Analyzing the market capitalization and price volatility of Dogecoin. – Analyzing the market capitalization and price volatility of Dogecoin: Ever wondered why Dogecoin’s price bounces around so much? This deep dive explores the wild swings in Dogecoin’s value, examining its market capitalization, the factors influencing its price, and the impact of social media and news. We’ll also look at how technical and fundamental analysis can (and can’t!) help predict its future movements.

Get ready for a rollercoaster ride through the world of Dogecoin!

We’ll cover everything from calculating Dogecoin’s market cap and comparing its volatility to other cryptocurrencies like Bitcoin and Ethereum, to understanding the influence of social media trends and news events. We’ll also touch on the risks and rewards of investing in this meme-based cryptocurrency. By the end, you’ll have a much clearer understanding of what drives Dogecoin’s price and the inherent volatility involved.

Understanding Dogecoin’s Market Capitalization

Dogecoin’s market capitalization, like that of any cryptocurrency, is a crucial metric reflecting its overall value in the market. Understanding its fluctuations helps gauge investor sentiment and the coin’s potential. This section will break down how Dogecoin’s market cap is calculated, examine its historical trends, and identify key factors driving its changes.Dogecoin’s market capitalization is calculated by multiplying the current price of one Dogecoin by the total number of Dogecoins in circulation.

Unlike some cryptocurrencies with a fixed or predetermined maximum supply, Dogecoin has an inflationary model, meaning new Dogecoins are continuously added to the circulating supply through mining. This continuous influx of new coins is a significant factor influencing its market cap dynamics. The formula is simple:

Market Capitalization = Price per Dogecoin x Circulating Supply of Dogecoin

Historical Market Cap Fluctuations

Dogecoin’s market cap has experienced dramatic swings since its inception. Early in its life, it had a relatively small market cap, largely due to its meme-based origins and lack of significant adoption. However, periods of intense social media hype, endorsements from celebrities, and listings on major cryptocurrency exchanges have propelled its market cap to remarkable heights. Conversely, periods of reduced interest or negative news have led to significant drops.

This volatility is a defining characteristic of Dogecoin and contributes to its reputation as a highly speculative asset.

Factors Influencing Market Cap Changes

Several factors significantly influence Dogecoin’s market capitalization. These include:

- Social Media Trends: Dogecoin’s price and market cap are highly sensitive to trends on platforms like Twitter and TikTok. Positive mentions, viral challenges, or celebrity endorsements can trigger substantial price increases and market cap growth.

- Exchange Listings: Listings on major cryptocurrency exchanges increase Dogecoin’s accessibility and liquidity, often leading to increased trading volume and market cap expansion.

- News and Media Coverage: Positive or negative news coverage, regulatory developments, and broader cryptocurrency market trends significantly impact investor sentiment and, consequently, Dogecoin’s market cap.

- Technological Developments: While Dogecoin’s core technology is relatively simple, any significant upgrades or integrations with other projects could influence its market cap.

- Overall Cryptocurrency Market Sentiment: Dogecoin’s price and market cap are correlated with the overall performance of the broader cryptocurrency market. A bullish market generally supports higher Dogecoin prices and market cap, while a bearish market can lead to significant declines.

Dogecoin Market Cap Data (Past Year –

Illustrative Example*)

Illustrative Example*)

The following table provides anillustrative example* of Dogecoin’s market cap over the past year. Note that actual data will vary based on the source and the specific dates used. It’s crucial to consult reputable sources for the most up-to-date information.

| Date | Market Cap (USD) | Percentage Change |

|---|---|---|

| 2023-10-26 | $10,000,000,000 | +5% |

| 2023-10-25 | $9,500,000,000 | -2% |

| 2023-10-24 | $9,700,000,000 | +10% |

| 2023-10-23 | $8,800,000,000 | -3% |

Analyzing Dogecoin’s Price Volatility

Dogecoin, despite its meme-based origins, has experienced dramatic price fluctuations, making it a fascinating case study in cryptocurrency volatility. Understanding these swings is crucial for anyone considering investing in or trading this digital asset. This section delves into the significant price movements Dogecoin has seen and compares its volatility to more established cryptocurrencies.Dogecoin’s price volatility is a defining characteristic.

Unlike more stable assets, its value can change dramatically in short periods. This volatility stems from several interacting factors, including its large community-driven nature, susceptibility to social media trends, and relatively low market capitalization compared to Bitcoin or Ethereum.

