Forex Factory’s impact on the overall forex market sentiment is significant, acting as a powerful hub for traders worldwide. Its influence stems from its massive user base, encompassing diverse experience levels and geographic locations. This creates a unique blend of perspectives that shapes market sentiment, often preceding and influencing actual price movements. We’ll explore how this platform’s features – from its economic calendar to its lively forums – contribute to this pervasive impact.

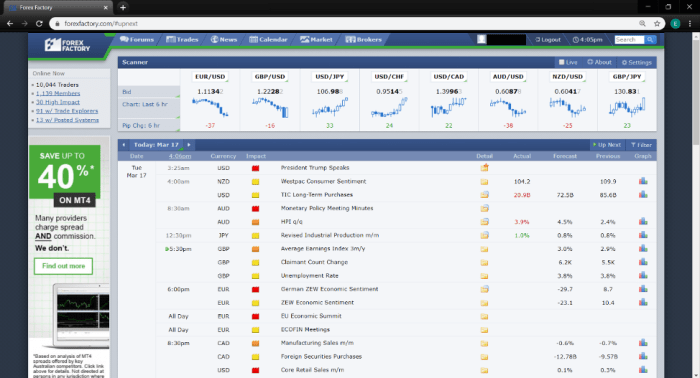

The platform’s economic calendar, for instance, plays a crucial role. The speed and accuracy of its data releases directly influence trader reactions, potentially triggering rapid market shifts. Furthermore, the platform’s forums and news sections become breeding grounds for analysis and speculation, creating a dynamic feedback loop between trader sentiment and market activity. Understanding this complex interplay is key to navigating the forex market effectively.

Forex Factory’s User Base and Influence

Forex Factory boasts a substantial and diverse user base, significantly impacting forex market sentiment. Understanding the demographics, geographic distribution, and engagement patterns of this community is crucial to grasping its overall influence. The platform’s unique blend of information and community interaction creates a powerful feedback loop, shaping how traders perceive and react to market events.

Forex Factory User Demographics and Trading Experience

The Forex Factory user base is a heterogeneous mix of individuals with varying levels of trading experience. While precise demographics aren’t publicly available, anecdotal evidence and forum observations suggest a significant portion comprises retail forex traders ranging from beginners to experienced professionals. A substantial number are likely self-directed learners, actively seeking educational resources and engaging in discussions to improve their trading skills.

Enhance your insight with the methods and methods of Forex Factory’s role in developing a successful trading plan.

The platform attracts a wide age range, but a considerable segment likely falls within the 25-50 age bracket, aligning with the typical profile of active online traders. The level of trading experience is also broad; from those just starting out, experimenting with demo accounts, to seasoned traders managing substantial portfolios. This diversity contributes to the richness of the platform’s discussions and the variety of perspectives shared.

Geographic Distribution of Forex Factory Users and its Impact on Regional Market Sentiment

Forex Factory’s user base is globally distributed, reflecting the international nature of the forex market. While the platform doesn’t explicitly publish user location data, forum activity and time stamps indicate a strong presence from North America, Europe, and Asia. This diverse geographic spread means market sentiment expressed on Forex Factory can reflect global perspectives, but certain regional biases might emerge depending on the prevailing economic conditions and news events impacting specific regions.

Obtain direct knowledge about the efficiency of how to comply with data protection regulations through case studies.

For example, during periods of significant economic news releases from the US, the platform might see a surge in discussions and sentiment shifts primarily driven by North American users. Similarly, significant events in the Eurozone could heavily influence the discussions and sentiments expressed by European users. This regional variation in user activity can influence the overall sentiment expressed on the platform and its potential impact on the broader market.

Influence of Community Features on Trader Sentiment

Forex Factory’s community features, particularly its forums and economic calendar, play a significant role in shaping trader sentiment. The forums allow users to share trading ideas, strategies, and analyses, fostering a dynamic exchange of information. This collective intelligence can amplify certain market narratives, potentially influencing traders’ decisions. The economic calendar, providing scheduled economic data releases, acts as a focal point for discussion and anticipation.

