Forex Factory’s influence on currency pair volatility is a fascinating area of study. This platform, with its economic calendars, news feeds, and vibrant forums, acts as a powerful information hub for forex traders worldwide. The speed at which information spreads across Forex Factory, coupled with the diverse opinions shared within its community, can significantly impact market sentiment and, consequently, the volatility of various currency pairs.

We’ll explore how this influence plays out, examining both the positive and negative effects of this readily available information.

This exploration will delve into how Forex Factory’s data influences trading decisions, the role of its forums in shaping market sentiment, and the platform’s relationship with algorithmic trading. We’ll analyze the correlation between Forex Factory activity and volatility spikes, consider potential biases in the data, and discuss other external factors that also affect currency pair movements. By the end, you’ll have a better understanding of Forex Factory’s complex and multifaceted impact on the forex market.

Forex Factory’s Data and its Impact

Forex Factory is a hugely popular online resource for forex traders, offering a wealth of information that significantly influences market activity. Its impact stems from the readily available data, its speed of dissemination, and the way traders react to this information. Understanding how Forex Factory’s data affects trading decisions is key to navigating the forex market effectively.

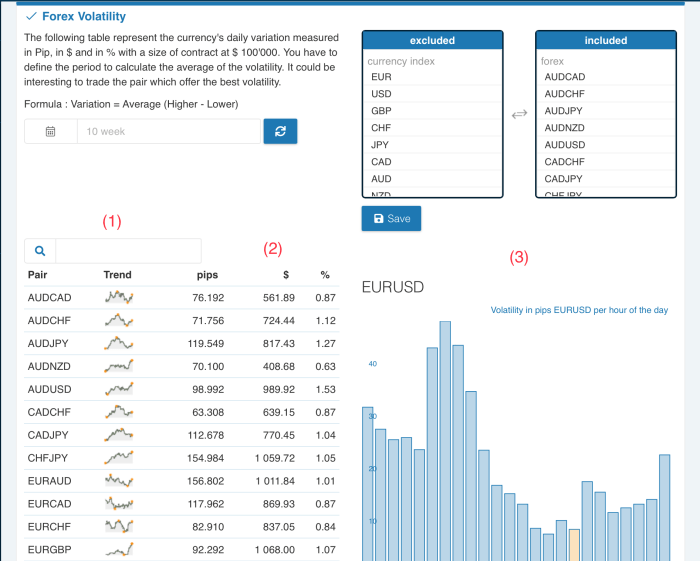

Types of Data Provided by Forex Factory

Forex Factory provides several crucial data types that traders rely on for their decision-making processes. These data points help traders anticipate market movements and adjust their strategies accordingly. The accessibility of this information levels the playing field, allowing both experienced and novice traders to access the same market insights.

- Economic Calendars: These calendars list upcoming economic announcements, such as interest rate decisions, employment reports, and inflation figures. Knowing the timing of these announcements allows traders to anticipate potential volatility and adjust their positions proactively.

- News: Forex Factory aggregates news from various sources, providing real-time updates on global events that could affect currency values. This news coverage is crucial, as unexpected events can trigger significant market shifts.

- Sentiment Indicators: These indicators reflect the overall market sentiment towards specific currency pairs. They are often based on trader surveys and comments, providing a sense of the prevailing market mood and potential trading biases.

Accessibility of Data and Trader Behavior

The free and readily accessible nature of Forex Factory’s data significantly influences trader behavior. The platform’s ease of use and comprehensive data collection enable traders to make more informed decisions. This democratization of information has made forex trading more accessible, leading to increased market participation and potentially increased volatility around news events. Traders often coordinate their actions based on the same information stream, leading to herd behavior and amplified market reactions.

Speed of Data Dissemination and Market Reactions

The speed at which Forex Factory disseminates information is a critical factor in market reactions. The platform’s near real-time updates mean traders can react almost instantaneously to breaking news and economic data. This speed can amplify market movements, as traders simultaneously adjust their positions based on the same information, leading to rapid price fluctuations. The quicker the information spreads, the faster and more pronounced the market reaction tends to be.

