Forex Factory’s impact on different trading styles (e.g., swing, day, scalping) is significant. This resource offers a wealth of data—from economic calendars and news announcements to order books and sentiment indicators—that traders across various strategies can leverage. We’ll explore how these tools affect swing, day, and scalping approaches, examining both their advantages and potential limitations. Understanding how to effectively utilize Forex Factory’s features can significantly enhance your trading performance, but it’s crucial to grasp both its strengths and weaknesses.

This guide will break down how Forex Factory’s tools are used in each trading style, showing you how to interpret the data, manage risk, and ultimately improve your trading outcomes. We’ll cover everything from analyzing economic calendars for swing trading to using the order book for scalping, and we’ll even discuss potential biases and alternative data sources. By the end, you’ll have a solid understanding of how to integrate Forex Factory into your trading strategy, regardless of your preferred timeframe.

Data Analysis and Interpretation on Forex Factory

Forex Factory is a treasure trove of information for forex traders of all stripes. Its economic calendar, technical indicators, and active forum provide a rich dataset for analyzing market movements and forming trading strategies. Effectively utilizing this data requires understanding how different elements impact various trading styles.

Forex Factory offers a wealth of data that, when properly interpreted, can significantly enhance your trading performance. This section will explore how to leverage the platform’s economic calendar, technical indicators, and forum discussions to inform your trading decisions across different timeframes.

Economic Calendar Impact on Currency Pairs

The Forex Factory economic calendar provides a schedule of upcoming economic events and their potential impact on currency pairs. Understanding this impact is crucial for making informed trading decisions. Below is a sample table illustrating the potential effects. Note that actual market reactions can vary.

| Date | Event | Impact (Example) | Trading Style Relevance |

|---|---|---|---|

| 2024-10-27 | US GDP | Stronger-than-expected GDP could strengthen USD, weakening EUR/USD and GBP/USD. JPY might strengthen slightly due to safe-haven demand if the data is unexpectedly weak. | Relevant for all styles; swing traders might adjust positions based on longer-term implications, while scalpers might look for short-term volatility around the release. |

| 2024-10-28 | Japanese CPI | Higher-than-expected inflation could strengthen JPY against USD, leading to a decline in USD/JPY. EUR/USD and GBP/USD might be indirectly affected depending on market sentiment. | Day traders and scalpers might exploit short-term price movements; swing traders would observe the trend’s persistence. |

| 2024-10-29 | BoE Interest Rate Decision | An unexpected interest rate hike could boost GBP, leading to increases in GBP/USD and GBP/JPY, while potentially weakening EUR/USD. | All trading styles benefit from understanding this data; swing traders may see longer-term shifts, day traders intraday volatility, and scalpers immediate price changes. |

Comparative Analysis of Technical Indicators

Forex Factory displays various technical indicators. Their suitability depends heavily on the chosen trading strategy.

- Moving Averages (MA): Useful for all trading styles. Swing traders use longer-term MAs (e.g., 200-day MA) to identify trends, while day traders and scalpers might use shorter-term MAs (e.g., 5-period, 20-period MA) to identify entry and exit points.

- Relative Strength Index (RSI): Useful for identifying overbought and oversold conditions. Scalpers can use short-term RSI divergences to spot potential reversals, while swing traders may use longer-term RSI levels to confirm trend changes.

- MACD (Moving Average Convergence Divergence): Useful for identifying momentum changes. Day traders and scalpers can use MACD crossovers for short-term trading signals, while swing traders can use MACD to confirm trend changes and potential breakouts.

- Bollinger Bands: Useful for identifying volatility and potential reversals. Scalpers might use band squeezes to anticipate breakouts, while swing traders might use band breakouts to confirm trend direction.

Utilizing Forum Discussions to Gauge Market Sentiment

Forex Factory’s forums offer a valuable source of market sentiment. Analyzing discussions can provide insights into trader expectations and potential market direction.

For example, a high volume of posts expressing bullish sentiment on a particular currency pair could indicate a potential upward price movement. Conversely, a preponderance of bearish sentiment might suggest a downward trend. However, it’s crucial to remember that forum sentiment is not a foolproof predictor and should be considered alongside other forms of analysis. Swing traders might find longer-term sentiment trends more useful, while day traders and scalpers may focus on short-term shifts in sentiment reflected in immediate forum activity.

