Developing a personalized Forex Factory trading system is about crafting a strategy uniquely tailored to your skills and risk tolerance. Forget cookie-cutter approaches; we’re diving deep into building a system that leverages Forex Factory’s data to maximize your potential, whether you’re a scalper, day trader, or swing trader. This involves everything from defining your trading style and risk appetite to backtesting, optimizing, and implementing a robust risk management plan.

We’ll cover the entire process, from extracting and cleaning Forex Factory’s historical data to building and backtesting different trading strategies. You’ll learn how to choose the right indicators, optimize your system for profitability, and manage risk effectively to achieve consistent returns. We’ll even walk through implementing your system and monitoring its performance, adapting it as market conditions change.

Defining Personalized Trading Strategies

Crafting a Forex Factory trading system tailored to your needs involves understanding your risk tolerance and preferred trading style. This isn’t a one-size-fits-all approach; success hinges on aligning your strategy with your personality and financial goals. Ignoring this crucial step often leads to frustration and losses.

Forex Factory Trading Strategies Based on Risk Tolerance

Choosing the right strategy depends heavily on your comfort level with potential losses. Here are three examples demonstrating different risk profiles:

- Low-Risk Strategy: This strategy prioritizes capital preservation. Entry signals might involve waiting for strong confirmation, like a breakout above a significant resistance level with low volatility. Exit rules could include a trailing stop-loss set at a fixed percentage (e.g., 1%) below the highest price reached, or a stop-loss order placed at a support level. Position sizing would be conservative, perhaps only risking 1% of your trading capital per trade.

This strategy might involve fewer trades but aims for consistent small profits.

- Medium-Risk Strategy: This balances risk and reward. Entry might involve using a combination of indicators, such as a moving average crossover combined with RSI divergence, to confirm a potential trend reversal. Stop-loss orders could be placed at a more aggressive distance (e.g., 2-3%) from the entry point, acknowledging a higher probability of stop-loss hits. Take-profit targets would be set based on technical analysis, aiming for a risk-reward ratio of at least 1:2 (e.g., risking 20 pips to target 40 pips).

Position sizing remains relatively moderate.

- High-Risk Strategy: This strategy focuses on maximizing potential profits, accepting higher chances of losses. Entry signals could be based on less reliable indicators or shorter-term price action, perhaps scalping opportunities. Stop-losses would be tighter, potentially closer to the entry price, and take-profit targets might be more ambitious, aiming for larger price swings. Position sizing would be higher, potentially risking a larger percentage of capital per trade.

This approach requires significant discipline and experience.

Incorporating Individual Trading Styles, Developing a personalized Forex Factory trading system

Your trading style – scalping, day trading, or swing trading – significantly impacts strategy design.

- Scalping: Focuses on very short-term price movements, often holding positions for minutes or seconds. Requires extremely fast execution and a high tolerance for frequent trades and small profits. A scalping strategy would utilize very short-term charts (e.g., 1-minute or 5-minute) and focus on quick price fluctuations.

- Day Trading: Involves opening and closing positions within a single trading day. Strategies typically rely on intraday price action and technical indicators, with the goal of capitalizing on daily trends. A day trading strategy might use hourly or 4-hour charts and focus on identifying intraday trends.

- Swing Trading: Holds positions for several days or weeks, capitalizing on larger price swings. Strategies often incorporate fundamental analysis alongside technical analysis. A swing trading strategy might use daily or weekly charts and look for longer-term trend reversals.

Automated Versus Manual Trading

The choice between automated and manual trading significantly influences system design and execution.

- Automated Trading: Uses algorithms and software to execute trades automatically based on pre-defined rules. Advantages include speed, consistency, and the elimination of emotional decision-making. Disadvantages include the potential for unexpected errors in the code, the need for robust backtesting, and the inability to adapt to unforeseen market events.

- Manual Trading: Involves manually placing and managing trades based on real-time market analysis and judgment. Advantages include flexibility and the ability to react to unexpected market changes. Disadvantages include the potential for emotional biases and inconsistencies in decision-making, as well as the time commitment required for constant monitoring.

