The legal and regulatory landscape surrounding cryptocurrencies worldwide. – The legal and regulatory landscape surrounding cryptocurrencies worldwide is a complex and rapidly evolving field. This exploration delves into the diverse approaches governments are taking to regulate this burgeoning digital asset class, from the established markets of the US and EU to the innovative approaches seen in Asia. We’ll examine the challenges of classifying cryptocurrencies (are they securities, commodities, or currencies?), the legal hurdles surrounding ICOs and STOs, and the unique regulatory complexities of decentralized finance (DeFi).

We’ll also consider the crucial role of international cooperation in creating a stable and predictable global regulatory framework for cryptocurrencies.

Understanding this landscape is crucial for investors, businesses, and policymakers alike. The decisions made today will shape the future of this transformative technology, influencing its potential to revolutionize finance and beyond. This analysis aims to provide a clear, concise overview of the current state of play, highlighting key issues and potential future trends.

Global Regulatory Approaches to Cryptocurrencies: The Legal And Regulatory Landscape Surrounding Cryptocurrencies Worldwide.

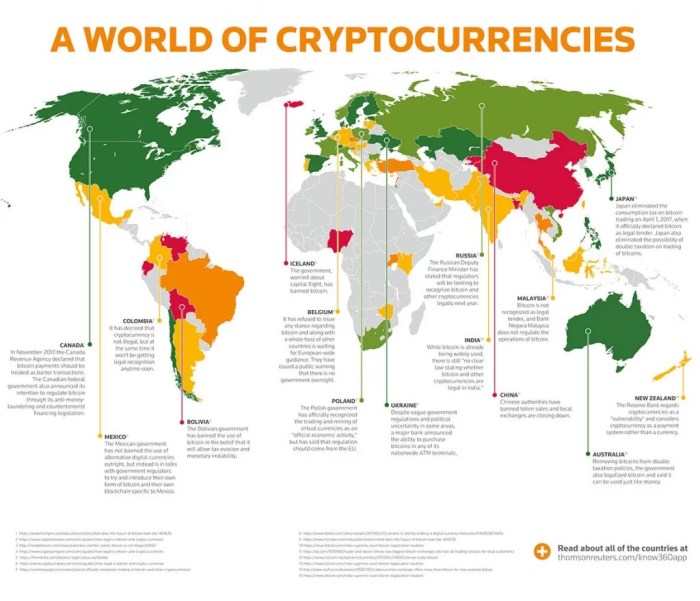

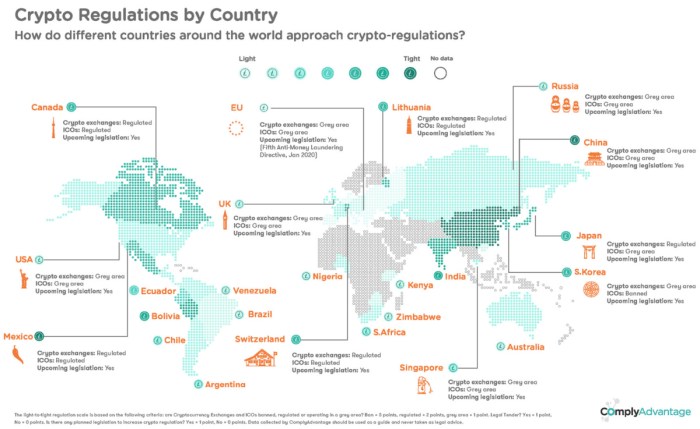

The global regulatory landscape for cryptocurrencies is a patchwork of differing approaches, reflecting varying levels of technological understanding, risk tolerance, and economic priorities. Countries are grappling with how to integrate this innovative technology into existing financial frameworks while mitigating potential risks. This section will compare and contrast the regulatory strategies of several key jurisdictions, highlighting the challenges and complexities involved.

