Forex Factory’s role in developing a successful trading plan is huge! It’s not just a website; it’s a toolbox brimming with resources that can significantly boost your trading game. From its economic calendar to its bustling forums, Forex Factory offers a wealth of data and insights to help you craft a robust and effective strategy. We’ll explore how to leverage these resources to build a plan that’s not just profitable, but also manages risk effectively.

This guide will walk you through using Forex Factory’s tools, from its economic calendar and sentiment indicators to its order book data and community forums. We’ll show you how to integrate this information into your trading strategy, including backtesting and risk management. By the end, you’ll have a clear understanding of how Forex Factory can become an indispensable part of your trading process.

Forex Factory’s Data and its Use in Strategy Development

Forex Factory is a treasure trove of data for forex traders, offering tools that can significantly enhance your trading plan. By effectively integrating its resources, you can improve your market analysis, refine your entry and exit strategies, and ultimately boost your trading performance. This section will explore how to leverage Forex Factory’s economic calendar, sentiment indicators, and order book data to build a robust trading strategy.

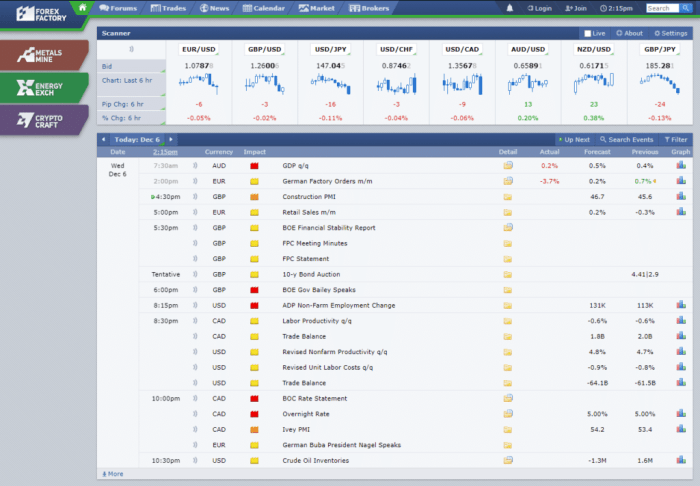

Integrating the Economic Calendar into a Trading Plan

The Forex Factory economic calendar provides a comprehensive list of upcoming economic news releases, categorized by impact and country. High-impact news events, such as Non-Farm Payrolls (NFP) or interest rate decisions, can cause significant volatility in the market. By incorporating this calendar into your trading plan, you can proactively manage risk during these periods. For instance, you might choose to avoid opening new trades shortly before or during high-impact releases, or adjust your stop-loss and take-profit levels to account for the increased volatility.

Alternatively, you could prepare specific strategies to capitalize on anticipated market movements following these announcements.

Utilizing Forex Factory’s Sentiment Indicators

Forex Factory offers various sentiment indicators that reflect the overall market mood towards specific currency pairs. These indicators, often based on trader polls or aggregated positions, provide valuable insights into market consensus. Understanding prevailing sentiment allows you to identify potential overbought or oversold conditions. For example, if the sentiment indicator shows extreme bullishness for a particular pair, it might suggest a potential reversal is imminent.

Conversely, extreme bearishness could signal a buying opportunity. It’s crucial to remember that sentiment is not a standalone trading signal, but rather a supplementary tool to be used in conjunction with other forms of technical and fundamental analysis.

In this topic, you find that running successful paid advertising campaigns on various platforms is very useful.

Incorporating Forex Factory’s Order Book Data into a Trading Strategy, Forex Factory’s role in developing a successful trading plan

Forex Factory provides access to order book data, which displays the current bids and asks for a currency pair. Analyzing order book depth and imbalances can help you identify potential entry and exit points. Large clusters of orders at specific price levels can indicate strong support or resistance. Conversely, a lack of orders at certain price levels might suggest a potential breakout.