Data Acquisition and Preprocessing from Forex Factory

Getting reliable Forex data is the cornerstone of any successful trading system. Forex Factory offers a wealth of historical data, but extracting and preparing it for algorithmic trading requires careful planning and execution. This section Artikels the process of acquiring, cleaning, and structuring this data for effective use in your personalized Forex Factory trading system.

Forex Factory doesn’t directly offer a bulk download of historical data in a perfectly formatted CSV file. You’ll need to employ some clever strategies, which might involve using web scraping techniques (with appropriate ethical considerations and adherence to Forex Factory’s terms of service) or relying on third-party data providers that aggregate Forex Factory information. Remember always to respect the website’s terms of service and robots.txt file.

Data Extraction from Forex Factory

The core data points needed are the Open, High, Low, Close (OHLC) prices, and volume for each trading period (e.g., hourly, daily). These represent the opening, highest, lowest, and closing prices of a currency pair within a specific timeframe, along with the trading volume. Depending on your strategy, you may also need additional data, such as indicators (like RSI or MACD) that you can calculate later based on the OHLC data.

Efficient data extraction methods, possibly involving APIs (if available) or web scraping, will significantly reduce the manual effort. Always check Forex Factory’s terms of service before automating data extraction.

Data Cleaning and Preprocessing

Raw data is rarely perfect. Common issues include missing values (gaps in the data), outliers (extreme values that deviate significantly from the norm), and inconsistencies in formatting. Addressing these issues is crucial for accurate analysis and model building.

Missing values can be handled through various imputation techniques. Simple methods include replacing missing values with the previous or next valid value, or the mean/median of the surrounding values. More sophisticated techniques, such as linear interpolation or using more advanced machine learning algorithms, may be necessary for more complex datasets. Outliers can be identified using techniques like box plots or Z-score calculations and handled by removal, capping (replacing extreme values with less extreme ones), or winsorization (replacing values outside a certain range with the values at the edge of that range).

Consistent formatting is ensured through data standardization – transforming data into a uniform structure, handling date and time formats consistently, and ensuring all numerical data is in the same units.

Data Organization for Algorithmic Trading

Once the data is cleaned, it needs to be structured for efficient use in your trading algorithms. A common format is a tabular structure, where each row represents a single trading period and each column represents a data point.

This structure facilitates easy access and manipulation of the data during backtesting and live trading. Below is an example of how your data might be organized.

| Date | Time | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|---|

| 2024-10-27 | 00:00:00 | 1.1000 | 1.1020 | 1.0980 | 1.1010 | 15000 |

| 2024-10-27 | 01:00:00 | 1.1010 | 1.1030 | 1.1005 | 1.1025 | 12000 |

| 2024-10-27 | 02:00:00 | 1.1025 | 1.1040 | 1.1015 | 1.1035 | 10000 |

Backtesting and Optimization: Developing A Personalized Forex Factory Trading System

Putting your Forex Factory trading strategy to the test is crucial. Backtesting allows you to evaluate its performance using historical data before risking real capital. This process helps refine your strategy and identify potential weaknesses before live trading. Optimization, on the other hand, involves fine-tuning the strategy’s parameters to maximize its profitability and minimize risk.Backtesting involves running your strategy on historical Forex Factory data to see how it would have performed in the past.

This isn’t a guarantee of future success, but it gives you a much better understanding of its strengths and weaknesses. Key performance indicators (KPIs) are vital in evaluating these results.

Backtesting Framework and Key Performance Indicators

A robust backtesting framework requires a clear methodology. You’ll need to define your testing period, the specific currency pairs you’re trading, and the timeframe of your charts (e.g., 1-hour, 4-hour, daily). Your framework should automatically execute your trading strategy on the historical data and calculate key performance indicators. These KPIs provide a quantitative assessment of your strategy’s performance.

Obtain access to how to use local SEO to attract local customers to private resources that are additional.

Common KPIs include:

- Sharpe Ratio: Measures risk-adjusted return. A higher Sharpe ratio indicates better performance relative to the risk taken. The formula is:

Sharpe Ratio = (Rp – Rf) / σp

where Rp is the portfolio return, Rf is the risk-free rate of return, and σp is the standard deviation of the portfolio return.

- Maximum Drawdown: Represents the largest peak-to-trough decline during the backtesting period. It indicates the maximum potential loss your strategy could experience. A lower maximum drawdown is desirable.

