Forex Factory and its influence on currency exchange rate fluctuations are significant. This platform, a hub for forex traders, provides a wealth of data—economic calendars, news, and lively forum discussions—that directly impacts trader sentiment and, consequently, market movement. Understanding how this information is used, interpreted, and potentially manipulated is key to navigating the complexities of the forex market. We’ll explore Forex Factory’s features, its short-term and long-term effects on currency pairs, and its role in shaping market sentiment, including its use in algorithmic trading strategies.

We will delve into the specifics of how news releases, forum discussions, and the collective wisdom (or sometimes misinformation) of the Forex Factory community affect both short-term volatility and longer-term trends. We’ll also examine the platform’s limitations and potential biases, emphasizing the importance of critical thinking and corroboration with other data sources. By the end, you’ll have a clearer picture of Forex Factory’s role in the dynamic world of currency trading.

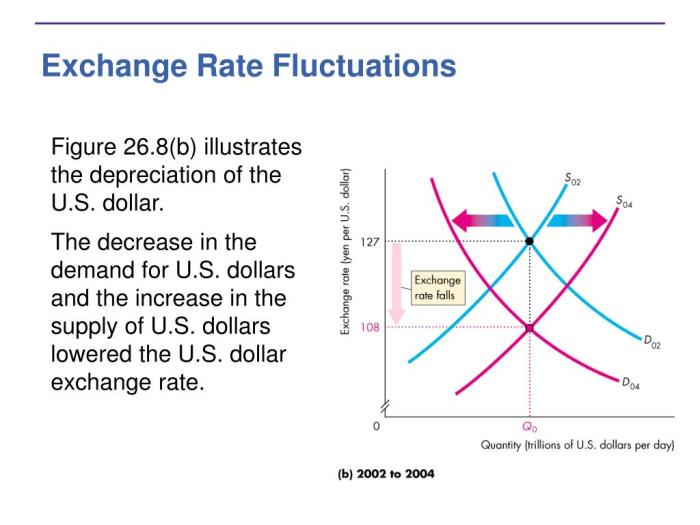

Impact on Short-Term Fluctuations

Forex Factory, with its real-time news feeds and active trader forums, significantly impacts short-term currency exchange rate fluctuations. The platform’s speed in disseminating information means traders react almost instantaneously to news, leading to rapid price movements. This contrasts with slower reactions to news disseminated through traditional media outlets.The immediate release of economic data, central bank announcements, or geopolitical news on Forex Factory often triggers immediate and sometimes dramatic shifts in currency pairs.

Traders constantly monitor the platform, and any surprising or impactful news can lead to a flurry of buy or sell orders, pushing prices up or down in a matter of seconds or minutes.

Impact of News Releases on Currency Pairs

A sudden unexpected announcement, for example, a better-than-expected jobs report from the US, might be instantly reflected on Forex Factory. This positive news would likely strengthen the US dollar (USD) against other currencies. Conversely, a negative surprise, such as a sharp drop in manufacturing output in the Eurozone, would probably weaken the Euro (EUR) relative to other currencies, including the USD.

Explore the different advantages of Developing automated trading strategies based on Forex Factory data that can change the way you view this issue.

These shifts are often amplified by leverage used by forex traders. For instance, the release of US Non-Farm Payroll data frequently causes significant short-term volatility in USD-based pairs. A higher-than-expected number leads to a stronger dollar, while a lower number weakens it.

Role of Trader Sentiment in Short-Term Volatility

Forex Factory’s forums serve as a barometer of trader sentiment. The discussions and analyses shared there can influence the collective market psychology, further exacerbating short-term price swings. If a majority of traders express a bullish outlook on a particular currency pair, this positive sentiment can create a self-fulfilling prophecy, pushing the price higher. Conversely, widespread pessimism can lead to a sell-off.

The speed at which sentiment shifts on the platform directly correlates with the volatility experienced in the market.

Hypothetical Scenario: News and Rapid Price Change

Imagine a scenario where a surprise interest rate hike by the Bank of Japan is announced on Forex Factory. The news is unexpected and significantly higher than market forecasts. This instantly triggers a wave of buy orders for the Japanese Yen (JPY) as traders anticipate higher returns. Simultaneously, traders holding positions short on JPY quickly close their positions to avoid further losses.

This combined buying pressure and short-covering activity results in a rapid and significant appreciation of the JPY against other major currencies like the USD and EUR within minutes of the announcement. The initial price jump might be followed by some consolidation as traders assess the longer-term implications of the rate hike, but the initial impact would be a sharp and swift price increase driven by the speed of information dissemination and the immediate reaction of traders.

