Forex Factory’s role in backtesting trading strategies is surprisingly significant. This platform offers a wealth of data – from historical price charts to economic calendars and even trader sentiment gleaned from its bustling forums – all potentially valuable for rigorously testing your trading ideas. We’ll explore how to harness this data, overcome potential pitfalls, and ultimately build more robust and reliable trading strategies.

This guide walks you through acquiring, preparing, and integrating Forex Factory data into your backtesting workflow. We’ll cover various platforms, offer code examples, and discuss crucial considerations like data biases and limitations. By the end, you’ll be equipped to leverage Forex Factory’s unique resources to significantly enhance your backtesting process.

Forex Factory Data Acquisition and its Suitability for Backtesting

Forex Factory is a popular online forum and resource for forex traders, offering a wealth of information, including historical forex data. While not explicitly designed as a backtesting data provider, its readily available data can be surprisingly useful, though it comes with its own set of caveats. Understanding these limitations and how to work around them is crucial for successful backtesting.Forex Factory’s data suitability hinges on its accessibility and the type of data offered.

However, it’s important to remember that its primary function isn’t data provision; therefore, its data quality and completeness can’t be guaranteed to the same level as dedicated data vendors.

Types of Forex Factory Data Relevant to Backtesting

Forex Factory primarily offers historical forex data through its various forums and user-submitted information. This includes historical price charts, often presented as images or downloadable files, and user-created indicators or spreadsheets containing price data. The data’s granularity varies widely, ranging from daily to tick data, depending on the source and the specific thread. However, consistently reliable, high-frequency data is not a guarantee.

Extracting Data from Forex Factory: Challenges and Limitations

Extracting data from Forex Factory is a manual process. There’s no automated API or direct download option. This means users need to manually collect data from charts (often requiring screen scraping) or by downloading user-provided spreadsheets. This is time-consuming and prone to errors. The data’s reliability also varies greatly depending on its source.

User-submitted data may contain inaccuracies or inconsistencies. Furthermore, the data’s historical coverage is not guaranteed to be complete or continuous. Gaps in data are common, requiring significant manual intervention to fill or address.

Cleaning and Preparing Forex Factory Data for Backtesting

Once extracted, the data usually requires significant cleaning and preparation before it’s suitable for backtesting software. This typically involves:

- Data Format Conversion: Data might need to be converted from image formats (like PNG or JPG) to a structured format like CSV or a database format accepted by the backtesting software.

- Data Validation: Checking for inconsistencies, missing values, and outliers is crucial. This might involve identifying and correcting obvious errors or removing problematic data points.

- Data Standardization: Ensuring consistent formatting of timestamps and price data is vital for accurate analysis. This often requires careful attention to detail and potentially some scripting.

- Data Alignment: If using multiple data sources, aligning the data by timestamps is essential to avoid errors in the backtesting process.

This process can be complex and requires programming skills, often involving scripting languages like Python with libraries such as Pandas.

Comparison with Other Data Sources

Forex Factory data contrasts sharply with data from dedicated providers like Dukascopy, FXCM, or MetaTrader’s history center. Dedicated vendors provide high-quality, consistent, and usually complete historical data with reliable APIs for automated downloads. However, this comes at a cost – subscriptions are usually required.

| Feature | Forex Factory | Dedicated Vendors |

|---|---|---|

| Cost | Free | Subscription required |

| Data Quality | Variable, potential inaccuracies | High quality, consistent |

| Data Acquisition | Manual, time-consuming | Automated, API access |

| Data Completeness | Inconsistent, gaps possible | Generally complete |

While Forex Factory data offers a free alternative, the time investment and potential for errors need careful consideration. For serious backtesting, the reliability and convenience of paid data sources often outweigh the cost.

Integrating Forex Factory Data into Backtesting Platforms

Getting your Forex Factory data ready for backtesting involves several key steps, from downloading the right files to ensuring compatibility with your chosen platform. This section will guide you through the process, providing practical examples and code snippets to streamline the workflow. Remember that data quality is paramount for reliable backtesting results.

Different backtesting platforms have varying data import requirements. Some accept CSV files directly, while others might need specific formats like MT4’s .csv or proprietary databases. Therefore, data conversion is often a necessary step. This often involves cleaning the data, ensuring consistency in date/time formats, and restructuring columns to match the platform’s expectations.

Importing Forex Factory Data into MetaTrader 4

Importing Forex Factory data into MetaTrader 4 (MT4) usually involves converting your downloaded data (likely in CSV format) into a format compatible with MT4. This often requires a specialized tool or custom script.