Below is a table illustrating various order book patterns and their potential implications:

| Pattern Name | Description | Potential Entry Point | Potential Exit Point |

|---|---|---|---|

| Order Book Imbalance | A significant disparity between bid and ask volume at a specific price level. | Breakout above/below the imbalance zone. | Stop-loss below/above the imbalance zone; Take-profit based on risk/reward ratio. |

| Large Order Cluster (Support/Resistance) | A high concentration of orders at a specific price level. | Breakout above/below the cluster. | Stop-loss below/above the cluster; Take-profit based on risk/reward ratio, or a retracement to the cluster level. |

| Liquidity Vacuum | A significant gap in order book depth between bid and ask prices. | Entry near the edge of the vacuum, anticipating a price move to fill the gap. | Stop-loss at the opposite edge of the vacuum; Take-profit at the far end of the gap or a predetermined target. |

| Order Flow Imbalance | A persistent imbalance in the flow of buy and sell orders. | Entry with the dominant order flow. | Stop-loss against the dominant order flow; Take-profit based on risk/reward ratio or a predetermined target. |

Leveraging Forex Factory’s Forums and Community Insights

Forex Factory’s forums represent a vast reservoir of trader experience and opinion. While not a substitute for rigorous backtesting and independent analysis, effectively navigating these forums can significantly enhance your trading plan development by offering diverse perspectives and insights you might otherwise miss. However, it’s crucial to approach this resource strategically, understanding how to separate valuable information from noise and potential biases.Understanding that the forum is a collection of individual opinions, not necessarily factual statements, is key to successfully using it.

Many traders share their strategies and experiences, but it’s vital to remember that past performance is not indicative of future results. Furthermore, confirmation bias—the tendency to seek out information confirming pre-existing beliefs—can significantly impact the interpretation of forum discussions.

Strategies for Gathering Diverse Trading Perspectives and Identifying Potential Biases

Effectively utilizing Forex Factory’s forums involves actively seeking out diverse opinions and critically assessing potential biases. This requires a conscious effort to read posts from traders with varying experience levels, trading styles, and risk tolerances. Pay attention to the consistency of a trader’s performance claims. Are they consistently profitable, or are their posts primarily focused on recent wins while glossing over losses?

Look for traders who openly discuss their losses and the lessons learned. These are often more reliable sources of information than those who only present a consistently positive narrative. Remember, successful trading involves managing risk and accepting losses as part of the process. A trader who only talks about wins should raise a red flag. Furthermore, look for dissenting opinions.

A strategy that everyone agrees on might be too obvious or already priced into the market.

Discerning Credible Information from Noise

Forex Factory’s forums, like any online community, contain a mix of high-quality information and less useful content. To filter the noise, prioritize posts from users with established track records and verifiable trading experience. Look for detailed explanations of strategies, including clear entry and exit criteria, risk management protocols, and documented performance (though remember that past performance is not indicative of future results).

Be wary of posts that promote get-rich-quick schemes or guarantee unrealistic returns. These are often red flags for scams or misleading information. Instead, focus on posts that provide thorough analysis, support their claims with data, and acknowledge the inherent risks of trading. Consider the overall tone of the post. Is it reasoned and objective, or is it filled with emotional outbursts or unsubstantiated claims?

Find out about how the importance of ongoing learning and development in digital marketing can deliver the best answers for your issues.

A calm, analytical approach is a better indicator of credible information.

Workflow for Validating and Refining Trading Hypotheses Using Forex Factory Forum Data

Using Forex Factory’s forum data to validate and refine your trading hypotheses requires a structured approach. Here’s a workflow to guide you:

- Formulate a Hypothesis: Begin with a specific trading hypothesis you want to test, such as “The RSI indicator combined with a moving average crossover provides profitable entry signals in the EUR/USD pair.”

- Search the Forums: Use Forex Factory’s search function to find discussions related to your hypothesis. Look for threads discussing the RSI indicator, moving average crossovers, and the EUR/USD pair.

- Analyze the Data: Carefully review the posts, paying attention to different perspectives and experiences. Note any supporting or contradicting evidence for your hypothesis. Identify potential biases in the discussions. Consider the sources of information. Are they reputable?

- Refine Your Hypothesis: Based on your analysis, adjust your hypothesis accordingly. For instance, you might discover that the RSI indicator works better with a specific timeframe or needs to be combined with additional indicators for improved accuracy.

