Forex Factory’s contribution to improving trading discipline is significant. This platform offers a wealth of resources – from its comprehensive economic calendar and insightful news analysis to its vibrant community forums and powerful charting tools – all designed to help traders cultivate better habits and make more informed decisions. We’ll explore how Forex Factory’s educational materials, supportive community, and practical tools work together to foster disciplined and ultimately, more successful trading practices.

This exploration will delve into the specific ways Forex Factory helps traders develop and stick to trading plans, manage risk effectively, and avoid impulsive, emotionally driven trades. We’ll examine the platform’s features and how they translate into tangible improvements in trading discipline, ultimately leading to better risk management and increased profitability.

Forex Factory’s Educational Resources and Their Impact on Trader Discipline

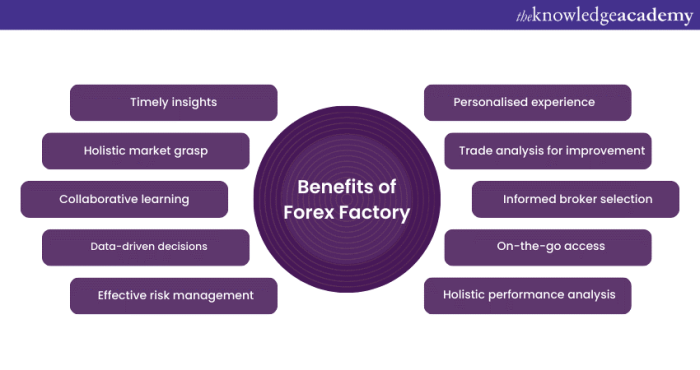

Forex Factory offers a wealth of resources that significantly contribute to a trader’s development of sound trading discipline. By providing tools and information that foster informed decision-making and structured trading approaches, Forex Factory empowers traders to move beyond impulsive actions and build sustainable strategies. This, in turn, can lead to improved risk management and ultimately, more consistent profitability.

Forex Factory’s Economic Calendar and News Impact on Trading Decisions

The economic calendar and news sections on Forex Factory are invaluable for disciplined traders. The calendar provides a clear schedule of upcoming economic announcements, allowing traders to anticipate potential market volatility. This proactive approach is crucial for risk management, enabling traders to adjust their positions or avoid entering trades during periods of heightened uncertainty. The detailed news section offers comprehensive analysis and commentary on these events, helping traders interpret their impact on currency pairs and make more informed trading choices.

This avoids reactive, emotional trading based on incomplete information. For example, a surprise interest rate hike announced on the calendar might lead a disciplined trader to close existing long positions on a specific currency, preventing potential losses.

Forum Discussions and the Development of Disciplined Trading Strategies

Forex Factory’s forums are a vibrant hub of trader interaction. The discussions within these forums often center around developing and refining trading strategies, with a strong emphasis on disciplined approaches. Traders share their experiences, successes, and failures, providing valuable insights and lessons learned. The collective wisdom within the forums helps traders avoid common pitfalls and develop robust strategies that emphasize patience, risk management, and consistent execution over chasing quick profits.

This peer-to-peer learning fosters a supportive environment where discipline is valued and rewarded. For example, discussions on money management techniques or backtesting strategies promote a methodical and disciplined approach to trading.

Educational Articles and Tutorials Promoting Structured Forex Trading

Forex Factory offers a substantial collection of educational articles and tutorials covering various aspects of forex trading. These resources provide a structured learning path, guiding traders through fundamental concepts, technical analysis, and risk management strategies. The articles often focus on developing a disciplined trading plan, emphasizing the importance of factors such as position sizing, stop-loss orders, and consistent execution.

This structured approach helps traders establish a solid foundation and avoid the emotional pitfalls that often lead to undisciplined trading decisions. For instance, tutorials on proper use of indicators and chart patterns promote a data-driven approach rather than relying on gut feeling.