Influence on Long-Term Trends

Forex Factory, while primarily known for its real-time market sentiment and short-term trading activity, doesn’t directlycause* long-term currency trends. However, the collective wisdom and aggregated data reflected on the platform can offer valuable insights into market psychology, potentially acting as a leading indicator of longer-term shifts. Understanding how Forex Factory data relates to these larger trends requires careful consideration of its limitations alongside other fundamental economic factors.It’s crucial to remember that Forex Factory data represents the opinions and actions of a subset of the forex market, predominantly retail traders.

These participants often react to news and events, rather than driving them. Therefore, while Forex Factory sentiment might reflect a developing trend, it’s more accurate to consider it a symptom rather than a cause of long-term movements. Fundamental economic indicators, such as GDP growth, inflation rates, interest rate decisions, and political stability, remain the primary drivers of long-term currency valuations.

Forex Factory Sentiment and Long-Term Market Shifts

Forex Factory’s strength lies in its ability to aggregate market sentiment in real-time. A sustained, significant shift in sentiment on Forex Factory, particularly if corroborated by other technical indicators, could potentially foreshadow a longer-term trend. For instance, consistent bearish sentiment towards a specific currency coupled with negative economic news might indicate a weakening of that currency over an extended period.

However, it’s vital to avoid relying solely on Forex Factory data for long-term predictions. The platform’s data should be interpreted in conjunction with fundamental economic analysis and other technical indicators for a more comprehensive understanding.

Examples of Potential Correlations

The following timeline illustrates potential correlations between long-term trends and Forex Factory sentiment, acknowledging the complexity of attributing causality solely to Forex Factory data:

| Period | Currency Pair | Long-Term Trend | Possible Forex Factory Correlation |

|---|---|---|---|

| 2014-2016 | EUR/USD | Downward trend | Increasing bearish sentiment on Forex Factory, potentially reflecting concerns about the Eurozone economy and the strength of the US dollar. |

| 2017-2019 | USD/JPY | Upward trend | Growing bullish sentiment on Forex Factory, possibly reflecting positive US economic data and a weakening Japanese Yen. |

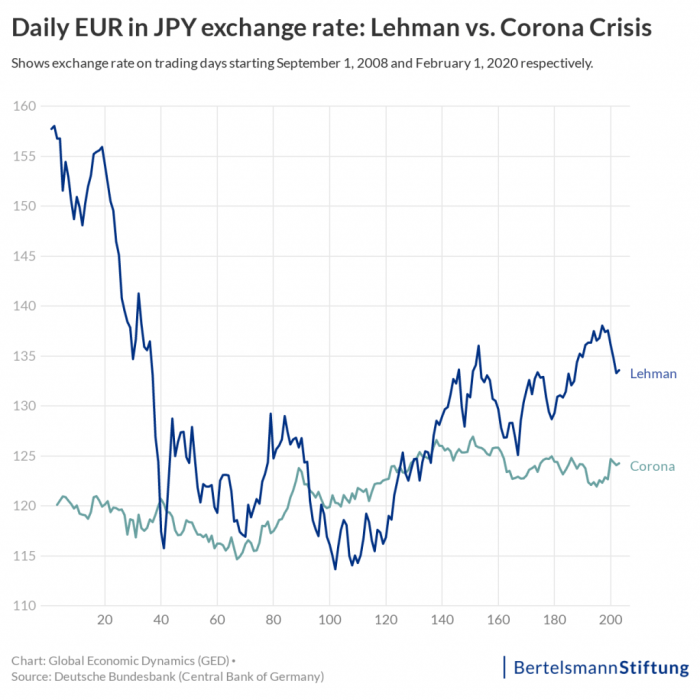

| 2020-2022 | GBP/USD | Volatile, but generally downward trend | Mixed sentiment on Forex Factory, reflecting uncertainty surrounding Brexit and the global pandemic, ultimately leaning towards bearishness. |

It is important to note that these examples are simplified illustrations. Numerous other factors contributed to these long-term trends. The Forex Factory data, while potentially indicative, should not be interpreted in isolation.

Limitations of Using Forex Factory for Long-Term Analysis

Relying solely on Forex Factory data for long-term forecasting is risky. The platform’s data primarily reflects retail trader sentiment, which can be highly susceptible to short-term market noise and emotional biases. Furthermore, significant events and fundamental economic shifts can dramatically alter market sentiment, rendering previous Forex Factory data less relevant. A comprehensive approach that integrates Forex Factory data with fundamental analysis and other technical indicators provides a more robust and reliable framework for long-term currency predictions.

Forex Factory’s Role in Market Sentiment: Forex Factory And Its Influence On Currency Exchange Rate Fluctuations

Forex Factory, a popular online forum for forex traders, plays a significant role in shaping market sentiment. Its large and active community acts as a real-time barometer of trader psychology, influencing trading decisions and ultimately affecting currency exchange rates. The platform’s influence stems from the rapid dissemination of information and the collective interpretation of market events by its users.Forex Factory fosters a community that shapes market sentiment primarily through its discussion forums, news feeds, and calendar of economic events.