- Backtest and Iterate: After refining your hypothesis, backtest it using historical data. Compare your results with the information you gathered from the forums. Iterate on your hypothesis based on the backtesting results and further forum research.

Remember, the Forex Factory forums are a valuable tool, but they should be used as a supplement to, not a replacement for, your own thorough research and analysis.

Forex Factory’s Role in Risk Management within a Trading Plan

Forex Factory offers a wealth of resources that are invaluable in developing a robust risk management strategy, a crucial component of any successful trading plan. By leveraging its data and community insights, traders can significantly improve their ability to control risk and protect their capital. Proper risk management isn’t just about minimizing losses; it’s about maximizing the potential for long-term profitability by ensuring survival through inevitable drawdowns.Effective risk management hinges on understanding and controlling position sizing and stop-loss placement.

Forex Factory’s historical data and analytical tools play a vital role in this process, allowing traders to assess the statistical likelihood of various outcomes and fine-tune their risk parameters accordingly. The platform’s community also provides a space to discuss different risk management approaches and learn from the experiences of other traders.

Determining Appropriate Position Sizing and Stop-Loss Levels Using Forex Factory Data

Forex Factory’s historical data, readily available for numerous currency pairs, allows traders to calculate the average true range (ATR) of a currency pair over a specific period. The ATR provides a measure of volatility, which is crucial for determining stop-loss levels. For example, a trader might set a stop-loss at 2 times the ATR, ensuring their trade is stopped out before a significant adverse price movement.

Similarly, position sizing can be determined using a percentage of the trading account, often expressed as a risk percentage per trade. By calculating the potential loss based on the stop-loss level and the ATR, a trader can determine the appropriate lot size to maintain their desired risk percentage. For instance, if a trader has a $10,000 account and wants to risk only 1% per trade, they can calculate the maximum loss acceptable ($100) and adjust their lot size accordingly.

Backtesting a Trading Strategy and Assessing its Risk Profile Using Forex Factory’s Historical Data

Forex Factory provides the necessary historical data for thorough backtesting. A trader can download historical price data and use it within their preferred backtesting software or spreadsheet program. This allows for simulating the strategy’s performance over various market conditions, including periods of high and low volatility. This process reveals the strategy’s win rate, average win and loss amounts, maximum drawdown, and other key risk metrics.

This data-driven approach allows for a realistic assessment of the strategy’s risk profile before risking real capital. For example, a backtest might reveal that a strategy has a high win rate but also suffers from occasional large losing trades, highlighting a potential risk that needs to be addressed through tighter stop-loss placement or improved position sizing.

Comparing and Contrasting Different Risk Management Techniques Informed by Forex Factory Resources

Forex Factory’s forums are a treasure trove of information on different risk management techniques. Traders can find discussions on various methods, including fixed fractional position sizing, volatility-based position sizing, and the use of trailing stops. By studying these discussions and comparing different approaches, traders can tailor their risk management strategy to their individual trading style and risk tolerance.

For example, a conservative trader might prefer a fixed fractional position sizing approach, while a more aggressive trader might employ volatility-based sizing, adjusting their position size based on market volatility as indicated by Forex Factory’s data. The key is to find a method that aligns with personal risk preferences and allows for consistent adherence to a defined risk management plan.

Integrating Forex Factory’s Technical Analysis Tools: Forex Factory’s Role In Developing A Successful Trading Plan

Forex Factory offers a suite of technical analysis tools that can significantly enhance your trading plan. While it’s crucial to remember that no single tool guarantees success, integrating these tools effectively can improve your understanding of market trends and potential entry/exit points. This section will explore several key indicators and charting features available on the platform, illustrating their practical application in a trading strategy.

Technical Indicators Available on Forex Factory and Their Use in a Trading Plan

Forex Factory provides access to a wide range of technical indicators. Understanding how to select and interpret these indicators is vital for successful trading. The proper application of these indicators within a broader trading plan, however, is key. Misinterpreting or relying solely on any single indicator can lead to poor trading decisions.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market. An RSI above 70 generally suggests an overbought condition, potentially signaling a price reversal. Conversely, an RSI below 30 might indicate an oversold condition, suggesting a potential price bounce. In a trading plan, the RSI can be used to identify potential entry and exit points, confirming signals from other indicators or chart patterns.