Comparative Analysis of Cryptocurrency Regulations

Understanding the global regulatory landscape requires examining specific jurisdictions. The following table compares the regulatory frameworks of the United States, the European Union, and Japan, focusing on cryptocurrency trading, issuance, and taxation. It’s important to note that these frameworks are constantly evolving, and the information below represents a snapshot in time. Always consult up-to-date legal resources for the most current information.

| Jurisdiction | Trading Regulations | Issuance Regulations | Tax Implications |

|---|---|---|---|

| United States | Varying state-level regulations; federal agencies like the SEC and CFTC have jurisdiction over specific aspects of crypto trading, focusing on anti-money laundering (AML) and Know Your Customer (KYC) compliance. Some exchanges are registered as broker-dealers. | The SEC scrutinizes crypto offerings, often classifying them as securities under the Howey Test. This means many initial coin offerings (ICOs) have faced regulatory scrutiny. | Cryptocurrency transactions are treated as property for tax purposes, meaning capital gains taxes apply to profits from trading or other disposals. |

| European Union | The Markets in Crypto-Assets (MiCA) regulation aims to create a unified regulatory framework across the EU, covering aspects like market abuse, custody, and transparency. Individual member states may have additional requirements. | MiCA sets standards for issuance and oversight of crypto assets, depending on their classification. Stablecoins are subject to stricter rules. | Taxation varies across member states, but generally aligns with the treatment of other assets, with capital gains taxes being a common feature. |

| Japan | Japan has a relatively mature regulatory framework for cryptocurrency exchanges, requiring licensing and adherence to AML/KYC rules. | Regulations exist for Initial Coin Offerings (ICOs), requiring disclosure and registration in some cases. | Similar to other jurisdictions, capital gains taxes generally apply to profits from cryptocurrency trading. |

Classification of Cryptocurrencies by Governments

Governments adopt diverse approaches to classifying cryptocurrencies, leading to different regulatory implications. Some treat them as commodities (like gold or oil), subject to regulations overseen by bodies like the Commodity Futures Trading Commission (CFTC) in the US. Others classify them as securities (like stocks or bonds), falling under the purview of securities regulators such as the Securities and Exchange Commission (SEC) in the US.

A third approach considers them as currencies, potentially subjecting them to regulations applicable to traditional fiat currencies. This lack of uniform classification creates legal uncertainty and challenges for businesses and investors. For example, the SEC’s classification of certain cryptocurrencies as securities has significant implications for their offering and trading.

Balancing Innovation and Consumer Protection

Regulators face the significant challenge of fostering innovation in the cryptocurrency space while simultaneously protecting consumers from fraud, market manipulation, and other risks. This necessitates a delicate balance. Overly restrictive regulations could stifle innovation and drive activity to less regulated jurisdictions. Conversely, a lack of regulation could expose consumers to significant harm. The ongoing debate focuses on finding regulatory frameworks that are both effective in mitigating risks and flexible enough to accommodate the rapid technological advancements in the cryptocurrency market.

This includes developing robust AML/KYC standards, implementing effective market surveillance mechanisms, and providing clear guidelines for investors. The success of this balancing act will significantly shape the future of the cryptocurrency industry.

Specific Regulatory Issues in the Cryptocurrency Space

The rapid growth of cryptocurrencies has presented significant legal and regulatory challenges worldwide. Governments are grappling with how to classify these digital assets, how to regulate their issuance and trading, and how to mitigate the risks associated with their use in illicit activities. This section delves into some of the most pressing specific regulatory issues currently facing the cryptocurrency industry.

Legal Challenges Surrounding ICOs and STOs

Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) represent two distinct approaches to raising capital using cryptocurrencies. However, both have faced significant legal scrutiny due to their potential to fall under existing securities regulations. ICOs, often perceived as unregulated fundraising events, have drawn criticism for lack of transparency and potential for fraud. STOs, on the other hand, attempt to comply with securities laws by offering tokens with associated ownership rights or other financial benefits.

The crucial distinction lies in how regulators classify the offered tokens: if deemed securities, they fall under existing securities laws requiring registration and compliance with disclosure requirements. This classification depends on the Howey Test, a legal framework used in the US to determine whether an investment contract exists. Failure to comply with securities laws can lead to significant legal repercussions for issuers.

