Combining Forex Factory data with technical analysis for improved accuracy is a powerful strategy for forex traders. This approach leverages the wealth of economic data, news announcements, and sentiment indicators available on Forex Factory to enhance the predictive power of traditional technical analysis. By integrating this real-time information into your trading decisions, you can potentially identify higher-probability setups, refine your risk management, and ultimately improve your trading accuracy.

This guide will walk you through the process, covering everything from data sources and integration techniques to backtesting and risk management strategies.

We’ll explore how to effectively incorporate Forex Factory’s economic calendar data into your existing technical analysis, demonstrating practical applications and potential pitfalls. We’ll also delve into the use of sentiment indicators to confirm or refute signals from popular indicators like RSI and MACD, and how to combine this information with candlestick patterns for even stronger trading setups. Finally, we’ll examine risk management techniques crucial for navigating the increased volatility that can accompany news-driven trades.

Integrating Forex Factory Data with Technical Indicators

Integrating Forex Factory’s economic calendar and news sentiment data with your technical analysis can significantly enhance your trading strategy’s accuracy and effectiveness. By combining the objective measures of technical indicators with the market-moving potential highlighted by Forex Factory’s data, you can gain a more nuanced understanding of price action and identify higher-probability trading setups. This approach allows for a more informed and potentially profitable trading strategy.

Incorporating Forex Factory Economic Calendar Data into a Moving Average Crossover System, Combining Forex Factory data with technical analysis for improved accuracy

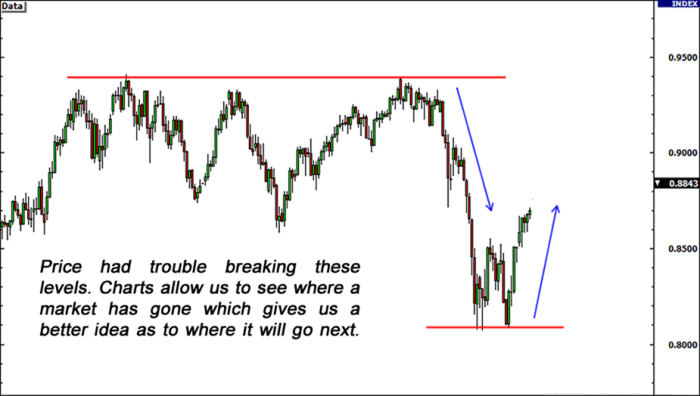

A moving average crossover system, typically using a fast and slow moving average (e.g., 50-day and 200-day), generates buy signals when the fast average crosses above the slow average and sell signals when the opposite occurs. However, these signals can be unreliable, especially during periods of high economic uncertainty. To improve this system, we can incorporate Forex Factory’s economic calendar.

Before a planned trade based on a moving average crossover, check the Forex Factory calendar for significant economic releases scheduled near the trade entry time. If a high-impact event is anticipated, consider delaying or avoiding the trade altogether. A positive surprise (better-than-expected data) might boost the currency pair, potentially validating a buy signal. Conversely, negative surprises could invalidate the signal.

Investigate the pros of accepting the importance of networking in the digital marketing industry in your business strategies.

This process reduces the likelihood of entering a trade just before a major news event that could drastically alter the market’s direction, leading to a potential loss. False signals can still occur, especially with less significant economic data or unexpected market reactions, highlighting the importance of risk management.

Using Forex Factory News Sentiment to Confirm or Contradict RSI/MACD Signals

Forex Factory provides news sentiment indicators reflecting market reaction to news events. For example, a strong positive sentiment following a positive economic release might confirm a bullish RSI or MACD signal, increasing confidence in a long position. Conversely, a negative sentiment despite a bullish technical signal could indicate potential market resistance, prompting caution or even a reversal of the trade plan.

Let’s say the RSI shows an overbought condition (above 70), suggesting a potential sell signal. However, Forex Factory’s news sentiment indicates overwhelmingly positive news regarding the currency pair. This discrepancy might suggest that the overbought condition is temporary and driven by positive news, indicating a continuation of the uptrend rather than an immediate reversal. The opposite scenario, where a bearish technical signal is contradicted by positive news sentiment, could signal a buying opportunity for a contrarian trader.

Combining Forex Factory Data with Candlestick Patterns for High-Probability Trading Setups

Candlestick patterns provide visual representations of price action, and combining them with Forex Factory data can refine their interpretation. For instance, a bullish engulfing pattern appearing after a positive economic announcement on Forex Factory would strengthen the bullish signal, suggesting a higher probability of a price increase. Conversely, a bearish engulfing pattern appearing after negative news would reinforce the bearish outlook.

