Forex Factory’s role in building a sustainable trading career is multifaceted. It’s not just a platform; it’s a comprehensive ecosystem offering resources, tools, and a vibrant community that can significantly impact a trader’s journey. From its educational materials and economic calendar to its bustling forum and powerful indicators, Forex Factory provides a wealth of tools for aspiring and experienced traders alike.

This exploration delves into how effectively leveraging these resources can contribute to building a robust, long-term trading strategy and a resilient trader mindset.

We’ll examine how Forex Factory’s educational resources compare to other platforms, analyze the practical application of its economic calendar for risk management, and discuss the benefits and pitfalls of its active forum community. We’ll also explore the specific tools and indicators available, highlighting their strengths and limitations in building a successful trading strategy. Finally, we’ll address the crucial role Forex Factory plays in cultivating the discipline and mindset essential for sustained success in the forex market.

Forex Factory’s Educational Resources and Their Impact

Forex Factory, while primarily known for its economic calendar and forex forums, offers a surprisingly robust collection of educational resources that significantly contribute to a trader’s development. These resources, while not a replacement for formal education or mentorship, provide a valuable supplement for building a strong foundation and refining trading strategies. Their impact lies in their accessibility, diverse formats, and community-driven nature.

Types of Educational Resources and Their Effectiveness

Forex Factory’s educational resources span several formats, catering to different learning styles. Articles covering fundamental and technical analysis, risk management, and trading psychology are readily available. These articles often feature insightful commentary and practical examples, making complex concepts more digestible. The forum itself serves as a massive repository of knowledge, with threads dedicated to specific strategies, indicators, and market analysis.

Experienced traders frequently share their insights, creating a dynamic learning environment. However, the effectiveness depends heavily on the user’s ability to discern credible information from noise. Critical thinking and independent verification are crucial for maximizing the benefits of these resources. The sheer volume of information can also be overwhelming for beginners, requiring a structured approach to learning.

Comparison to Other Platforms

Compared to dedicated online trading courses or educational platforms, Forex Factory’s resources are generally less structured and lack the hand-holding often found in paid programs. However, Forex Factory boasts a significant advantage in its community aspect. The interaction between experienced and novice traders, the constant stream of real-time market discussions, and the sharing of diverse perspectives are unmatched by many other platforms.

While some platforms offer highly polished video courses and structured learning paths, Forex Factory’s organic, community-driven approach fosters a unique learning experience that encourages critical thinking and self-discovery. The free access is a significant advantage, allowing traders to explore various concepts without financial commitment.

Contribution to Sustainable Trading Strategy Development

Forex Factory’s resources directly contribute to developing a sustainable trading strategy by providing the tools and knowledge necessary for informed decision-making. Learning fundamental analysis through articles on economic indicators and geopolitical events helps traders understand the underlying forces driving market movements. Exposure to various technical analysis techniques and indicators, coupled with discussions on risk management and money management, equips traders with the skills to develop a robust trading plan.

The forum’s discussions on trading psychology help traders manage emotions and avoid common pitfalls, leading to improved discipline and consistency – essential components of sustainable trading.

Categorization of Educational Resources and Analysis

The following table categorizes Forex Factory’s educational resources and highlights their strengths and weaknesses:

| Category | Strengths | Weaknesses | Example |

|---|---|---|---|

| Articles | Comprehensive coverage of various topics, clear explanations, often include practical examples | Can be overwhelming due to volume, quality varies, requires critical evaluation | Articles on Fibonacci retracements, support and resistance levels |

| Forums | Community-driven, real-time discussions, diverse perspectives, access to experienced traders | Requires critical thinking to filter information, can be overwhelming for beginners, potential for misinformation | Threads discussing specific trading strategies, market analysis, and indicator usage |

| Calendar | Provides essential economic data, helps understand market-moving events | Data interpretation requires understanding of economic concepts | Economic calendar showing scheduled announcements of interest rates and employment data |