Risk Management and Forex Factory: Forex Factory’s Impact On Different Trading Styles (e.g., Swing, Day, Scalping)

Forex Factory is a treasure trove of information for traders of all stripes, but its real value shines when integrated into a robust risk management plan. Understanding how to leverage its data effectively can significantly improve your trading outcomes, regardless of your preferred style – swing, day, or scalping. This section explores how Forex Factory’s tools can be used to build a strong risk management framework across different trading approaches.

Risk Management Plan for Swing Traders Using Forex Factory Data

Swing trading, by its nature, involves holding positions for several days or even weeks. Therefore, a well-defined risk management plan is crucial to weather potential market fluctuations. Forex Factory contributes significantly to this process. By combining fundamental and technical analysis gleaned from Forex Factory, swing traders can establish more informed entry and exit strategies, reducing overall risk.

A key aspect is utilizing Forex Factory’s economic calendar. Identifying high-impact news events allows swing traders to adjust their positions accordingly, avoiding potential whipsaws or significant losses during periods of heightened volatility. For example, if a major central bank is expected to announce an interest rate decision, a swing trader might choose to close their position before the announcement or reduce their position size to limit potential losses.

They can also use the calendar to identify periods of potentially lower volatility, increasing their chances of successful trades.

Find out further about the benefits of how to use video marketing to engage your audience that can provide significant benefits.

Furthermore, Forex Factory’s forums offer insights into market sentiment, allowing swing traders to gauge potential support and resistance levels. Analyzing these discussions, combined with technical indicators derived from chart analysis available elsewhere, can help swing traders determine appropriate stop-loss levels and take-profit targets. This layered approach helps define a clear risk-reward ratio before entering a trade.

Managing Risk in Day Trading with Forex Factory Data

Day trading demands quick decision-making and precise risk management. Forex Factory’s real-time data streams, including news headlines and order book information (where available), are invaluable in this context.

The ability to monitor news events in real-time is paramount. Forex Factory provides immediate updates, enabling day traders to react swiftly to market-moving events. For example, an unexpected economic report could trigger a sharp price movement. A day trader monitoring Forex Factory could quickly close a losing position or adjust their stop-loss orders to limit potential losses before the situation worsens.

Similarly, positive news might signal an opportunity to adjust a position to increase profits.

Forex Factory’s discussion forums can provide insights into the immediate market sentiment, which is especially valuable for day trading. Reading the discussions can provide context to price movements and alert the trader to potential shifts in momentum. This allows for quick adjustments to trading strategies and the mitigation of unexpected losses.

Risk Mitigation Strategies for Scalpers Using Forex Factory Tools

Scalping requires exceptionally tight risk management, as even small price movements can significantly impact profitability. Forex Factory’s tools can be particularly helpful here.

Forex Factory’s order book information (where available) can provide insights into the immediate liquidity in the market, enabling scalpers to identify potential entry and exit points with greater precision. This allows for tighter stop-loss orders and increases the probability of smaller, more frequent profits. By understanding the order flow, scalpers can better anticipate market reactions to news and reduce their risk of getting trapped in unfavorable positions.

Further details about how to use local SEO to attract local customers is accessible to provide you additional insights.

Forex Factory’s news calendar allows scalpers to avoid periods of high volatility, focusing instead on quieter times when the market is less susceptible to unexpected price swings. This targeted approach reduces the likelihood of significant losses due to unpredictable events. Scalpers can also use the forum discussions to identify potential short-term trends and patterns, helping them to fine-tune their entry and exit strategies.

Enhancing Profitability Across Trading Styles with Forex Factory Data and Risk Management

Combining Forex Factory’s data with sound risk management principles significantly enhances profitability across all trading styles. By utilizing the platform’s resources for market analysis, news monitoring, and sentiment gauging, traders can make more informed decisions, optimize their entry and exit strategies, and ultimately reduce losses while increasing the probability of successful trades. This approach is not a guarantee of profits, but it provides a solid foundation for consistent and sustainable trading.