For example, a bearish trend confirmed by a falling RSI below 30 might be a good opportunity for a long position, anticipating a price bounce.

- Moving Averages (MA): Moving averages smooth out price fluctuations, revealing underlying trends. Different types of moving averages (e.g., simple moving average (SMA), exponential moving average (EMA)) offer varying degrees of sensitivity to recent price changes. In a trading plan, the crossover of two different moving averages (e.g., a short-term EMA crossing above a long-term SMA) can be used as a buy signal, indicating a potential uptrend.

Conversely, a crossover of the short-term EMA below the long-term SMA might signal a potential downtrend and trigger a sell signal. For example, a golden cross (a short-term MA crossing above a long-term MA) might be used to confirm a bullish signal from other indicators.

- MACD (Moving Average Convergence Divergence): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It comprises a MACD line, a signal line, and a histogram. Buy signals might be generated when the MACD line crosses above the signal line, while sell signals might occur when the MACD line crosses below the signal line. Divergence between the MACD and the price action can also provide valuable insights.

For instance, bullish divergence occurs when the price makes lower lows, but the MACD makes higher lows, suggesting a potential bullish reversal. Incorporating MACD into a trading plan allows for the identification of momentum shifts and potential trend changes.

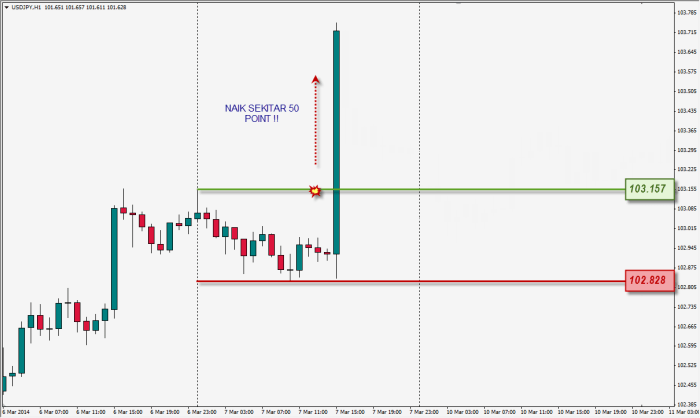

Using Forex Factory’s Charting Tools to Identify Trading Opportunities

Forex Factory’s charting tools are essential for identifying potential trading opportunities. Effective use involves combining technical analysis indicators with chart pattern recognition.

- Select a Currency Pair and Timeframe: Begin by choosing the currency pair you wish to trade and the timeframe that aligns with your trading strategy (e.g., 1-hour, 4-hour, daily charts).

- Apply Technical Indicators: Add the chosen indicators (RSI, MA, MACD, etc.) to your chart to assess market momentum and potential trend direction.

- Analyze Price Action: Examine the price movement to identify potential chart patterns (head and shoulders, double tops/bottoms, triangles, etc.).

- Identify Support and Resistance Levels: Determine significant support and resistance levels that could act as potential entry and exit points.

- Confirm Signals: Look for confirmation of trading signals from multiple indicators and chart patterns before entering a trade.

- Set Stop-Loss and Take-Profit Orders: Always use stop-loss and take-profit orders to manage risk and protect your capital.

Chart pattern recognition is crucial. Identifying patterns like head and shoulders, triangles, or flags can significantly improve your prediction of future price movements. However, it is important to remember that chart patterns are not foolproof and should be used in conjunction with other forms of technical analysis.

Limitations of Relying Solely on Forex Factory’s Technical Analysis Tools

While Forex Factory’s technical analysis tools are valuable, relying solely on them for trading decisions is risky. These tools are based on past price data and do not account for unforeseen events (e.g., geopolitical events, economic news). Furthermore, over-reliance can lead to confirmation bias, where traders selectively focus on information confirming their pre-existing beliefs. A holistic approach that incorporates fundamental analysis, risk management, and sound money management practices is essential for sustainable trading success.

Forex Factory and Backtesting a Trading Strategy

Forex Factory offers a wealth of historical data, making it a valuable resource for backtesting your trading strategies. Backtesting allows you to evaluate your strategy’s performance on past market data before risking real capital, helping you refine your approach and increase your chances of success. This section details how to leverage Forex Factory’s data for effective backtesting.

