Analyzing Forex Factory news for profitable trading opportunities is a skill that can significantly boost your forex trading success. This guide walks you through understanding the different types of news, identifying key indicators, and developing a robust trading strategy that integrates news analysis with technical indicators. We’ll cover risk management, explore various news types and their market impacts, and provide practical examples to illustrate how to effectively use Forex Factory news for your advantage.

Get ready to learn how to turn news events into profitable trades!

We’ll cover everything from interpreting economic data releases like NFP and CPI, to understanding central bank announcements and navigating unexpected market volatility. You’ll learn to differentiate between market-moving news and noise, and develop a systematic approach to identifying and capitalizing on trading opportunities. We’ll also discuss the importance of risk management and position sizing to protect your capital while pursuing potentially lucrative trades.

Understanding Forex Factory News

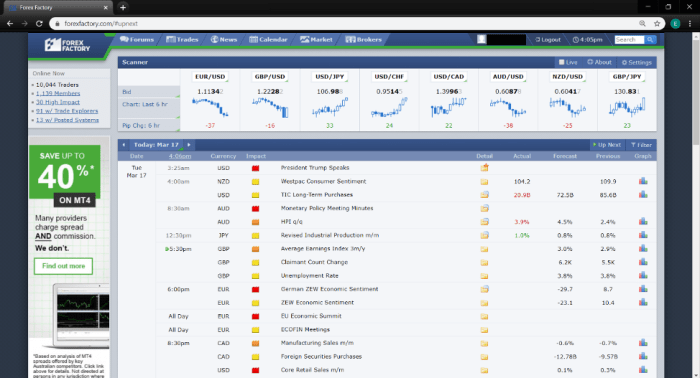

Forex Factory is a popular website for forex traders, offering a wealth of information, including economic news releases. Understanding how to interpret this news is crucial for successful trading. This section will break down the types of news, their structure, and the impact of high-impact events.

Types of Forex Factory News

Forex Factory provides a wide range of economic news, categorized by country and economic indicator. You’ll find everything from central bank interest rate decisions to employment data and inflation reports. The news is generally sourced from official government and central bank releases. Knowing the different types of news allows you to focus on the most relevant information for your trading strategy.

For example, if you trade EUR/USD, you’ll want to pay close attention to Eurozone news, while news releases from other regions may have a lesser impact.

Structure of a Forex Factory News Item

Each news item on Forex Factory typically follows a consistent structure. First, you’ll see a headline clearly stating the event. Then, a brief summary provides a quick overview of the news. Next, the actual data is presented, often compared to previous figures (prior period and/or forecast) to show the difference. Finally, there is often a short analysis or interpretation of the data and its potential market impact.

This structured presentation allows traders to quickly assess the significance of the news and react accordingly.

High-Impact News Events and Their Effects

Certain news releases have a significantly greater impact on currency markets than others. These high-impact events often involve central bank announcements, such as interest rate decisions or monetary policy statements. For example, an unexpected interest rate hike by the Federal Reserve (the US central bank) can cause the US dollar (USD) to strengthen against other currencies. Conversely, unexpectedly weak employment data could lead to a weakening of the relevant currency.

Another example: a surprise announcement of a significant change in economic forecasts by the European Central Bank (ECB) might cause a substantial movement in the EUR. The magnitude of the effect depends on several factors including the unexpectedness of the news, the scale of the change, and the overall market sentiment.

Comparison of News Sources

The reliability and timeliness of news sources vary. While Forex Factory aggregates news from multiple sources, it’s crucial to be aware of potential differences.

| News Source | Reliability | Timeliness | Notes |

|---|---|---|---|

| Forex Factory (aggregated) | High (generally) | High | Aggregates from various official and reputable sources. Check source for specific reliability. |

| Central Bank Websites | Very High | High (official source) | Direct source, but may have delays in publication. |

| Major News Outlets (e.g., Reuters, Bloomberg) | High | High | Fast reporting, but potential for minor inaccuracies or biases. |

| Unverified Online Sources | Low | Variable | Avoid these sources; prone to inaccuracies and manipulation. |

Identifying Trading Opportunities from Forex Factory News

Forex Factory is a treasure trove of market information, but navigating its news section effectively requires a discerning eye. Successfully using Forex Factory news for trading hinges on understanding which news items are truly impactful and how to interpret their effect on currency prices. This section will guide you through identifying key indicators, filtering noise, and understanding the interplay between news sentiment, price action, and technical indicators.