The anticipation surrounding these releases, combined with the real-time reactions and interpretations shared on the forums, can directly impact short-term market volatility and trader sentiment. For example, a widely anticipated interest rate hike might generate a considerable buzz on the forums leading up to the announcement, influencing trader positions and creating a self-fulfilling prophecy if the sentiment is widespread enough.

Comparison of Forex Factory’s User Base to Other Major Forex Trading Forums

The following table offers a comparative overview, though precise data on user numbers and demographics for many platforms isn’t publicly available. The comparison is based on observable characteristics and general reputation.

| Forum | Estimated User Base Size | Dominant User Type | Geographic Focus |

|---|---|---|---|

| Forex Factory | Large (hundreds of thousands) | Retail Traders (wide range of experience) | Global, with strong representation from North America, Europe, and Asia |

| Babypips | Large (hundreds of thousands) | Beginners to intermediate retail traders | Global, with a significant presence in North America |

| FXStreet | Large | Mix of retail and institutional traders, analysts | Global |

| Myfxbook | Large | Retail traders focused on performance tracking and social trading | Global |

Impact of Forex Factory’s Economic Calendar on Market Sentiment

Forex Factory’s economic calendar is a widely used tool among forex traders, significantly influencing market sentiment due to its accessibility, relatively comprehensive data coverage, and generally reliable timeliness. The calendar’s impact stems from its ability to provide traders with crucial information about upcoming economic data releases, allowing them to anticipate potential market movements and adjust their trading strategies accordingly.The accuracy and timeliness of Forex Factory’s economic calendar directly affect trader reactions.

Accurate and timely data allows traders to make informed decisions, potentially leading to more successful trades. Conversely, delays or inaccuracies can cause confusion and potentially lead to losses. The speed at which the information is disseminated is critical; a delay, even by a few seconds, can mean the difference between profiting from a significant market shift or missing the opportunity entirely.

Economic Data Releases and Market Movements

Several instances demonstrate how specific economic data releases, as presented on Forex Factory, have affected market movements. For example, the release of unexpectedly strong US Non-Farm Payroll numbers often leads to a surge in the US dollar, as investors react to the positive economic outlook. Conversely, weaker-than-expected data, such as a sharp decline in manufacturing PMI, can trigger a sell-off in the related currency.

The speed and magnitude of these reactions are often amplified by the widespread use of Forex Factory’s calendar, as many traders react simultaneously to the information. Consider, for instance, the reaction to the surprise interest rate hike announced by the Federal Reserve in 2022. The announcement, rapidly disseminated via Forex Factory’s calendar, triggered immediate and substantial market volatility across various currency pairs.

Potential for Manipulation and Misinformation

While Forex Factory strives for accuracy, the potential for manipulation or misinformation regarding economic data on the platform exists. This risk is inherent in any platform that relies on external data sources. There’s always a possibility of human error in data entry or unintentional delays. However, Forex Factory’s reputation largely depends on maintaining accuracy, suggesting that deliberate manipulation is unlikely.

Nonetheless, traders should always cross-reference information from multiple sources to mitigate any risks associated with relying solely on one platform. It is crucial to be aware that the information presented is a snapshot in time and may be subject to revision as more data becomes available.

Trader Utilization of the Economic Calendar

Traders employ Forex Factory’s calendar in various ways to inform their trading strategies. Many use it to identify high-impact economic events and plan their trades around them. This might involve adjusting position sizes, setting stop-loss and take-profit orders, or avoiding trading altogether during periods of heightened volatility. Others might use the calendar to filter for specific types of data releases relevant to their trading strategies, focusing, for instance, on inflation data or central bank announcements.

Some advanced traders might even incorporate the calendar data into algorithmic trading systems, automating their responses to specific economic releases. Essentially, the calendar acts as a crucial tool for market timing and risk management, helping traders to proactively adapt to changing market conditions.