For example, the SEC has taken enforcement actions against several ICOs deemed to be unregistered securities offerings. The regulatory landscape for STOs is still evolving, with ongoing debates about the appropriate level of regulation and the best practices for ensuring compliance.

Legal Considerations Related to Money Laundering and Terrorist Financing

Cryptocurrencies, due to their pseudonymous nature and cross-border accessibility, pose significant challenges for anti-money laundering (AML) and counter-terrorist financing (CTF) efforts. The lack of centralized control and the speed of transactions make it difficult to track the flow of funds and identify suspicious activities. Regulatory bodies worldwide are working to address these concerns through various measures, including: requiring cryptocurrency exchanges to implement robust KYC (Know Your Customer) and AML/CTF compliance programs; enhancing international cooperation to share information and track illicit transactions; and developing technological solutions, such as blockchain analytics, to improve transparency and traceability.

Non-compliance with AML/CTF regulations can result in significant penalties for cryptocurrency businesses and individuals. For instance, exchanges failing to properly implement KYC procedures risk facing substantial fines and operational restrictions. The ongoing challenge lies in balancing the need for robust regulation with the desire to avoid stifling innovation within the cryptocurrency space.

Comparative Analysis of Regulatory Responses to Stablecoins

Stablecoins, designed to maintain a stable value pegged to a fiat currency or other asset, have attracted significant regulatory attention due to their potential to bridge the gap between traditional finance and the cryptocurrency world. Different jurisdictions have adopted varying approaches to regulating stablecoins. Some countries, like the US, are exploring a comprehensive regulatory framework that addresses issues such as reserve requirements, transparency, and consumer protection.

Others, like Singapore, have adopted a more principles-based approach, focusing on ensuring the stability and resilience of the stablecoin ecosystem rather than imposing strict prescriptive rules. The European Union is also developing a regulatory framework for crypto-assets, including stablecoins, as part of its broader digital finance strategy. The differing approaches reflect the varying levels of regulatory maturity and the differing priorities of individual jurisdictions.

The lack of a globally harmonized regulatory approach to stablecoins presents challenges for cross-border transactions and raises concerns about regulatory arbitrage. The future will likely see increased international cooperation to develop a more consistent and effective regulatory framework for stablecoins.

The Role of Decentralized Finance (DeFi) in the Regulatory Landscape

DeFi, with its promise of open, permissionless financial services, presents a significant challenge to traditional regulatory frameworks. The decentralized and borderless nature of DeFi platforms makes it difficult for any single jurisdiction to effectively oversee their operations, leading to a complex and evolving regulatory landscape. This section explores the challenges posed by DeFi and examines various regulatory approaches being considered globally.DeFi’s decentralized structure, built on blockchain technology, inherently circumvents traditional intermediaries like banks and exchanges.

This creates both opportunities and risks. The lack of central control makes it difficult to enforce traditional financial regulations designed for centralized institutions. Furthermore, the global reach of DeFi protocols means that jurisdictional boundaries are blurred, making it hard to pinpoint responsibility in cases of fraud, market manipulation, or other illicit activities.

Regulatory Challenges Posed by the Decentralized and Borderless Nature of DeFi Platforms

The decentralized and borderless nature of DeFi presents unique challenges for regulators. Unlike traditional financial institutions that operate within clearly defined geographical boundaries and are subject to national or regional oversight, DeFi protocols often operate across multiple jurisdictions, making it difficult to establish clear regulatory authority. The lack of a central point of control makes it challenging to identify responsible parties in case of failures or misconduct.

Enforcement of regulations becomes problematic, as DeFi protocols are often governed by smart contracts that are resistant to external intervention. This requires regulators to develop new tools and strategies to effectively monitor and regulate these platforms while considering the underlying technology’s design and capabilities. The anonymity offered by some DeFi protocols further complicates regulatory efforts, enabling money laundering and other illegal activities.

