Best Forex Factory indicators for scalping and day trading: Unlocking consistent profits in the forex market requires a keen understanding of technical analysis and the right tools. This guide dives into the world of Forex Factory indicators, specifically highlighting those best suited for both scalping and day trading strategies. We’ll explore top-rated indicators, discuss their strengths and weaknesses, and provide practical examples to help you build robust and profitable trading systems.

We’ll cover everything from identifying reliable indicators to mastering parameter optimization and risk management techniques. We’ll also address the common pitfalls of relying solely on indicators, emphasizing the importance of combining them with other forms of analysis for a more holistic approach. Prepare to learn how to leverage the power of Forex Factory indicators to enhance your trading performance.

Introduction to Forex Factory Indicators

Forex Factory is a popular online resource for forex traders, offering a wealth of information, including a vast library of custom indicators. These indicators are tools designed to analyze price charts and help traders identify potential trading opportunities. They process raw market data (price, volume, time) and present it in a more digestible and insightful format, allowing traders to make more informed decisions.

Understanding how these indicators work and which ones are best suited to your trading style is crucial for success.The key difference between indicators used for scalping and day trading lies primarily in their responsiveness and the timeframe they analyze. Scalping, which involves holding trades for very short periods (seconds to minutes), requires indicators that react extremely quickly to price changes.

Day trading, on the other hand, focuses on holding trades for a longer duration (hours), allowing for a more measured approach and the use of indicators that can identify broader trends. Scalping indicators need to be very sensitive, sometimes even prone to false signals, while day trading indicators prioritize identifying sustainable trends, even if it means reacting slower to minor price fluctuations.

Indicator Categories on Forex Factory

Forex Factory hosts a wide variety of indicators, categorized based on their function and the type of market information they analyze. Choosing the right indicator depends heavily on your trading strategy and risk tolerance.

- Oscillators: These indicators measure the momentum of price movements, often fluctuating between overbought and oversold levels. Popular examples include the Relative Strength Index (RSI), Stochastic Oscillator, and Moving Average Convergence Divergence (MACD). The RSI, for instance, plots a line between 0 and 100; readings above 70 are generally considered overbought, while readings below 30 are considered oversold, potentially suggesting a price reversal.

The Stochastic Oscillator uses two lines to show momentum, with similar interpretations of overbought and oversold levels. The MACD uses moving averages to identify momentum shifts and potential trend changes. Scalpers might use fast-reacting oscillators, while day traders may prefer slower oscillators to filter out noise.

- Trend Indicators: These indicators aim to identify the prevailing direction of the market. Common examples are moving averages (simple, exponential, weighted), trendlines, and the Average Directional Index (ADX). Moving averages smooth out price fluctuations, providing a clearer picture of the overall trend. The ADX measures the strength of a trend, not its direction. Scalpers often utilize shorter-period moving averages to capture quick price shifts, whereas day traders might use longer-period moving averages to focus on larger trends.

Trendlines, drawn manually on the chart, are equally useful for both scalpers and day traders, though the timeframe for drawing them differs significantly.

- Volume Indicators: These indicators analyze trading volume to confirm price movements and identify potential breakouts or reversals. Examples include On-Balance Volume (OBV) and Money Flow Index (MFI). The OBV sums volume based on price direction, providing a cumulative measure of buying and selling pressure. The MFI is a momentum indicator that considers both price and volume. Both volume indicators can be used by both scalpers and day traders, although the interpretation of volume spikes might vary depending on the timeframe.

A significant volume spike accompanying a price breakout is often considered a stronger confirmation signal than a price move without substantial volume.

Top Indicators for Day Trading on Forex Factory

Forex Factory is a treasure trove of indicators, but choosing the right ones for your day trading strategy is crucial. Effective day trading hinges on speed and accuracy, requiring indicators that provide clear, timely signals. This section highlights five highly-regarded indicators available on Forex Factory and explores how they can be combined for a robust trading system.

