Forex Factory calendar and its impact on trading strategies are crucial for forex traders. This calendar provides a comprehensive overview of upcoming economic events, allowing traders to anticipate market movements and adjust their strategies accordingly. Understanding how high-impact, medium-impact, and low-impact events influence currency pairs is key to successful trading. We’ll explore how to use this calendar for both anticipating volatility and managing risk, ultimately helping you refine your trading approach.

We’ll delve into specific strategies for navigating high-impact news releases, examining both long and short position approaches. We’ll also show how to incorporate even seemingly minor events into your overall trading plan. Beyond just reacting to events, we’ll cover how visualizing calendar data and comparing it to other economic calendars can improve your decision-making process. Finally, we’ll touch upon the use of the Forex Factory calendar in algorithmic trading and analyze real-world case studies to highlight both successes and pitfalls.

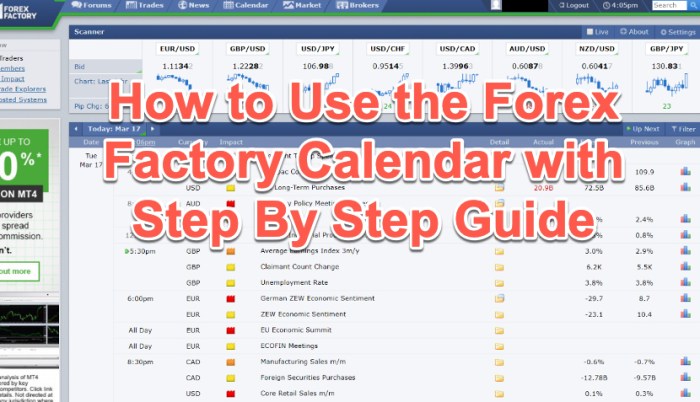

Introduction to Forex Factory Calendar

The Forex Factory calendar is a free, online resource that provides a comprehensive schedule of upcoming economic events and news releases that are likely to impact the foreign exchange (forex) market. It’s an indispensable tool for forex traders of all levels, helping them anticipate market volatility and make more informed trading decisions. Essentially, it acts as a central hub for tracking significant economic data releases, allowing traders to prepare for potential market shifts.The Forex Factory calendar lists a wide variety of economic events, each with the potential to influence currency values.

These events generally fall into several categories. Understanding these categories is key to effectively using the calendar.

Types of Economic Events

The Forex Factory calendar covers a broad spectrum of economic indicators and news releases. These range from high-impact events like interest rate decisions and employment figures to lower-impact events such as manufacturing indices and consumer confidence reports. High-impact events are generally those that have a significant and immediate effect on currency pairs. For example, a surprise interest rate hike by a central bank will usually trigger a rapid and substantial move in the related currency.

Lower-impact events, while less dramatic, can still contribute to overall market sentiment and influence price movements, particularly when viewed in context with other events. The calendar’s categorization helps traders prioritize which events warrant the closest attention. Examples of event types include:

- Central Bank Interest Rate Decisions: These announcements from central banks (like the Federal Reserve in the US or the European Central Bank) regarding interest rate changes are often highly anticipated and can cause significant market volatility.

- Gross Domestic Product (GDP) Reports: GDP reports provide a measure of a country’s economic output and are considered key indicators of economic health.

- Employment Data (e.g., Non-Farm Payrolls): Employment figures, such as the US Non-Farm Payrolls report, show changes in the number of jobs created or lost and often have a substantial impact on currency values.

- Inflation Data (e.g., Consumer Price Index – CPI): Inflation data, such as the CPI, measures the rate of price increases in an economy. High inflation can weaken a currency.

- Manufacturing and Purchasing Manager’s Indices (PMI): PMIs are forward-looking indicators of manufacturing and business activity. They offer insights into future economic growth.

Calendar Data Fields, Forex Factory calendar and its impact on trading strategies

Each event listed on the Forex Factory calendar provides crucial information to help traders assess its potential impact. Key data fields include:

- Time: The precise date and time the event is scheduled to be released. This is critical for traders to plan their trading activity accordingly.

- Currency: The currency or currencies most directly affected by the event. For example, a US interest rate decision would primarily impact the USD (US Dollar).

- Impact: A rating (often represented by a system of stars or similar) indicating the anticipated market impact of the event. High-impact events are generally those with a greater potential to cause significant price swings.

- Actual/Forecast/Previous: These fields show the actual value of the released data, the market forecast (prior expectation) and the previous reading. Comparing these values allows traders to assess whether the outcome was better or worse than expected and gauge potential market reactions.

- Event: A brief description of the economic event.

Impact on Trading Strategies: Forex Factory Calendar And Its Impact On Trading Strategies

The Forex Factory calendar, with its comprehensive listing of economic events, is an invaluable tool for forex traders. Understanding its impact, particularly regarding high-impact events, is crucial for developing effective trading strategies and managing risk. Proper utilization allows traders to anticipate market movements and adjust their positions accordingly, potentially maximizing profits and minimizing losses.High-impact events significantly influence currency pairs by affecting market sentiment and causing substantial price volatility.

These events, often announcements of key economic indicators like Non-Farm Payrolls (NFP) or interest rate decisions, can lead to sharp and sudden price swings. Traders use the calendar to identify these events, assess their potential impact, and prepare their trading strategies in advance.

High-Impact Events and Volatility

The Forex Factory calendar categorizes events by their perceived impact, usually using a system of low, medium, and high impact. High-impact events are those expected to cause the most significant market reactions. Anticipating this volatility is key. Traders often adjust their position sizes before a high-impact announcement, reducing risk by either closing positions entirely or using tighter stop-loss orders to limit potential losses.

Conversely, they may also increase their position sizes if they believe the event will move the market in their favor. The time immediately surrounding the announcement is often characterized by heightened volatility, creating opportunities for both profitable trades and significant losses. Successful traders carefully analyze the potential outcomes of the event and adjust their strategies accordingly.

Trading Strategies Around High-Impact News

Several trading strategies are specifically designed to capitalize on the volatility surrounding high-impact news releases. These strategies typically involve anticipating market reactions and placing trades based on the expected price movement.

| Strategy | Long Position (Expecting Price Increase) | Short Position (Expecting Price Decrease) | Risk Management |

|---|---|---|---|

| News Trading | Buy before the announcement, anticipating a positive reaction. Place a stop-loss order below the entry price. | Sell before the announcement, anticipating a negative reaction. Place a stop-loss order above the entry price. | Tight stop-losses are crucial due to high volatility. |

| Scalping | Quickly buy and sell within seconds or minutes of the announcement, aiming to profit from small price fluctuations. | Quickly sell and buy within seconds or minutes of the announcement, aiming to profit from small price fluctuations. | Very tight stop-losses are essential; high frequency of trades. |

| Range Trading | Identify a likely trading range before the announcement and place buy orders at the lower bound, expecting a bounce. | Identify a likely trading range before the announcement and place sell orders at the upper bound, expecting a reversal. | Stop-losses should be placed outside the range. |

Mastering the Forex Factory calendar isn’t just about predicting market swings; it’s about developing a robust, adaptable trading strategy. By understanding the nuances of different event impacts and incorporating risk management techniques, you can significantly improve your trading outcomes. Remember, consistent analysis, careful planning, and a willingness to learn from both successes and failures are the cornerstones of successful forex trading informed by economic calendars like Forex Factory’s.

Find out further about the benefits of how to create effective landing pages for lead generation that can provide significant benefits.

Do not overlook explore the latest data about How to consistently profit from Forex Factory signals.