Traders share their analyses, strategies, and predictions, creating a dynamic environment where opinions are formed and amplified. This collective intelligence, while not always accurate, can significantly impact trading decisions and, consequently, market movements.

Information Dissemination on Forex Factory

The information shared on Forex Factory spreads rapidly through several mechanisms. The platform’s forum structure allows for immediate responses and discussions around breaking news or significant economic data releases. This creates a snowball effect, where initial interpretations and opinions are quickly amplified and disseminated among a large number of traders. Furthermore, many traders actively monitor Forex Factory for sentiment shifts, using it as a tool to gauge market expectations and potential price movements.

Investigate the pros of accepting how to create effective landing pages for lead generation in your business strategies.

This continuous feedback loop ensures that information shared on the platform quickly influences the broader trading community. News articles and analysis posted on Forex Factory are often cited and referenced by other trading websites and publications, extending its reach beyond the platform itself.

Potential for Information Bias and Manipulation on Forex Factory

While Forex Factory offers valuable insights, it’s crucial to acknowledge the potential for information bias and manipulation. The platform is largely unregulated, meaning that the accuracy and reliability of information shared cannot always be guaranteed. Experienced traders may deliberately spread misinformation to influence market sentiment in their favor, creating a “pump and dump” scenario. Additionally, the inherent biases of individual traders can be amplified within the community, leading to herd behavior and potentially irrational market reactions.

Confirmation bias, where traders seek out information that confirms their pre-existing beliefs, can further exacerbate this issue. It’s essential for traders to critically evaluate the information found on Forex Factory and to cross-reference it with other reliable sources before making trading decisions.

Visual Representation of Information Flow

Imagine a network diagram. At the center is the Forex Factory platform, represented as a large node. From this central node, numerous lines radiate outwards, representing the flow of information to various market participants. These participants include individual retail traders, institutional investors, algorithmic trading systems, and news outlets. The thickness of each line represents the volume of information flow, with thicker lines indicating stronger influence.

Some lines might be colored differently to represent the type of information (e.g., news, analysis, sentiment). The diagram visually demonstrates how Forex Factory acts as a central hub, distributing information and influencing the overall market sentiment. The arrows on the lines would all point outwards from Forex Factory, showing the unidirectional nature of information flow from the platform to the market.

Forex Factory and Algorithmic Trading

Forex Factory, with its wealth of forex-related news, economic calendar data, and forum discussions, presents a unique data source for algorithmic trading strategies. While not a primary source of raw market data like a broker’s feed, its information can provide valuable context and signals that, when integrated correctly, can enhance trading algorithms. Understanding how this data is used, its advantages and disadvantages, and its speed relative to other sources is crucial for algorithmic traders.Algorithmic trading strategies can leverage Forex Factory data in several ways.

The platform offers a concentrated source of market sentiment, allowing algorithms to gauge the overall market mood before making decisions. For example, an algorithm could monitor the sentiment expressed in Forex Factory’s forums regarding a specific currency pair and use this to inform its trading strategy. Additionally, the economic calendar data provides precise timing for potential market reactions to economic announcements, allowing algorithms to anticipate and potentially profit from predictable price movements.

Advantages and Disadvantages of Using Forex Factory Data in Automated Trading Systems

Using Forex Factory data in algorithmic trading offers several advantages. The readily available sentiment analysis from forum discussions can provide a unique perspective on market expectations not readily captured by traditional technical indicators. The economic calendar allows for precise timing of trades around news events. However, disadvantages also exist. The information on Forex Factory is not always accurate or unbiased; forum discussions can be influenced by noise and speculation.

Furthermore, the speed of information dissemination on Forex Factory is slower than dedicated market data feeds, potentially leading to missed opportunities in fast-moving markets. Real-time data feeds from brokers generally provide much faster updates. The delay in Forex Factory’s updates can significantly impact high-frequency trading strategies.

Speed of Forex Factory Data Dissemination Compared to Other Sources

Forex Factory’s data dissemination speed is significantly slower than that of professional-grade real-time market data feeds offered by brokers and data vendors. While the economic calendar provides scheduled events, the actual news and market reaction are not reflected instantaneously. The forum discussions, while potentially insightful, are subject to delays in posting and require natural language processing to extract actionable insights, adding further latency.

High-frequency trading algorithms, which rely on microsecond-level data updates, would find Forex Factory’s data unsuitable for their strategies. In contrast, dedicated market data providers offer near real-time updates, crucial for speed-sensitive algorithms.

Types of Algorithmic Trading Strategies Incorporating Forex Factory Information

Several algorithmic trading strategies can incorporate information from Forex Factory. The inherent delay necessitates strategies that are less reliant on immediate price movements.

