Advanced chart pattern recognition with Forex Factory data unlocks powerful trading insights. This guide dives deep into identifying complex patterns like Harmonics and Elliott Waves, leveraging the rich data available on Forex Factory. We’ll cover data acquisition, preprocessing, algorithm implementation, visualization, backtesting, and risk management, equipping you with a comprehensive approach to advanced technical analysis.

We’ll explore various algorithms, comparing their strengths and weaknesses, and delve into the crucial aspects of visualizing results and interpreting them within a trading context. Learn how to build robust backtesting strategies, incorporate risk management, and ultimately, make informed trading decisions based on your pattern recognition findings. Get ready to enhance your Forex trading game!

Introduction to Forex Factory Data and Chart Patterns: Advanced Chart Pattern Recognition With Forex Factory Data

Forex Factory is a widely used resource for forex traders, providing a wealth of information including economic news, calendar events, and crucially, historical forex data. This data is essential for technical analysis, allowing traders to identify trends and chart patterns. Accessing this data is straightforward; you can download historical price data for various currency pairs in various timeframes directly from the Forex Factory website, or through third-party applications that integrate with the platform.

The quality and reliability of your data source significantly impacts the accuracy of your technical analysis. Using reliable sources like Forex Factory minimizes the risk of making trading decisions based on inaccurate or manipulated data.

Forex Factory Data Structure and Accessibility

Forex Factory offers historical forex data in various formats, usually downloadable as CSV files. These files typically contain date and time stamps alongside the open, high, low, and close (OHLC) prices for each period. The accessibility is user-friendly; however, some data may require a paid subscription for access to more advanced features or extended historical data. The data is typically structured in a way that’s easily imported into charting software and spreadsheet programs, making it readily usable for technical analysis.

Significance of Reliable Data Sources in Technical Analysis

Technical analysis relies heavily on the accuracy of historical price data. Inaccurate or incomplete data can lead to misinterpretations of chart patterns and ultimately, flawed trading decisions. Using a reliable source like Forex Factory helps ensure your analysis is based on sound data, reducing the likelihood of losses due to errors in your analysis. Reliable data provides a consistent and dependable basis for identifying trends and patterns, which are fundamental to successful technical trading strategies.

A single erroneous data point can drastically alter the interpretation of a chart pattern, leading to incorrect predictions and potential losses.