Comparison of Forex Factory’s Educational Resources with Other Platforms

The following table compares Forex Factory’s educational resources with those offered by other popular forex trading platforms. The effectiveness rating is subjective and based on general user feedback and observed impact on trader discipline.

| Platform | Resource Type | Discipline Focus | Effectiveness Rating |

|---|---|---|---|

| Forex Factory | Economic Calendar, News, Forum, Articles, Tutorials | Risk Management, Strategy Development, Consistent Execution | ⭐⭐⭐⭐⭐ |

| TradingView | Charting Tools, Educational Videos, Articles | Technical Analysis, Strategy Backtesting | ⭐⭐⭐⭐ |

| Babypips | Beginner Tutorials, Articles, Glossary | Fundamental Analysis, Risk Management Basics | ⭐⭐⭐⭐️ |

| Myfxbook | Performance Tracking, AutoTrading, Community Forum | Accountability, Strategy Evaluation | ⭐⭐⭐⭐️ |

Forex Factory’s Community and its Role in Fostering Disciplined Trading Habits

Forex Factory’s vibrant community plays a crucial role in shaping disciplined trading habits among its members. The platform’s open forum structure facilitates peer-to-peer learning, fostering an environment where traders of all experience levels can share knowledge, strategies, and experiences, ultimately contributing to improved trading practices. This collaborative environment encourages self-reflection and accountability, essential components of successful and disciplined trading.The peer-to-peer learning environment on Forex Factory cultivates responsible trading practices through a constant exchange of ideas and experiences.

Traders learn from both successes and failures, understanding that consistent profitability requires a structured approach and adherence to a well-defined trading plan. This shared learning experience minimizes the risk of costly mistakes by allowing newcomers to learn from the experiences of others.

Mentorship and Guidance within the Forex Factory Community

Experienced traders on Forex Factory frequently mentor newcomers, offering valuable insights and guidance. This mentorship often involves sharing trading strategies, risk management techniques, and psychological approaches to trading. For instance, seasoned traders might guide beginners on the importance of maintaining a trading journal, demonstrating how consistent record-keeping helps identify patterns, refine strategies, and improve overall discipline. The emphasis on disciplined trading is consistently reinforced through these interactions, promoting a culture of responsible trading practices.

Mentors often provide examples of their own trading logs, highlighting successful trades as well as those that resulted in losses, thereby emphasizing the importance of learning from both wins and losses. This transparency fosters trust and facilitates a more effective learning environment.

Self-Reflection and Accountability through Community Interaction

Forex Factory’s community fosters self-reflection and accountability through several mechanisms. The platform’s open forums allow traders to share their trading experiences, both positive and negative, promoting self-assessment and encouraging the identification of areas for improvement. Publicly discussing trading decisions, even those that resulted in losses, creates a sense of accountability and encourages traders to critically analyze their approach.

The feedback received from other community members can be invaluable in identifying flaws in trading strategies or risk management practices. Moreover, the community acts as a sounding board, allowing traders to test their ideas and receive constructive criticism before implementing them in live trading environments.

Remember to click how to stay updated on the latest digital marketing trends to understand more comprehensive aspects of the how to stay updated on the latest digital marketing trends topic.

Specific Community Practices Promoting Disciplined Trading

The importance of consistent application of various trading tools and methodologies cannot be overstated. Forex Factory’s community actively promotes several key practices that support disciplined trading.

Understand how the union of managing client relationships effectively in a digital marketing agency can improve efficiency and productivity.

- Trading Journals: Many Forex Factory members actively maintain and share excerpts from their trading journals. These journals serve as a record of trades, providing valuable insights into performance and areas needing improvement. Analyzing past trades helps identify recurring mistakes and develop more effective strategies.

- Detailed Trading Plans: The community emphasizes the creation and adherence to comprehensive trading plans. These plans Artikel entry and exit strategies, risk management parameters, and psychological considerations. The discussion and refinement of these plans within the community contribute to a more robust and disciplined trading approach.

- Risk Management Techniques: Forex Factory members frequently discuss various risk management techniques, such as position sizing, stop-loss orders, and diversification. The community shares experiences and strategies for implementing effective risk management, minimizing potential losses and promoting responsible trading.