Forex Factory’s Economic Calendar and its Role in Risk Management

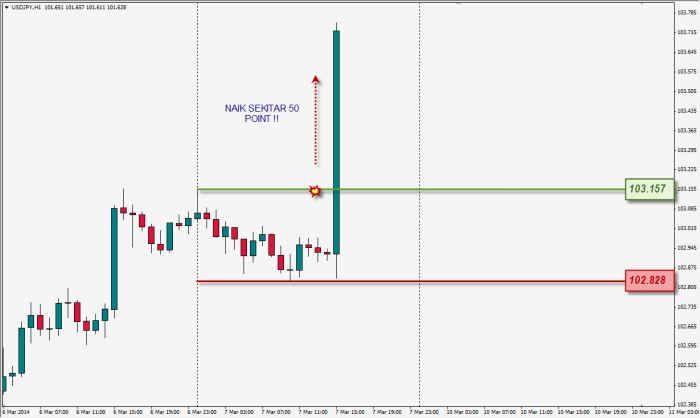

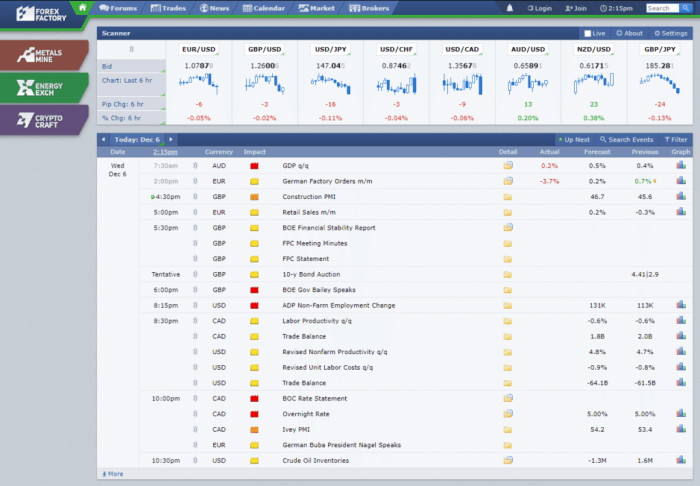

The Forex Factory economic calendar is a powerful tool for forex traders, offering a centralized view of upcoming economic news releases. Understanding and utilizing this calendar effectively is crucial for proactive risk management and improving trading decisions. It allows traders to anticipate potential market volatility and adjust their trading strategies accordingly, thereby minimizing potential losses and maximizing opportunities.The Forex Factory economic calendar provides traders with crucial information such as the time, impact, and actual result of economic events.

This data helps traders anticipate market movements by understanding how specific economic indicators might influence currency pairs. For instance, a stronger-than-expected Non-Farm Payroll report in the US might cause the USD to appreciate against other currencies, potentially impacting trades involving the dollar. Conversely, a weaker-than-expected inflation report might lead to a depreciation of the currency. This allows traders to adjust positions or avoid entering trades during periods of heightened volatility.

Using the Economic Calendar to Improve Trading Decisions

The calendar’s impact assessment helps traders prioritize important events. High-impact events, like interest rate announcements or GDP releases, are likely to cause significant market swings. Traders can use this information to plan their trades, potentially avoiding entries immediately before such events, or to prepare for increased volatility and wider spreads. They might also choose to close positions before a high-impact event to avoid unexpected losses.

Lower-impact events might offer opportunities for scalpers or day traders looking for smaller, more predictable price movements. Consistent monitoring allows for informed decision-making based on the anticipated market reaction to these announcements.

Limitations of Relying Solely on the Economic Calendar for Trading Decisions

While the economic calendar is invaluable, relying solely on it for trading decisions is risky. Market sentiment, unexpected geopolitical events, and technical analysis factors also significantly impact currency prices. A strong economic report might not necessarily lead to the expected price movement if the market was already anticipating it, or if other factors are at play. Therefore, traders should always combine calendar information with other forms of analysis for a comprehensive view of the market.