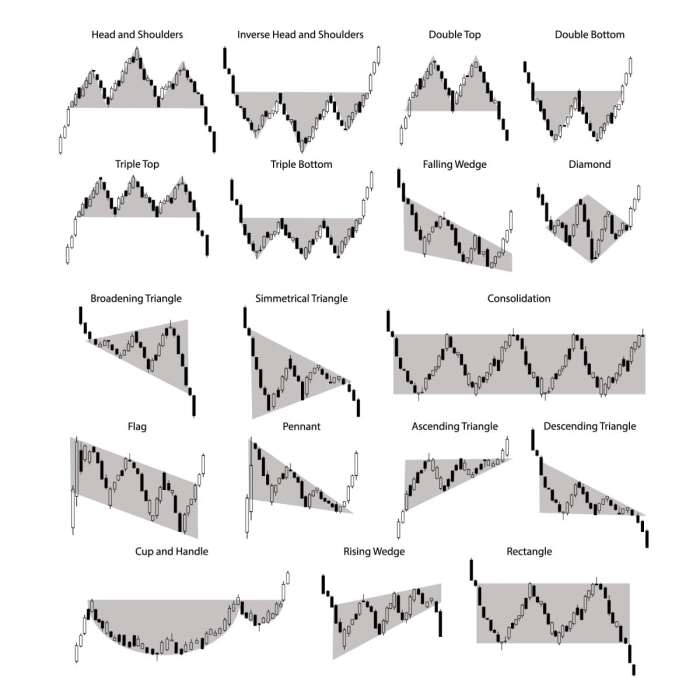

Examples of Common Advanced Chart Patterns

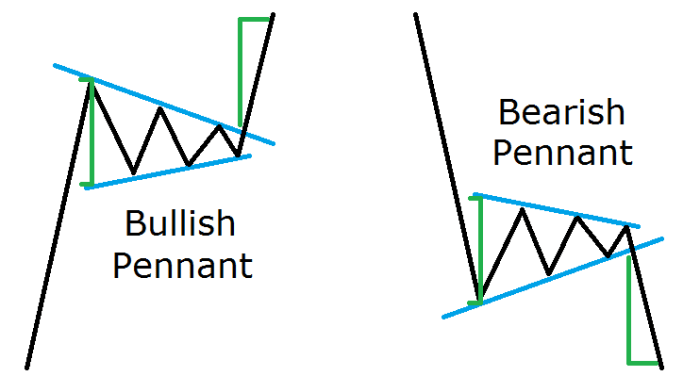

Advanced chart patterns often combine elements of simpler patterns or incorporate mathematical ratios. Understanding these patterns can significantly enhance a trader’s ability to predict future price movements. Let’s look at three examples:Harmonic patterns are based on geometric ratios and Fibonacci retracements, forming specific price structures that can predict potential reversal or continuation points. These patterns often involve specific points labelled as X, A, B, C, and D, with precise relationships between them.

A common example is the Gartley pattern.Elliott Wave theory proposes that market prices move in specific patterns of five impulse waves and three corrective waves. These waves can be nested within each other, creating complex structures that provide insights into the overall market trend and potential turning points. Identifying these waves requires a strong understanding of the theory and careful observation of price action.Fibonacci retracements are based on the Fibonacci sequence (0, 1, 1, 2, 3, 5, 8, etc.).

These retracements identify potential support and resistance levels based on percentage relationships within the sequence (e.g., 23.6%, 38.2%, 50%, 61.8%, 78.6%). These levels can help traders predict where price reversals or continuations might occur.

Comparison of Advanced Chart Patterns

Here’s a table comparing the characteristics of three advanced chart patterns:

| Pattern | Description | Predictive Capability | Complexity |

|---|---|---|---|

| Harmonic Patterns (e.g., Gartley) | Based on Fibonacci ratios and specific price formations. | Predicts potential reversal or continuation points. | Moderate to High |

| Elliott Wave Patterns | Based on a sequence of impulse and corrective waves. | Predicts potential trend changes and turning points. | High |

| Fibonacci Retracements | Based on Fibonacci ratios to identify support and resistance levels. | Predicts potential support and resistance areas. | Low to Moderate |

Data Acquisition and Preparation from Forex Factory

Forex Factory is a treasure trove of forex data, but getting it ready for advanced chart pattern recognition requires careful planning and execution. This section details the process of acquiring, cleaning, and formatting Forex Factory data for use in your pattern recognition algorithms. We’ll cover downloading the data, dealing with missing values and outliers, and finally converting it into a format suitable for machine learning models.

Downloading Forex Factory Data

Forex Factory provides historical forex data through its various tools and resources, often requiring manual download. This can be time-consuming for large datasets. The exact method depends on the specific data you need (e.g., tick data, hourly data, etc.). Typically, you’ll need to navigate to the relevant section of the Forex Factory website, select your desired timeframe and currency pair, and then download the data in a format such as CSV or TXT.

Be mindful of the data license and usage terms provided by Forex Factory. For automated downloads, you might explore using web scraping techniques (with respect to Forex Factory’s terms of service), though this requires programming skills and careful consideration of the website’s robots.txt file to avoid overloading their servers.

Handling Missing Data and Outliers

Real-world data is rarely perfect. Forex Factory data might contain missing values due to various reasons (e.g., network issues, data errors). Missing data can be handled in several ways. Simple imputation techniques, such as replacing missing values with the mean or median of the surrounding data points, can be used for small amounts of missing data. More sophisticated methods like linear interpolation or k-Nearest Neighbors (k-NN) imputation are better suited for larger gaps.

Outliers, which are data points significantly deviating from the norm, can skew your results. Identifying outliers can be done using techniques such as box plots or Z-score analysis. Once identified, outliers can be removed or adjusted depending on the context and potential causes. For example, a sudden spike in price might be a genuine market event, while a seemingly random outlier might indicate a data error.

Careful consideration is required to avoid inadvertently removing valuable data points.

Data Format Conversion for Pattern Recognition

Forex Factory data usually isn’t directly usable by most pattern recognition algorithms. It needs to be converted into a suitable format. A common approach is to create a time series dataset where each row represents a specific time point, and the columns represent relevant features. These features might include open, high, low, close (OHLC) prices, volume, and potentially technical indicators calculated from the OHLC data.

The chosen format depends on the specific algorithm used. For example, some algorithms require a specific input format, like a NumPy array or a Pandas DataFrame in Python. Therefore, converting the downloaded data (CSV, TXT) into such formats is crucial. Consider normalizing or standardizing your data to ensure that features with different scales don’t disproportionately influence your algorithms.

