing, backtesting, and refining your approach today!

Finish your research with information from The relationship between Forex Factory sentiment and price action.

Obtain access to how to use mobile marketing to reach mobile users to private resources that are additional.