Blindly following calendar predictions without considering broader market dynamics can lead to losses.

Hypothetical Trading Scenario: Risk Mitigation Using the Forex Factory Economic Calendar

Let’s imagine a trader is long EUR/USD. The Forex Factory calendar shows a high-impact US Non-Farm Payroll report scheduled for the next day. The trader anticipates potential USD strength based on historical data and forecasts. To mitigate risk, the trader could take several actions. They might decide to close their long EUR/USD position before the announcement, locking in their profits or minimizing potential losses if the USD strengthens as expected.

Alternatively, they might reduce their position size, lowering their exposure to the upcoming volatility. They might also implement a stop-loss order at a pre-determined level to limit potential losses should the market move against their position. This proactive approach, guided by the calendar, reduces the trader’s risk profile during a period of anticipated market uncertainty.

Forex Factory’s Forum Community and its Influence on Trader Development

Forex Factory’s forum is a vibrant hub of activity for forex traders of all levels, from complete beginners to seasoned professionals. Its influence on trader development is significant, providing a unique blend of learning opportunities, collaborative environments, and, at times, challenging interactions. The sheer volume of information shared and debated daily makes it a powerful resource for those seeking to improve their trading skills and understanding of the market.The forum facilitates knowledge sharing and collaboration through diverse channels.

Traders readily share their trading strategies, chart analyses, and market perspectives. Discussions often revolve around specific currency pairs, trading styles (scalping, day trading, swing trading), and technical indicators. Experienced traders frequently offer guidance and mentorship to newer members, fostering a learning environment where practical experience is readily exchanged. The collaborative aspect is particularly valuable; traders can bounce ideas off each other, receive constructive criticism, and benefit from diverse viewpoints, leading to a more nuanced understanding of market dynamics.

Benefits and Drawbacks of Forum Participation

Active participation in the Forex Factory forum offers several potential advantages. Exposure to a wide range of trading perspectives broadens one’s understanding of market analysis and risk management. The opportunity to learn from experienced traders can accelerate the learning curve significantly. Moreover, the forum fosters a sense of community, reducing the isolation often felt by solo traders.

Enhance your insight with the methods and methods of The limitations and potential pitfalls of relying on Forex Factory data.

However, it’s crucial to acknowledge potential drawbacks. The forum can be overwhelming for beginners due to the sheer volume of information and the varying levels of expertise among participants. Misinformation and conflicting opinions are also prevalent, requiring critical evaluation of all information received. Furthermore, the anonymity of the forum can sometimes lead to unproductive arguments or the spread of unsubstantiated claims.

Careful discernment and a healthy dose of skepticism are essential for navigating these challenges.

Characteristics of Successful Forum Users

Successful traders who actively engage in the Forex Factory forum generally exhibit certain key characteristics. They are active listeners, carefully considering diverse perspectives before forming their own conclusions. They are discerning consumers of information, distinguishing between well-reasoned arguments and unsubstantiated claims. They are respectful and constructive in their interactions with other members, contributing positively to the community.

Remember to click Forex Factory and its impact on different trading account sizes to understand more comprehensive aspects of the Forex Factory and its impact on different trading account sizes topic.

Finally, they consistently apply what they learn from the forum to their own trading, actively testing and refining their strategies based on feedback and market experience. These individuals understand the forum as a tool for enhancing their skills, not as a source of guaranteed profits.

Forum Etiquette and Best Practices

Before engaging in the Forex Factory forum, understanding proper etiquette and best practices is crucial for a positive and productive experience.

- Respectful Communication: Maintain a courteous and respectful tone in all interactions, avoiding personal attacks or inflammatory language.

- Constructive Criticism: When offering criticism, focus on specific aspects of a strategy or analysis, providing concrete suggestions for improvement.

- Source Verification: Always cite your sources when sharing information, especially when presenting data or research findings.

- Avoid Self-Promotion: Refrain from excessively promoting your own services or products; focus on contributing to the community’s knowledge base.