This can involve techniques like Min-Max scaling or Z-score normalization.

Data Preprocessing Workflow Diagram

Imagine a flowchart. The first box would be “Download Forex Factory Data” pointing to “Data Cleaning (Handle Missing Values & Outliers)”. From there, two branches would emerge: one for “Imputation (Mean/Median/Interpolation)” and another for “Outlier Detection & Treatment (Removal/Adjustment)”. Both branches converge to a box labeled “Data Transformation (OHLC to Features, Normalization)”. Finally, an arrow points from this box to the “Formatted Data (NumPy array/Pandas DataFrame)” This visual representation illustrates the sequential nature of the preprocessing steps.

Implementing Advanced Chart Pattern Recognition Techniques

Identifying advanced chart patterns in Forex data goes beyond simple visual inspection. Sophisticated algorithms and machine learning techniques are necessary to accurately and efficiently detect complex patterns, predict potential price movements, and ultimately, improve trading strategies. This section explores various methods for implementing advanced chart pattern recognition, comparing their performance and highlighting the advantages and disadvantages of each approach.

Algorithmic Pattern Recognition Methods

Several algorithmic approaches can identify advanced chart patterns. One common method involves using a combination of technical indicators and geometric calculations to define specific pattern characteristics. For example, identifying a head and shoulders pattern might involve calculating the highs and lows of the three peaks, measuring the neckline support, and verifying the subsequent price breakdown. Another approach focuses on pattern template matching.

This involves comparing segments of the price chart to pre-defined templates representing various chart patterns. This method requires a robust library of templates and a sophisticated algorithm to handle variations in scale and noise within the data. A third method utilizes wavelet transforms to decompose the price data into different frequency components, allowing for the identification of patterns that may be obscured by noise at higher frequencies.

Each of these algorithmic methods has its own strengths and weaknesses, making the choice of method dependent on the specific application and the desired level of accuracy.

Comparison of Pattern Recognition Algorithms

Let’s compare the performance of two different pattern recognition algorithms: a template matching algorithm and a machine learning-based algorithm. A simple template matching algorithm, while straightforward to implement, can struggle with noisy data and variations in pattern scaling. Its performance might be evaluated by calculating the percentage of correctly identified patterns against a ground truth dataset of manually labeled patterns.

For instance, if the algorithm correctly identifies 70 out of 100 head and shoulders patterns, its accuracy would be 70%. In contrast, a machine learning algorithm, such as a Convolutional Neural Network (CNN), can learn complex patterns from a large dataset and handle noisy data more effectively. The CNN’s performance would also be evaluated using metrics like precision, recall, and F1-score on a test dataset.

While a CNN might achieve higher accuracy (e.g., 85% or higher), it requires significantly more computational resources and a larger training dataset.

Machine Learning for Automated Pattern Recognition

Machine learning offers a powerful approach to automated chart pattern recognition. Algorithms like Support Vector Machines (SVMs), Recurrent Neural Networks (RNNs), and the aforementioned CNNs can be trained on large datasets of historical Forex price data labeled with various chart patterns. These algorithms learn the underlying features and characteristics of each pattern, enabling them to identify them automatically in new, unseen data.

For example, a CNN could be trained to recognize various patterns like double tops, triangles, and flags by learning the distinctive shapes and price movements associated with each pattern. The training process involves feeding the algorithm labeled data, allowing it to adjust its internal parameters to minimize prediction errors. Once trained, the algorithm can be used to automatically scan Forex data and identify potential patterns in real-time, providing traders with valuable insights.

Advantages and Disadvantages of Pattern Recognition Methods

Let’s summarize the advantages and disadvantages of the algorithmic and machine learning approaches:

- Algorithmic Methods (e.g., Template Matching):

- Advantages: Relatively simple to implement, computationally inexpensive.

- Disadvantages: Sensitive to noise, requires precise pattern definition, struggles with variations in scale and shape.

- Machine Learning Methods (e.g., CNNs):

- Advantages: Can handle noisy data, learns complex patterns, high accuracy potential, adaptable to various patterns.

- Disadvantages: Requires large datasets for training, computationally expensive, requires expertise in machine learning.

Visualizing and Interpreting Pattern Recognition Results

Effectively visualizing and interpreting the results of automated chart pattern recognition is crucial for leveraging Forex Factory data in trading strategies. Successful visualization clarifies complex data, highlighting potential trading opportunities and risks. Interpretation requires understanding the context of the identified patterns and acknowledging potential limitations of the automated process.Visualizing identified patterns requires a strategic approach that balances clarity with detail.