- Win Rate: The percentage of trades that resulted in a profit. While a high win rate is generally good, it’s important to consider the average profit and loss per trade to get a complete picture.

- Average Profit/Loss per Trade: This metric, combined with win rate, gives a more comprehensive view of profitability. A high win rate with small profits and a low win rate with large profits can both lead to profitable overall strategies.

Optimization Process

Optimization involves systematically adjusting your strategy’s parameters to improve its performance based on the backtesting results. This is an iterative process, and you’ll likely need to repeat the backtesting and adjustment steps multiple times.For example, if your strategy uses moving averages, you might adjust the period lengths of the moving averages to find the combination that produces the best results.

Similarly, if your strategy uses stop-loss and take-profit levels, you can optimize these parameters to improve profitability and risk management.Optimization methods can range from manual adjustments based on observation to more sophisticated techniques like genetic algorithms or gradient descent. The choice of method depends on the complexity of your strategy and your comfort level with different optimization techniques.

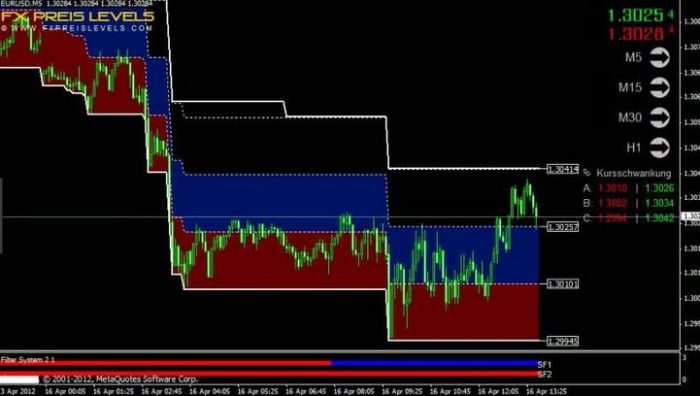

Visualizing Backtesting Results

Visualizing your backtesting results is crucial for understanding your strategy’s performance and identifying areas for improvement. Charts and graphs are essential tools for this.For example, an equity curve chart shows the cumulative performance of your strategy over time. This helps visualize the overall growth or decline of your trading account. A drawdown chart shows the maximum drawdown experienced during the backtesting period, highlighting periods of significant losses.

Histograms can illustrate the distribution of your profits and losses, providing insights into the consistency of your strategy’s performance. Finally, a heatmap can visually represent the relationship between different parameters and their effect on the strategy’s performance. These visualizations should clearly highlight key metrics like the Sharpe ratio, maximum drawdown, and win rate, along with the overall equity curve.

A well-designed visualization makes it easy to spot patterns and trends, leading to more informed optimization decisions.

Understand how the union of the use of automation in digital marketing campaigns can improve efficiency and productivity.

Risk Management and Money Management

Protecting your capital and ensuring consistent profitability in Forex trading are paramount. A robust risk management and money management plan is not just a good idea; it’s absolutely essential for long-term success. This section will detail how to integrate these crucial elements into your personalized Forex Factory trading system. Ignoring these principles can quickly lead to significant losses, even with a well-defined trading strategy.Risk management and money management are intertwined concepts.

Risk management focuses on limiting potential losses on individual trades, while money management focuses on the overall allocation of your capital across multiple trades. Both are vital for preserving your trading account and achieving sustainable profitability. Effective strategies often involve a combination of position sizing, stop-loss orders, and take-profit targets, all carefully calibrated to your individual risk tolerance and trading style.

Position Sizing, Stop-Loss Orders, and Take-Profit Targets

Determining the appropriate size of your trades (position sizing) is fundamental. This involves calculating how much capital to allocate to each trade based on your risk tolerance and the potential reward. A common approach is to risk a fixed percentage of your account balance on any single trade – for example, 1% or 2%. This percentage should remain consistent across all your trades, regardless of your perceived confidence in a particular setup.

Stop-loss orders automatically exit a trade when the price moves against you by a predetermined amount, limiting potential losses. Take-profit targets define the point at which you’ll close a profitable trade, securing your gains. These targets should be set based on your trading strategy and technical analysis, ensuring they align with your risk/reward ratio. For instance, a strategy might aim for a 1:2 risk-reward ratio, meaning the potential profit is twice the potential loss.