Let’s assume you’ve downloaded your Forex Factory data as a CSV file. A typical CSV file will have columns for date, time, open, high, low, close, and volume. You will need to ensure the date and time format is consistent with MT4’s requirements (YYYY.MM.DD HH:MM:SS). Then, you’ll need to import this CSV file into MT4. MT4 doesn’t directly import CSV files for historical data; you’ll need to use a custom script or a third-party tool to convert the data into a format MT4 understands.

This typically involves creating an .hst (history) file.

Screenshot Description: A screenshot would show the MT4 platform with a data import window (if one exists). Alternatively, it might show a custom script running in the MetaEditor, the MT4’s integrated code editor. The screenshot would visually represent the process of importing the data into MT4, showing the location of the .csv file and potentially a progress bar or confirmation message.

Importing Forex Factory Data into TradingView

TradingView offers more flexibility in data import. While it primarily uses its own data sources, you can upload custom data. This usually involves preparing your Forex Factory data in a CSV file with specific columns (timestamp, open, high, low, close, volume). TradingView has its own format requirements for the timestamp column; you’ll need to ensure your dates and times are in the correct format for successful upload.

Understand how the union of how to generate consistent leads using digital marketing strategies can improve efficiency and productivity.

After uploading, you can then use the data in your backtesting strategies.

Screenshot Description: The screenshot would display the TradingView Pine Editor with a script that accesses and uses the uploaded data. The chart panel would show the uploaded data plotted against time. Another screenshot could show the TradingView interface where a user is uploading the CSV file. The upload window would show file selection and options for data format specification.

Data Format Conversion and Preprocessing

Often, Forex Factory data needs preprocessing before it’s suitable for backtesting. This includes handling missing values, correcting inconsistencies, and converting data types. Python is well-suited for these tasks.

Do not overlook the opportunity to discover more about the subject of best practices for email marketing in a digital marketing strategy.

The following table demonstrates code snippets for automating data import and preprocessing. Note that these are simplified examples and might require adjustments based on your specific data and platform.

| Code Snippet | Description | Platform | Notes |

|---|---|---|---|

| “`python import pandas as pd data = pd.read_csv(“forex_factory_data.csv”) data[‘Timestamp’] = pd.to_datetime(data[‘Date’] + ‘ ‘ + data[‘Time’]) data = data.drop([‘Date’, ‘Time’], axis=1) data.to_csv(“processed_data.csv”, index=False) “` | Reads CSV, converts date/time columns to a single timestamp, and saves as a processed CSV. | MetaTrader 4 (after conversion to .hst), TradingView | Requires pandas library. Adjust column names as needed. |

| “`python import pandas as pd data = pd.read_csv(“forex_factory_data.csv”) data.fillna(method=’ffill’, inplace=True) #Forward fill missing values #Further data cleaning and transformation as needed… data.to_csv(“cleaned_data.csv”, index=False) “` | Handles missing data using forward fill. | MetaTrader 4 (after conversion to .hst), TradingView | Other methods for handling missing data (e.g., backward fill, interpolation) can be used. |

Analyzing Backtesting Results using Forex Factory Data: Forex Factory’s Role In Backtesting Trading Strategies

Forex Factory offers a wealth of data beyond just price information, significantly enriching the backtesting process. Analyzing the results requires careful consideration of this additional context to avoid misinterpretations and to gain a more nuanced understanding of your strategy’s performance. This section explores how to effectively analyze backtested results incorporating Forex Factory’s economic calendar and forum sentiment.

Economic Calendar Influence on Backtesting Results

Forex Factory’s economic calendar provides crucial data points like scheduled economic announcements (e.g., Non-Farm Payroll, CPI). These events can cause significant market volatility, impacting the performance of any trading strategy. During backtesting, it’s essential to identify instances where your strategy’s trades coincided with major economic releases. Analyzing the strategy’s performance

- before*,

- during*, and

- after* these events helps determine its resilience to news-driven market swings. For example, a strategy showing high profitability might actually be benefiting from reacting to predictable post-announcement price movements, rather than fundamental market analysis. This would need to be factored into your evaluation. Conversely, a seemingly poor performing strategy might exhibit resilience during high volatility periods, indicating potential strength in less predictable market conditions.

Incorporating News Sentiment from Forex Factory Forums

Forex Factory’s forums offer a valuable, albeit subjective, source of market sentiment. This data can be incorporated into backtesting by creating a sentiment indicator. One approach is to analyze the frequency of positive and negative s or phrases within forum posts around the time of your trades. A higher frequency of positive sentiment might suggest increased market confidence, potentially boosting your strategy’s performance, while negative sentiment might indicate increased risk.

