How does Solana blockchain technology compare to other platforms? That’s the burning question we’ll tackle here. We’ll dive into a head-to-head comparison of Solana against major players like Ethereum, Cardano, and Polkadot, examining transaction speeds, scalability, smart contract capabilities, security, tokenomics, and real-world applications. Get ready for a comprehensive look at what makes Solana tick (or not!) compared to its competitors.

This comparison will explore the strengths and weaknesses of each platform, helping you understand which blockchain might best suit your needs, whether you’re a developer, investor, or simply curious about the future of decentralized technology. We’ll look at concrete data, analyze different approaches to scaling and security, and discuss the overall maturity and health of each ecosystem.

Scalability and Decentralization: How Does Solana Blockchain Technology Compare To Other Platforms?

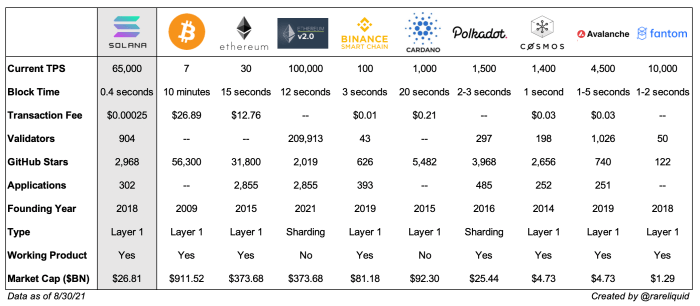

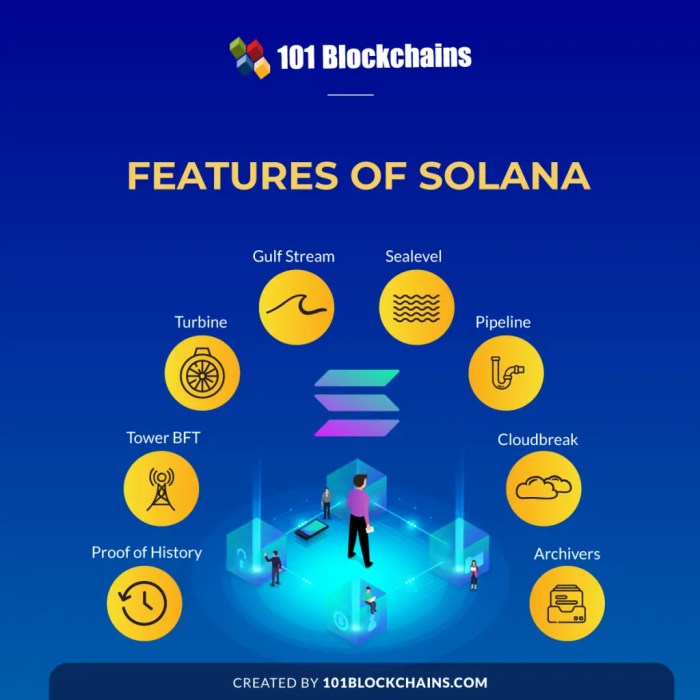

Solana and other leading blockchains tackle the challenge of balancing scalability and decentralization in different ways. While high transaction throughput is crucial for mainstream adoption, maintaining a truly decentralized network is vital for security and censorship resistance. Let’s examine how Solana approaches this trade-off and compare it to other prominent platforms.Solana’s scalability is achieved through a combination of innovative technologies, including its unique Proof-of-History (PoH) consensus mechanism and a novel approach to transaction processing.

PoH allows for a much higher throughput compared to traditional Proof-of-Work (PoW) or Proof-of-Stake (PoS) systems by providing a verifiable history of events, reducing the need for extensive consensus rounds. This, coupled with its parallel processing capabilities, enables Solana to handle a large number of transactions per second. Ethereum, in contrast, relies primarily on PoS (with its recent transition from PoW), which, while more energy-efficient than PoW, still faces scalability limitations.

Algorand, on the other hand, utilizes a Pure Proof-of-Stake mechanism designed for scalability, but its throughput is still lower than Solana’s.

Solana’s Scalability Mechanisms Compared to Others

Solana’s high throughput comes from a combination of its PoH consensus, pipelined transaction processing, and sharding. PoH creates a verifiable timestamping mechanism, allowing for faster block creation and confirmation times. Pipelining allows transactions to be processed concurrently, significantly boosting throughput. Sharding, while still under development, aims to further improve scalability by partitioning the network into smaller, more manageable pieces.

Ethereum, while moving towards sharding with Ethereum 2.0, is still primarily relying on a single, monolithic chain. Algorand, with its Byzantine agreement-based consensus, also benefits from high efficiency, but its approach differs fundamentally from Solana’s architecture. The result is a notable difference in transaction speed and cost.

Trade-offs Between Scalability and Decentralization

Solana’s focus on scalability has led to some trade-offs in decentralization. While it boasts a large number of validators, its complex architecture and specialized node requirements could potentially lead to a more centralized network compared to simpler protocols like Algorand. The higher technical barrier to entry for running a Solana validator node could result in a smaller, potentially more concentrated, set of validators controlling the network.

Ethereum, despite its scalability challenges, benefits from a larger and more diverse validator set due to its relatively simpler architecture and lower technical barriers. The trade-off, however, is that Ethereum’s transaction speed and costs remain comparatively higher.

Advantages and Disadvantages of Solana’s Scalability Approach

Let’s Artikel the advantages and disadvantages of Solana’s approach to scalability:

- Advantages:

- High transaction throughput, enabling faster and cheaper transactions.

- Potential for improved scalability through further development and implementation of sharding.

- Innovative technology that offers a different approach to solving blockchain scalability problems.