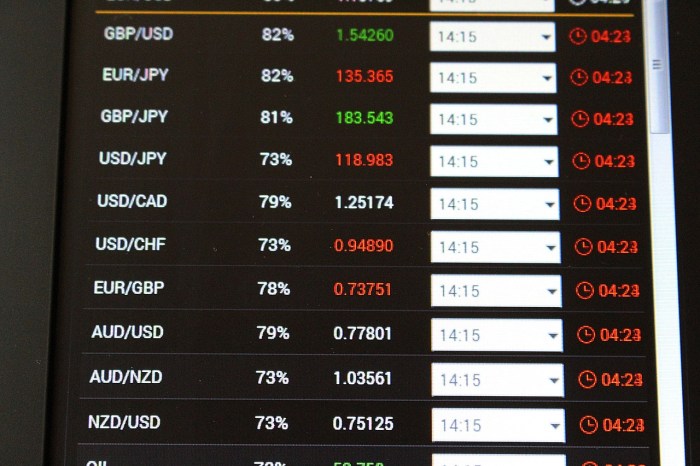

Impact of Forex Factory Data on Different Currency Pairs

The impact of Forex Factory’s data varies across different currency pairs. Some pairs are more sensitive to specific types of data than others. For example, pairs involving the US dollar are often highly responsive to US economic data, while others might be more affected by geopolitical events.

| Currency Pair | Volatility Impact | Data Type Most Influential | Example of Recent Impact |

|---|---|---|---|

| EUR/USD | High | Economic Calendar (ECB & Fed announcements) | Significant price swings following recent Eurozone inflation data releases. |

| USD/JPY | Medium | News (Geopolitical events, US interest rate decisions) | Increased volatility after news regarding US-China trade tensions. |

| GBP/USD | High | Economic Calendar (Bank of England announcements) | Sharp movements after recent UK employment data releases. |

| AUD/USD | Medium | News (Australian economic data, commodity prices) | Price fluctuations following recent Australian interest rate decisions. |

Forex Factory’s Forums and Community Influence

Forex Factory’s forums are a vibrant hub of trader activity, acting as a significant, albeit informal, barometer of market sentiment. The sheer volume of discussions, ranging from technical analysis interpretations to fundamental news reactions, creates a collective pulse that can demonstrably influence price action in various currency pairs. Understanding this influence is crucial for any trader aiming to gain a comprehensive market perspective.The discussions and opinions shared on Forex Factory’s forums can directly impact price movements through several mechanisms.

The platform facilitates the rapid dissemination of information and trading ideas, potentially triggering herd behavior. A strongly positive sentiment, for example, expressed by a large number of traders regarding a particular currency pair, can lead to increased buying pressure, driving prices upwards. Conversely, widespread negativity can fuel selling pressure and price declines. This isn’t to say Forex Factory dictates price movements, but rather that it acts as a significant amplifier of existing market trends and sentiment.

You also can investigate more thoroughly about how to use chatbots to improve customer service and lead generation to enhance your awareness in the field of how to use chatbots to improve customer service and lead generation.

Impact of Collective Sentiment on Volatility

The correlation between collective sentiment expressed on Forex Factory and subsequent volatility in specific currency pairs is observable in numerous instances. For example, during periods of significant geopolitical uncertainty, such as the escalation of a particular international conflict, a surge in anxious posts and bearish predictions on Forex Factory’s forums often precedes increased volatility in related currency pairs.

Traders reacting to the shared anxiety contribute to the volatile market conditions, creating a self-fulfilling prophecy of sorts. The platform, in this case, acts as a magnifying glass on pre-existing anxieties, making the volatility more pronounced.

Differing Viewpoints and Market Uncertainty

The existence of diverse and sometimes contradictory viewpoints within Forex Factory’s forums contributes significantly to market uncertainty and heightened volatility. When experienced traders present conflicting technical analyses or fundamental forecasts, it creates a climate of indecision amongst less experienced participants. This indecision translates into hesitant trading activity, potentially leading to price fluctuations that are less predictable and more volatile.