This sentiment indicator could then be added as a factor in your backtesting analysis, revealing how your strategy performs under varying market sentiment conditions. For example, you might find your strategy performs significantly better during periods of high bullish sentiment, suggesting a potential bias towards trending markets.

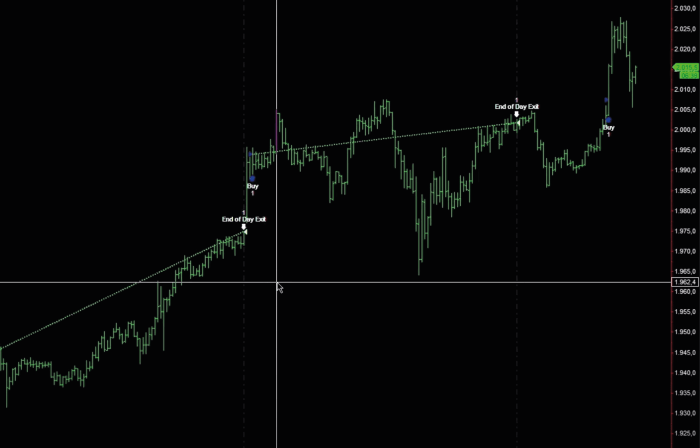

Visualizing Backtesting Performance Metrics

Visualizing backtesting results is crucial for effective analysis. Using Forex Factory data, you can create charts showing the strategy’s performance against specific economic events or sentiment indices. For instance, a chart could plot the Sharpe ratio over time, with different colors representing periods of high and low forum sentiment. Similarly, maximum drawdown could be visualized against the economic calendar, highlighting potential vulnerabilities of the strategy during specific economic announcements.

A simple table could show the average return and maximum drawdown for different sentiment levels. Such visualizations provide a clear and concise overview of your strategy’s performance under varying market conditions, helping identify strengths and weaknesses. For instance, a bar chart comparing Sharpe ratios during periods of high vs. low economic event volatility can quickly highlight the strategy’s robustness.

Example: Interpreting Backtesting Results with Forex Factory Data, Forex Factory’s role in backtesting trading strategies

Let’s imagine a backtest of a mean reversion strategy using 1-hour EUR/USD data. The backtest shows high profitability overall. However, by incorporating Forex Factory’s economic calendar, we discover the strategy’s profits are heavily concentrated around periodsfollowing* major economic news announcements. Further analysis of Forex Factory forums reveals a consistently high level of volatility and uncertainty surrounding these announcements.

This suggests the strategy is not genuinely exploiting mean reversion but rather benefiting from post-news price corrections, a riskier and less sustainable approach. Analyzing maximum drawdown against the economic calendar could reveal significant losses during periods of high volatility, reinforcing the vulnerability of this strategy. This example highlights the importance of considering external data sources like Forex Factory to gain a more comprehensive and accurate understanding of backtesting results, avoiding potentially misleading conclusions.

Forex Factory’s Role in Evaluating Trading Strategy Robustness

Forex Factory’s extensive historical forex data provides a valuable resource for assessing the robustness of a trading strategy. By backtesting your strategy across a wide range of market conditions represented in this data, you can gain a much clearer picture of its potential performance in real-world scenarios and identify its weaknesses. This goes beyond simply measuring profitability; it’s about understanding how your strategy behaves under stress.By comparing backtesting results from Forex Factory data with those from other sources, you can gain insights into the reliability and generalizability of your strategy’s performance.

This comparative analysis is crucial in evaluating the robustness of your approach. Differences in performance across datasets can highlight biases in individual data providers or reveal vulnerabilities in your strategy itself.

Comparing Forex Factory Backtest Results with Other Data Sources

Using Forex Factory data alongside data from other providers like Dukascopy or MetaTrader allows for a more comprehensive robustness check. For example, you might find that a strategy performs exceptionally well on Forex Factory’s data but poorly on Dukascopy’s data. This discrepancy could indicate that the strategy is overly sensitive to specific characteristics of the Forex Factory data, such as tick frequency or data granularity, which might not reflect real-market conditions accurately.

A robust strategy should show relatively consistent performance across different data sources. Significant variations warrant further investigation into the strategy’s underlying assumptions and parameters.

Limitations of Using Forex Factory Data for Robustness Evaluation

While Forex Factory offers a wealth of data, it’s important to acknowledge its limitations. The data is primarily sourced from various brokers, and inconsistencies in data quality, such as slippage or latency differences, might exist. Furthermore, Forex Factory data may not fully capture events like flash crashes or significant geopolitical shifts that could dramatically impact trading strategies. Relying solely on Forex Factory data could lead to an overly optimistic or pessimistic assessment of strategy robustness.