Forex Factory’s Role in Disseminating Market News and Analysis

Forex Factory acts as a significant hub for the dissemination of forex market news and analysis, influencing trader sentiment and market dynamics. Its unique blend of user-generated content and readily available data sources creates a dynamic information ecosystem with both benefits and drawbacks.Forex Factory’s news and analysis come from a variety of sources, contributing to its comprehensive yet sometimes fragmented nature.

These sources include news wires (often aggregated from major providers like Reuters and Bloomberg), user-submitted posts and comments, and analysis from various independent sources and contributors. The reliability of this information varies considerably. While established news wires generally offer high reliability, user-generated content requires critical evaluation, as accuracy and bias can significantly impact trading decisions. Verifying information from multiple sources is crucial for traders relying on Forex Factory for market intelligence.

Sources of News and Analysis and Their Reliability

The reliability of news and analysis on Forex Factory is a spectrum. Reputable news agencies integrated into the platform offer high levels of accuracy and verification. However, user-generated content, including forum posts and comments, ranges from insightful analysis to speculative rumors and misinformation. Traders must actively assess the credibility of each source before acting on any information. For example, a post from a known expert in a particular currency pair might carry more weight than an anonymous comment in a general forum thread.

Critical thinking and cross-referencing with other reputable sources are essential.

Speed of Information Dissemination and Market Impact

The speed at which Forex Factory disseminates news significantly affects market liquidity and volatility. The platform’s real-time nature, coupled with its large user base, means news spreads rapidly, often before official announcements from major news outlets. This rapid dissemination can trigger immediate market reactions, increasing volatility as traders react to the information almost instantaneously. For instance, a surprise interest rate announcement reported first on Forex Factory could lead to a sharp spike in trading volume and price fluctuations as traders adjust their positions based on the news.

Conversely, the speed can also increase liquidity, as many traders are simultaneously reacting to the same information, leading to more active trading.

Comparison of Forex Factory Sentiment with Other Financial News Outlets

While Forex Factory reflects market sentiment, it’s crucial to compare its tone with that of other established financial news outlets. Forex Factory’s sentiment is often more immediate and potentially more volatile, reflecting the reactions of a broad range of traders, including retail and institutional. Major news outlets, on the other hand, tend to offer a more measured and analytical perspective, often incorporating broader economic contexts.

For example, during a major geopolitical event, Forex Factory might show a range of highly emotional responses from individual traders, whereas a major news outlet’s coverage would likely offer a more balanced overview, integrating expert opinions and historical context. Comparing perspectives from multiple sources offers a more comprehensive understanding of market sentiment.

Timeline of News Events and Market Sentiment Impact

Consider the period surrounding the unexpected announcement of the Swiss National Bank’s (SNB) decision to abandon its EUR/CHF floor in January 2015. The news broke rapidly on Forex Factory, causing immediate panic and massive volatility in the EUR/CHF pair. The speed at which this news spread on Forex Factory, before official confirmation from the SNB, contributed to the extreme price swings and significant losses experienced by many traders.

In contrast, other financial news outlets, while also reporting the news, offered more measured analyses and commentary, allowing for a more considered interpretation of the event’s impact. This highlights the speed and intensity of the reaction visible on Forex Factory compared to the more measured response from traditional media.

The Influence of Forex Factory’s Sentiment Indicators

Forex Factory’s various sentiment indicators, primarily its poll results, offer a glimpse into the collective mindset of a significant portion of the forex trading community. While not a perfect predictor of market movements, analyzing these indicators alongside other market data can provide valuable context and potentially enhance trading strategies. Understanding both the potential insights and limitations of this crowd-sourced data is crucial for any trader considering its use.Forex Factory’s sentiment indicators, such as the daily polls on currency pair direction, reflect the aggregated opinions of its users.

These polls gauge whether traders anticipate a currency pair to rise or fall. A strong consensus (e.g., a high percentage of traders expecting a rise) might suggest a potential bullish bias in the market, but this is not always the case. A simple correlation analysis could be performed comparing the poll results with the actual price movements of the currency pair over a specific period.

For instance, one might compare the percentage of traders expecting EUR/USD to rise against the actual price change of EUR/USD over the following 24 hours. A positive correlation would suggest that a higher percentage of bullish sentiment on Forex Factory tends to precede upward price movements in EUR/USD.