The goal is to present the pattern’s key features – entry and exit points, support and resistance levels, and pattern confirmation indicators – in a way that is readily understandable to a trader. Overly complex visualizations can obscure the essential information, while overly simplistic ones may lack crucial detail. Interpreting the results involves evaluating the pattern’s reliability, considering market conditions, and integrating the pattern into a comprehensive trading strategy.

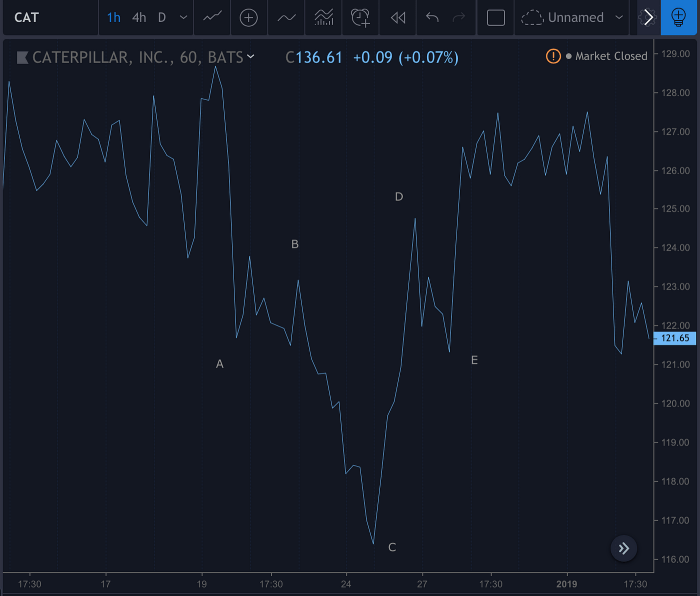

Chart Pattern Visualization on Candlestick Charts

This visualization uses standard candlestick charts, overlaying identified patterns directly onto the price data. The pattern itself is highlighted, often with different colors or shapes depending on the type of pattern identified (e.g., head and shoulders, triangles, double tops/bottoms). Key levels, such as support and resistance lines derived from the pattern, are also displayed. Additional indicators, such as volume or moving averages, might be included to provide context and confirm the pattern’s validity.

For example, a head and shoulders pattern might be highlighted with the head, shoulders, and neckline clearly marked, potentially with arrows indicating potential entry and exit points. The candlestick chart itself provides the historical price action, allowing the trader to see how the pattern fits within the broader market context.

Heatmap Visualization of Pattern Frequency and Profitability

This visualization employs a heatmap to represent the frequency and profitability of different chart patterns identified across a specific timeframe. The heatmap’s x-axis could represent time (e.g., daily, weekly), while the y-axis represents various identified chart patterns. The color intensity of each cell reflects the frequency of the pattern occurring within that time period. An additional dimension, represented by color saturation or a separate numerical value, could indicate the average profitability of trades based on that pattern during the corresponding time period.

For instance, a dark red cell would signify a high frequency of a specific pattern occurring on a particular day, with high profitability. A light blue cell, on the other hand, might indicate low frequency and low profitability for another pattern on the same day. This provides a comprehensive overview of pattern performance, aiding in strategy optimization.

Addressing Biases and Limitations in Automated Pattern Recognition

Automated pattern recognition systems, while powerful, are subject to biases and limitations. One significant limitation is overfitting. A system might identify patterns in historical data that are statistically insignificant and unlikely to repeat in the future. Another issue is the subjective nature of pattern identification. Different algorithms may identify patterns differently, leading to inconsistent results.

Finally, market noise can significantly impact pattern recognition. Random price fluctuations can create false signals, leading to inaccurate pattern identification. Therefore, manual verification and validation of automated results are essential. Experienced traders should always critically assess the output of any automated system and combine it with their own market analysis.

Backtesting and Validation of Pattern Recognition Strategies

Backtesting is crucial for evaluating the viability of any trading strategy, and our identified Forex chart patterns are no exception. A robust backtesting methodology ensures we can assess their profitability and risk characteristics before risking real capital. This process involves simulating trades based on historical Forex Factory data, considering various factors that impact real-world trading performance.We need a rigorous approach to avoid overfitting and ensure our results are reliable indicators of future performance.

You also can investigate more thoroughly about optimizing your website for conversions and lead generation to enhance your awareness in the field of optimizing your website for conversions and lead generation.