Fixed Fractional Position Sizing and the Kelly Criterion

Fixed fractional position sizing, as mentioned above, involves risking a consistent percentage of your account balance on each trade. This method provides stability and prevents overly aggressive trading that could deplete your capital rapidly. The Kelly Criterion, a more advanced money management technique, calculates the optimal position size based on your historical win rate and average win/loss ratio.

While potentially maximizing returns, the Kelly Criterion can also lead to larger drawdowns if your win rate deviates from your initial estimations. Therefore, it’s crucial to thoroughly backtest and understand the implications before implementing it. The formula for the Kelly Criterion is:

f = (bp – q) / b

where:f = fraction of capital to betb = win/loss ratio (average win / average loss)p = probability of winq = probability of loss (1-p)

It’s important to note that using the Kelly Criterion requires careful calculation and understanding. Many traders opt for a fractional Kelly approach (e.g., half-Kelly or quarter-Kelly) to reduce the risk of significant drawdowns.

Implementing a Risk Management and Money Management Plan

The successful implementation of a comprehensive risk and money management plan requires a systematic approach. Here’s a step-by-step guide:

- Define your risk tolerance: Determine the maximum percentage of your account you’re willing to lose on any single trade (e.g., 1%, 2%).

- Establish position sizing rules: Calculate the appropriate position size for each trade based on your risk tolerance and the stop-loss level.

- Set stop-loss orders: Place stop-loss orders for every trade to limit potential losses.

- Determine take-profit targets: Set take-profit targets based on your trading strategy and risk/reward ratio.

- Choose a money management technique: Select a money management approach, such as fixed fractional position sizing or a modified Kelly Criterion, that aligns with your risk profile and trading style.

- Monitor and adjust: Regularly review your trading performance and adjust your risk and money management parameters as needed. This might involve modifying your position sizing, stop-loss levels, or take-profit targets based on market conditions or your evolving trading strategy.

- Maintain a trading journal: Keep a detailed record of your trades, including position sizes, stop-losses, take-profits, and the outcomes. This will allow you to analyze your performance and identify areas for improvement.

System Implementation and Monitoring

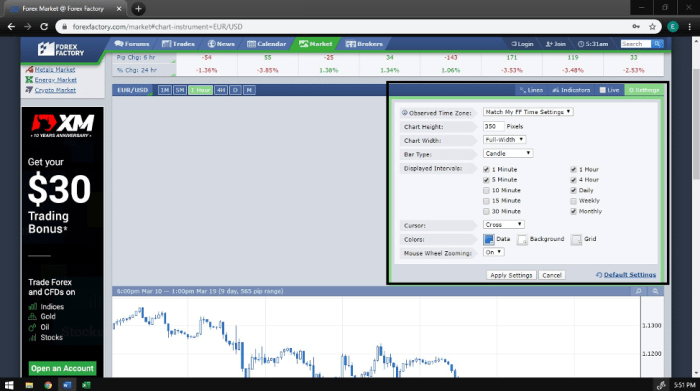

Implementing your optimized Forex Factory trading system involves transitioning from backtesting to live trading. This requires careful consideration of your trading platform, coding/scripting choices, and a robust monitoring plan to ensure consistent performance and adaptability. Remember, even the best-optimized system requires ongoing adjustments to remain profitable.Choosing the right trading platform is crucial. Consider factors like ease of integration with your chosen programming language, charting capabilities, order execution speed, and available automated trading features.

Popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader offer robust API access for algorithmic trading. The choice depends on your familiarity with the platform and its suitability for your specific strategy. For example, if your strategy involves complex indicators or requires high-frequency trading, MT5 might be preferable due to its enhanced features.

Platform Selection and Coding

The implementation process begins with selecting a suitable trading platform. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular choices due to their extensive community support, large library of indicators and Expert Advisors (EAs), and relatively easy-to-use APIs for custom development. cTrader is another strong contender, particularly for its speed and sophisticated order management tools. The coding process involves translating your backtested strategy into a script or EA using the platform’s native language (MQL4/MQL5 for MetaTrader, cAlgo for cTrader).