Five Reputable Day Trading Indicators from Forex Factory

Selecting the right indicators depends heavily on your trading style and risk tolerance. However, these five consistently appear in successful day traders’ toolkits. Understanding their strengths and weaknesses is key to integrating them effectively.

| Name | Type | Timeframe | Strengths |

|---|---|---|---|

| Moving Average Convergence Divergence (MACD) | Momentum | Multiple (5, 15, 30 minutes commonly used) | Identifies momentum shifts, potential trend reversals, and confirms price action. |

| Relative Strength Index (RSI) | Momentum/Oscillator | Multiple (14 period is common) | Pinpoints overbought and oversold conditions, indicating potential trend reversals. Useful for identifying potential entry and exit points. |

| Stochastic Oscillator | Momentum/Oscillator | Multiple (14,3,3 period is common) | Similar to RSI, but often provides earlier signals of momentum changes. Useful for identifying potential entry and exit points. |

| Bollinger Bands | Volatility | Multiple (20 period is common) | Shows price volatility; bounces off bands can signal potential reversals or continuation of trends. Helps identify potential support and resistance levels. |

| Exponential Moving Average (EMA) | Trend | Multiple (8, 21, 50 periods are commonly used) | Smooths price action, highlighting the trend direction. Crossovers of different EMAs can generate buy/sell signals. |

Combining Indicators for a Comprehensive Day Trading System

These five indicators aren’t meant to be used in isolation. Their combined application provides a more holistic view of the market, reducing reliance on any single indicator’s potential limitations. For example, using the MACD to confirm trend direction, RSI and Stochastic to identify overbought/oversold conditions, and Bollinger Bands to gauge volatility and potential support/resistance levels, creates a more robust system.

The EMAs can provide further confirmation of the trend or act as dynamic support and resistance levels. A buy signal might be generated when the MACD crosses above its signal line, the RSI is below 30, the Stochastic is in oversold territory, the price bounces off the lower Bollinger Band, and the shorter EMA crosses above the longer EMA.

A stop-loss order should be placed below recent support levels. A sell signal would be the opposite scenario. Remember that this is just one example; successful day trading often involves refining your system through backtesting and experience. Always use proper risk management.

Indicator Customization and Parameter Optimization: Best Forex Factory Indicators For Scalping And Day Trading

Forex Factory offers a wealth of indicators, but their out-of-the-box settings might not always be ideal for your specific trading style or the current market conditions. Mastering indicator customization is crucial for maximizing their effectiveness in scalping and day trading. Think of it like fine-tuning a high-performance engine – small adjustments can dramatically improve results.Optimizing indicator parameters involves experimenting with different settings to find the combination that best suits your needs and generates the most reliable signals.

This process isn’t about finding a “holy grail” setting that works perfectly all the time, but rather about improving signal clarity and reducing false signals. Market conditions are dynamic; what works well during a period of high volatility might be useless during a quiet period. Therefore, adaptability is key.

Adjusting Indicator Parameters for Different Market Conditions

Modifying indicator settings allows you to adapt to changing market dynamics. For example, a fast-moving, volatile market might benefit from a shorter period setting on a moving average, while a slow, trending market might benefit from a longer period. Similarly, the sensitivity of an oscillator, like the Relative Strength Index (RSI), might need adjustment depending on the market’s overall activity.

A highly sensitive RSI might generate numerous false signals in a choppy market, while a less sensitive one might miss crucial turning points in a fast-moving market.

Modifying Indicator Settings: Example with the Moving Average

Let’s consider a simple moving average (MA). The standard setting often defaults to a 20-period MA. However, you could change this to a 10-period MA for faster responsiveness in a fast-paced market, leading to quicker identification of potential entry/exit points. Conversely, a 50-period or even a 200-period MA might be more suitable for identifying long-term trends in slower markets.

Experimenting with different period lengths will allow you to determine which setting provides the most reliable signals for your chosen timeframe and trading style. You could also experiment with different types of moving averages (simple, exponential, weighted) to further refine your approach.

