How to interpret Forex Factory data in various market conditions is key to successful forex trading. This guide unlocks the power of Forex Factory’s calendar, news, and sentiment data, showing you how to navigate trending, ranging, and volatile markets. We’ll explore practical strategies for using this data across different timeframes and in combination with other indicators, ultimately helping you make more informed trading decisions and manage risk effectively.

We’ll break down how to decipher the different data types offered by Forex Factory, focusing on how each affects your trading strategies. Learn to identify market trends, spot potential breakouts, and adjust your approach based on market volatility. We’ll also cover risk management techniques and how to integrate Forex Factory data with other analytical tools for a holistic view of the market.

Understanding Forex Factory Data Sources

Forex Factory is a popular resource for forex traders, offering a wealth of information to help inform trading decisions. Understanding the different data types available and how to interpret them is crucial for effectively using this platform. This section will break down the key data sources and their applications.

Forex Factory Data Types

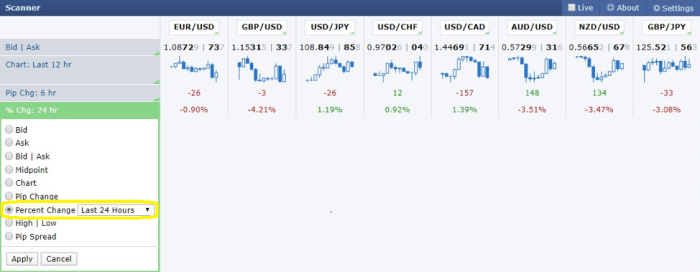

Forex Factory provides three main types of data: economic calendars, news announcements, and sentiment indicators. Each plays a unique role in helping traders understand market dynamics and anticipate potential price movements.

Economic Calendar Data

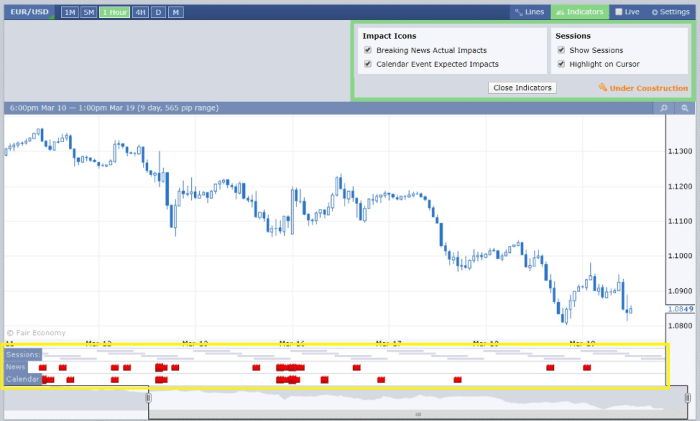

The Forex Factory calendar is a comprehensive listing of upcoming economic events and announcements, including their release times and expected impact. These events, ranging from interest rate decisions to employment reports, can significantly influence currency values. For example, a surprise interest rate hike by a central bank is likely to cause a sharp appreciation in that country’s currency.

By reviewing the calendar, traders can identify potential market-moving events and plan their trading strategies accordingly. They can anticipate increased volatility around the release times of these high-impact events and adjust their position sizing or even avoid trading altogether during periods of heightened uncertainty.

News Announcements

Forex Factory also provides access to real-time news headlines and summaries related to the forex market. These news items can cover a broad range of topics, including political developments, economic data revisions, and geopolitical events. These news announcements often directly impact currency prices, and understanding their context is vital for successful trading. For instance, a sudden escalation of a geopolitical conflict might lead to a sharp sell-off in riskier currencies, benefiting safe-haven assets like the Japanese Yen or Swiss Franc.

Sentiment Indicators

While not explicitly a data source like the calendar or news, Forex Factory indirectly provides sentiment data through user comments and forum discussions. Observing the overall sentiment expressed by other traders can offer valuable insights into market expectations and potential future price movements. However, it’s crucial to remember that this type of data is subjective and should be treated with caution.

While a generally bullish sentiment might suggest a potential upward trend, it’s not a guaranteed predictor of future price action.