Consider a hammer candlestick pattern forming at the bottom of a downtrend. If this coincides with a positive economic report (from Forex Factory) showing a significant improvement in economic indicators related to the currency pair, the bullish signal of the hammer pattern is significantly strengthened, suggesting a higher probability of a price reversal. Similarly, a bearish engulfing pattern forming after a negative news event on Forex Factory strengthens the bearish signal.

Backtesting and Optimization Strategies

Backtesting your trading strategy is crucial to understanding its potential profitability and risk profile before risking real capital. Combining Forex Factory news sentiment with technical indicators adds complexity, requiring a robust backtesting plan and optimization methodology. This section details a systematic approach to evaluate and refine a strategy incorporating both data sources.

Backtesting Plan

A thorough backtest requires a well-defined plan. We’ll use historical Forex data, preferably encompassing several years to account for market regime changes. Our data will include OHLC (Open, High, Low, Close) prices, and we’ll incorporate Forex Factory news sentiment data – perhaps a sentiment score derived from news headlines and comments – aligned with specific timeframes. Technical indicators, such as moving averages, RSI, or MACD, will be integrated to generate trading signals.

The backtesting period should be split into in-sample and out-of-sample periods to assess overfitting.

Metrics: We will track several key performance indicators:

- Net Profit/Loss: The overall profit or loss generated by the strategy.

- Sharpe Ratio: Measures risk-adjusted return, indicating how much excess return you receive for the extra volatility you endure for holding a riskier asset. A higher Sharpe ratio is better.

- Maximum Drawdown: The largest peak-to-trough decline during the backtesting period. This metric helps quantify the strategy’s risk.

- Win Rate: The percentage of trades that resulted in profits.

- Average Trade Duration: The average time a position is held.

- Average Profit/Loss per Trade: The average profit or loss per winning and losing trade.

Data Sources: Historical Forex data can be obtained from various providers (e.g., MetaTrader, TradingView). Forex Factory data will be scraped or accessed via their API (if available), carefully noting the limitations of the data quality and potential biases.

Parameter Optimization Methodology

Optimizing technical indicator parameters based on Forex Factory news sentiment involves a systematic approach. We’ll use a grid search or a more sophisticated optimization technique like genetic algorithms. The goal is to find the parameter combination that maximizes the Sharpe ratio while keeping the maximum drawdown within acceptable limits.

Find out about how managing your time effectively as a digital marketing professional can deliver the best answers for your issues.

Process:

- Define Parameter Space: Determine the range of values for each parameter of the chosen technical indicator (e.g., period for moving averages, overbought/oversold levels for RSI).

- Generate Combinations: Create a grid of all possible parameter combinations within the defined space.

- Backtest Each Combination: Run the backtest for each parameter combination using the in-sample data, calculating the Sharpe ratio and maximum drawdown for each.

- Select Optimal Parameters: Identify the parameter combination that yields the highest Sharpe ratio while keeping the maximum drawdown below a predefined threshold. This threshold represents the acceptable level of risk.

- Out-of-Sample Testing: Validate the optimized parameters by running a backtest on the out-of-sample data to assess the strategy’s performance in unseen market conditions.

Challenges of Backtesting with Real-Time News

Incorporating real-time news events from Forex Factory presents several challenges. The biggest is the inherent subjectivity and potential for manipulation in news sentiment. A headline might be interpreted differently by different traders, leading to inconsistent trading signals. Furthermore, the speed at which news impacts the market can be difficult to capture accurately in a backtest. Lag in data acquisition and processing can significantly affect results.

Finally, overfitting is a serious risk; a strategy might perform well during the backtesting period due to specific news events but fail to generalize to future market conditions. Robust statistical measures and careful out-of-sample testing are crucial to mitigate these risks.

Risk Management and Position Sizing

Incorporating Forex Factory news into your trading strategy can significantly boost potential profits, but it also introduces increased volatility. Effective risk management is paramount to avoid substantial losses. This section details a robust risk management plan tailored to this approach, focusing on stop-loss and take-profit strategies and position sizing adjustments based on news event significance.This involves a multi-pronged approach combining careful trade selection, precise position sizing, and disciplined adherence to pre-defined risk parameters.

The goal is to maximize potential gains while limiting potential losses, even during periods of heightened market volatility triggered by Forex Factory news releases.

Stop-Loss and Take-Profit Strategies

A well-defined stop-loss order is crucial when using Forex Factory data. Since news events can cause rapid price swings, your stop-loss should be placed strategically to minimize potential losses. Instead of a fixed percentage, consider a dynamic stop-loss based on volatility. For instance, you might use a wider stop-loss during periods of high volatility surrounding major economic announcements, and a tighter stop-loss during calmer periods.