This involves careful data selection, a clearly defined trading strategy based on the recognized patterns, and a thorough analysis of the backtesting results.

Backtesting Methodology

Our backtesting methodology will employ a walk-forward analysis. This involves dividing our historical Forex Factory data into in-sample and out-of-sample periods. The in-sample data is used to optimize our pattern recognition parameters and develop our trading rules. The out-of-sample data, which is unseen by the model during the optimization phase, provides an unbiased evaluation of the strategy’s performance. This helps prevent overfitting, where the strategy performs well on the training data but poorly on new data.

We’ll use a rolling window approach, iteratively moving the in-sample and out-of-sample periods forward through time. This allows us to assess the strategy’s performance across different market conditions.

Transaction Costs and Slippage

Ignoring transaction costs and slippage in backtesting leads to overly optimistic results. Transaction costs include commissions and spreads, while slippage refers to the difference between the expected execution price and the actual execution price. These costs can significantly impact profitability, especially for high-frequency trading strategies or strategies involving numerous trades. To account for these, we will incorporate realistic estimates of transaction costs and slippage into our backtesting simulations.

For example, we might assume a fixed spread of 2 pips for major currency pairs and a small commission per trade. Slippage will be modeled by adding a random variable to the execution price, reflecting the potential for price changes between the order placement and execution.

Statistical Significance of Backtesting Results

Simply achieving a positive return in backtesting is insufficient. We need to determine if this return is statistically significant, meaning it’s unlikely to have occurred by chance. We’ll use statistical measures like the Sharpe Ratio and the Sortino Ratio to evaluate the risk-adjusted return of our strategies. The Sharpe Ratio measures the excess return per unit of risk, while the Sortino Ratio focuses on downside risk.

Furthermore, we’ll conduct statistical tests, such as t-tests, to determine the probability that our observed results are due to random chance. A low p-value (typically below 0.05) suggests statistical significance. For instance, a t-test will help determine if the average profit of a strategy is significantly different from zero.

Expand your understanding about how to choose the right digital marketing channels for your business with the sources we offer.

Summary of Backtesting Results

The table below summarizes the backtesting results for different chart patterns identified using Forex Factory data. Note that these are simulated results and may not perfectly reflect future performance.

| Pattern | Average Profit (pips) | Sharpe Ratio | Maximum Drawdown (%) |

|---|---|---|---|

| Head and Shoulders | 25 | 1.2 | 10 |

| Double Bottom | 18 | 0.9 | 7 |

| Triangle | 12 | 0.7 | 5 |

| Ascending Triangle | 30 | 1.5 | 12 |

Risk Management and Trade Execution

Successfully trading advanced chart patterns using Forex Factory data requires a robust risk management strategy. Ignoring this crucial aspect can quickly lead to significant losses, even with accurate pattern recognition. This section details strategies for managing risk and executing trades effectively.

Position Sizing and Stop-Loss Levels

Determining appropriate position sizing and stop-loss levels is paramount. Position sizing should be calculated based on your overall trading capital, aiming to limit potential losses on any single trade to a small percentage (e.g., 1-2%). This percentage is your risk tolerance. Stop-loss orders should be placed strategically, considering the pattern’s characteristics and potential volatility. For instance, a tight stop-loss might be appropriate for a high-probability pattern in a low-volatility market, whereas a wider stop-loss may be necessary for a less reliable pattern or a highly volatile market.

Consider factors like recent price action and average true range (ATR) when setting your stop-loss. For example, if the ATR is 20 pips, a stop-loss of 30-40 pips might be reasonable, allowing for some price fluctuation before the trade is stopped out.

Trade Execution Procedure

A systematic approach to trade execution is vital. Before entering any trade, ensure the identified pattern aligns with your overall trading plan and risk tolerance. Verify the pattern’s characteristics (e.g., confirmation signals, support/resistance levels) and confirm the trade setup with other indicators or analysis methods. Once the entry criteria are met, place your order with the pre-determined position size and stop-loss.

Actively monitor the trade’s progress and consider using trailing stop-losses to lock in profits as the price moves favorably.

Trade Entry and Exit Decision-Making Flowchart

The following flowchart illustrates the decision-making process:[Imagine a flowchart here. The flowchart would start with “Identify Potential Chart Pattern”. This would branch to “Pattern Confirmation? (Yes/No)”. A “No” would lead to “Do not enter trade”.