Reliability of Forex Factory Data Sources

The reliability of Forex Factory’s data varies depending on the source. While the economic calendar is generally considered highly reliable, the news summaries and user sentiment are more subjective.

| Data Source | Reliability | Timeliness | Usefulness |

|---|---|---|---|

| Economic Calendar | High (official sources) | High (real-time updates) | High (identifying market-moving events) |

| News Announcements | Medium (relies on news agencies) | High (real-time updates) | Medium (requires critical analysis) |

| User Sentiment | Low (subjective opinions) | High (real-time discussions) | Low (should be used cautiously) |

| Forex Factory Forums | Variable (depends on poster credibility) | High | Variable (valuable insights but requires critical analysis) |

Interpreting Forex Factory Data in Trending Markets

Forex Factory offers a wealth of information that can be incredibly useful for traders operating in trending markets. By combining sentiment indicators, news releases, and economic calendar data, traders can significantly improve their ability to identify, confirm, and capitalize on trends while managing risk effectively. This section will detail how to leverage Forex Factory data for this purpose.

Identifying Trending Markets Using Forex Factory Data

Identifying a trend using Forex Factory involves looking at several key indicators across different data sources. The economic calendar highlights potential catalysts for significant price movements. A consistent series of positive economic releases (e.g., consistently strong employment data) might suggest an upward trend for a given currency pair. Conversely, a string of negative releases could signal a downward trend.

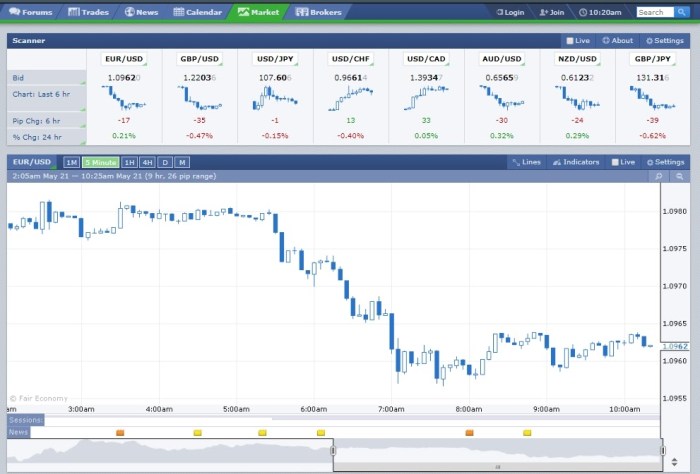

Simultaneously, analyzing the price charts themselves, readily accessible through many Forex Factory linked brokers or charts, will show the direction of the price action. A clear directional move over a period of time, supported by volume, is indicative of a trend. Combining this visual confirmation with the economic calendar’s data creates a more robust picture. For example, consistently strong US economic data alongside a steadily rising USD/JPY chart points towards an uptrend in USD/JPY.

Using Forex Factory Sentiment Data to Confirm or Contradict a Trend

Forex Factory’s sentiment indicators, such as the sentiment poll or the trader sentiment section, provide valuable insight into market psychology. A strongly bullish sentiment during an uptrend provides confirmation; the majority of traders are already positioned in the direction of the prevailing trend. However, a strongly bullish sentiment during an established uptrend might also be a contrarian indicator – suggesting the market might be overbought and due for a correction.

Similarly, a strongly bearish sentiment during a downtrend offers confirmation, while a strongly bearish sentiment in an established downtrend could signal an oversold market, potentially ripe for a bounce. It’s crucial to understand that sentiment is not a predictive tool in itself, but rather a confirmatory or contrarian one.

Strategies for Using Forex Factory News to Capitalize on Trending Markets

Forex Factory’s news section provides real-time updates on economic releases and geopolitical events that can impact forex markets. In trending markets, news can act as a catalyst to either accelerate the existing trend or cause temporary corrections. For example, a positive economic surprise (better-than-expected GDP growth) during an uptrend might significantly boost the price further. Conversely, negative news (unexpectedly high inflation) could lead to a temporary pullback within the overall uptrend.

Traders can use this information to time entries and exits. For example, waiting for a news event to confirm an existing trend before entering a trade can improve the risk/reward ratio. Alternatively, preparing for potential price corrections after significant news releases, allowing for strategic re-entry, can be beneficial.

A Step-by-Step Guide for Using Forex Factory Data to Manage Risk in Trending Markets

Managing risk in trending markets is crucial. Using Forex Factory data can significantly enhance this process.

- Identify the Trend: First, confirm the existence of a clear trend using the price charts and economic calendar data as discussed previously.

- Assess Sentiment: Analyze Forex Factory’s sentiment indicators to gauge market psychology and look for potential confirmation or contrarian signals. Extreme sentiment can indicate overbought or oversold conditions.

- Determine Entry Points: Use news events to confirm the trend and potentially identify optimal entry points. Consider waiting for a pullback within the trend to enter, potentially at a more favorable price.

- Set Stop-Loss Orders: Place stop-loss orders to limit potential losses. In trending markets, these orders might be placed slightly below recent swing lows (for uptrends) or above recent swing highs (for downtrends).