- Search Before Posting: Check if a similar question or topic has already been discussed before creating a new thread.

- Thread Organization: Keep your posts focused and concise, avoiding unnecessary tangents or rambling.

- Accurate Information: Ensure the accuracy of any information you share, avoiding the spread of misinformation or rumors.

Forex Factory’s Tools and Indicators and Their Contribution to Sustainable Trading: Forex Factory’s Role In Building A Sustainable Trading Career

Forex Factory offers a range of tools and indicators beyond its renowned calendar and forum, significantly contributing to the development of a robust and sustainable trading strategy. These resources, while not replacing fundamental and technical analysis, provide valuable supplementary data and insights that can enhance decision-making and risk management. Understanding and effectively utilizing these tools can be a key differentiator for traders aiming for long-term success.Forex Factory’s tools and indicators offer a unique blend of readily available data and community-driven analysis.

Unlike some platforms that focus solely on charting or algorithmic indicators, Forex Factory integrates these elements with economic news and sentiment data, creating a holistic view of the market. This integration allows traders to connect price action with the underlying economic factors influencing it, leading to more informed trading decisions. For instance, a trader might use Forex Factory’s sentiment indicator alongside a moving average crossover strategy, adding another layer of confirmation before entering a trade.

Sentiment Indicators and Their Application in Trading Strategies

Forex Factory’s sentiment indicators gauge the collective market mood towards specific currency pairs. These indicators, often presented as percentage values representing the proportion of traders holding long or short positions, can provide insights into potential market reversals or confirmations of existing trends. A high percentage of traders holding long positions, for example, might suggest a potential overbought condition and a possible upcoming price correction.

This information, combined with technical analysis, helps traders to identify potential entry and exit points with a higher degree of confidence. However, it’s crucial to remember that sentiment is not a predictive tool in itself; it’s one piece of the puzzle.

Comparison of Forex Factory Tools with Other Platforms

While many platforms offer charting tools and technical indicators, Forex Factory distinguishes itself by integrating these with its economic calendar and forum. Platforms like TradingView excel at charting and advanced technical analysis, but often lack the real-time economic news and community-driven insights that Forex Factory provides. MetaTrader platforms, while powerful, require separate integrations to access comparable sentiment data and economic news.

Forex Factory’s unique strength lies in its consolidated ecosystem, offering a comprehensive view of market conditions from multiple perspectives.

Impact of Forex Factory Tools on Trading Performance

Consistent use of Forex Factory’s tools, especially when combined with a well-defined trading strategy, can demonstrably improve trading performance over time. By incorporating sentiment analysis into their decision-making, traders can potentially reduce the frequency of entering trades against the prevailing market sentiment, thus minimizing losses. Furthermore, the economic calendar helps traders to anticipate market volatility surrounding major economic announcements, allowing for better risk management through adjustments to position sizing or even avoiding trades during periods of heightened uncertainty.

Improved risk management and more informed entry/exit points naturally translate to better win rates and more consistent profitability.

Comparison of Three Forex Factory Indicators

| Indicator | Application | Limitations | Example Usage |

|---|---|---|---|

| Sentiment Indicator | Gauging overall market sentiment towards a currency pair; identifying potential overbought/oversold conditions. | Not a predictive tool; can be influenced by market manipulation; needs to be used in conjunction with other indicators. | High long sentiment + bearish candlestick pattern might suggest a potential short opportunity. |

| Economic News Impact Analysis | Assessing the potential impact of economic news releases on currency pairs; identifying potential trading opportunities. | Market reactions can be unpredictable; news impact can vary depending on market context. | Expected positive data release + bullish trend might warrant increasing a long position. |

| Volatility Indicator (e.g., Average True Range) | Measuring market volatility; identifying periods of high and low volatility. | Doesn’t predict future volatility; can be lagging. | High volatility might suggest scalping opportunities, while low volatility might suggest a longer-term strategy. |

The Role of Forex Factory in Developing a Trader’s Mindset and Discipline

Forex Factory isn’t just a repository of data; it’s a crucial tool for cultivating the mental fortitude and disciplined approach essential for long-term success in forex trading. Its diverse resources, from the economic calendar to the vibrant forum community, contribute to shaping a trader’s mindset, helping them navigate the emotional rollercoaster inherent in this market. This goes beyond technical analysis; it’s about building resilience, managing risk effectively, and fostering a sustainable trading strategy.Forex Factory’s content and community directly address the psychological challenges traders face.