Key Indicators of Potential Trading Opportunities

Significant market movements often follow the release of high-impact economic data or geopolitical events. Look for news items related to central bank announcements (interest rate decisions, monetary policy statements), employment reports (non-farm payrolls, unemployment rates), inflation data (CPI, PPI), and major political developments that could significantly impact a country’s economy or its currency’s value. The higher the impact, the more likely it is to create a trading opportunity.

For instance, a surprise interest rate hike by the Federal Reserve will likely cause a significant move in the USD, creating opportunities for both long and short trades depending on your analysis and risk tolerance. Conversely, a minor revision to a less-important economic indicator might have minimal market impact.

Filtering Irrelevant News from Significant Events

Not all news is created equal. To avoid getting bogged down in noise, focus on high-impact economic releases and major geopolitical events. Pay close attention to the calendar function on Forex Factory to see what data is due to be released, and prioritize those events. A useful strategy is to pre-plan your trades based on expected volatility around specific releases.

Consider using a news filter that allows you to select only the highest impact events, based on your own criteria of what moves the markets you trade. This helps you concentrate on truly significant news and ignore the less impactful ones.

Interpreting News Sentiment and Its Impact on Price Action

News sentiment refers to the overall market feeling about a particular event or economic data. A positive sentiment generally leads to higher prices, while a negative sentiment often results in lower prices. However, the reaction isn’t always straightforward. Sometimes, the market might have already priced in expected news, leading to a muted response or even a counter-intuitive reaction.

For example, if the market anticipates a rate hike and it happens as expected, there might be little price movement. Conversely, if the news is unexpectedly positive or negative, the reaction can be quite dramatic. Learning to anticipate market expectations is key to interpreting news sentiment accurately.

The Relationship Between News Events and Technical Indicators

News events often create significant price swings, which in turn, impact technical indicators. For example, a strong positive news event might create a bullish candlestick pattern, confirmed by indicators like the RSI moving into overbought territory. This can be used to identify potential entry and exit points for trades. Conversely, a negative news event might lead to bearish patterns and oversold conditions, indicating potential shorting opportunities.

However, it’s crucial to remember that technical indicators alone are not sufficient for making trading decisions. They should be used in conjunction with news analysis for a more holistic approach. It’s also important to remember that the impact of news events on technical indicators can vary depending on the timeframe being considered. A significant news event might cause a large swing on a daily chart, but have a less pronounced effect on an hourly chart.

Risk Management and News Trading

Trading based on Forex Factory news can be highly profitable, but it also carries significant risk. A robust risk management plan is crucial to protect your capital and ensure long-term success. This section Artikels key strategies for managing risk when trading on news events.

Risk Management Plan for News-Based Forex Trading

A comprehensive risk management plan for news trading should incorporate several key elements. First, you need to define your risk tolerance – how much are you willing to lose on any single trade? This is a personal decision and depends on your overall trading capital and risk appetite. Next, determine your position sizing strategy (discussed in more detail below).

Finally, you must meticulously set stop-loss and take-profit orders for each trade, ensuring they’re placed based on a clear understanding of the potential market reaction to the news. Regularly reviewing and adjusting your plan based on market conditions and your trading performance is also essential.

Discover more by delving into using data analytics to improve digital marketing campaign performance further.

Stop-Loss and Take-Profit Order Usage, Analyzing Forex Factory news for profitable trading opportunities

Stop-loss orders automatically close your position when the price reaches a predetermined level, limiting your potential losses. In news trading, stop-losses should be wider than usual to account for the increased volatility. For example, instead of a 10-pip stop-loss, you might use a 20-30 pip stop-loss during a high-impact news event. The placement of your stop-loss should consider the potential price swing based on past reactions to similar news.