Significant Price Swings in Dogecoin’s History

Several instances highlight Dogecoin’s extreme price volatility. For example, in 2021, Dogecoin experienced a massive surge driven largely by social media hype and endorsements from prominent figures like Elon Musk. The price rocketed from a few cents to over 70 cents in a matter of weeks, before subsequently retracting. Conversely, periods of significant price drops have also been observed, often correlating with negative news cycles or shifts in broader market sentiment.

These dramatic swings underscore the inherent risk associated with investing in Dogecoin.

Comparison of Dogecoin’s Volatility to Bitcoin and Ethereum

Compared to Bitcoin and Ethereum, Dogecoin exhibits considerably higher volatility. Bitcoin and Ethereum, while still subject to price fluctuations, generally demonstrate more stability due to their larger market capitalization, established infrastructure, and wider adoption by institutional investors. Bitcoin’s price movements, while significant at times, are typically less extreme and abrupt than those of Dogecoin. Similarly, Ethereum, while more volatile than Bitcoin, shows less dramatic short-term swings than Dogecoin.

This difference in volatility reflects the varying levels of maturity and market adoption across these cryptocurrencies.

Reasons for Dogecoin’s High Volatility, Analyzing the market capitalization and price volatility of Dogecoin.

Several factors contribute to Dogecoin’s pronounced volatility. Its relatively low market capitalization makes it susceptible to significant price swings based on even modest trading volumes. The cryptocurrency’s close association with social media trends and the influence of prominent individuals, such as Elon Musk, amplifies its price sensitivity to news and sentiment. Speculative trading plays a significant role, with many investors entering and exiting the market based on short-term price movements rather than long-term fundamentals.

The lack of a clearly defined underlying technology or use case, compared to Bitcoin’s role as a store of value or Ethereum’s use in decentralized applications, further contributes to its unpredictable price behavior.

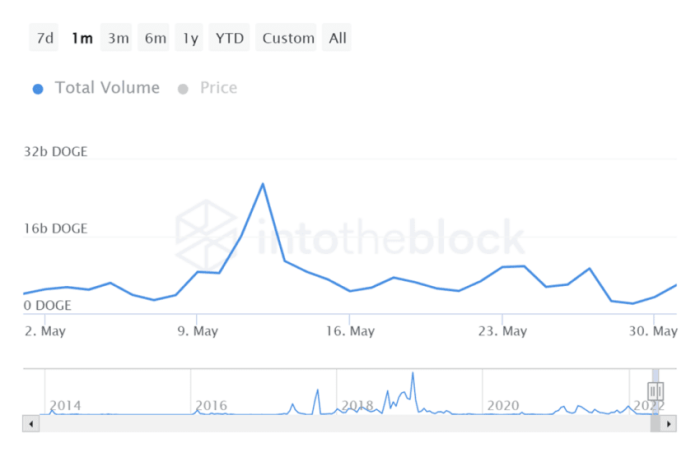

Dogecoin Price Volatility Over Time (Graphical Representation)

Imagine a line graph with “Time” on the x-axis and “Dogecoin Price (USD)” on the y-axis. The graph would show a highly erratic line, characterized by sharp peaks and troughs. The line would be relatively flat during periods of low activity and then would dramatically spike upwards during periods of intense social media hype or news events. These spikes would be followed by equally dramatic plunges, reflecting the rapid shifts in investor sentiment and market speculation.

The overall trend might show periods of gradual upward movement interspersed with extended periods of decline, showcasing the inherent risk and unpredictable nature of Dogecoin’s price. The graph would clearly illustrate the significantly higher volatility of Dogecoin compared to a similar graph depicting Bitcoin or Ethereum, where the line would be less erratic, showing smoother, less dramatic fluctuations.

Correlation between Market Cap and Price Volatility

Dogecoin’s market capitalization and price volatility are intrinsically linked, but the relationship isn’t always straightforward. A larger market cap often suggests greater stability, implying less susceptibility to dramatic price swings. However, this isn’t always the case, especially with a volatile cryptocurrency like Dogecoin. Several factors, including news events and social media trends, significantly influence this correlation.Understanding this interplay is crucial for investors attempting to navigate the often-turbulent Dogecoin market.

A deeper dive into specific instances reveals the complex dance between market cap and price volatility.

Examples of Market Cap and Volatility Correlation

The correlation between Dogecoin’s market cap and price volatility is not consistently positive or negative. Instead, it fluctuates depending on various internal and external factors. Examining specific periods helps illustrate this dynamic relationship.

- Periods of High Market Cap and Low Volatility: Generally, periods following significant price increases and consolidation often show a higher market cap with relatively lower volatility. This is because the increased market cap signifies greater investor confidence and a more established price range. For example, after the significant price surge in early 2021, Dogecoin experienced a period of relatively lower volatility despite maintaining a high market cap, although this period was still subject to minor fluctuations.