Correlation Between Forex Factory Sentiment and Market Movements

The correlation between Forex Factory sentiment and actual market movements is often debated. While a strong consensus might sometimes precede price movements, it’s not always a reliable predictor. Several factors contribute to this, including the self-selection bias inherent in the user base (traders who actively participate in polls might not represent the broader market), the timing of the poll relative to market events, and the fact that market sentiment is only one factor influencing price.

For example, even with a highly bullish sentiment on Forex Factory, unexpected economic news could easily outweigh the collective sentiment and cause a price drop. Further research comparing Forex Factory sentiment data with other market indicators (such as order book imbalances or technical indicators) could provide a more nuanced understanding of its predictive power.

Biases Inherent in Crowd-Sourced Sentiment Data

Crowd-sourced sentiment data, by its nature, is susceptible to several biases. The most significant is

- self-selection bias*. Forex Factory users who participate in polls are likely to be more active and engaged traders than the average forex market participant. Their opinions may not accurately reflect the broader market sentiment. Additionally,

- confirmation bias* can influence poll results, as traders might be more inclined to vote according to their pre-existing trading positions or beliefs. Finally,

- herd behavior* can amplify existing trends, leading to exaggerated sentiment readings that might not accurately reflect the underlying market dynamics. For instance, if a significant portion of the Forex Factory user base already holds long positions in EUR/USD, they might be more likely to vote bullish, regardless of their actual assessment of the market’s future direction.

Comparison with Other Market Sentiment Gauges

Forex Factory’s sentiment indicators can be compared to other market sentiment gauges, such as the Commitment of Traders (COT) reports, VIX index (for general market risk appetite), and various sentiment indices from financial news providers. While COT reports provide a broader perspective on the positioning of large speculators, Forex Factory offers a more real-time snapshot of retail trader sentiment.

The VIX, while not directly measuring forex sentiment, provides an indication of overall market volatility and risk aversion, which can indirectly impact forex trading. Other sentiment indices often rely on surveys of professional traders or algorithmic analysis of news sentiment, offering different perspectives and potential predictive capabilities. Comparing the predictive accuracy of these various indicators requires extensive backtesting and statistical analysis.

Visual Representation of Forex Factory Sentiment and Currency Pair Price Action

A chart could visually depict the relationship between Forex Factory’s daily poll results for EUR/USD and the subsequent 24-hour price movement. The x-axis would represent time, while the y-axis would have two lines: one showing the percentage of Forex Factory users expecting EUR/USD to rise, and the other showing the percentage change in EUR/USD price over the following 24 hours.

A positive correlation would be visually apparent if the “percentage expecting rise” line tends to move in the same direction as the “percentage price change” line. For instance, periods where a high percentage of users expect a rise should ideally correlate with periods of positive price changes in EUR/USD. Discrepancies between the two lines would highlight instances where Forex Factory sentiment failed to accurately predict price movements, emphasizing the limitations of relying solely on this indicator.

Forex Factory’s Impact on Different Trader Types: Forex Factory’s Impact On The Overall Forex Market Sentiment

Forex Factory’s influence isn’t uniform across the forex trading spectrum. Its impact varies significantly depending on a trader’s style, experience, and risk tolerance. Understanding these nuances is crucial for effectively leveraging the platform’s resources. Retail traders, institutional investors, scalpers, day traders, and swing traders all interact with Forex Factory in distinct ways, extracting different types of value from its offerings.Forex Factory’s influence on retail traders versus institutional investors differs primarily in scale and sophistication.

Retail Trader Influence

Retail traders often rely heavily on Forex Factory for market sentiment, news, and economic calendar data. They use the forum to discuss trading ideas, seek advice, and gauge the prevailing mood among other traders. The economic calendar helps them anticipate market movements and plan their trades accordingly. Many retail traders lack the resources for in-depth fundamental analysis, making Forex Factory’s readily available information particularly valuable.

