How to use Forex Factory to identify currency pair correlations? Unlocking the secrets of forex trading often involves understanding how different currency pairs move together. Forex Factory, with its wealth of data, is a powerful tool for uncovering these relationships. This guide will walk you through the process of identifying currency pair correlations using Forex Factory’s resources, from data acquisition and analysis to visualizing results and implementing practical trading strategies.

We’ll cover various methods, including calculating correlation coefficients and interpreting the results, equipping you with the knowledge to make informed trading decisions.

We’ll explore different correlation coefficients, show you how to use Forex Factory’s data to calculate them, and illustrate the process with clear examples. Visualizing these correlations with charts and graphs will be key to understanding the relationships between currency pairs. We’ll also delve into advanced techniques like rolling correlations and moving averages, and discuss the importance of risk management in this context.

By the end, you’ll be equipped to leverage correlation analysis to enhance your forex trading strategy.

Advanced Correlation Analysis Techniques: How To Use Forex Factory To Identify Currency Pair Correlations

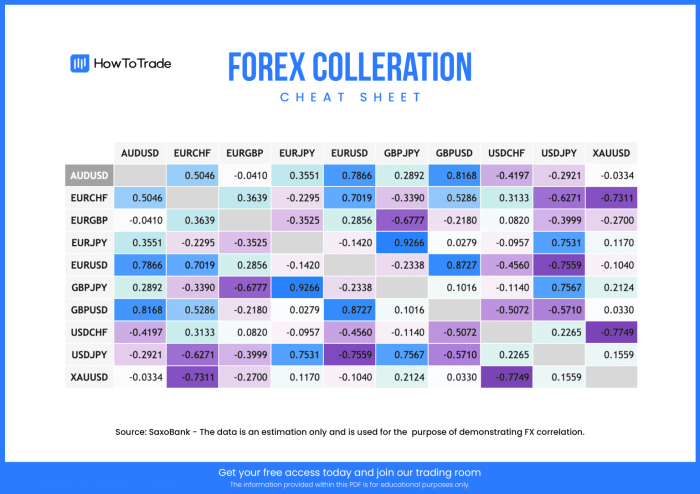

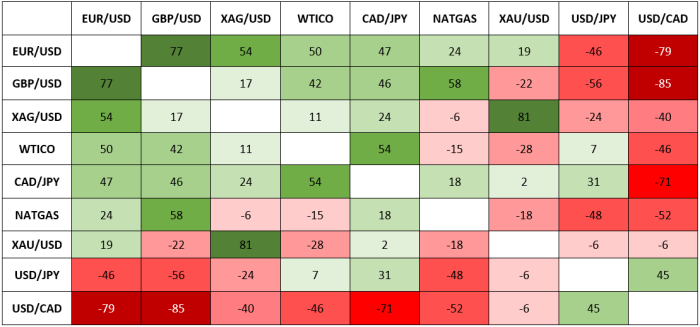

Forex Factory’s correlation matrix provides a snapshot in time. However, currency relationships are dynamic, constantly shifting due to economic events, market sentiment, and central bank actions. To gain a more nuanced understanding, we need to move beyond simple correlation coefficients and explore more advanced techniques. This section will delve into using rolling correlations and moving averages to track these evolving relationships, and finally, discuss the importance of statistical significance in interpreting correlation results.

Rolling Correlations

Understanding how correlations change over time is crucial. A static correlation coefficient might mask significant shifts in the relationship between currency pairs. Rolling correlations calculate the correlation coefficient over a defined period, which then “rolls” forward as new data becomes available. For example, a 20-day rolling correlation of EUR/USD and GBP/USD would calculate the correlation using the previous 20 days’ data.

As a new day’s data is added, the oldest day’s data is dropped, creating a continuously updated view of the correlation. This dynamic approach helps identify periods of high and low correlation, revealing potential trading opportunities or shifts in market dynamics. Visualizing this rolling correlation on a chart alongside the currency pairs themselves can be incredibly insightful, highlighting periods where the relationship strengthens or weakens.

For instance, a period of consistently high positive rolling correlation might suggest that these pairs are moving in tandem, offering opportunities for pairs trading strategies. Conversely, a shift to a low or negative rolling correlation indicates a divergence that could signal a change in market conditions.