- Adjust Position Sizing: Adjust position sizing based on your risk tolerance and the strength of the trend. Stronger trends with confirmed sentiment may justify larger positions, while weaker trends might warrant smaller ones.

- Monitor News and Sentiment: Continuously monitor Forex Factory’s news and sentiment updates to gauge potential shifts in market momentum and adjust your strategy accordingly.

Interpreting Forex Factory Data in Ranging Markets

Ranging markets, characterized by sideways price movement within a defined high and low, present unique challenges and opportunities for Forex traders. Understanding how to interpret Forex Factory data within these conditions is crucial for identifying potential breakouts and managing risk effectively. Unlike trending markets where the direction is clear, ranging markets require a more nuanced approach to data analysis.Forex Factory data, with its calendar of economic news releases and sentiment indicators, becomes a valuable tool for navigating the complexities of ranging markets.

By analyzing the impact of news events on price action within the range, and observing shifts in market sentiment, traders can improve their chances of accurately predicting breakouts and managing their trades.

Identifying Characteristics of Ranging Markets Using Forex Factory Data

Identifying a ranging market using Forex Factory data involves looking for consistent price confinement within a specific price band. This is often visually apparent on a price chart. Confirmation can be found by examining the lack of significant, sustained price momentum reflected in the news and sentiment data. For example, if a currency pair is trading within a tight range, and significant economic news releases (as shown on Forex Factory’s calendar) have little to no impact on pushing the price outside that range, this strongly suggests a ranging market.

The absence of strong, sustained reactions to news events reinforces the sideways trend. Furthermore, Forex Factory’s sentiment indicators might show a lack of strong bullish or bearish conviction among traders, further supporting the identification of a ranging market.

Using Forex Factory Data to Identify Potential Breakout Points in Ranging Markets

Pinpointing potential breakout points requires a combination of chart analysis and Forex Factory data interpretation. A sustained increase in trading volume, often coinciding with a significant news event (as detailed on the Forex Factory calendar), coupled with a price move towards the range’s boundaries, can signal an impending breakout. Forex Factory’s sentiment indicators can also provide clues; a sudden shift in sentiment towards strong bullishness (or bearishness) might precede a breakout in the corresponding direction.

For instance, if a major economic report is expected (as seen on Forex Factory), and the sentiment gauge shows a strong bullish bias leading up to the release, a breakout above the range’s high becomes more likely. Conversely, a strongly bearish sentiment before a negative report could signal a downside breakout.

Explore the different advantages of leveraging the power of data-driven decision making in digital marketing that can change the way you view this issue.

Comparing and Contrasting Different Strategies for Trading Ranging Markets Based on Forex Factory Information

Several strategies utilize Forex Factory data for ranging markets. One common approach is mean reversion trading, where traders anticipate price movements back towards the average price within the range. Forex Factory’s news calendar helps determine if any unexpected events might disrupt this reversion. Another strategy focuses on breakouts, anticipating a decisive move beyond the range’s boundaries. Here, the news calendar and sentiment indicators on Forex Factory become crucial for anticipating the breakout’s timing and direction.

Finally, some traders use range-bound strategies like scalping, taking small profits from minor price fluctuations within the range. Forex Factory data provides the context – the relatively calm market environment – that makes this strategy viable. The choice depends on risk tolerance and trading style.

Using Forex Factory Data to Set Stop-Loss and Take-Profit Levels in Ranging Markets

Setting appropriate stop-loss and take-profit levels is paramount in ranging markets. For mean reversion trades, stop-losses can be placed just beyond the range’s boundaries, while take-profits are set at the opposite end of the range. For breakout trades, stop-losses are typically placed slightly below (for long positions) or above (for short positions) the breakout level, protecting against false breakouts.

Take-profits might be set at a distance determined by the range’s width or based on prior price movements. Forex Factory data can help assess the potential magnitude of a breakout by examining the impact of similar news events in the past. For example, analyzing previous reactions to similar economic reports (from the Forex Factory calendar) can inform the placement of take-profit levels.

The goal is to balance risk and reward based on the market’s volatility and the information gleaned from Forex Factory.

Interpreting Forex Factory Data in High Volatility Markets

High volatility presents unique challenges when interpreting Forex Factory data. The rapid price swings and increased market noise can make it difficult to discern genuine signals from random fluctuations. Successfully navigating these conditions requires a nuanced understanding of how volatility affects various data points on Forex Factory and a robust risk management strategy.

Discover how building a successful partnership with other businesses in digital marketing has transformed methods in this topic.