However, this reliance can also expose them to the risk of herd behavior and emotional trading, especially if they follow opinions without critical evaluation. The platform’s accessibility can be a double-edged sword; while empowering, it also makes them vulnerable to misinformation or biased viewpoints.

Institutional Investor Influence

Institutional investors, with their dedicated research teams and advanced analytical tools, typically use Forex Factory more selectively. They might utilize the economic calendar for timing, but their primary focus is likely less on the forum’s sentiment and more on confirming their own independently derived analyses. Forex Factory’s value for institutional investors lies more in its real-time market pulse – offering a snapshot of broader sentiment that can help refine their strategies or identify potential market anomalies.

However, they’re less likely to be significantly swayed by the opinions or discussions found within the forum itself.

Forex Factory’s Impact on Different Trading Timeframes

The information shared on Forex Factory impacts different trading styles differently due to the varying time horizons involved.

Scalper Influence, Forex Factory’s impact on the overall forex market sentiment

Scalpers, who aim for small profits from quick trades, find Forex Factory’s real-time news feed and order book data particularly valuable. The rapid dissemination of news and market events is crucial for their strategy. They may also monitor sentiment shifts to anticipate short-term price fluctuations. However, the constant barrage of information can be overwhelming, and the risk of reacting to noise instead of meaningful signals is significant.

Forex Factory’s speed is a double-edged sword for scalpers.

Day Trader Influence

Day traders benefit from Forex Factory’s economic calendar and news section to identify potential trading opportunities within a single day. They might use the forum to gauge market sentiment and confirm their own analysis. The ability to track market trends throughout the day, informed by news and sentiment, is critical to their approach. However, they need to be highly disciplined to avoid getting caught up in the constant flow of information and making impulsive decisions.

Swing Trader Influence

Swing traders, who hold positions for several days or weeks, primarily use Forex Factory’s economic calendar and analysis to identify longer-term trends and potential entry/exit points. They might use the forum to gain insights into broader market sentiment, but their decisions are less driven by short-term fluctuations. The forum’s discussions on technical and fundamental analysis can provide additional perspectives, but swing traders are less reliant on real-time news than scalpers or day traders.

Examples of Forex Factory Usage by Trader Profiles

A retail trader might use the economic calendar to anticipate volatility around a major economic release, then monitor forum sentiment to gauge potential market reactions. A scalper might use the live news feed to react instantly to breaking news affecting their target currency pairs. A day trader might combine technical analysis with Forex Factory’s sentiment indicators to identify high-probability trading setups.

A swing trader might use forum discussions on a specific currency pair to confirm their own analysis before entering a longer-term position.

Advantages and Disadvantages of Forex Factory Usage by Trading Style

The following table summarizes the advantages and disadvantages of using Forex Factory for different trading styles:

| Trading Style | Advantages | Disadvantages |

|---|---|---|

| Scalping | Access to real-time news and order book data; quick sentiment gauge. | Information overload; risk of emotional trading; potential for noise to outweigh signal. |

| Day Trading | Economic calendar for planning; sentiment indicators; forum discussions for confirming analysis. | Potential for impulsive decisions; susceptibility to herd behavior; information overload. |

| Swing Trading | Economic calendar for identifying longer-term trends; forum discussions for broader market perspectives. | Less reliance on real-time information; potential for delayed reaction to market events. |

| Retail Trading (General) | Accessibility of information; community support; economic calendar. | Risk of misinformation; susceptibility to herd behavior; potential for emotional trading. |

| Institutional Investing | Real-time market pulse; confirmation of independent analysis. | Less reliance on forum sentiment; information may be less critical than proprietary data. |

Forex Factory undeniably shapes forex market sentiment, acting as a powerful aggregator of trader opinions and market information. Its influence extends beyond individual traders, impacting market liquidity and volatility. While inherent biases exist in crowd-sourced data, understanding how Forex Factory’s features – from its economic calendar to sentiment indicators – influence market dynamics is crucial for any serious forex participant.

By recognizing both the opportunities and limitations of this platform, traders can better interpret market signals and refine their trading strategies.