This requires programming skills and thorough testing to ensure the code accurately reflects your strategy. For instance, a simple moving average crossover strategy would be relatively straightforward to implement, while a more complex strategy involving machine learning might require significant programming expertise. Thorough testing on a demo account is crucial before deploying the system live.

Real-time Performance Tracking and Adjustment

Monitoring your system’s performance in real-time is essential for identifying potential issues and making necessary adjustments. This involves tracking key metrics such as win rate, average win/loss, maximum drawdown, and overall profitability. A simple spreadsheet can suffice for tracking these metrics, or dedicated portfolio management software can provide more sophisticated analytics. Visualizing performance using charts can help quickly identify trends and potential problems.

For example, a sudden increase in drawdown might indicate a need to review risk management parameters or adjust stop-loss levels. Regularly reviewing your system’s performance against its backtested results is vital. Significant deviations could signal the need for strategy recalibration or even a complete overhaul.

Adapting to Changing Market Conditions

Markets are dynamic, and what worked yesterday might not work today. Your trading system must be adaptable to changing market conditions. This involves regularly reviewing your strategy’s performance and making adjustments as needed. This could involve modifying parameters, adding new indicators, or even completely changing the strategy if the market environment has shifted significantly. For example, a strategy that performed well during a trending market might underperform during a sideways market.

Regularly monitoring economic news, geopolitical events, and overall market sentiment can help inform your adjustments. Remember, flexibility and adaptability are key to long-term success in forex trading.

Illustrative Examples

Let’s bring our Forex Factory trading system to life with some concrete examples. We’ll walk through a hypothetical trade, explore chart pattern interpretation, and visualize a potential trading application interface. Remember, these examples are for illustrative purposes and should be adapted to your specific system parameters and risk tolerance.

Hypothetical Trade Example

Imagine our system, based on the Relative Strength Index (RSI) and moving averages, identifies a potential long position in EUR/USD. The 20-period simple moving average (SMA) has crossed above the 50-period SMA, suggesting a bullish trend. Simultaneously, the RSI is in oversold territory (below 30), indicating potential buying pressure. The current price is 1.

1000. Our system suggests entering a long position at 1.1010 with a stop-loss order at 1.0980 (30 pips below the entry price) and a take-profit order at 1.1070 (60 pips above the entry price). This represents a risk-reward ratio of 1

2. If the price rises to 1.1070, we would close the position and secure a profit. If the price drops to 1.0980, our stop-loss order automatically closes the position, limiting our potential loss.

Chart Pattern and Indicator Interpretation

Our system uses several indicators to confirm trading signals. For instance, a head and shoulders pattern on the daily chart, coupled with a bearish crossover of the 20-period and 50-period SMAs and an RSI above 70 (overbought territory), would strongly suggest a short selling opportunity. The head and shoulders pattern visually represents a potential price reversal, while the indicator confirmations add further weight to the sell signal.

Conversely, an ascending triangle pattern, along with bullish crossovers of moving averages and an RSI below 30, could indicate a strong buy signal. These patterns and indicators are not used in isolation; rather, they are combined to generate a higher probability trading signal.

Hypothetical Trading Application Interface

Our hypothetical trading application features a clean, intuitive interface. The main window displays the chosen currency pair’s chart with adjustable timeframes. Below the chart, a panel shows real-time data, including current price, bid/ask spread, and key indicators (RSI, SMAs, MACD, etc.). Another panel displays open positions, with details such as entry price, stop-loss, take-profit levels, and current profit/loss.

A separate tab allows users to adjust system parameters (e.g., indicator settings, risk tolerance), backtest strategies, and review trading history. A “Trade” button initiates order placement, while a “Close Position” button allows users to manually close any open trades. Alerts can be set for price breaches, indicator crossovers, or other relevant events. The overall design prioritizes clear visualization of key information and streamlined trade execution.

Building your own Forex Factory trading system is a journey, not a destination. This guide has equipped you with the tools and knowledge to create a personalized strategy that aligns with your individual trading style and risk tolerance. Remember that consistent monitoring, adaptation, and disciplined risk management are crucial for long-term success. Start experimenting, refine your approach, and watch your personalized Forex Factory system evolve and grow with your expertise.