Take-profit orders automatically close your position when the price reaches a predetermined profit target. These should be set based on your risk/reward ratio (e.g., a 1:2 or 1:3 ratio). For instance, if your stop-loss is 20 pips, your take-profit could be 40 or 60 pips, respectively. This ensures that your potential profits significantly outweigh your potential losses.

Potential Risks and Mitigation Strategies

Several risks are inherent in news-based trading.

Here are some potential risks and how to mitigate them:

| Risk | Mitigation Strategy |

|---|---|

| Sudden and significant price gaps (slippage) | Use limit orders instead of market orders where possible to avoid execution at unfavorable prices. Be aware of increased slippage during high-impact news releases. |

| False signals | Use multiple confirmation methods (e.g., technical indicators, other news sources) before entering a trade. Avoid relying solely on one news report. |

| Increased volatility | Use wider stop-losses and smaller position sizes during periods of high volatility. Consider scaling in or out of positions gradually. |

| Unexpected market reactions | Thoroughly analyze past market reactions to similar news events to better anticipate potential price movements. |

| Emotional trading | Develop a disciplined trading plan and stick to it. Avoid impulsive decisions based on fear or greed. Consider using a trading journal to track your emotions and trading performance. |

Effective Position Sizing Techniques

Position sizing is crucial for managing risk in news trading. A common approach is to risk a fixed percentage of your trading capital on each trade, regardless of the expected profit. For example, you might risk only 1-2% of your account balance on each trade.

Here’s how to calculate position size:

Risk Percentage = (Stop Loss in Pips

Pip Value) / Account Balance

Example: If you have a $10,000 account, a 20-pip stop loss, and a pip value of $10, your maximum risk per trade is:

(20 pips – $10) / $10,000 = 0.02 or 2%

This means you should adjust your lot size to ensure that a 20-pip loss only reduces your account balance by 2%. You can use a position size calculator to determine the appropriate lot size based on your risk tolerance, stop-loss, and account balance. Another technique is to use fixed lot sizes, but this approach requires careful consideration of your risk tolerance in relation to your account balance and volatility.

Obtain a comprehensive document about the application of how to use influencer marketing to promote your business that is effective.

Analyzing Specific News Types and Their Impact

Forex Factory, and similar news sources, provide a constant stream of information impacting currency pairs. Understanding how different types of news affect the market is crucial for successful trading. This section breaks down the impact of various news categories, allowing you to anticipate market movements and potentially capitalize on opportunities.

Economic Data Releases versus Geopolitical Events

Economic data releases, such as Non-Farm Payroll (NFP) figures and Consumer Price Index (CPI) reports, tend to have a more direct and often predictable impact on currency pairs. These data points reflect the health of a nation’s economy, directly influencing interest rate expectations and investor confidence. A strong NFP report, for example, might strengthen the US dollar as it suggests a robust economy and potential for higher interest rates.

Conversely, geopolitical events – wars, political instability, elections – are often less predictable and can cause significant short-term volatility regardless of economic fundamentals. A major geopolitical event can trigger sharp, sudden movements in multiple currency pairs, sometimes defying typical economic indicators. The impact is often more emotional and driven by risk aversion rather than purely economic factors.

For example, the Russian invasion of Ukraine in 2022 caused significant volatility in the Ruble and other related currencies, irrespective of pre-existing economic data.

Central Bank Announcements and Statements

Central bank announcements and statements carry immense weight in the forex market. These announcements, often concerning interest rate decisions or monetary policy changes, directly influence the value of a nation’s currency. An unexpected interest rate hike, for example, will typically strengthen the currency of the country implementing the hike, attracting investors seeking higher returns. Conversely, a dovish statement signaling potential rate cuts might weaken the currency.

The phrasing and tone of the announcement are also important; even without a change in policy, a hawkish (pro-growth) tone might lead to a currency appreciation, while a cautious or pessimistic tone can lead to a decline. The European Central Bank (ECB) unexpectedly raising interest rates in 2022 led to a strengthening of the Euro against other major currencies.

Interpreting and Reacting to Unexpected News Events and Market Volatility

Unexpected news events, by their very nature, create market volatility. The key to navigating this volatility is to have a well-defined trading plan, including strict risk management rules. It’s crucial to avoid impulsive reactions based solely on the initial market shock. Instead, focus on analyzing the potential long-term implications of the news. For instance, a sudden political upheaval might cause immediate price swings, but the longer-term impact will depend on the resolution of the situation and its effect on the economy.