For instance, a situation where some traders highlight bullish indicators for EUR/USD based on chart patterns while others point to bearish signals based on economic data releases, creates confusion and market uncertainty, contributing to increased volatility in the EUR/USD pair. This divergence of opinions fuels a range of trading strategies, further increasing volatility as traders react to conflicting signals.

The Relationship Between Forex Factory Activity and Volatility: Forex Factory’s Influence On Currency Pair Volatility

Forex Factory, a popular online platform for forex traders, significantly influences currency market volatility. Its impact stems from its dual role as a news aggregator and a vibrant online community. Analyzing the interplay between Forex Factory activity and market fluctuations reveals a complex but demonstrable correlation. This analysis will explore the relationship between website traffic, forum discussions, news announcements, and subsequent volatility spikes in major currency pairs.

Correlation Between Forex Factory Website Traffic and Volatility

To establish a correlation, we would need to gather data on Forex Factory’s daily website traffic and concurrent volatility levels for major currency pairs (e.g., EUR/USD, USD/JPY, GBP/USD). This data could be obtained through web analytics tools for Forex Factory and volatility indices from reputable financial data providers. A statistical analysis, such as calculating the correlation coefficient, could then be performed to determine the strength and direction of the relationship.

For instance, a positive correlation would suggest that higher website traffic is associated with increased volatility. A strong positive correlation would indicate that spikes in website traffic precede or coincide with significant volatility increases. This analysis would need to control for other factors influencing volatility, such as major economic news releases outside of Forex Factory.

Visual Representation of News Events and Subsequent Volatility, Forex Factory’s influence on currency pair volatility

A line graph would effectively illustrate the relationship between significant news events reported on Forex Factory and subsequent volatility. The x-axis would represent time, while the y-axis would show two lines: one representing Forex Factory’s news event frequency (perhaps a count of significant news items per day) and the other representing a volatility index (like the average true range or ATR) for a specific currency pair.

Points on the graph would highlight specific news events, with arrows connecting them to corresponding volatility spikes. For example, a sharp increase in Forex Factory’s news event frequency concerning a particular central bank’s policy announcement would be visually linked to a corresponding surge in the currency pair’s volatility on the same graph. The graph would clearly demonstrate the temporal relationship between news events and volatility changes, providing a visual confirmation of Forex Factory’s influence.

Get the entire information you require about the impact of big data on digital marketing strategies on this page.

Comparison of Forex Factory News and Economic Calendar Releases

A comparative analysis can be conducted to assess the relative impact of Forex Factory news announcements versus official economic calendar releases on currency pair volatility. This would involve comparing the magnitude and duration of volatility spikes triggered by each source. We can hypothetically compare the volatility reaction to a major economic indicator release (like Non-Farm Payrolls) announced on the official economic calendar versus a similar piece of news broken on Forex Factory slightly earlier.

If the Forex Factory news led to a significant volatility increasebefore* the official announcement, it would demonstrate the platform’s ability to pre-empt market reactions and its significant influence. This comparison would necessitate analyzing a large dataset of news events and corresponding volatility data to identify patterns and draw meaningful conclusions. A table summarizing the average volatility change and duration following each type of news event would be useful.

Impact of Timing on Volatility Magnitude and Duration

The timing of news releases or forum discussions on Forex Factory significantly influences the magnitude and duration of volatility. News released during Asian trading hours, for example, might have a smaller initial impact compared to news released during the more liquid London or New York sessions. Similarly, a rumour circulating on Forex Factory forums over several hours might build anticipation and amplify the volatility response when official confirmation eventually arrives.

Conversely, a sudden, unexpected announcement on Forex Factory might cause a sharp, short-lived spike in volatility, while a gradually unfolding news story might lead to a more sustained period of increased volatility. To illustrate this, we could present case studies of specific news events, analyzing the timing of their release on Forex Factory, the resulting volatility, and the duration of its impact.