Successfully backtesting a strategy involves more than just plugging data into a software. It requires a methodical approach, careful data selection, and a critical eye for interpreting results. Understanding the limitations of backtesting is crucial; past performance doesn’t guarantee future results. However, a well-executed backtest provides valuable insights into your strategy’s robustness and potential weaknesses.

Utilizing Forex Factory’s Historical Data for Backtesting

Forex Factory provides historical forex data through its various tools and resources. The most common method involves downloading historical price data in CSV or similar formats. This data usually includes open, high, low, close (OHLC) prices, and potentially volume, for specific currency pairs and timeframes. You can find this data either directly on Forex Factory’s website (check for any data download options available) or via third-party tools that integrate with Forex Factory’s data feeds.

Remember to carefully select the timeframe (e.g., M1, M5, H1, D1) that matches your trading strategy’s timeframe. Incorrect timeframe selection can lead to misleading backtest results. For example, a strategy designed for daily trading (D1) should not be backtested using minute data (M1), as the increased noise will skew the results.

Step-by-Step Backtesting Process Using Forex Factory Data

The following steps Artikel a typical backtesting procedure using data obtained from Forex Factory. Remember to adapt these steps to your specific strategy and chosen backtesting platform.

- Data Acquisition and Preparation: Download the required historical forex data from Forex Factory. Ensure the data is clean and complete, addressing any missing or erroneous values. This might involve data cleaning and pre-processing techniques. If using a spreadsheet program, check for inconsistencies and missing values.

- Strategy Coding/Implementation: Translate your trading strategy into code using a programming language like Python (with libraries like Pandas and TA-Lib) or using a dedicated backtesting platform. This involves defining your entry and exit rules, stop-loss and take-profit levels, and any other parameters specific to your strategy.

- Backtesting Execution: Run your coded strategy on the prepared historical data. The backtesting platform or code should automatically execute your strategy on each bar of historical data, recording trades and their outcomes (profit or loss).

- Results Analysis: Analyze the backtest results carefully. This includes evaluating key metrics such as net profit, maximum drawdown, win rate, average win/loss, Sharpe ratio, and others. Visualize the results using charts and graphs to better understand the strategy’s performance over time.

- Optimization (Optional): Based on the backtest results, you might want to optimize your strategy’s parameters. However, be cautious about over-optimizing, which can lead to strategies that perform well in the past but poorly in live trading.

Interpreting Backtest Results and Making Adjustments

Backtest results provide valuable insights, but it’s crucial to interpret them critically. A high net profit doesn’t automatically mean a successful strategy. Consider the following:

- Drawdown: Analyze the maximum drawdown, which represents the largest peak-to-trough decline during the backtest period. A high drawdown indicates significant risk. A strategy with consistently high returns but also substantial drawdowns might not be suitable for all traders.

- Win Rate and Average Win/Loss: Examine the win rate (percentage of winning trades) and the average win/loss ratio. A low win rate compensated by large average wins can be acceptable, but it implies higher risk.

- Sharpe Ratio: The Sharpe ratio measures risk-adjusted return. A higher Sharpe ratio indicates better risk-adjusted performance. This metric helps compare strategies with different levels of risk and return.

- Data Period: Consider the period of historical data used. Backtesting on a period with specific market conditions might not reflect performance during different market regimes. Test your strategy across multiple time periods to assess its robustness.

Based on the backtest results, adjustments to your strategy might be necessary. This could involve modifying entry/exit rules, adjusting stop-loss and take-profit levels, or even completely revising the strategy. Remember that backtesting is an iterative process; you’ll likely need to refine your strategy based on the results of multiple backtests.

Mastering Forex Factory isn’t about passively consuming information; it’s about actively engaging with its resources to refine your trading approach. By combining Forex Factory’s data with your own analysis and risk management strategies, you can build a powerful trading plan designed for long-term success. Remember to always critically evaluate information, test your strategies thoroughly, and adapt your approach as market conditions change.

Forex Factory provides the tools; you provide the discipline and strategy.