Regulatory Approaches to Address Risks Associated with DeFi Lending, Borrowing, and Yield Farming

Regulators are exploring various approaches to address the risks associated with DeFi lending, borrowing, and yield farming. Some jurisdictions are adopting a “wait-and-see” approach, monitoring developments in the DeFi space before implementing specific regulations. Others are taking a more proactive approach, issuing guidance or implementing regulations targeting specific DeFi activities, such as stablecoin issuance or lending platforms. For example, some regulators are focusing on classifying DeFi activities under existing regulatory frameworks, while others are considering the development of bespoke regulatory frameworks tailored to the specific characteristics of DeFi.

A key challenge lies in balancing the need to protect consumers and maintain financial stability with the need to foster innovation in the DeFi space. The inherent complexities of DeFi, including the use of sophisticated algorithms and smart contracts, require regulators to possess a deep understanding of the underlying technology to effectively address the associated risks.

A Hypothetical Regulatory Framework for DeFi

A robust regulatory framework for DeFi needs to strike a balance between promoting innovation and ensuring consumer protection and financial stability. This hypothetical framework incorporates the following key principles:

- Clear Definitions and Classifications: Establish clear definitions and classifications for different DeFi activities, such as lending, borrowing, yield farming, and stablecoin issuance, to provide clarity and facilitate regulatory oversight.

- Licensing and Registration: Implement a licensing and registration regime for DeFi platforms that operate above a certain threshold of activity or handle significant amounts of assets. This would allow regulators to monitor and supervise these platforms more effectively.

- Smart Contract Audits and Security Standards: Mandate regular security audits of smart contracts used by DeFi platforms to identify and mitigate potential vulnerabilities. Establish minimum security standards for DeFi platforms to protect users’ assets.

- Consumer Protection Measures: Implement consumer protection measures, such as disclosure requirements, to ensure that users are fully informed about the risks associated with using DeFi platforms. This includes clear warnings about the volatility of DeFi investments and the potential for losses.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance: Require DeFi platforms to comply with AML and KYC regulations to prevent the use of DeFi platforms for illicit activities. This could involve integrating KYC/AML checks into the platform’s user onboarding process.

- Cross-border Cooperation: Foster international cooperation among regulators to address the cross-border nature of DeFi platforms. This would involve sharing information and coordinating regulatory actions to ensure a consistent and effective regulatory approach.

- Sandboxes for Innovation: Establish regulatory sandboxes to allow DeFi innovators to experiment with new technologies and business models under a controlled environment. This would facilitate innovation while minimizing the risks associated with untested technologies.

International Cooperation and Harmonization of Cryptocurrency Regulations

The rapid growth of cryptocurrencies has highlighted the urgent need for international cooperation in establishing a consistent regulatory framework. Without coordinated efforts, the inherent borderless nature of digital assets creates opportunities for regulatory arbitrage, hindering market stability and potentially fueling illicit activities. Harmonizing regulations, while challenging, offers significant benefits in promoting innovation, investor protection, and global financial stability.International collaborations are crucial for navigating the complexities of crypto regulation, as a patchwork of disparate national rules can create uncertainty and impede cross-border transactions.

A unified approach fosters trust and transparency, encouraging wider adoption and reducing the risk of regulatory fragmentation.

Examples of International Collaborations on Cryptocurrency Regulation

Several international organizations and forums are actively engaged in fostering dialogue and cooperation on cryptocurrency regulation. The Financial Stability Board (FSB), for instance, plays a key role in coordinating global regulatory responses to financial innovation, including cryptocurrencies. Its work focuses on identifying and addressing systemic risks associated with crypto assets. Similarly, the G20, a group of the world’s major economies, has also addressed cryptocurrency regulation within its broader agenda on financial stability and international cooperation.

Regional organizations like the European Union are also developing comprehensive regulatory frameworks for cryptocurrencies, impacting not only member states but also influencing regulatory discussions globally. These collaborations often involve sharing best practices, conducting joint research, and coordinating regulatory approaches to address common challenges.

Challenges and Benefits of Harmonizing Cryptocurrency Regulations

Harmonizing cryptocurrency regulations presents both significant challenges and substantial benefits. Challenges include the varying levels of technological expertise and regulatory capacity across jurisdictions, differences in national priorities and risk tolerance, and the difficulty in reaching consensus on complex technical issues. Different countries may prioritize different aspects of regulation, such as consumer protection, anti-money laundering (AML) measures, or tax implications.