- Sentiment-Based Trading: Algorithms can analyze the sentiment expressed in Forex Factory’s forums to gauge market expectations and adjust their trading positions accordingly. For example, a high level of bullish sentiment might trigger an algorithm to take a long position, while bearish sentiment could prompt a short position. This strategy relies on the assumption that market sentiment can predict future price movements.

- News-Based Trading: The economic calendar data can be used to trigger trades around the release of economic news. The algorithm can be programmed to execute trades based on the anticipated impact of the news on specific currency pairs. For instance, a positive surprise in US employment data might trigger an algorithm to buy the USD/JPY pair.

- Mean Reversion Strategies: Forex Factory’s sentiment data can be used to identify potential mean reversion opportunities. If sentiment becomes excessively bullish or bearish, an algorithm could bet on a price correction back to the mean.

- Calendar Spread Strategies: These strategies exploit the time decay of options around economic news events. Forex Factory’s calendar can help to identify optimal entry and exit points for these strategies.

Limitations and Biases of Forex Factory Data

Forex Factory, while a popular resource for forex traders, isn’t without its flaws. Relying solely on its data for trading decisions can be risky, as the information presented is subject to various biases and limitations. Understanding these shortcomings is crucial for informed and successful forex trading.The information shared on Forex Factory, primarily from user contributions, is inherently susceptible to biases.

These biases can stem from individual trader experiences, perspectives, and even intentional manipulation. For example, a trader who has experienced significant losses with a particular strategy might post negatively about it, potentially swaying other traders’ opinions unfairly. Conversely, a trader who has profited significantly might oversell a specific approach, leading to a skewed perception of its effectiveness.

This subjective nature means the information isn’t necessarily objective or representative of the broader market sentiment.

Confirmation Bias and Echo Chambers, Forex Factory and its influence on currency exchange rate fluctuations

Forex Factory’s forum structure can create echo chambers, where similar opinions are amplified and dissenting voices are marginalized. This reinforces confirmation bias, where traders tend to seek out and interpret information confirming their pre-existing beliefs, regardless of its accuracy. For instance, a trader bullish on a particular currency pair might selectively focus on positive news and comments on Forex Factory, ignoring contradictory information.

This can lead to overconfidence and poor risk management.

Lack of Verification and Data Accuracy

The data posted on Forex Factory, especially in the forums, is largely unverified. Users can post anything, including inaccurate or misleading information, without any formal fact-checking process. This lack of verification increases the risk of traders making decisions based on flawed information. For example, a user might post a false rumor about a central bank intervention, causing a temporary price swing that could result in losses for those who acted on the inaccurate information.

Relying solely on this unverified data is a significant risk.

Over-reliance on Sentiment and Speculation

Forex Factory’s strength, its active community, is also its weakness. The focus on market sentiment and speculation can overshadow fundamental analysis. While sentiment is a factor in price movements, relying solely on it without considering fundamental economic data, technical analysis, or other indicators can lead to inaccurate predictions and poor trading decisions. For example, overly optimistic sentiment reflected in Forex Factory discussions might lead traders to buy a currency at an overvalued price, resulting in losses when the price corrects.

Examples of Poor Trading Outcomes from Sole Reliance on Forex Factory Data

Imagine a trader solely relying on positive sentiment expressed on Forex Factory regarding a particular currency pair. They enter a long position, ignoring contradictory fundamental data suggesting an economic slowdown in that country. If the economic slowdown materializes, the currency’s value might drop, leading to significant losses for the trader who ignored the fundamental data and relied solely on the optimistic sentiment on Forex Factory.

Similarly, a trader acting on an unverified rumor about a policy change, found only on Forex Factory, might experience losses if the rumor proves false. These examples highlight the importance of diversifying information sources and employing a robust trading strategy.

The Importance of Verifying Information from Multiple Sources

To mitigate the risks associated with Forex Factory’s limitations, it is crucial to verify information obtained from the platform with other reliable sources. This includes checking news from reputable financial news outlets, consulting economic indicators, and using technical analysis tools. Cross-referencing information from multiple sources helps to form a more comprehensive and accurate picture of the market, reducing the reliance on potentially biased or inaccurate data from Forex Factory.

Forex Factory undeniably plays a significant role in influencing currency exchange rate fluctuations, acting as both a source of crucial information and a barometer of market sentiment. While it offers valuable data and insights, it’s crucial to remember that it’s not a standalone source of truth. Successful forex trading necessitates a critical approach, verifying information from multiple sources and understanding the potential biases inherent in any online community.

By combining Forex Factory’s real-time data with a broader understanding of fundamental economic factors and sound risk management, traders can harness its power while mitigating its inherent limitations.