This would demonstrate how the platform’s influence is not just about the news itself but also about when that news is disseminated.

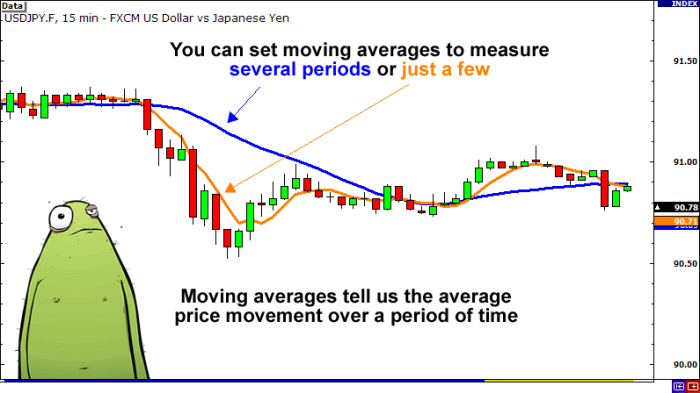

Forex Factory’s Role in Algorithmic Trading and High-Frequency Trading

Forex Factory, with its real-time data feeds and active community forums, has become a significant player in the algorithmic and high-frequency trading (HFT) landscape. Its influence stems from the readily available, albeit unstructured, information that can be parsed and used to inform trading strategies. While not a direct data provider in the same way as a dedicated market data feed, its aggregated news, economic calendar, and sentiment indicators provide valuable insights that can be leveraged by sophisticated trading algorithms.Forex Factory data is utilized by automated trading systems primarily through its readily available economic calendar and news sentiment analysis.

Algorithms can be programmed to scan Forex Factory’s calendar for upcoming economic releases and react accordingly, potentially initiating trades based on predicted market movements. Similarly, sentiment analysis techniques can be applied to forum discussions and news comments to gauge market sentiment and trigger trades based on identified shifts in bullish or bearish attitudes. The speed and volume of data processing inherent in algorithmic trading makes Forex Factory’s relatively accessible data a potentially valuable resource.

Forex Factory Data as a Trigger for Algorithmic Trading Strategies

The potential for Forex Factory data to trigger algorithmic trading strategies that contribute to market volatility is significant. A sudden surge of negative sentiment expressed on the Forex Factory forums, for instance, could be interpreted by an algorithm as a signal to sell a particular currency pair. If multiple algorithms react similarly to the same perceived signal, it can lead to a cascading effect, amplifying the initial price movement and creating increased volatility.

The speed at which these algorithms can react to information makes the impact potentially more pronounced than traditional trading methods. This highlights the importance of understanding the limitations and potential biases present within the data sourced from community forums.

High-Frequency Trading and Forex Factory Data: Impact on Liquidity and Volatility

High-frequency trading (HFT) algorithms using Forex Factory data can have a complex impact on market liquidity and volatility. On one hand, the increased participation of HFT algorithms based on Forex Factory insights can contribute to increased market liquidity, as these algorithms frequently buy and sell, providing a continuous flow of orders. However, the speed and scale at which HFT algorithms operate also increases the risk of exacerbating market volatility.

A rapid, coordinated response to information gleaned from Forex Factory could lead to sharp price swings, particularly during periods of already heightened market uncertainty. The exact effect depends on the prevalence of algorithms using this data and the sophistication of their trading strategies. A real-life example would be observing the price action of a currency pair immediately following a major economic announcement covered on Forex Factory; a sharp and quick price move could be indicative of HFT algorithms reacting to the news and sentiment expressed in the subsequent forum discussions.

Risks and Benefits of Using Forex Factory Data in Algorithmic Trading

Before outlining the risks and benefits, it’s crucial to remember that Forex Factory data is not vetted or guaranteed in the same way as professional market data feeds. This inherent uncertainty needs to be factored into any trading strategy.

- Benefits:

- Access to potentially valuable sentiment indicators and early warnings of market shifts.

- Potential for identification of trading opportunities not readily apparent through traditional analysis.