Challenges of Interpreting Forex Factory Data During High Volatility

During periods of high volatility, the usual relationships between Forex Factory data points and price movements can become distorted. For instance, sentiment indicators might show a strong bullish bias, yet the price continues to plummet due to unexpected news events or massive sell-offs. Similarly, economic calendar releases, usually reliable indicators, can have amplified, short-lived impacts, making accurate predictions challenging.

The sheer volume of news and speculation further complicates the picture, making it harder to isolate meaningful signals from the background noise. Technical indicators derived from price action, such as moving averages, can also become less reliable as price whipsaws dramatically.

Risk Management Strategies for Volatile Conditions

Effective risk management is paramount during high volatility. Smaller position sizes are crucial to limit potential losses. Instead of aiming for large profits, focus on preserving capital. Tight stop-loss orders are essential to automatically exit trades if the market moves against you. These stop-losses should be placed based on technical analysis, potentially using volatility-based indicators like Average True Range (ATR) to dynamically adjust stop-loss levels.

Diversifying your trading across different currency pairs can help mitigate risk. Don’t put all your eggs in one basket. Furthermore, avoiding leverage or using significantly reduced leverage is a key strategy to limit potential losses during these periods. Finally, consider taking breaks from trading during extremely volatile periods to avoid emotional decision-making.

Adapting Trading Strategies Based on Volatility Levels

Forex Factory data can provide clues about volatility levels. For example, a surge in forum activity, coupled with large price swings and increased volume, suggests high volatility. In such situations, scalping strategies, which rely on short-term price movements, become extremely risky. Instead, consider longer-term strategies that focus on larger trends or swing trading, which can better withstand short-term price fluctuations.

You might also adjust your entry and exit points, using wider stop-losses and take-profit levels to account for the increased price swings. For example, instead of aiming for small, frequent profits, a trader might focus on capturing a significant portion of a larger trend, accepting that the trade might take longer to materialize and involve larger price fluctuations.

Best Practices for Using Forex Factory Data During High Volatility

Prior to engaging in trading during periods of high volatility, it’s crucial to adopt a set of best practices:

- Reduce Position Size: Significantly decrease the size of your trades to limit potential losses.

- Utilize Tight Stop-Losses: Implement stop-loss orders based on technical analysis and volatility indicators.

- Increase Stop-Loss Levels Dynamically: Use volatility indicators such as the Average True Range (ATR) to adjust stop-loss levels in line with market conditions.

- Diversify Currency Pairs: Avoid concentrating your trades on a single currency pair.

- Avoid Leverage or Use Reduced Leverage: Minimize the impact of potential losses by limiting the use of leverage.

- Focus on Longer-Term Strategies: Consider swing trading or longer-term strategies that are less susceptible to short-term price fluctuations.

- Take Breaks During Extreme Volatility: Step away from trading when market conditions become excessively volatile.

- Monitor News and Economic Data Carefully: Pay close attention to news releases and economic indicators that might impact the market.

- Review and Adapt Your Strategy: Continuously assess your trading strategy and make adjustments as needed to account for changing market conditions.

Interpreting Forex Factory Data Across Different Timeframes

Forex Factory offers a wealth of information, but its usefulness changes dramatically depending on the timeframe you’re analyzing. Understanding this difference is key to effective trading. While short-term traders might focus on hourly or daily data, long-term investors will find more value in weekly or monthly data. This section explores how to adapt your interpretation based on the timeframe in question.Interpreting Forex Factory data across different timeframes involves understanding how the various data points – economic calendars, news sentiment, and forum discussions – gain or lose significance as you zoom in or out on the market.

A significant news event might cause a massive spike on a daily chart, but on a monthly chart, it might appear as just a minor fluctuation. Conversely, a gradual shift in market sentiment, barely noticeable on a daily chart, could be a major trend when viewed monthly.

Timeframe-Specific Data Relevance

The relevance of different Forex Factory data types shifts depending on the timeframe. For instance, high-frequency economic data releases (like hourly manufacturing data) are crucial for intraday traders but less relevant for weekly or monthly strategies. Conversely, monthly employment reports carry more weight for longer-term traders than for scalpers. Economic calendar events become more impactful as the timeframe lengthens, accumulating into broader market trends over time.

Forum sentiment, while useful at all timeframes, provides a different level of detail. Daily forum discussions offer a snapshot of immediate market reaction, while monthly summaries might reveal longer-term shifts in trader psychology.

Combining Forex Factory Data with Different Chart Timeframes, How to interpret Forex Factory data in various market conditions

Effective trading often involves combining Forex Factory data with multiple chart timeframes. For example, a trader might use a daily chart to identify the overall trend, a 4-hour chart to pinpoint potential entry points, and a 1-hour chart to manage risk and set stop-losses. The economic calendar can be used to anticipate potential volatility around specific news releases, informing the trader’s choice of timeframe and trading strategy.