The Influence of Forex Factory’s Tools on Improving Trading Discipline: Forex Factory’s Contribution To Improving Trading Discipline

Forex Factory offers a suite of tools designed to bolster trading discipline, moving beyond simple community interaction to provide practical aids for executing and refining trading strategies. These tools help traders stay focused on their plans, minimizing impulsive decisions driven by fear or greed. By providing data-driven insights and organizational features, Forex Factory empowers traders to build and maintain a consistent, disciplined approach to the market.

The platform’s effectiveness stems from its ability to centralize crucial information and analytical tools, reducing the need to jump between multiple resources. This streamlined workflow helps maintain focus and prevents distractions that can lead to rash trading decisions. This integrated approach contrasts sharply with the fragmented experience of using disparate tools and resources, where crucial data might be missed or misinterpreted.

Forex Factory’s Charting Tools and Their Impact on Disciplined Trading

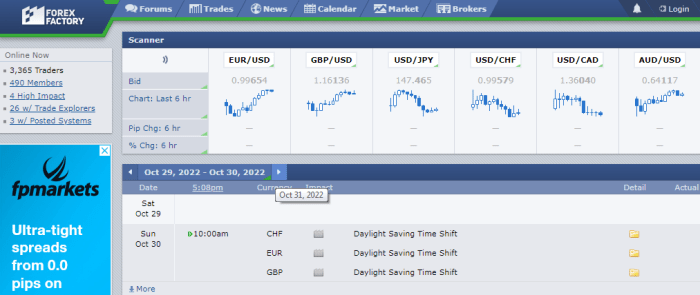

Forex Factory’s charting tools, while seemingly basic, play a crucial role in disciplined trading. The ability to customize charts with various indicators, timeframes, and drawing tools allows traders to visually represent and monitor their trading strategies. For example, a trader using a moving average crossover strategy can easily plot the relevant moving averages on the chart, providing clear visual signals for entry and exit points.

This visual representation reduces ambiguity and emotional interference in decision-making, allowing the trader to stick to their pre-defined rules. The ability to save and recall chart setups also promotes consistency, ensuring the trader maintains a uniform approach across different trading sessions. This contrasts with less organized charting solutions that might lack customization options or the ability to save and recall specific setups, leading to inconsistencies in analysis and execution.

The Role of Forex Factory’s Economic Calendar in Disciplined Trading

The economic calendar is another invaluable tool. It provides a centralized source for upcoming economic news releases that can significantly impact currency markets. By anticipating these events, disciplined traders can adjust their trading plans accordingly, avoiding potential surprises. For example, a trader might choose to avoid taking new positions before a high-impact news release, or they might adjust their stop-loss levels to account for increased volatility.

This proactive approach contrasts with traders who ignore economic news, leaving themselves vulnerable to unexpected market swings driven by emotional reactions to unforeseen events. The calendar’s clarity and organization reduce the risk of overlooking critical information that could derail a carefully planned trade.

Sentiment Analysis Tools and Their Contribution to Disciplined Trading

Forex Factory offers various sentiment indicators, reflecting the collective market mood. While not a predictive tool, sentiment analysis helps traders assess prevailing market conditions. A trader might observe overwhelmingly bullish sentiment, suggesting potential overbought conditions and a heightened risk of a price reversal. This information, while not a definitive signal, can encourage a more cautious approach, prompting a trader to delay entry or adjust position sizing.

This contrasts with ignoring overall market sentiment, which can lead to taking overly aggressive positions during periods of extreme bullishness or bearishness. By incorporating sentiment analysis, traders can make more informed decisions, aligning their trading plans with the broader market context and reducing the risk of impulsive trades based solely on individual technical analysis.

Hypothetical Trading Scenario Illustrating the Use of Forex Factory’s Tools

Imagine a trader using a breakout strategy on the EUR/USD pair. Using Forex Factory’s charts, they identify a key resistance level and set a pending order to enter a long position once the price breaks above it. They consult the economic calendar to ensure no major news releases are scheduled that could impact the trade. Finally, they check the sentiment indicators to gauge overall market mood towards the EUR/USD.