Furthermore, the rapidly evolving nature of cryptocurrency technology necessitates a flexible and adaptable regulatory framework that can keep pace with innovation. However, the benefits of harmonization are compelling. A globally consistent regulatory environment fosters greater legal certainty, reduces regulatory arbitrage, and attracts investment in the cryptocurrency sector. It also enhances cross-border transactions, improves market efficiency, and strengthens efforts to combat illicit activities like money laundering and terrorist financing.

A harmonized approach can lead to a more robust and stable global financial system, facilitating innovation while mitigating risks.

Hypothetical Scenario Illustrating the Impact of Inconsistent Global Regulations

Imagine a scenario where Country A implements strict regulations requiring all cryptocurrency exchanges to be licensed and heavily scrutinized, while neighboring Country B takes a largely laissez-faire approach, with minimal oversight. This disparity could lead to a situation where cryptocurrency trading shifts from Country A to Country B, attracting businesses seeking less stringent regulatory environments. This “regulatory arbitrage” could undermine Country A’s efforts to protect investors and prevent illicit activities.

Furthermore, the lack of harmonization could create market instability, as price fluctuations and trading volumes might be disproportionately influenced by the regulatory policies of individual countries, leading to potential market crashes or manipulation. This scenario highlights the importance of international cooperation in establishing a balanced and consistent regulatory landscape for cryptocurrencies, promoting both innovation and stability in the global financial system.

Future Trends and Challenges in Cryptocurrency Regulation

The rapid evolution of cryptocurrency and related technologies presents a continuously shifting landscape for regulators worldwide. Predicting the future is inherently uncertain, but analyzing current trends and emerging technologies allows us to anticipate likely challenges and opportunities in the regulatory space. Understanding these potential developments is crucial for creating adaptable and effective regulatory frameworks.The impact of emerging technologies like blockchain and NFTs will profoundly shape the future of cryptocurrency regulation.

These technologies are not merely tools for facilitating cryptocurrency transactions; they represent fundamental shifts in how value is exchanged and stored, impacting various sectors beyond finance.

The Impact of Blockchain and NFTs on Regulation

Blockchain’s inherent transparency and immutability present both opportunities and challenges for regulators. While this transparency can aid in tracking illicit activities, the decentralized nature of many blockchains makes it difficult to enforce traditional regulatory measures. Non-Fungible Tokens (NFTs), meanwhile, blur the lines between digital assets, collectibles, and intellectual property, creating new regulatory questions regarding ownership, taxation, and consumer protection.

For instance, the rise of NFT marketplaces necessitates clear guidelines on how to address fraud, copyright infringement, and the potential for market manipulation. Consider the case of OpenSea, a leading NFT marketplace, which has faced scrutiny regarding fraudulent NFTs and the need for improved verification processes. This illustrates the urgent need for regulatory frameworks to address the unique characteristics of NFTs.

Future Challenges in Regulating Cryptocurrencies, The legal and regulatory landscape surrounding cryptocurrencies worldwide.

The decentralized nature of cryptocurrencies creates significant challenges for regulatory bodies. The emergence of Decentralized Autonomous Organizations (DAOs), which operate autonomously based on pre-programmed rules, poses a particular challenge. Regulators grapple with determining which legal entities are responsible for the actions of DAOs and how to enforce regulations on entities without a traditional corporate structure. Similarly, the metaverse, a persistent, shared, 3D virtual world, presents new challenges.

The increasing use of cryptocurrencies within metaverse platforms necessitates regulatory frameworks addressing virtual property rights, taxation, and consumer protection in these virtual environments. The lack of clear jurisdiction over virtual assets and activities within the metaverse is a key challenge that needs immediate attention. For example, virtual land ownership and trading within the metaverse raise questions about property rights and taxation similar to real-world property transactions, but in a vastly different context.