Observing forum sentiment across different timeframes can help confirm or contradict signals from the charts, adding another layer of confirmation to trading decisions. Imagine a situation where the daily chart shows a clear uptrend, but the hourly chart reveals a temporary pullback. Forex Factory’s forum might show traders discussing this pullback as a buying opportunity, reinforcing the longer-term bullish outlook.

News Event Impact Across Timeframes

Major news events, as reflected in Forex Factory’s news section and forum discussions, have varying impacts depending on the timeframe. A surprise interest rate hike might cause a dramatic immediate price movement visible on a 1-minute or hourly chart. The same event, when viewed on a weekly or monthly chart, might appear as a significant but less dramatic shift in the overall trend.

Smaller, less impactful news might only show up as a minor blip on a daily chart, while having virtually no visible effect on a monthly chart. Conversely, the cumulative effect of several smaller news events over a month could create a significant trend, readily apparent on the monthly chart but less obvious on shorter timeframes. For example, a series of positive economic reports over a month might lead to a steady appreciation of a currency, easily observed on the monthly chart but less pronounced on daily charts due to daily market fluctuations.

Combining Forex Factory Data with Other Market Indicators: How To Interpret Forex Factory Data In Various Market Conditions

Forex Factory offers a wealth of information, but combining its data with other technical and fundamental indicators significantly enhances your market analysis and trading strategy. Using Forex Factory data in isolation can be limiting; integrating it with other tools provides a more holistic view, allowing for more informed trading decisions and potentially improved risk management. This section explores how to effectively combine Forex Factory data with other indicators to gain a competitive edge.

Forex Factory’s calendar, sentiment indicators, and news announcements provide valuable context, but they need to be interpreted within the broader market picture. Technical indicators, such as moving averages and RSI, help you identify trends, momentum, and potential reversals, complementing the information provided by Forex Factory. Fundamental indicators, like economic data releases, can further refine your analysis, aligning your interpretation of Forex Factory’s data with broader economic trends.

Combining Forex Factory Data with Moving Averages

Moving averages smooth out price action, helping identify trends. Combining this with Forex Factory’s data allows you to assess whether the current market sentiment (as reflected in Forex Factory’s sentiment indicators) aligns with the identified trend. For example, if Forex Factory shows bullish sentiment while a 20-day moving average is trending upward, this strengthens the bullish case. Conversely, if Forex Factory shows bearish sentiment while the moving average is declining, it confirms the bearish trend.

This combination provides a more robust signal than relying on either data source alone.

Combining Forex Factory Data with RSI

The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Integrating Forex Factory’s news calendar with RSI analysis helps determine if news events are driving price movements or if the market is simply reacting to overbought/oversold conditions. A high RSI value combined with negative news from Forex Factory might suggest a potential price correction, even if the overall market trend is upward.

Conversely, a low RSI value coupled with positive news from Forex Factory could indicate a potential buying opportunity.

Benefits of Combining Data Sources

Combining Forex Factory data with other indicators provides several key benefits:

A more comprehensive market analysis is possible, reducing reliance on any single data source. This diversification minimizes the impact of potential biases or inaccuracies in individual indicators. It also allows for more accurate prediction of price movements. By combining the context provided by Forex Factory with the technical analysis provided by indicators like moving averages and RSI, you can develop a more complete understanding of market dynamics.

Integrating Forex Factory Data into a Trading Strategy: A Flowchart

The following describes a simplified flowchart illustrating the integration process. Note that this is a general example and should be adapted to your specific trading style and risk tolerance.

Step 1: Review the Forex Factory calendar for upcoming news events and economic data releases. Step 2: Analyze Forex Factory’s sentiment indicators to gauge market sentiment. Step 3: Examine price charts and apply technical indicators (e.g., moving averages, RSI). Step 4: Compare and contrast the information from Steps 1-

3. Look for consistencies or divergences.

Step 5: Based on the integrated analysis, formulate a trading plan, considering potential entry and exit points, stop-loss levels, and take-profit targets. Step 6: Execute your trade according to your plan and monitor its performance. Step 7: Regularly review and adjust your strategy based on market conditions and the performance of your trades.

Mastering the interpretation of Forex Factory data empowers you to react strategically to various market conditions. By understanding how different data types influence trading decisions and combining this information with other indicators, you’ll be well-equipped to navigate the complexities of the forex market. Remember, consistent practice and adapting your strategies based on market dynamics are crucial for long-term success. So, start analyzing, refine your approach, and confidently navigate the exciting world of forex trading!