How to mitigate the risks associated with investing in cryptocurrencies. – How to mitigate the risks associated with investing in cryptocurrencies is a crucial question for anyone considering entering this exciting but volatile market. Cryptocurrencies offer the potential for significant returns, but they also come with a unique set of challenges. This guide will equip you with the knowledge and strategies needed to navigate the complexities of crypto investing, minimizing your exposure to potential losses and maximizing your chances of success.

We’ll explore everything from diversifying your portfolio and conducting thorough due diligence to understanding the regulatory landscape and managing your own emotional responses to market fluctuations.

We’ll break down the inherent risks – from market volatility and regulatory uncertainty to security threats and scams – and provide actionable steps to mitigate each. You’ll learn how to build a robust investment strategy tailored to your risk tolerance, secure your holdings, and stay informed about the ever-evolving regulatory environment. By the end, you’ll have a clear understanding of how to approach cryptocurrency investment with confidence and prudence.

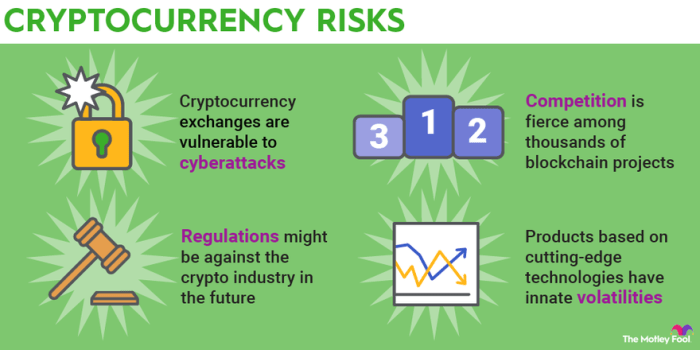

Understanding Cryptocurrency Risks

Investing in cryptocurrencies offers the potential for high returns, but it also comes with significant risks. Understanding these risks is crucial for making informed investment decisions and mitigating potential losses. This section details the various risks involved and suggests strategies to manage them.

Cryptocurrency Risk Categories

Cryptocurrency investments are subject to a variety of risks, which can be broadly categorized for better understanding and management. The following table provides a structured overview.

| Risk Type | Description | Mitigation Strategies | Example |

|---|---|---|---|

| Market Volatility | Cryptocurrency prices are highly volatile, experiencing significant price swings in short periods. This is due to factors such as market sentiment, regulatory changes, and technological developments. | Diversification, Dollar-Cost Averaging (DCA), Stop-loss orders | Bitcoin’s price dropping 50% in a single month. |

| Regulatory Uncertainty | Governments worldwide are still developing regulations for cryptocurrencies. Changes in regulations can significantly impact the market and individual investments. | Stay informed about regulatory developments, invest in jurisdictions with clearer regulatory frameworks. | A government banning cryptocurrency trading within its borders. |

| Security Risks | Cryptocurrency exchanges and wallets are potential targets for hackers. Loss of private keys or exchange breaches can result in the loss of funds. | Use reputable exchanges, secure hardware wallets, enable two-factor authentication (2FA). | A major cryptocurrency exchange being hacked and millions of dollars worth of crypto being stolen. |

| Scams and Fraud | The cryptocurrency space is susceptible to scams, including pump-and-dump schemes, rug pulls, and fraudulent ICOs. | Thorough due diligence, avoiding get-rich-quick schemes, researching projects before investing. | An ICO promising unrealistic returns that disappears with investors’ money. |

| Technological Risks | Underlying blockchain technology and cryptocurrency protocols are constantly evolving. Bugs, vulnerabilities, and unforeseen technical issues can impact the value and functionality of cryptocurrencies. | Research the technology behind the cryptocurrency, understand its limitations and potential vulnerabilities. | A major bug in a smart contract leading to a loss of funds. |

| Liquidity Risk | Some cryptocurrencies have low trading volume, making it difficult to buy or sell quickly without significantly impacting the price. | Focus on more liquid cryptocurrencies, avoid investing heavily in obscure or illiquid assets. | Trying to sell a large amount of a lesser-known cryptocurrency and receiving a much lower price than expected. |

Market Volatility and Investment Strategies

Market volatility in cryptocurrencies is characterized by rapid and unpredictable price fluctuations. These fluctuations can be dramatic, creating both significant opportunities and substantial risks for investors. The impact on investment strategies is substantial, requiring careful consideration of risk tolerance and investment horizons. High volatility necessitates a more cautious approach, potentially favoring strategies that reduce exposure to short-term price swings.