Observing market reaction over a period of time, rather than immediately jumping in, allows for a more informed decision. Sticking to your risk management plan, such as stop-loss orders, is paramount during periods of high volatility to limit potential losses.

Typical Market Reactions to Different News Types

| News Type | Typical Market Reaction (Currency of Country in News) | Example | Potential Trading Opportunity |

|---|---|---|---|

| Stronger-than-expected NFP | Appreciation | US Dollar strengthens after a positive NFP report. | Long USD positions |

| Higher-than-expected CPI | Depreciation (if unexpected inflation) or Appreciation (if expected inflation leading to rate hike) | Euro weakens if inflation is unexpectedly high, signaling potential ECB intervention. | Short EUR positions (if unexpected), Long EUR positions (if expected) |

| Unexpected Interest Rate Hike | Appreciation | British Pound strengthens after a surprise rate hike by the Bank of England. | Long GBP positions |

| Major Geopolitical Crisis | Volatile, often initially depreciation of affected country’s currency | Japanese Yen weakens sharply after a significant earthquake. | Short JPY positions (with caution due to volatility) |

Developing a Forex Factory News Trading Strategy

Crafting a successful Forex Factory news trading strategy requires a systematic approach, combining careful analysis with disciplined risk management. It’s not about predicting the future, but about identifying high-probability setups based on market reactions to significant economic releases. This involves understanding how different news events affect currency pairs and developing a plan to capitalize on those movements.

Step-by-Step Forex Factory News Trading Strategy

This strategy focuses on identifying high-impact news events and anticipating the market’s response. We’ll use a combination of technical and fundamental analysis. Remember, no strategy guarantees profit, and losses are a part of trading. The key is to manage risk effectively.

- Identify High-Impact News Events: Utilize the Forex Factory calendar to pinpoint high-impact economic releases, such as Non-Farm Payrolls (NFP) or interest rate decisions. Prioritize events with a significant historical impact on the chosen currency pair.

- Pre-News Analysis: Before the news release, analyze the current market conditions. Look at the chart for potential support and resistance levels, recent price action, and overall market sentiment. This helps determine a potential entry point and stop-loss placement.

- News Release and Immediate Reaction: Observe the market’s immediate reaction to the news. A strong reaction confirms the news’s impact. Enter a trade based on your pre-news analysis and the immediate price movement, aiming to capitalize on the initial volatility.

- Profit Target and Stop-Loss: Set a profit target based on your risk tolerance and the expected price movement. Place a stop-loss order to limit potential losses. These should be determined

before* entering the trade.

- Post-News Analysis: After the initial volatility subsides, assess the trade’s outcome. Analyze the market’s longer-term reaction to the news. This helps refine your strategy for future trades.

Backtesting the Forex Factory News Trading Strategy

Backtesting involves applying your strategy to historical data to evaluate its effectiveness. This helps refine your approach and identify potential weaknesses.To backtest, you need historical Forex data and a record of past news events. You can find this information through various Forex brokers or data providers. Review your chosen currency pair’s price action around past high-impact news releases.

Compare your hypothetical trades based on your strategy against the actual price movements. Document your trades, including entry and exit points, profit/loss, and reasons for the outcome. This data will highlight strengths and weaknesses in your strategy, helping you optimize it.

News Trading Checklist

Preparation is crucial for successful news trading. This checklist helps ensure you’re ready for each trade.

- Review Forex Factory Calendar: Identify high-impact news events relevant to your chosen currency pairs.

- Analyze Market Conditions: Assess current price action, support/resistance levels, and overall market sentiment.

- Determine Entry and Exit Points: Define your entry price, stop-loss, and profit target before the news release.

- Set Order Types: Use limit orders for entry and stop-loss orders to manage risk effectively.

- Monitor News Release and Market Reaction: Observe the market’s response to the news and adjust your strategy if needed.

- Review and Analyze Trades: After each trade, analyze the outcome and identify areas for improvement.