The forum, for instance, provides a platform where experienced traders share their insights on overcoming fear, greed, and other emotional biases that can derail even the most well-researched trading plans. Access to diverse perspectives and real-world experiences helps traders learn from both successes and failures, fostering a more realistic and adaptable approach to the market. The economic calendar, while seemingly a purely technical tool, also plays a vital role in managing expectations and avoiding impulsive decisions driven by emotional reactions to unexpected news events.

Overcoming Psychological Barriers Through Forex Factory

The Forex Factory forum acts as a virtual support group and a valuable resource for overcoming common psychological barriers. Traders can learn from others who have experienced similar struggles, finding comfort and strategies in shared experiences. For example, threads discussing dealing with losing streaks often feature advice on adjusting position sizing, taking breaks from trading, and revisiting their trading plan.

This communal aspect helps traders feel less isolated and provides a sense of perspective, crucial for maintaining a healthy trading mindset. Reading analyses of past market events and observing how others reacted can help new traders anticipate their own potential emotional responses to similar situations.

Risk Management and Emotional Control: The Forex Factory Perspective, Forex Factory’s role in building a sustainable trading career

Successful forex trading hinges on effective risk management and emotional control. Forex Factory provides numerous resources that directly support this. The economic calendar allows traders to anticipate potential market volatility and adjust their trading strategies accordingly, minimizing exposure to unexpected price swings. The forum discussions often emphasize the importance of sticking to a pre-defined trading plan, regardless of short-term market fluctuations.

This consistent adherence to a risk management strategy, informed by the resources available on Forex Factory, helps traders avoid impulsive decisions driven by fear or greed, which are common causes of significant losses. For example, many experienced traders on the forum advocate for using stop-loss orders and position sizing techniques to limit potential losses, a concept reinforced by many educational articles available on the platform.

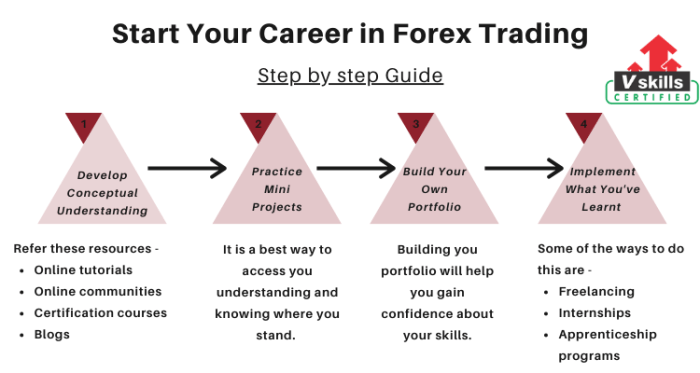

A Step-by-Step Guide to Cultivating Disciplined Trading Using Forex Factory

- Assess Your Current Mindset: Before utilizing Forex Factory’s resources, honestly evaluate your current trading psychology. Are you prone to impulsive decisions? Do you struggle with losses? Identifying these weaknesses is the first step towards improvement.

- Utilize the Economic Calendar for Planning: Use Forex Factory’s economic calendar to plan your trades. Anticipate high-impact news events and adjust your trading activity accordingly. This proactive approach reduces emotional reactions to unexpected market movements.

- Engage with the Forum Community: Participate in relevant forum discussions. Learn from others’ experiences, both successes and failures. Share your own struggles and seek advice. The collective wisdom of the community can be invaluable.