- Relatively low cost compared to professional market data feeds.

- Risks:

- Data quality and reliability can be inconsistent, leading to inaccurate trading signals.

- Potential for information bias and manipulation within the forum discussions.

- Increased risk of “herd behavior” among algorithms reacting to the same information, amplifying volatility.

- Susceptibility to false signals and “noise” within the data.

Limitations of Forex Factory’s Influence on Volatility

Forex Factory, while a significant online resource for forex traders, doesn’t hold a monopoly on information, nor does its influence on currency pair volatility operate in a vacuum. Understanding its limitations is crucial for a balanced perspective on its impact on the market. Several factors mitigate its overall effect and introduce potential biases.Forex Factory’s influence is not absolute; it’s just one piece of the puzzle in the complex world of currency trading.

Over-reliance on its data or community sentiment can lead to inaccurate assessments of market direction and volatility.

Potential Biases in Forex Factory Data and Discussions

The data presented on Forex Factory, while often useful, is susceptible to biases. For instance, the forum’s user base might skew towards certain trading styles or strategies, leading to an overrepresentation of particular viewpoints. This can create echo chambers where certain opinions are amplified disproportionately, while others are marginalized. Furthermore, the anonymity afforded to many users can encourage the spread of misinformation or unsubstantiated claims, impacting the overall quality of information available.

The lack of rigorous fact-checking mechanisms within the forum further exacerbates this issue. Consider, for example, a situation where a significant number of users express strong bullish sentiment on a particular currency pair based on a misinterpreted news article. This could temporarily inflate the perceived demand, influencing short-term price movements even if the underlying fundamentals don’t support the optimism.

External Factors Affecting Currency Pair Volatility

Numerous factors beyond Forex Factory significantly impact currency pair volatility. Geopolitical events, such as wars, political instability, or significant international agreements, often trigger substantial market swings. Central bank announcements, interest rate changes, and shifts in monetary policy also play a dominant role. Economic data releases, like employment figures, inflation rates, and GDP growth, can dramatically influence currency valuations.

These external forces often dwarf the impact of any single online forum, including Forex Factory. The 2008 global financial crisis, for instance, demonstrated the overwhelming influence of macroeconomic factors over online sentiment. The crisis triggered massive volatility across all currency pairs, irrespective of any discussion on forums like Forex Factory.

Reliability of Forex Factory Information and its Impact on Volatility

The reliability of information on Forex Factory is variable. While some users provide insightful analysis and well-researched perspectives, others might offer unsubstantiated opinions or even deliberately misleading information. The lack of editorial oversight or verification processes means that traders need to critically evaluate the information they encounter. The credibility of a particular piece of information often depends on the source’s track record, the supporting evidence, and the overall context.

Relying solely on Forex Factory data without cross-referencing with other reputable sources could lead to poor trading decisions and increased exposure to risk.

Comparison with Other Market Information Sources

Forex Factory’s impact on volatility pales in comparison to the influence of major news agencies, central bank announcements, and official economic data releases. While Forex Factory can provide a snapshot of market sentiment, its influence is largely reactive rather than proactive. Major news outlets and official announcements, on the other hand, often serve as primary drivers of market movements.

Think of the immediate price reactions to a surprise interest rate hike by the Federal Reserve – this reaction far surpasses any influence a forum like Forex Factory could exert. Other professional platforms offering real-time market data, sophisticated analytical tools, and expert commentary also significantly outweigh Forex Factory’s impact on currency volatility.

Ultimately, Forex Factory serves as a powerful microcosm of the forex market itself, reflecting both the opportunities and the risks inherent in this dynamic trading environment. While its data and community discussions can provide valuable insights, it’s crucial to remember that Forex Factory is just one piece of the puzzle. Successful forex trading requires a holistic approach, incorporating diverse information sources and a keen understanding of broader economic and geopolitical factors.

By critically evaluating the information available on Forex Factory and combining it with other market analyses, traders can make more informed decisions and navigate the volatile world of currency trading more effectively.