Backtesting Indicator Settings to Optimize Performance

Backtesting is the process of applying your chosen indicator with its customized settings to historical data to evaluate its past performance. This helps determine if the adjusted settings improve the accuracy of signals and enhance profitability. Most charting platforms offer backtesting capabilities. You’d input your chosen indicator with its specific settings and then run the backtest over a significant historical period.

The results will show you the number of successful trades, the average win/loss ratio, and other key metrics. Remember that past performance isn’t a guarantee of future results, but backtesting offers valuable insights into how well your indicator settings perform under various market conditions. By comparing the results of different settings, you can identify the most effective configuration for your strategy.

For example, you could compare the performance of a 10-period MA against a 20-period MA, and a 50-period MA, to see which produced the best risk-reward ratio in your backtest.

Risk Management with Forex Factory Indicators

Successfully using Forex Factory indicators for scalping and day trading isn’t just about identifying profitable setups; it’s fundamentally about managing risk. Ignoring risk management can quickly erase any profits generated by even the most accurate indicators. This section will Artikel key risk management strategies to integrate with your indicator-based trading.

Effective risk management hinges on understanding your tolerance for loss and implementing strategies to limit potential downsides. This involves carefully setting stop-loss orders, determining appropriate take-profit levels, and calculating position sizes that align with your risk profile. Remember, even the best indicators will produce losing trades occasionally – proper risk management ensures these losses remain manageable.

Stop-Loss and Take-Profit Order Usage

Stop-loss and take-profit orders are crucial for automating your risk management. A stop-loss order automatically closes your position when the price reaches a predetermined level, limiting potential losses. Conversely, a take-profit order automatically closes your position when the price reaches a predetermined profit target, securing your gains. These orders should be set based on your chosen indicators and the specific trading setup.

For instance, a stop-loss might be placed below a support level identified by a moving average, while a take-profit could be set at a resistance level indicated by another indicator, or at a level representing a specific percentage gain. The key is to define these levels

Explore the different advantages of how to use influencer marketing to drive sales that can change the way you view this issue.

before* entering the trade to avoid emotional decision-making during market fluctuations.

Position Sizing Based on Risk Tolerance

Determining the appropriate position size is critical for consistent profitability. This involves calculating the amount of capital to risk on each trade based on your overall account balance and your risk tolerance. A common approach is to risk a fixed percentage of your account balance per trade, regardless of the potential reward. For example, a trader might risk 1% of their account balance on each trade.

This means if you have a $10,000 account and risk 1%, your maximum loss per trade would be $100. To calculate the position size, you need to know your stop-loss distance (in pips) and the value of one pip for your specific currency pair and lot size.

Let’s illustrate with an example: Assume a trader has a $10,000 account, a 1% risk tolerance, and a stop-loss of 20 pips. If one pip is worth $1 (for a standard lot on a particular pair), then the maximum loss per trade is $100 (1% of $10,000). To determine the lot size, divide the maximum loss by the stop-loss distance: $100 / 20 pips = 5 units.

This suggests a position size of 0.05 lots (5 micro lots) for this trade.

Position Size = (Account Balance

- Risk Percentage) / (Stop Loss in Pips

- Pip Value)

This formula helps manage risk by ensuring that a single losing trade doesn’t significantly impact your overall account balance. Remember to adjust your position sizing based on your risk tolerance and the specific characteristics of each trade setup. Higher-risk setups should generally involve smaller position sizes.

False Signals and Indicator Limitations

Forex Factory indicators, while powerful tools, aren’t perfect predictors of market movements. Understanding their limitations and the potential for false signals is crucial for successful trading. Over-reliance on any single indicator can lead to significant losses. This section explores common pitfalls and strategies for mitigating the risks associated with indicator-based trading.Understanding that indicators lag behind actual price action is key.

They react to past price movements, not future ones. This inherent delay means that by the time an indicator suggests a buy or sell signal, the most profitable entry point might already have passed. Furthermore, indicators are susceptible to noise and market manipulation, leading to false signals that can confuse even experienced traders.