Moving Averages and Correlation Analysis, How to use Forex Factory to identify currency pair correlations

Moving averages smooth out price fluctuations, revealing underlying trends. Combining moving averages with correlation analysis enhances our understanding of the relationship between currency pairs. For example, we could calculate the 20-day rolling correlation between EUR/USD and USD/JPY, and simultaneously plot the 50-day moving average of both currency pairs. If the correlation is high and both moving averages are trending upwards, it suggests a strong, positive relationship and a potentially favorable environment for certain trading strategies.

Conversely, if the correlation is weakening while one moving average trends upward and the other downward, this might indicate a diverging relationship, requiring a more cautious approach. The combination allows for a more comprehensive analysis of both short-term fluctuations and longer-term trends, leading to more informed trading decisions.

Statistical Significance Testing

A correlation coefficient simply quantifies the strength and direction of a linear relationship. However, it doesn’t tell us if this relationship is statistically significant. A high correlation coefficient could simply be due to random chance, especially with limited data. Statistical significance tests, such as the t-test, determine the probability that the observed correlation is not due to random chance.

The p-value associated with the test indicates this probability. A low p-value (typically below 0.05) suggests that the correlation is statistically significant, meaning it’s unlikely to have occurred by chance. Incorporating significance testing into correlation analysis on Forex Factory data is crucial for avoiding false signals. Ignoring statistical significance can lead to trading decisions based on spurious correlations, resulting in potentially significant losses.

Always check the statistical significance of any correlation before making trading decisions based on it.

Risk Management Considerations

Correlation analysis, while a powerful tool for Forex trading, shouldn’t be your sole decision-making factor. Integrating it effectively into a robust risk management strategy is crucial for long-term success. Understanding its limitations and potential pitfalls is key to avoiding costly mistakes.Incorporating correlation analysis into your risk management strategy involves using it to diversify your portfolio and better understand the potential for simultaneous losses across different currency pairs.

By identifying highly correlated pairs, you can avoid overexposure to similar market movements. For instance, if you notice a strong positive correlation between EUR/USD and GBP/USD, you might choose to limit your positions in both pairs to mitigate the risk of simultaneous losses should the Euro or the British Pound weaken. Conversely, identifying negatively correlated pairs allows for hedging strategies, potentially reducing overall portfolio risk.

Diversification and Position Sizing Based on Correlation

Understanding correlations helps in optimizing position sizing. If you’re trading multiple highly correlated pairs, you should reduce your individual position sizes compared to trading less correlated pairs. This prevents significant losses if the correlated markets move against you simultaneously. A simple example would be reducing your position size in EUR/USD if you already have a large position in EUR/JPY, given their usual positive correlation.

Sophisticated risk management software can even automatically adjust position sizes based on real-time correlation calculations.

Pitfalls of Solely Relying on Correlation Analysis

Relying solely on correlation analysis for trading decisions is extremely risky. Correlations can shift dramatically and unexpectedly due to geopolitical events, economic news releases, or changes in market sentiment. What was a strong positive correlation yesterday might be weak or even negative today. Furthermore, correlation doesn’t imply causation. Just because two pairs move together doesn’t mean one directly influences the other.

A third, unseen factor could be driving both movements.

Avoiding Overfitting and False Correlations

Overfitting occurs when a correlation analysis model is too closely tailored to past data, resulting in poor predictive accuracy for future market movements. This is especially common with short-term, high-frequency data. To avoid this, it’s essential to use robust statistical methods, test your analysis on out-of-sample data (data not used in the initial analysis), and be wary of correlations based on limited data sets.

Additionally, be aware of spurious correlations— seemingly strong correlations that are purely coincidental. A thorough understanding of fundamental and technical analysis, alongside correlation analysis, helps to avoid these pitfalls. Always consider broader market context and don’t blindly follow correlations without further validation.

Mastering the art of identifying currency pair correlations using Forex Factory can significantly improve your forex trading strategies. By understanding how different currency pairs move in relation to each other, you can make more informed decisions, manage risk more effectively, and potentially uncover profitable trading opportunities. Remember that while correlation analysis is a valuable tool, it’s crucial to use it in conjunction with other forms of analysis and to always incorporate robust risk management techniques.

Keep practicing, refine your methods, and always stay updated on market dynamics to maximize your success in the forex market.

Discover how Analyzing Forex Factory news for profitable trading opportunities has transformed methods in this topic.

Obtain a comprehensive document about the application of how to use mobile marketing to reach mobile users that is effective.