For example, dollar-cost averaging (DCA) can help mitigate the impact of volatility by spreading investments over time, reducing the risk of investing a large sum at a market peak.

Cryptocurrency Investment Scenario Flowchart

The following flowchart illustrates the potential outcomes of various cryptocurrency investment scenarios. This is a simplified representation and does not cover all possibilities.[Imagine a flowchart here. The flowchart would start with a central node “Cryptocurrency Investment Decision”. Branching out would be “Invest” and “Don’t Invest”. The “Invest” branch would further branch into “Market Increases,” “Market Decreases,” and “Market Stagnates.” Each of these would then have further branches depicting potential consequences, such as profit, loss, or holding.

The “Don’t Invest” branch would lead to a node indicating “Missed Opportunity” or “Avoided Losses,” depending on subsequent market movements. The flowchart visually represents the uncertainty and risk inherent in cryptocurrency investments, highlighting the potential for both significant gains and substantial losses.]

When investigating detailed guidance, check out A beginner’s guide to understanding blockchain technology and its applications. now.

Diversification and Portfolio Management: How To Mitigate The Risks Associated With Investing In Cryptocurrencies.

Diversifying your cryptocurrency portfolio is crucial for mitigating risk. Don’t put all your digital eggs in one basket! By spreading your investments across different cryptocurrencies, you reduce the impact of any single asset’s price fluctuations on your overall portfolio. Smart portfolio management involves understanding your risk tolerance and adjusting your allocation accordingly.Diversification strategies aim to reduce the overall volatility of your portfolio and limit potential losses.

Effective portfolio management requires a balance between risk and reward, and understanding how different cryptocurrencies correlate with each other.

Find out further about the benefits of How to choose the right cryptocurrency exchange for your investment needs. that can provide significant benefits.

Diversification Strategies

Diversifying your cryptocurrency portfolio involves spreading your investments across different assets to minimize risk. Several strategies can be employed, each with its own advantages and disadvantages.

- Diversification by Market Capitalization: This involves investing in a mix of large-cap, mid-cap, and small-cap cryptocurrencies. Large-cap cryptocurrencies (like Bitcoin and Ethereum) are generally considered less volatile, while smaller-cap coins can offer higher potential returns but with increased risk. The benefit is a balance between stability and growth potential; however, it requires research to identify promising smaller-cap projects, increasing the risk of choosing underperforming assets.

- Diversification by Cryptocurrency Type: This strategy focuses on investing in different types of cryptocurrencies, such as payment coins (like Bitcoin), smart contract platforms (like Ethereum), decentralized finance (DeFi) tokens, and non-fungible tokens (NFTs). The benefit is a broad exposure to the different segments of the cryptocurrency market, reducing the impact of sector-specific downturns; the drawback is that some segments might be more volatile than others.

- Diversification by Technology: This involves investing in cryptocurrencies based on different underlying technologies, such as Proof-of-Work (PoW), Proof-of-Stake (PoS), or other consensus mechanisms. This approach helps mitigate risks associated with specific technological limitations or vulnerabilities; however, understanding the nuances of different consensus mechanisms requires significant technical knowledge.

- Geographic Diversification: While less common in crypto compared to traditional markets, considering the geographic origins and adoption rates of different cryptocurrencies can add another layer of diversification. For example, a coin popular in Asia may have different market dynamics than one predominantly used in North America. The benefit is reducing dependence on specific regional economic factors; the drawback is the difficulty in accurately assessing regional influences on cryptocurrency markets.

Asset Allocation Models

Asset allocation refers to the proportion of your portfolio dedicated to each cryptocurrency. Your allocation should align with your risk tolerance and investment goals.

- Conservative Portfolio (Low Risk): A conservative approach might allocate a significant portion (e.g., 70%) to established, large-cap cryptocurrencies like Bitcoin and Ethereum, with smaller allocations to a few other well-established projects. This minimizes risk but potentially limits returns.

- Moderate Portfolio (Medium Risk): A moderate portfolio could allocate 50% to large-cap, 30% to mid-cap, and 20% to small-cap or more speculative cryptocurrencies. This balances risk and reward.