Causes of False Signals

Several factors contribute to the generation of false signals. These include market noise, which refers to random price fluctuations unrelated to underlying trends. High volatility periods, often associated with news events or economic announcements, can also distort indicator readings, producing inaccurate signals. Finally, indicator settings play a critical role; poorly chosen parameters can lead to frequent false signals, generating whipsaws and unnecessary trades.

Check leveraging the power of data-driven decision making in digital marketing to inspect complete evaluations and testimonials from users.

Overlapping indicators, while potentially offering more information, can also create conflicting signals and increase the risk of false interpretations.

Limitations of Indicator-Only Trading, Best Forex Factory indicators for scalping and day trading

Relying solely on indicators for trading decisions is a risky strategy. Indicators provide a technical perspective, focusing on price and volume data. However, they ignore crucial aspects of market dynamics such as fundamental factors and overall market sentiment. Ignoring these elements can lead to significant losses, particularly during major market shifts driven by economic news or geopolitical events.

A successful trading strategy requires a holistic approach that incorporates both technical and fundamental analysis.

Factors Beyond Indicator Signals

Successful traders consider various factors beyond indicator signals. Fundamental analysis, which examines economic data, company performance (if trading stocks), and geopolitical events, provides context for technical analysis. Market sentiment, gauged through news headlines, social media sentiment, and trader behavior, can indicate potential shifts in price direction. Price action itself, observing candlestick patterns and support/resistance levels, provides valuable insights that indicators alone cannot capture.

Finally, risk management techniques, including position sizing and stop-loss orders, are essential to protect capital from potential losses stemming from inaccurate signals or unforeseen market events. Ignoring these broader market forces in favor of solely relying on indicators dramatically increases the likelihood of losses.

Combining Indicators for Enhanced Accuracy

Using a single Forex Factory indicator for trading decisions can be risky. Market noise and false signals are common, leading to potentially costly mistakes. Combining multiple indicators, however, significantly improves the accuracy of your trading signals by providing confirmation and reducing the impact of individual indicator flaws. This layered approach helps filter out unreliable signals and increases the probability of successful trades.Combining indicators isn’t about throwing every indicator you find onto your chart.

Instead, it’s a strategic process of selecting indicators that provide complementary information about price action, momentum, and volume. Effective combinations leverage the strengths of each indicator to compensate for their weaknesses, creating a more robust trading system.

Indicator Combinations for Scalping and Day Trading

Successful indicator combinations often involve pairing trend-following indicators with momentum or oscillators. For scalping, speed and precision are paramount. A fast-moving average, like a 5-period Exponential Moving Average (EMA), combined with a stochastic oscillator can generate quick entry and exit signals. The EMA identifies the short-term trend, while the stochastic oscillator pinpoints overbought and oversold conditions for potential reversals.

For day trading, a longer timeframe is typically used. The Relative Strength Index (RSI) paired with a 20-period EMA can be effective. The RSI helps identify potential reversals within a trend identified by the EMA. Another popular combination for day trading is the Moving Average Convergence Divergence (MACD) with the Parabolic SAR. The MACD highlights momentum shifts, while the Parabolic SAR suggests potential trend reversals and stop-loss levels.

Steps for Combining Indicators in a Trading Strategy

Before combining indicators, it’s crucial to understand each indicator’s strengths and weaknesses, its typical timeframe, and how it reacts to different market conditions. Relying solely on backtesting without a deep understanding of the underlying logic is risky. A well-defined strategy minimizes emotional trading.

- Identify your trading style: Determine whether you’re a scalper or a day trader. This dictates the timeframe and types of indicators suitable for your strategy.

- Select complementary indicators: Choose indicators that offer different perspectives on price action (trend, momentum, volatility). Avoid combining indicators that provide redundant information.

- Define clear entry and exit rules: Establish precise rules based on the combined signals of your chosen indicators. This removes subjectivity and ensures consistency.