- Develop a Strict Trading Plan: Create a detailed trading plan that includes clear entry and exit strategies, risk management rules, and emotional control techniques. Regularly review and refine this plan based on your experiences and feedback from the Forex Factory community.

- Track Your Performance: Maintain a detailed trading journal. Record your trades, including your rationale, emotions, and the outcomes. Analyze your performance to identify patterns and areas for improvement. Forex Factory’s tools can assist in this process.

- Practice Consistent Self-Reflection: Regularly review your trading journal and reflect on your successes and failures. Identify emotional biases that might be impacting your trading decisions. The forum’s discussions can provide valuable insights and support during this process.

Forex Factory’s Limitations and Potential Pitfalls

Forex Factory, while a valuable resource for forex traders, isn’t a magic bullet. Relying solely on its information can lead to significant drawbacks if not approached with a critical and discerning eye. Understanding its limitations and potential pitfalls is crucial for building a sustainable and successful trading career. This section will highlight key areas where caution is necessary.Over-reliance on Forex Factory can create a false sense of security.

While the platform offers a wealth of data and community interaction, it’s essential to remember that not all information is accurate, reliable, or suitable for your individual trading style. Blindly following advice or signals without independent verification can be detrimental to your trading account.

The Risk of Biased Information and Confirmation Bias

Forex Factory’s forum, while vibrant, is susceptible to biases. Experienced traders might inadvertently (or intentionally) steer the conversation in ways that benefit their own positions. New traders, eager for confirmation of their own biases, may latch onto these opinions without sufficient critical analysis. This confirmation bias can lead to poor decision-making and ultimately, losses. For example, a trader convinced a specific currency pair is about to rise might selectively focus on positive comments and ignore dissenting opinions within the forum, reinforcing their pre-existing belief.

The Dangers of Following Trading Signals Blindly

Many users on Forex Factory share trading signals. While some signal providers might be genuinely experienced and successful, many are not. Following signals blindly, without understanding the underlying rationale or risk management strategy, is extremely risky. A signal might appear profitable in hindsight, but the actual risk-reward ratio could be unfavorable. Consider a scenario where a signal provider suggests a trade with a 1:5 risk-reward ratio, meaning a potential loss of 5% to gain 1%.

Even with a high win rate, consistent losses of 5% will quickly erode your capital. Independent verification and risk management are crucial before acting on any signal.

Limitations of Economic Calendar Data

Forex Factory’s economic calendar is a useful tool, but it’s not a crystal ball. The impact of economic news releases can be unpredictable. Market reactions can vary wildly depending on various factors not always reflected in the calendar, such as unexpected comments from central bank officials or geopolitical events. Therefore, relying solely on the calendar for trading decisions is insufficient.

Best Practices for Mitigating Risks

It’s crucial to develop a robust strategy to mitigate the risks associated with using Forex Factory. This includes:

Always conduct independent research: Don’t solely rely on information from Forex Factory. Cross-reference data with other reliable sources, analyze charts, and develop your own trading plan.

Develop critical thinking skills: Learn to identify biases, question assumptions, and evaluate information objectively. Don’t blindly accept opinions, even from experienced traders.

Focus on risk management: Always use stop-loss orders and position sizing techniques to limit potential losses. Never risk more than you can afford to lose.

Diversify your information sources: Don’t limit your learning to Forex Factory. Consult other reputable websites, educational materials, and experienced traders.

Backtest your strategies: Before implementing any trading strategy based on information from Forex Factory, rigorously backtest it using historical data to evaluate its performance and risk profile.

Mastering the forex market requires more than just technical skills; it demands discipline, risk management, and a constant pursuit of knowledge. Forex Factory, with its diverse range of resources and engaged community, offers a powerful platform to cultivate all three. While it’s not a magic bullet, effectively utilizing its tools, educational materials, and community insights can significantly enhance a trader’s chances of building a sustainable and profitable trading career.

Remember to always approach any information with critical thinking and supplement it with independent research. The key is to use Forex Factory strategically as part of a broader, well-defined trading plan.