- Aggressive Portfolio (High Risk): An aggressive portfolio might allocate a larger percentage (e.g., 60% or more) to smaller-cap or more volatile cryptocurrencies, with a smaller allocation to established assets. This strategy aims for higher potential returns but carries significantly higher risk.

Hypothetical Diversified Portfolio

This example demonstrates a moderately diversified portfolio suitable for investors with a medium risk tolerance. Remember, this is a hypothetical example and should not be considered financial advice.

| Cryptocurrency | Allocation (%) |

|---|---|

| Bitcoin (BTC) | 40 |

| Ethereum (ETH) | 25 |

| Solana (SOL) | 15 |

| Cardano (ADA) | 10 |

| Polygon (MATIC) | 10 |

Due Diligence and Research

Investing in cryptocurrencies can be exciting, but it’s crucial to remember that it’s also a high-risk endeavor. Thorough due diligence is your best defense against scams and significant losses. Don’t rush into any investment; take the time to understand what you’re buying into.Before investing in any cryptocurrency project, a comprehensive investigation is essential. This involves scrutinizing various aspects of the project to assess its viability and potential for success.

A methodical approach will significantly reduce your risk.

Whitepaper Analysis

The whitepaper is the project’s blueprint. It Artikels the project’s goals, technology, tokenomics, and team. A well-written whitepaper will clearly explain the problem the project solves, its proposed solution, the technology behind it, and the team’s qualifications. Look for clarity, detail, and a realistic roadmap. Beware of whitepapers filled with jargon, vague promises, or unrealistic projections.

Compare the claims made in the whitepaper with independent analyses and reviews from reputable sources. Discrepancies should raise serious concerns.

Team Assessment

The team behind a cryptocurrency project is crucial to its success. Research the team members’ backgrounds, experience, and reputation. Look for evidence of their expertise in relevant fields such as blockchain technology, cryptography, or finance. A strong team with a proven track record increases the project’s credibility. Conversely, an anonymous or inexperienced team should be a significant red flag.

Check LinkedIn profiles, professional websites, and news articles to verify their claims. Look for any history of involvement in previous projects, both successful and unsuccessful.

Technology Evaluation

Understanding the underlying technology is vital. Assess the project’s innovation, scalability, and security. Does the technology offer a genuine advantage over existing solutions? Is the code open-source and auditable? Independent audits by reputable security firms can significantly bolster confidence.

If the technology is proprietary and lacks transparency, it’s a major warning sign. Research similar projects and compare their technological capabilities. Look for any patents or intellectual property that might protect the project’s technology.

Market Potential Analysis

Assess the market demand for the cryptocurrency project. Is there a real-world problem that the project addresses? Is the target market large enough to support the project’s growth? Analyze market trends, competitor analysis, and potential regulatory hurdles. Overly optimistic projections without supporting data should be viewed skeptically.

Consider the token’s utility and its potential adoption by businesses and consumers. Compare the project’s market capitalization to its competitors and assess its relative value.

Red Flags Indicating Fraudulent or High-Risk Investments

Understanding potential red flags is crucial for protecting your investment. Several warning signs should prompt immediate caution.

Before investing, consider these red flags:

- Unrealistic promises of high returns: Promises of quick, guaranteed riches are classic scams.

- Anonymous or unverified team members: Lack of transparency regarding the team’s identity is a major concern.

- Poorly written or vague whitepaper: A lack of detail or clarity in the project’s description indicates a lack of seriousness.

- Lack of transparency and open-source code: Proprietary code that cannot be independently verified is risky.

- Pressure to invest quickly: Legitimate projects don’t typically pressure investors into making hasty decisions.

- No clear use case or utility for the cryptocurrency: If the token doesn’t have a clear purpose, its value is questionable.

- Overly enthusiastic marketing with little substance: Focus on hype rather than facts is a major red flag.

- Negative news or controversies surrounding the project: Research the project’s history for any red flags.

Methods for Evaluating Project Credibility

Several approaches can help assess a cryptocurrency project’s legitimacy. Combining multiple methods provides a more robust evaluation.

Different methods offer varied insights:

- Independent audits: Security audits from reputable firms provide an objective assessment of the project’s technology and security.