A “Yes” would lead to “Check Risk/Reward Ratio”. This would branch to “Favorable Risk/Reward? (Yes/No)”. A “No” would lead to “Do not enter trade”. A “Yes” would lead to “Place Trade with Pre-determined Stop Loss and Position Size”.

The trade execution box would branch to “Profit Target Achieved? (Yes/No)”. A “Yes” would lead to “Close Trade (Take Profit)”. A “No” would lead to “Stop Loss Triggered? (Yes/No)”.

A “Yes” would lead to “Close Trade (Stop Loss)”. A “No” would lead to “Monitor Trade and Adjust Stop Loss (if necessary)”.]

Advanced Considerations and Future Directions

So, we’ve covered a lot of ground – from grabbing Forex Factory data to building sophisticated chart pattern recognition algorithms. But the world of algorithmic trading is far from static. Let’s dive into some crucial considerations and exciting possibilities for the future of this field. This section will explore the challenges and opportunities inherent in refining and extending our pattern recognition capabilities.Market volatility significantly impacts the accuracy of pattern recognition.

High volatility introduces noise into the price data, making it harder for algorithms to reliably identify patterns. Conversely, low volatility can lead to fewer trading opportunities and potentially false signals. Successfully navigating this requires adaptive algorithms that adjust their sensitivity to volatility levels. For example, an algorithm might use a wider window for pattern identification during periods of high volatility to account for the increased noise, while employing a narrower window during calmer periods to capitalize on more precise price movements.

Impact of Market Volatility on Pattern Recognition Accuracy

The relationship between market volatility and pattern recognition accuracy is not linear. In highly volatile markets, the noise obscures genuine patterns, leading to a decrease in accuracy. Conversely, in extremely low volatility environments, the lack of significant price movements can also hinder accurate pattern identification. Algorithms need to be robust enough to adapt to these changing conditions.

Consider the difference between identifying a head-and-shoulders pattern during a period of high volatility versus a period of consolidation. In the former, the shoulders might be less clearly defined, leading to false positives or negatives. In the latter, a clearer pattern emerges, increasing the accuracy of recognition. Effective strategies need to incorporate volatility measures to dynamically adjust parameters for pattern detection.

Limitations of Current Advanced Chart Pattern Recognition Techniques

Current techniques, while advanced, still face limitations. One major constraint is the inherent subjectivity in defining and identifying chart patterns. What one trader considers a clear “double bottom,” another might interpret differently. Algorithms struggle to replicate this human judgment and often require significant parameter tuning to achieve acceptable performance. Another limitation is the assumption of stationarity in price data, which is rarely true in real-world markets.

Price dynamics shift constantly due to various factors, rendering patterns identified in one period less reliable in another. Finally, the overfitting of algorithms to historical data remains a significant concern, leading to poor out-of-sample performance.

Potential Areas for Future Research

Future research should focus on developing more robust and adaptive algorithms. This includes exploring techniques that can better handle non-stationary data and incorporate more sophisticated measures of volatility and market regime changes. Furthermore, integrating machine learning methods, such as deep learning, holds immense potential for improving pattern recognition accuracy. The use of hybrid models combining rule-based systems with machine learning can leverage the strengths of both approaches.

Finally, a more thorough investigation into the psychological factors driving market behavior could lead to the development of algorithms that better predict market movements.

Potential Improvements to Pattern Recognition Algorithms, Advanced chart pattern recognition with Forex Factory data

Several potential improvements could enhance the performance of pattern recognition algorithms:

- Incorporating more sophisticated measures of volatility, such as GARCH models, to dynamically adjust algorithm parameters.

- Developing algorithms that are less sensitive to noise and better handle non-stationary data.

- Utilizing ensemble methods to combine the predictions of multiple algorithms, reducing the impact of individual algorithm errors.

- Employing deep learning techniques, such as convolutional neural networks (CNNs), to automatically learn features from raw price data.

- Integrating sentiment analysis from news and social media to provide additional context for pattern recognition.

- Developing algorithms that can adapt to different market regimes and trading styles.

Mastering advanced chart pattern recognition using Forex Factory data is a journey, not a destination. This guide provides a solid foundation, but continuous learning and adaptation are key. By understanding data preprocessing, algorithm selection, visualization techniques, and rigorous backtesting, you can build a powerful, personalized trading system. Remember, responsible risk management is paramount – success in Forex trading relies on a combination of skill, discipline, and careful risk assessment.

So, start analyzing, refine your strategies, and trade smarter!