If sentiment is overwhelmingly bearish despite the technical setup, the trader might reconsider their entry, choosing to wait for a more favorable confluence of factors or reduce position size. This careful consideration, facilitated by Forex Factory’s tools, helps the trader avoid impulsive entries based solely on a single technical indicator and instead makes a more informed and disciplined decision, minimizing risk and increasing the likelihood of successful trade execution.

Forex Factory’s Contribution to Risk Management and its Connection to Trading Discipline

Forex Factory significantly aids traders in developing robust risk management strategies, a cornerstone of disciplined trading. Its diverse resources, from educational articles to community discussions, empower traders to understand and apply vital risk management principles, ultimately leading to more consistent and sustainable trading performance. This isn’t just about theoretical knowledge; it’s about practical application and the development of a mindset that prioritizes capital preservation.Forex Factory’s resources help traders develop and implement effective risk management strategies by providing readily accessible information on crucial concepts.

The platform offers numerous articles and forum threads dedicated to position sizing, stop-loss orders, and risk-reward ratios. These resources explain these concepts clearly, often with practical examples and real-world scenarios, making them easily digestible for traders of all experience levels. Furthermore, the active community allows for peer-to-peer learning and the sharing of effective strategies, fostering a collaborative environment for continuous improvement in risk management practices.

Position Sizing and Stop-Loss Order Implementation

Understanding and implementing position sizing and stop-loss orders are paramount to effective risk management. Forex Factory’s educational materials provide detailed explanations of different position sizing techniques, such as percentage-based risk and fixed-lot sizing. The platform also highlights the importance of setting appropriate stop-loss orders, emphasizing the need to protect capital from significant losses. Through forums and discussions, traders can learn from others’ experiences, sharing strategies and refining their approaches to determining optimal position sizes and stop-loss levels based on their individual risk tolerance and trading style.

Many experienced traders share their methods and backtest results, providing tangible examples for newcomers to learn from.

The Relationship Between Risk Management and Trading Discipline, Forex Factory’s contribution to improving trading discipline

Proper risk management is intrinsically linked to improved trading discipline. For example, a trader who consistently uses stop-loss orders demonstrates discipline by adhering to a pre-defined risk level, preventing emotional decisions from derailing their trading plan. Conversely, a trader who ignores stop-losses or over-leverages their account often succumbs to emotional trading, leading to impulsive decisions and potentially significant losses.

Forex Factory’s emphasis on risk management, therefore, indirectly fosters trading discipline by promoting a methodical and calculated approach to trading. The platform’s resources encourage traders to create and stick to a trading plan, thereby reducing the impact of emotions on trading decisions.

Visual Representation of Disciplined Risk Management’s Impact

Imagine a graph charting trading account equity over time. One line represents a trader with poor risk management – erratic ups and downs, sharp drops due to uncontrolled losses, and slow, inconsistent growth. The other line depicts a trader employing disciplined risk management. This line shows steadier growth, with smaller drawdowns after losses, and a more consistent upward trend.

The disciplined trader’s line might not always be the highest, but it exhibits greater resilience and less volatility. This visual comparison clearly illustrates how consistent risk management minimizes potential losses and contributes to long-term profitability, even if individual trades may not always be winners. The disciplined trader’s line represents consistent progress, while the undisciplined trader’s line shows the potentially devastating impact of ignoring risk management principles.

The difference highlights the long-term benefits of disciplined risk management.

Ultimately, Forex Factory’s impact on trading discipline boils down to its holistic approach. It’s not just about providing information; it’s about fostering a community that supports learning, accountability, and continuous improvement. By combining educational resources, interactive forums, and practical tools, Forex Factory empowers traders to develop the discipline necessary for long-term success in the forex market. The platform’s commitment to providing a comprehensive and supportive environment makes it a valuable asset for traders of all experience levels striving for greater control and consistency in their trading strategies.