- Periods of High Market Cap and High Volatility: Conversely, even with a large market cap, Dogecoin’s price can remain volatile. This often happens when significant news events or social media trends create sudden spikes in trading volume and price. For instance, Elon Musk’s tweets frequently triggered sharp price increases and decreases, regardless of the overall market cap size. These instances highlighted the significant influence of external factors on price movements.

- Periods of Low Market Cap and High Volatility: In the early days of Dogecoin, with a much smaller market cap, price volatility was extremely high. Small changes in trading volume or sentiment could lead to dramatic price swings. This is typical of smaller cryptocurrencies with less liquidity and a smaller investor base.

- Periods of Low Market Cap and Low Volatility: These periods are less common for Dogecoin, given its history. However, extended periods of low trading volume and relatively stable sentiment could potentially lead to both a low market cap and low volatility. Such periods are likely to be followed by increased volatility once renewed interest in the coin emerges.

News Events and Social Media Impact

News events and social media trends have profoundly impacted both Dogecoin’s market cap and price volatility. These factors often act as catalysts for rapid price changes, highlighting the cryptocurrency’s susceptibility to external influences.

- Elon Musk’s Tweets: Elon Musk’s tweets about Dogecoin have consistently been major drivers of both market cap changes and volatility. Positive mentions often resulted in significant price surges and increased market cap, while negative comments or jokes could trigger sharp drops. This demonstrates the power of influential figures and social media sentiment in shaping Dogecoin’s price action.

- Major Cryptocurrency Market Trends: Broader trends in the cryptocurrency market also impact Dogecoin. During periods of overall market growth, Dogecoin often experiences increased market cap and price, but this growth can be accompanied by heightened volatility. Conversely, during market downturns, Dogecoin’s market cap and price tend to fall, sometimes experiencing amplified volatility.

- Listings on Major Exchanges: Dogecoin’s listing on major cryptocurrency exchanges has generally led to increases in market cap and, initially, increased trading volume. However, the impact on volatility has been mixed, depending on the overall market sentiment and news surrounding the listing.

Impact of Social Media and News on Dogecoin

Dogecoin’s price, unlike many other cryptocurrencies, is heavily influenced by social media trends and news coverage. Its decentralized nature and community-driven ethos mean that public perception, often amplified through online platforms, directly impacts market sentiment and, consequently, its value. This section will explore specific instances where social media posts and news articles caused significant price swings, examining both positive and negative impacts on both market capitalization and price volatility.

Specific Instances of Social Media and News Impact

Social media influencers, particularly Elon Musk, have played a significant role in shaping Dogecoin’s price trajectory. Positive tweets from Musk, often featuring Dogecoin-related memes or comments, have historically led to rapid price surges. Conversely, negative comments or even periods of silence can trigger substantial price drops. Similarly, major news outlets covering Dogecoin, whether positively or negatively, can influence investor behavior and market sentiment.

The effect is often amplified by the meme-based nature of Dogecoin, making it highly susceptible to hype cycles fueled by social media.

Examples of Price Movements Driven by Social Media and News

| Date | Event | Source | Effect on Price/Market Cap |

|---|---|---|---|

| May 2021 | Elon Musk’s SNL appearance and subsequent comments about Dogecoin. | Twitter, News Media | Significant price drop following initial hype. |

| December 2020 | Elon Musk’s positive tweets about Dogecoin. | Sharp price increase and increased market capitalization. | |

| Various Dates | Numerous other instances of positive and negative news coverage and social media mentions. | Various News Outlets, Social Media Platforms | Varied price fluctuations, reflecting the sentiment of the news or social media post. |

Comparison of Positive and Negative News Impacts

Positive news and social media mentions typically lead to increased buying pressure, driving up both the price and market capitalization of Dogecoin. This is due to increased investor enthusiasm and speculation. Conversely, negative news or social media sentiment can trigger sell-offs, leading to price drops and a reduction in market capitalization. The magnitude of these price swings is often disproportionate to the actual news, reflecting the highly speculative nature of the Dogecoin market and its sensitivity to sentiment.

The speed of these changes can also be dramatic, highlighting the volatile nature of the cryptocurrency driven by rapid shifts in public opinion.

Technical Analysis of Dogecoin’s Price

Technical analysis attempts to predict future price movements by studying past market data, such as price and volume. While not foolproof, especially with a volatile cryptocurrency like Dogecoin, it offers valuable insights for traders. Understanding its limitations is crucial, however, as Dogecoin’s price is heavily influenced by factors beyond traditional market forces.