Similarly, your take-profit should reflect the potential magnitude of price movement anticipated based on the news event. For instance, a significant positive news release might warrant a higher take-profit target than a less impactful announcement. Consider trailing stop-losses to lock in profits as the price moves in your favor, further mitigating risk. For example, a trailing stop-loss of 20 pips could be implemented after a 50 pip profit, ensuring that some profit is always secured even if the price reverses.

Position Sizing Based on News Event Significance

The significance of a Forex Factory news event directly impacts your position sizing. Major economic announcements, like Non-Farm Payrolls or interest rate decisions, are typically associated with higher volatility and thus warrant smaller position sizes to limit risk. Less impactful news, like a minor economic indicator release, might allow for slightly larger positions. A practical approach is to use a risk percentage of your trading capital.

For example, risk only 1% per trade, regardless of news significance. However, adjust the number of units traded based on your stop-loss distance. A wider stop-loss (due to higher volatility around a major news event) necessitates fewer units to maintain the 1% risk level.

Position Sizing Techniques

Several position sizing techniques can be effectively employed when incorporating Forex Factory data. The Fixed Fractional method, for instance, allocates a fixed percentage of your capital to each trade, irrespective of volatility. This offers simplicity and consistency. However, it might not be ideal during periods of extreme volatility around significant news releases. The Martingale system, where you increase your position size after a loss, is generally discouraged in Forex trading due to its inherent risk of significant losses during a string of unfavorable outcomes.

A more suitable approach might be a hybrid strategy combining fixed fractional with volatility adjustments. This involves using a fixed percentage of capital but modifying the position size based on an assessment of the anticipated volatility from the Forex Factory news. For example, you might use a 1% risk per trade, but reduce this to 0.5% for high-impact news events.

This allows you to participate in potentially profitable opportunities while maintaining a disciplined risk management approach.

Real-World Applications and Case Studies: Combining Forex Factory Data With Technical Analysis For Improved Accuracy

Let’s move beyond the theoretical and delve into real-world examples of how combining Forex Factory data with technical analysis can impact your trading. We’ll examine both successful and unsuccessful trades, highlighting the crucial lessons learned from each. This practical approach will solidify your understanding and help you refine your trading strategy.

Successful Trade Example: EUR/USD Long Position

This example showcases a successful long position in the EUR/USD pair. Market conditions showed a period of low volatility following a significant news event (the release of positive Eurozone PMI data, widely reported on Forex Factory). Technically, the EUR/USD was trading above its 20-period moving average, with the Relative Strength Index (RSI) showing a bullish divergence – indicating potential upward momentum.

The Forex Factory news section confirmed the positive sentiment surrounding the Euro, with many analysts predicting further appreciation. This confluence of technical indicators and fundamental news, as reflected on Forex Factory, prompted a long position. The trade was managed using a trailing stop-loss order, securing profits as the price moved favorably. The trade resulted in a 1.5% profit within three trading days.

The Forex Factory data provided confirmation of the technical signals, boosting confidence in the trade setup.

Failed Trade Example: GBP/USD Short Position

Conversely, a short position in the GBP/USD pair illustrates a less successful outcome. Forex Factory highlighted significant upcoming UK economic data releases, potentially causing volatility. Technically, the GBP/USD was near overbought territory on the RSI, suggesting a potential pullback. However, the actual data release exceeded expectations, causing a sharp rally. The initial technical signals, while suggesting a potential short opportunity, were overridden by the unexpectedly positive economic news.

The reliance on technical indicators alone, without fully considering the potential impact of the news as reported on Forex Factory, resulted in a significant loss. The key takeaway is the importance of comprehensive market analysis, incorporating both technical and fundamental factors as reported on Forex Factory and other reliable sources. Better risk management, such as using smaller position sizes and tighter stop-losses in high-volatility situations, could have mitigated the losses.

Key Lessons Learned

- Successful Trade: The combination of technical indicators and Forex Factory news provided a strong confirmation signal, leading to a profitable trade. This emphasizes the importance of corroborating technical analysis with fundamental insights.

- Failed Trade: Over-reliance on technical indicators without considering the potential impact of fundamental news (as reported on Forex Factory) resulted in a loss. This highlights the need for comprehensive market analysis, incorporating both technical and fundamental factors and robust risk management.

Successfully integrating Forex Factory data with your technical analysis can significantly improve your forex trading performance. By carefully considering the limitations of each data source, employing robust backtesting methodologies, and implementing a rigorous risk management plan, you can harness the power of this combined approach to identify high-probability trading opportunities and minimize potential losses. Remember that consistent learning, adaptation, and disciplined execution are key to long-term success in forex trading.

Don’t just react to the market; understand it. Use Forex Factory to gain that crucial edge.