- Community engagement: Active and engaged communities often indicate a healthy project. Look for discussions on forums, social media, and dedicated channels.

- News and media coverage: Positive coverage from reputable news outlets can boost confidence.

- Third-party reviews and analysis: Independent analyses from experts in the field can provide valuable insights.

- Tokenomics analysis: Scrutinize the token’s supply, distribution, and utility to understand its long-term value potential.

Security Best Practices

Protecting your cryptocurrency investments requires a proactive approach to security. Neglecting even basic security measures can lead to significant financial losses. This section Artikels essential practices to safeguard your assets. Remember, the more diligent you are, the better protected your investments will be.

Secure Wallet Management, Two-Factor Authentication, and Phishing Scam Avoidance, How to mitigate the risks associated with investing in cryptocurrencies.

Implementing robust security measures is crucial for protecting your cryptocurrency holdings. The following table details key security practices and their associated risks.

| Security Measure | Description | Implementation Steps | Potential Risks if Neglected |

|---|---|---|---|

| Secure Wallet Management | Choosing a reputable and secure wallet to store your cryptocurrencies. This includes considering hardware wallets, software wallets, and exchange wallets, each with its own level of security. | Research different wallet types, read reviews, and choose a wallet that aligns with your technical skills and risk tolerance. Always back up your seed phrase securely and offline. | Complete loss of access to your funds due to hacking, malware, or loss of device. |

| Two-Factor Authentication (2FA) | Adding an extra layer of security to your accounts by requiring a second form of verification beyond your password. | Enable 2FA on all your cryptocurrency exchanges and wallets. Use an authenticator app (like Google Authenticator or Authy) for the second factor, and never reuse codes. | Unauthorized access to your accounts and theft of your funds. |

| Phishing Scam Avoidance | Protecting yourself from fraudulent attempts to steal your login credentials and private keys. | Never click on links or download attachments from unknown sources. Verify the legitimacy of emails and websites before entering any sensitive information. Be wary of unsolicited messages offering unrealistic returns or urgent actions. | Loss of funds due to unauthorized access and fraudulent transactions. |

| Regular Software Updates | Keeping your software and operating systems updated to patch security vulnerabilities. | Enable automatic updates on your devices and wallets. Regularly check for updates and install them promptly. | Exposure to exploits and malware, leading to loss of funds. |

Exchange vs. Personal Wallet Storage

Storing cryptocurrencies on exchanges versus personal wallets presents different levels of risk. Exchanges offer convenience but are centralized targets for hackers. Personal wallets, while requiring more technical knowledge, offer greater control and security if managed properly. Exchanges are often insured against hacking but not necessarily against user error.

Secure Offline Cryptocurrency Storage (Cold Storage)

Storing your cryptocurrencies offline, also known as cold storage, is the most secure method. This involves keeping your private keys on a device that is not connected to the internet. This significantly reduces the risk of hacking or malware.Here’s a step-by-step guide:

1. Choose a Cold Storage Method

Popular options include hardware wallets (like Ledger or Trezor) or paper wallets. Hardware wallets are more secure but require an initial investment. Paper wallets are cheaper but require careful handling and storage.

2. Generate Your Wallet

Follow the instructions provided by your chosen cold storage method to generate a new wallet and receive your private keys and public address. This process should be done offline.

3. Transfer Cryptocurrencies

Once your cold wallet is set up, transfer your cryptocurrencies from your exchange or hot wallet to your cold storage address.

4. Securely Store Your Private Keys

This is the most crucial step. For hardware wallets, keep the device in a safe place. For paper wallets, store the printed keys in a secure, fireproof, and water-resistant location, ideally in multiple separate locations. Consider using a safety deposit box.

5. Regularly Back Up Your Private Keys

Create multiple backups of your private keys and store them securely in separate locations. Consider using a password manager to securely store digital backups.

Successfully navigating the world of cryptocurrency investment requires a blend of careful planning, diligent research, and a realistic understanding of the inherent risks. By implementing the strategies Artikeld in this guide – from diversifying your portfolio and practicing robust security measures to understanding your risk tolerance and staying informed about the regulatory landscape – you can significantly reduce your exposure to potential losses.

Remember, consistent learning and adaptation are key to long-term success in this dynamic market. Don’t be afraid to seek professional financial advice if needed, and always remember that responsible investing is the cornerstone of sustainable growth.