- Backtest your strategy: Thoroughly test your strategy using historical data to evaluate its performance and identify potential weaknesses. Adjust parameters as needed to optimize performance.

- Forward test and refine: After backtesting, use a demo account to test your strategy in real-market conditions before risking real capital. Continuously monitor and refine your strategy based on market feedback.

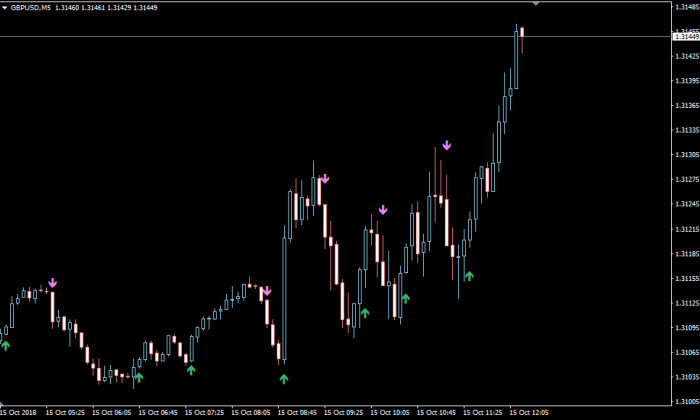

Illustrative Example: A Scalping Strategy

This section details a scalping strategy using two popular Forex Factory indicators: the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD). This strategy focuses on identifying short-term price reversals within a tight timeframe, aiming for small, quick profits. Remember that scalping requires intense focus and quick execution.This strategy relies on the RSI to identify overbought and oversold conditions, signaling potential price reversals, and the MACD to confirm the trend and identify potential momentum shifts.

We’ll use a 5-minute chart for this example.

RSI and MACD Settings

The RSI will be set with a period of 14, and the MACD will use a 12-period fast EMA, a 26-period slow EMA, and a 9-period signal line. These settings are commonly used but can be adjusted based on personal preference and market conditions. Experimentation is key to finding what works best for you.

Entry and Exit Signals

The strategy generates a long (buy) signal when the following conditions are met:

- The RSI is below 30 (oversold condition).

- The MACD line crosses above the signal line, indicating a bullish momentum shift.

- Price is approaching a support level (identified through chart analysis).

A short (sell) signal is generated when:

- The RSI is above 70 (overbought condition).

- The MACD line crosses below the signal line, indicating a bearish momentum shift.

- Price is approaching a resistance level (identified through chart analysis).

Stop-loss and take-profit levels are typically set at a fixed pip distance from the entry point. For this example, a 5-pip stop-loss and a 10-pip take-profit will be used. These levels can be adjusted based on risk tolerance and market volatility.

Hypothetical Trade Example

Let’s imagine a scenario on the EUR/USD 5-minute chart. The price is approaching a support level at 1.1000. The RSI is at 28, indicating an oversold condition. The MACD line is below the signal line, but shows a clear upward trend, suggesting a potential bullish crossover is imminent.As the MACD line crosses above the signal line, we execute a long position (buy) at 1.1000.

Our stop-loss is placed at 1.0995 (5 pips below the entry price), and our take-profit is at 1.1010 (10 pips above the entry price).The price then rises to 1.1010, hitting our take-profit target. We close the position, securing a 10-pip profit. The entire trade lasted approximately 10-15 minutes. The chart would visually show the price approaching support, the RSI in oversold territory, and the MACD crossing bullishly, all confirming the trade setup.

The subsequent price increase validated the trade decision.

Mastering the art of forex trading involves more than just identifying profitable indicators; it’s about understanding their nuances, managing risk effectively, and adapting to ever-changing market conditions. By combining the insights gained from this guide on the best Forex Factory indicators for scalping and day trading, along with diligent practice and a disciplined approach, you’ll be well-equipped to navigate the complexities of the forex market and increase your chances of success.

Remember, consistent learning and refinement of your trading strategies are key to long-term profitability.