Diversifying data sources is crucial to mitigate these risks.

Refining Trading Strategies Based on Forex Factory Backtesting Results

Understanding how your strategy performs under various market conditions, as revealed by backtesting on Forex Factory data, is vital for refinement. Here are some examples of how to use this information to improve your trading strategy:

- Identifying drawdown periods: Analyze periods of significant drawdowns in your Forex Factory backtests. This helps identify specific market conditions that negatively impact your strategy and allow for the development of risk management techniques or modifications to better handle such situations.

- Adjusting stop-loss and take-profit levels: Backtesting on Forex Factory data can reveal optimal stop-loss and take-profit levels for different market environments. This involves adjusting these parameters based on observed performance under various conditions.

- Optimizing entry and exit rules: By analyzing the performance of different entry and exit signals across diverse market conditions using Forex Factory data, you can refine these rules to enhance profitability and reduce risk.

- Developing robust risk management: Forex Factory data can help you test various risk management strategies, such as position sizing and diversification, to determine the optimal approach for your specific strategy and market conditions.

Limitations and Considerations when using Forex Factory for Backtesting

Forex Factory, while a valuable resource for forex data, isn’t without its limitations when used for backtesting trading strategies. Understanding these limitations is crucial for interpreting backtest results accurately and avoiding potentially misleading conclusions. Ignoring these limitations can lead to overconfidence in a strategy’s performance and ultimately, significant losses in live trading.

Potential Biases in Forex Factory Data

Forex Factory data, like any freely available dataset, is susceptible to various biases that can skew backtesting results. One significant concern is survivorship bias. Forex Factory primarily showcases data from brokers and providers that have survived in the market. This means that data from failed brokers or strategies that didn’t succeed is likely absent, creating an artificially optimistic view of market performance.

Furthermore, the possibility of data manipulation, though less likely with reputable sources, cannot be entirely ruled out. It’s important to be aware that even slight inaccuracies in the data can significantly impact the results of a backtest, leading to an overestimation or underestimation of strategy profitability. A thorough understanding of the data’s source and potential limitations is essential before proceeding with any backtesting.

The Importance of the Backtesting Time Period

The choice of backtesting period significantly influences the results obtained from Forex Factory data. A short backtesting period might not capture the full range of market conditions, leading to inaccurate assessments of a strategy’s robustness. Conversely, an excessively long period might include outdated market dynamics that are no longer relevant. For example, a strategy backtested over a period encompassing a major financial crisis might show poor performance, even if it would perform well in current market conditions.

The optimal backtesting period depends on the strategy being tested and the market’s characteristics. A well-designed backtest should consider multiple time periods and compare the results to gain a more comprehensive understanding of the strategy’s performance.

Mitigating the Limitations of Forex Factory Data

Several steps can be taken to mitigate the limitations inherent in using Forex Factory data for backtesting. Firstly, diversifying data sources is recommended. Supplementing Forex Factory data with data from other reputable providers can help to cross-validate results and identify potential biases. Secondly, carefully examining the data for anomalies and inconsistencies is crucial. Any unusual spikes or gaps in the data should be investigated thoroughly to determine their cause and potential impact on the backtest.

Finally, understanding the limitations of any data set and interpreting the results accordingly is critical for responsible backtesting. No dataset is perfect, and understanding the potential biases is essential for avoiding overconfidence and making informed trading decisions.

Best Practices for Using Forex Factory Data in Backtesting

Before beginning your backtesting process using Forex Factory data, consider these best practices:

- Always cross-reference data with at least one other reliable source to identify and mitigate potential biases.

- Thoroughly analyze the data for any inconsistencies or anomalies that could skew your results.

- Use a robust backtesting platform that allows for detailed analysis and customization of parameters.

- Consider using multiple time periods for your backtests to gain a more comprehensive understanding of your strategy’s performance.

- Document your backtesting methodology meticulously, including data sources, parameters, and any adjustments made during the process.

- Never rely solely on backtesting results. Always conduct thorough forward testing and risk management before implementing a strategy in live trading.

Successfully integrating Forex Factory data into your backtesting process can provide a significant edge. Remember, while Forex Factory offers a rich dataset, critical analysis is key. Understanding the inherent limitations and potential biases is crucial for interpreting results accurately. By carefully considering these factors and employing best practices, you can use Forex Factory to refine your strategies, improve their robustness, and ultimately boost your trading performance.

So, dive in and start building those winning strategies!