Examples of Successful and Unsuccessful News Trades

Analyzing both successful and unsuccessful trades is essential for learning and improvement.

- Successful Trade: A trader anticipated a strong positive reaction to a better-than-expected NFP report for the USD. They placed a buy order on EUR/USD before the release, anticipating a drop in the pair. The report was indeed positive, the USD strengthened, and the EUR/USD fell as predicted, resulting in a profitable trade. The trader’s pre-news analysis, well-defined stop-loss, and profit target contributed to the success.

- Unsuccessful Trade: A trader anticipated a significant drop in GBP/USD following a negative UK inflation report. They placed a sell order. However, the market reacted unexpectedly positively, perhaps due to other unforeseen factors. The GBP/USD rose, and the trader’s stop-loss was triggered, resulting in a loss. The trader’s analysis failed to account for other market influences, highlighting the need for comprehensive market analysis.

Technical Analysis Integration with Forex Factory News: Analyzing Forex Factory News For Profitable Trading Opportunities

Forex Factory news, while invaluable for understanding market sentiment and potential price movements, shouldn’t be used in isolation. Integrating it with technical analysis provides a more robust and reliable trading strategy, reducing reliance on news alone and mitigating the risk of false signals. By combining the fundamental insights from Forex Factory with the visual representation of price action on charts, traders can significantly improve their trading decisions.Combining technical analysis with Forex Factory news involves using chart patterns and indicators to confirm or deny the trading signals suggested by news events.

This approach helps filter out noise and improve accuracy. For instance, a positive economic report might suggest a bullish outlook, but if the price is already near resistance levels and showing bearish candlestick patterns, a trader might choose to wait for a clearer confirmation before entering a long position. Conversely, a negative news event might suggest a bearish outlook, but a bullish engulfing pattern could signal a potential price reversal.

Identifying Breakouts and Reversals Using News and Chart Patterns

News events often coincide with significant price movements, creating breakout or reversal opportunities. A strong positive news release, coupled with a price breakout above a key resistance level accompanied by high volume, could signal a strong bullish trend. Conversely, a negative news event combined with a bearish breakdown below support, confirmed by increasing volume, might suggest a significant bearish move.

Traders should look for confirmation from chart patterns like head and shoulders (reversal), triangles (continuation or breakout), or flags (continuation), to further strengthen their trading decisions based on the news.

Using Candlestick Patterns to Confirm or Deny Forex Factory News Signals

Candlestick patterns provide valuable insights into the market’s immediate sentiment and can act as powerful confirmation tools for news-driven trades. For example, a bullish news event coupled with a bullish engulfing candlestick pattern at a support level would strengthen the bullish signal. Conversely, a bearish news event combined with a bearish engulfing pattern at a resistance level would increase the likelihood of a downward trend.

However, a divergence between the news sentiment and candlestick patterns might suggest a potential reversal or weakening of the anticipated trend. A strong bullish news event with a bearish harami candlestick pattern might indicate that the market isn’t fully embracing the positive news.

Illustrative Example of Successful News and Technical Analysis Integration

Imagine a EUR/USD chart showing a clear ascending triangle pattern nearing its apex. A positive Eurozone PMI report is released exceeding expectations. This news, combined with the impending breakout from the triangle pattern, presents a strong bullish signal. A subsequent bullish engulfing candlestick pattern confirms the breakout, signaling a potential long entry point. The trader might set a stop-loss below the triangle’s lower trendline and a take-profit target at a previously identified resistance level.

The volume accompanying the breakout and subsequent price movement would also provide additional confirmation of the strength of the move. The overall picture – a bullish chart pattern approaching a breakout, positive news reinforcing the bullish sentiment, and confirmation from a bullish candlestick pattern – creates a high-probability trading opportunity.

Mastering the art of analyzing Forex Factory news for profitable trading opportunities involves a blend of understanding market dynamics, interpreting news sentiment, and implementing a solid risk management strategy. By combining news analysis with technical indicators, you can significantly improve your trading accuracy and potentially enhance your profitability. Remember, consistent practice, backtesting, and continuous learning are key to success in this dynamic market.

Start applying these strategies today and watch your trading evolve!