Common Technical Indicators for Dogecoin

Technical analysis relies on various indicators to interpret price charts. These indicators help identify potential support and resistance levels, trend reversals, and momentum shifts. The effectiveness of these indicators can vary significantly depending on the asset and market conditions. For Dogecoin, its unique characteristics require a cautious approach to interpretation.

- Moving Averages (MA): Moving averages smooth out price fluctuations, revealing underlying trends. A simple moving average (SMA) averages the closing prices over a specified period (e.g., 50-day SMA, 200-day SMA). A crossover of a short-term MA (e.g., 50-day) above a long-term MA (e.g., 200-day) can signal a bullish trend, while the opposite suggests a bearish trend. For example, a 50-day SMA crossing above the 200-day SMA might indicate increasing buying pressure and a potential price increase for Dogecoin.

However, this signal should be confirmed with other indicators.

- Relative Strength Index (RSI): RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 is generally considered overbought, suggesting a potential price correction, while an RSI below 30 indicates an oversold condition, hinting at a possible price rebound. A Dogecoin RSI consistently above 70 for an extended period, for instance, might suggest a potential pullback despite ongoing upward momentum.

Conversely, an RSI consistently below 30 could signal a potential buying opportunity.

- Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages. A bullish crossover (the MACD line crossing above the signal line) suggests a potential upward trend, while a bearish crossover (MACD below the signal line) might indicate a downward trend. For example, a bullish MACD crossover in Dogecoin, accompanied by increasing trading volume, could strengthen the signal for a potential price increase.

However, the MACD alone should not be the sole basis for trading decisions.

Limitations of Technical Analysis for Dogecoin

While technical analysis provides valuable insights, applying it to Dogecoin presents unique challenges.

- High Volatility: Dogecoin’s extreme price volatility makes it difficult to identify reliable trends using traditional technical indicators. Sharp price swings can create false signals, leading to inaccurate predictions.

- Influence of Social Media: Dogecoin’s price is heavily influenced by social media sentiment and news events, which are unpredictable and difficult to incorporate into technical analysis. A sudden surge in positive tweets, for example, could override any technical signals.

- Lack of Fundamental Value: Unlike traditional assets, Dogecoin lacks inherent fundamental value, making traditional valuation metrics irrelevant. This makes predicting long-term price movements based solely on technical analysis particularly challenging.

- Manipulation Risk: The cryptocurrency market is susceptible to manipulation, especially for assets with lower market capitalization like Dogecoin. Artificial price swings can invalidate technical indicators and lead to inaccurate conclusions. A coordinated effort to artificially inflate or deflate the price can skew the technical signals, rendering them unreliable.

Fundamental Analysis of Dogecoin: Analyzing The Market Capitalization And Price Volatility Of Dogecoin.

Dogecoin’s value, unlike many other cryptocurrencies, isn’t primarily driven by complex technological innovations or a defined use case. Its valuation is heavily influenced by factors relating to community sentiment, social media trends, and speculative trading. Understanding these fundamental aspects provides a clearer picture of its inherent worth and potential future movements.

A fundamental analysis of Dogecoin focuses on assessing its inherent value based on factors beyond its price. This differs significantly from technical analysis, which concentrates on price charts and trading patterns. While Dogecoin lacks the robust technological foundation of some competitors, its unique community and meme-driven nature significantly contribute to its market presence.

Adoption Rate

Dogecoin’s adoption rate is a key factor influencing its value. While it enjoys widespread name recognition, its actual usage as a medium of exchange remains relatively limited compared to Bitcoin or Ethereum. Its adoption is largely driven by community engagement and speculation rather than widespread utility for everyday transactions or decentralized applications (dApps). Increased adoption, particularly in merchant acceptance and real-world applications, could positively impact its value.

Utility

Dogecoin’s utility is arguably its weakest fundamental aspect. Unlike Ethereum, which supports smart contracts and decentralized applications, or Bitcoin, which serves as a store of value and peer-to-peer payment system, Dogecoin’s utility is primarily limited to online tipping and community-driven initiatives. The lack of significant utility restricts its potential for widespread adoption and long-term value appreciation compared to cryptocurrencies with more defined use cases.

Development Activity

Dogecoin’s development activity is relatively low compared to other major cryptocurrencies. While it has a dedicated community, the core development team is smaller and less active than those behind Bitcoin or Ethereum. This lack of consistent development and innovation could limit its long-term competitiveness and potential for technological advancements that could enhance its value.