The Role of Self-Regulatory Organizations (SROs)

Self-regulatory organizations (SROs) can play a significant role in shaping the future of cryptocurrency regulation. By fostering industry best practices, establishing ethical guidelines, and implementing internal compliance mechanisms, SROs can help bridge the gap between the rapid innovation in the cryptocurrency space and the need for robust regulatory frameworks. This approach allows for a more agile and responsive regulatory environment, adapting to the constant evolution of the cryptocurrency market. Effective SROs would require collaboration between regulators and industry participants, ensuring both accountability and innovation.

The Impact of Cryptocurrency Regulation on Innovation and Market Development

The regulatory landscape surrounding cryptocurrencies significantly impacts the pace of innovation and the overall health of the market. A balance must be struck between protecting investors and fostering the growth of this nascent technology. Too much regulation can stifle innovation, while too little can lead to instability and market manipulation. This section explores the effects of different regulatory approaches on cryptocurrency market development and innovation.The relationship between cryptocurrency regulation and market development is complex and multifaceted.

Different regulatory approaches have demonstrably different effects on the growth of the cryptocurrency market and the level of innovation within the sector.

Regulatory Approaches and Their Market Impact

The impact of regulatory approaches on cryptocurrency market growth and innovation can be seen clearly when comparing stricter versus more lenient regulatory environments. Strict regulations often lead to decreased market participation and slower innovation, while more lenient approaches can foster growth but may also increase risks.

| Regulatory Approach | Market Impact |

|---|---|

| Strict Regulation (e.g., extensive KYC/AML requirements, limitations on trading, high tax burdens) | Reduced market participation, slower innovation, potentially higher compliance costs for businesses, hindering smaller players. May lead to a decrease in trading volume and a flight of activity to less regulated jurisdictions. Examples include some jurisdictions in Asia that have imposed strict regulations on cryptocurrency exchanges leading to decreased trading volume. |

| Lenient Regulation (e.g., clear but less restrictive guidelines, focus on consumer protection, fostering innovation through regulatory sandboxes) | Increased market participation, faster innovation, potentially attracting more investment and talent. However, this may also increase the risk of market manipulation, fraud, and money laundering if not properly managed. Examples include jurisdictions like Malta or Switzerland which have adopted a more welcoming approach, fostering innovation and attracting cryptocurrency businesses. |

Regulatory Uncertainty and Investor Confidence

Regulatory uncertainty significantly impacts investor confidence and market participation. The lack of clear, consistent rules across different jurisdictions creates uncertainty for investors, making them hesitant to invest significant amounts of capital. This uncertainty can lead to volatility in cryptocurrency prices and reduced overall market liquidity. For instance, inconsistent regulatory pronouncements from different governmental bodies regarding the tax treatment of cryptocurrencies have led to investor confusion and hesitancy.

This uncertainty makes it difficult for businesses to plan long-term strategies and makes it harder to attract investment.

Regulation’s Potential to Stifle or Promote Responsible Development

Regulation has the potential to either stifle innovation or promote responsible development within the cryptocurrency space. Overly restrictive regulations can stifle innovation by creating barriers to entry for new projects and discouraging experimentation. However, well-designed regulations can promote responsible development by protecting consumers, preventing fraud, and ensuring market integrity. A balanced approach is needed to avoid stifling innovation while ensuring a safe and secure environment for users.

For example, regulatory sandboxes allow for experimentation with new technologies under supervision, mitigating risks while fostering innovation. Conversely, poorly designed regulations focusing solely on restriction can drive innovation underground, hindering legitimate growth and potentially increasing risks.

Navigating the global regulatory landscape of cryptocurrencies requires a nuanced understanding of the diverse approaches taken by different jurisdictions. While challenges remain – including the need for greater international cooperation and the complexities of regulating decentralized technologies – the ongoing evolution of regulatory frameworks reflects a commitment to balancing innovation with consumer protection and financial stability. The future of cryptocurrencies will undoubtedly be shaped by the ongoing dialogue between regulators, innovators, and the broader crypto community.

The journey towards a cohesive global regulatory framework is ongoing, promising a dynamic and evolving future for the cryptocurrency market.