The key lies in disciplined adherence to a pre-defined risk management plan tailored to the specific trading style and leveraging Forex Factory’s tools to gain a comprehensive understanding of the market environment.

Forex Factory’s Limitations and Alternatives

Forex Factory is a valuable resource for many forex traders, offering a wealth of information and tools. However, it’s crucial to understand its limitations and consider alternative resources to gain a more comprehensive market perspective and avoid potential biases. Relying solely on Forex Factory can be risky, especially for specific trading styles.Potential Biases and Inaccuracies in Forex Factory Data and Their Impact on Trading StylesForex Factory, like any data aggregator, is susceptible to biases and inaccuracies.

The economic calendar, for example, relies on announcements from various sources, which may contain slight variations or even errors. These discrepancies, though sometimes minor, can significantly impact scalpers who rely on immediate reactions to news events. Similarly, the forum’s sentiment, while offering valuable insights, can be influenced by herd mentality or the opinions of a vocal minority, potentially leading to inaccurate market predictions for swing traders relying on sentiment analysis.

Day traders, depending heavily on real-time data, may face challenges if Forex Factory experiences technical glitches or delays in updating information.

Alternative Resources for Forex Traders

Traders should diversify their data sources to mitigate the risks associated with relying on a single platform. Supplementing Forex Factory with other tools provides a more robust trading strategy.

- Broker Platforms: Most brokers provide charting tools, economic calendars, and market analysis, often with superior speed and reliability compared to third-party websites like Forex Factory.

- Dedicated Economic Data Providers: Services like Bloomberg Terminal or Refinitiv Eikon offer in-depth economic data, including forecasts and historical analysis, crucial for fundamental analysis-based strategies.

- Social Sentiment Analysis Tools: Tools specifically designed to analyze social media sentiment towards currencies can provide a different perspective compared to Forex Factory’s forum.

- Technical Analysis Software: TradingView, for instance, offers advanced charting tools and technical indicators, allowing traders to perform detailed technical analysis beyond what Forex Factory provides.

Comparison of Forex Factory with Other Market Data Providers, Forex Factory’s impact on different trading styles (e.g., swing, day, scalping)

Choosing the right data provider depends on individual trading needs and styles.

- Forex Factory: Strengths: Free access to a wide range of data, including economic calendars, news, and a trader forum. Weaknesses: Potential for inaccuracies and biases in data, reliance on user-generated content, and occasional technical issues.

- Bloomberg Terminal/Refinitiv Eikon: Strengths: High accuracy, real-time data, advanced analytics. Weaknesses: Expensive subscription fees, complex interface.

- TradingView: Strengths: Powerful charting tools, large community, integration with various brokers. Weaknesses: Some advanced features require paid subscriptions.

Scenarios Where Forex Factory Data May Be Insufficient or Misleading

Several trading scenarios highlight Forex Factory’s limitations.

- High-Frequency Trading (HFT): The latency in Forex Factory’s data updates is unacceptable for HFT strategies requiring microsecond-level precision. The platform simply cannot provide the speed needed for these sophisticated algorithms.

- News-Based Trading: While Forex Factory provides an economic calendar, it may lack the depth and speed of dedicated news services, leading to delayed reactions to significant market-moving events, especially crucial for scalpers and day traders.

- Algorithmic Trading: Complex algorithms require highly reliable and structured data, which may not always be the case with Forex Factory. Inconsistent data quality could lead to flawed trading signals and ultimately, losses.

Visual Representation of Forex Factory’s Impact

Visualizing the relationship between Forex Factory data and trading outcomes helps traders understand how this platform can inform their strategies. Different chart types can highlight the impact on various trading styles, from swing trading’s longer-term perspectives to the rapid-fire decisions of scalpers.

Forex Factory News Releases and Swing Trading Price Movements

Imagine a chart showing the EUR/USD exchange rate over a period of several weeks. Superimposed on this price chart are vertical lines indicating the release times of significant economic news announcements from Forex Factory, such as Non-Farm Payrolls or Eurozone CPI data. We’d expect to see noticeable price spikes or dips immediately following these news releases. For swing traders, this visualization would illustrate how significant news events, as reported on Forex Factory, can create opportunities to enter long or short positions, capitalizing on the price volatility generated by the market’s reaction to the news.