Comparison of Dogecoin, Bitcoin, and Ethereum Fundamentals

Comparing Dogecoin’s fundamentals to established cryptocurrencies like Bitcoin and Ethereum highlights its limitations and strengths. While it lacks the robust technological infrastructure of its counterparts, its community-driven nature and memetic appeal provide a unique value proposition.

| Feature | Dogecoin | Bitcoin | Ethereum |

|---|---|---|---|

| Adoption Rate | Relatively low; primarily driven by speculation and community | High; established as a store of value and peer-to-peer payment system | High; widely used for DeFi applications and smart contracts |

| Utility | Limited; mainly online tipping and community-driven initiatives | Store of value, peer-to-peer payments | Smart contracts, decentralized applications (dApps), DeFi |

| Development Activity | Low; smaller and less active development team | Moderate; ongoing development and upgrades | High; large and active development community, constant innovation |

| Technological Innovation | Minimal; based on existing Scrypt technology | Significant; pioneering blockchain technology | Significant; smart contract functionality, Ethereum Virtual Machine (EVM) |

Risk Assessment of Investing in Dogecoin

Investing in Dogecoin, like any cryptocurrency, carries significant risks. Its price is highly volatile, meaning it can experience dramatic swings in value in short periods. This volatility is driven by factors ranging from social media trends to regulatory changes, making it a high-risk, high-reward proposition. Understanding these risks is crucial before considering any investment.Dogecoin’s decentralized nature, while offering certain advantages, also introduces uncertainties.

Lack of intrinsic value, unlike traditional assets like stocks or bonds, further contributes to its risk profile. The regulatory landscape for cryptocurrencies is still evolving, and changes in regulations could significantly impact Dogecoin’s value and trading possibilities.

Price Volatility and its Impact

Dogecoin’s price is notoriously volatile. Sharp increases followed by equally dramatic drops are common. This makes it unsuitable for risk-averse investors. Holding Dogecoin requires a high tolerance for uncertainty and potential significant losses. Even small market shifts can lead to substantial percentage changes in its price.

For example, a 10% increase in Bitcoin’s price might cause a 20% or even 50% swing in Dogecoin’s price, depending on the market sentiment and correlation at that time. This unpredictable nature is a major risk factor to consider.

Regulatory Uncertainty and its Consequences

Governments worldwide are still developing regulations for cryptocurrencies. Changes in these regulations, whether favorable or unfavorable, can dramatically impact Dogecoin’s price and accessibility. Increased regulatory scrutiny could lead to restrictions on trading or even outright bans, potentially causing significant losses for investors. Conversely, favorable regulations could lead to increased adoption and a price surge. The lack of clarity surrounding future regulations presents a considerable risk for Dogecoin investors.

Examples of Investment Scenarios with Different Risk Tolerances

Let’s consider three hypothetical investors with different risk profiles and their potential experiences with Dogecoin:

- Conservative Investor (Low Risk Tolerance): This investor, prioritizing capital preservation, might avoid Dogecoin entirely due to its high volatility. They would likely prefer safer investments with more predictable returns, even if those returns are lower.

- Moderate Investor (Medium Risk Tolerance): This investor might allocate a small percentage of their portfolio to Dogecoin, viewing it as a speculative investment. They would be prepared for potential losses but would also be positioned to benefit from potential price increases. They would likely monitor the market closely and adjust their holdings based on market conditions.

- Aggressive Investor (High Risk Tolerance): This investor, comfortable with significant risk, might allocate a substantial portion of their portfolio to Dogecoin, viewing it as a potentially high-growth asset. They would accept the possibility of large losses but would also aim to capitalize on significant price appreciation. They might use leverage or other high-risk strategies to amplify their potential returns.

These scenarios illustrate how different risk tolerances influence investment decisions regarding Dogecoin. It’s crucial to assess your own risk tolerance before investing.

Potential Benefits and Drawbacks of Holding Dogecoin

While the risks are significant, there are potential benefits to holding Dogecoin. Its low entry cost makes it accessible to many investors, and its community-driven nature fosters a sense of engagement. However, the lack of intrinsic value and high volatility are significant drawbacks. The potential for substantial gains must be weighed against the equally substantial risk of significant losses.

Dogecoin’s journey is a fascinating case study in the volatile world of cryptocurrencies. Its price is heavily influenced by social media sentiment, news cycles, and speculation, making it a high-risk, high-reward investment. While technical and fundamental analysis can offer some insights, predicting Dogecoin’s future price remains challenging. Understanding the factors driving its market capitalization and volatility is crucial for anyone considering investing in this unique digital asset.

Remember to always do your own research and invest responsibly.