For example, a positive surprise in the Non-Farm Payroll report might trigger a sharp upward movement in the EUR/USD, allowing swing traders who anticipated this positive reaction to profit from a long position held over several days. Conversely, a negative surprise could offer a shorting opportunity. The chart’s visual representation would clearly demonstrate the timing of these opportunities relative to the news releases.

The magnitude of the price movement after each news event would also highlight the potential profitability of anticipating market reactions.

Forex Factory Sentiment and Trading Volume Across Timeframes

A second chart could display the relationship between Forex Factory’s sentiment indicators (e.g., bullish/bearish percentage) and trading volume for the GBP/USD pair across different timeframes (e.g., 1-hour, 4-hour, daily). This graph would use two Y-axes: one for sentiment (ranging from 0% to 100% bullish), and the other for trading volume (measured in number of lots traded). The X-axis represents time.

We might observe that periods of high bullish sentiment on Forex Factory often correlate with increased trading volume, particularly in shorter timeframes (e.g., 1-hour). Day traders could use this visualization to identify periods of high market activity fueled by strong directional sentiment. For example, a surge in bullish sentiment accompanied by a spike in volume on a 1-hour chart might signal a strong upward trend, presenting a day trading opportunity.

Conversely, periods of low volume despite strong sentiment could indicate a lack of conviction and potential for price reversals, cautioning day traders against entering positions. The visual correlation between sentiment and volume across various timeframes would help day traders assess the strength and potential longevity of market movements.

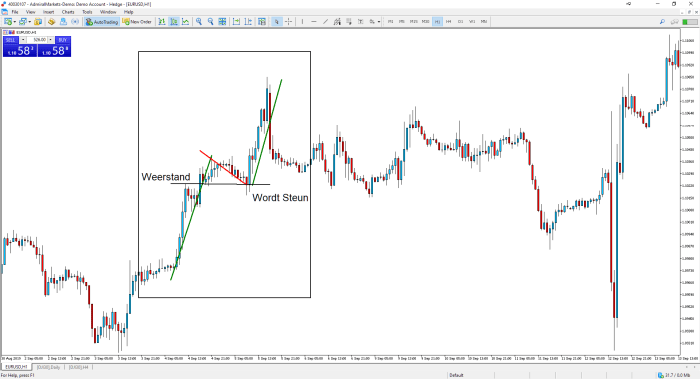

Forex Factory Order Book Data and Scalping Opportunities

A third visualization would focus on the impact of Forex Factory’s order book data on scalping opportunities. This chart would show a highly magnified view of the price action for a very short period, perhaps 5-10 minutes, for a currency pair like USD/JPY. Superimposed on the price chart would be data points representing the order book depth at various price levels, as might be gleaned from Forex Factory’s aggregated data (note: direct order book access is not typically available through Forex Factory).

Areas of high order book density (a large number of buy or sell orders clustered at a specific price) would be highlighted. Scalpers could use this visualization to identify potential support and resistance levels. For example, a large cluster of buy orders just below the current market price could indicate strong support, suggesting a potential short-term bounce. A scalper might then enter a long position, expecting the price to rebound off this support level.

The visual representation of the order book data, combined with the price chart, would allow scalpers to identify potential entry and exit points with higher accuracy and potentially improve their profitability by capitalizing on small price fluctuations. The chart would illustrate how the proximity of these order book clusters to the current market price can directly influence the likelihood and profitability of a scalping trade.

Mastering Forex Factory means understanding its multifaceted impact on different trading styles. While its economic calendar, news announcements, and order book provide invaluable insights for swing, day, and scalping traders, critical analysis and awareness of potential biases are key. Remember, no single tool guarantees success; combining Forex Factory’s data with robust risk management and a thorough understanding of market dynamics is crucial for maximizing profitability and mitigating losses.

By thoughtfully integrating this resource into your trading strategy, you can gain a significant edge in the forex market.