- Disadvantages:

- Higher technical barrier to entry for node operators, potentially leading to less decentralization.

- Complexity of the system can make it more susceptible to vulnerabilities and outages.

- Past network outages and performance issues raise concerns about the reliability and stability of the network.

Smart Contract Capabilities and Development

Solana, Ethereum, and EOS each offer distinct approaches to smart contract development, impacting developer experience and the types of applications built on each platform. Understanding these differences is crucial for choosing the right blockchain for a specific project. This section will compare the capabilities, ease of use, and costs associated with smart contract development across these three prominent platforms.

Solana’s smart contract ecosystem revolves around the Rust programming language. This choice prioritizes performance and security, allowing for highly efficient smart contract execution. Ethereum, on the other hand, primarily uses Solidity, a language designed specifically for the Ethereum Virtual Machine (EVM). EOS utilizes C++, offering developers familiarity with a widely used and powerful language. Each language presents a different learning curve and set of tools for developers.

Smart Contract Languages and Development Environments

The choice of programming language significantly influences the developer experience. Rust, while powerful, has a steeper learning curve than Solidity, which boasts a larger community and more readily available learning resources. C++, used by EOS, offers a mature ecosystem but can be complex for developers less familiar with its intricacies. Solana’s development environment is improving constantly, but it still lags behind the more mature tooling available for Ethereum and, to a lesser extent, EOS.

Popular smart contracts on Ethereum include decentralized finance (DeFi) applications like Uniswap and Aave, while EOS has seen significant adoption in decentralized applications (dApps) focused on gaming and social media. Solana’s ecosystem features projects like Raydium (a decentralized exchange) and Serum (a decentralized order book).

Ease of Use and Developer Experience

Developer experience varies considerably across these platforms. Ethereum benefits from a massive and active community, resulting in abundant documentation, tutorials, and readily available support. Solidity’s relative simplicity compared to Rust also contributes to a smoother onboarding process for many developers. EOS, while having a dedicated community, has a smaller developer base than Ethereum, resulting in less readily available resources.

Solana’s developer community is growing rapidly, but the relative youth of the platform means that the available resources are still expanding.

Gas Fees and Transaction Costs

The cost of deploying and executing smart contracts is a critical factor in choosing a platform. Gas fees, the cost of computation on a blockchain, vary widely based on network congestion and the complexity of the smart contract. Generally, Solana boasts significantly lower transaction fees compared to Ethereum, particularly during periods of high network activity. EOS, with its delegated proof-of-stake consensus mechanism, also tends to have lower transaction costs than Ethereum.

However, it’s important to note that these costs can fluctuate. The following table provides a general comparison, keeping in mind that these figures are subject to change.

| Platform | Smart Contract Language | Typical Gas Fee (USD equivalent, approximate) | Ease of Development | Community Support |

|---|---|---|---|---|

| Ethereum | Solidity | $1 – $100+ (highly variable) | Moderate | Extensive |

| Solana | Rust | High (Steeper Learning Curve) | Growing rapidly | |

| EOS | C++ | High (requires C++ expertise) | Moderate |

Security and Ecosystem

Solana’s security and the overall health of its ecosystem are crucial factors in determining its viability as a blockchain platform. Comparing Solana to other platforms requires a nuanced look at its security mechanisms, its resistance to various attacks, and the overall growth and activity within its community. This section will delve into these aspects, offering a comparative analysis.Solana’s Security Mechanisms and Resistance to AttacksSolana employs a unique hybrid consensus mechanism called Proof-of-History (PoH) combined with Proof-of-Stake (PoS).

PoH aims to improve transaction throughput by creating a verifiable, globally consistent ordering of events, reducing the reliance on network consensus for every transaction. PoS, like many other blockchains, allows validators to stake their SOL tokens to participate in consensus and secure the network. This mechanism makes 51% attacks, where a malicious actor controls more than half the network’s hash rate (or, in Solana’s case, staking power), significantly more difficult and expensive due to the large amount of SOL that would need to be staked.

Similarly, Sybil attacks, where a single entity creates numerous fake identities to influence the network, are mitigated through the staking mechanism and identity verification processes. However, no system is impervious to attacks, and Solana has experienced security challenges, which will be discussed later. Compared to platforms like Ethereum, which relies primarily on PoS (or previously PoW), or Bitcoin’s PoW, Solana’s hybrid approach presents a different risk profile.

While the PoH element aims to enhance speed and efficiency, its complexity can introduce potential vulnerabilities. Ethereum’s established ecosystem and vast community participation also provide a certain level of security through network effect. The relative security of each platform is an ongoing area of research and development.

Solana Ecosystem Health and Maturity

The health and maturity of a blockchain ecosystem are multifaceted. Key indicators include developer activity (measured by the number of developers contributing to the platform, the number of new projects being built, and the overall codebase activity), community size (reflected in active users, social media engagement, and community forums), and the number of deployed applications (DApps). Solana boasts a vibrant developer community, evidenced by its frequent hackathons and the growing number of projects built on its platform.

However, compared to Ethereum, which has a significantly larger and more established developer base and a broader range of deployed applications, Solana’s ecosystem is still considered relatively younger. The size of the Solana community, while growing rapidly, is also smaller than that of Ethereum. The number of DApps deployed on Solana, while impressive, lags behind Ethereum’s extensive DApp ecosystem.

The long-term sustainability and resilience of the Solana ecosystem will depend on continued growth in these areas.

Notable Security Incidents and Vulnerabilities

Solana has experienced several notable security incidents and vulnerabilities throughout its history. These include network outages, exploits affecting specific DApps, and instances of vulnerabilities in the Solana codebase. While these incidents have been addressed through updates and improvements, they highlight the inherent risks associated with any blockchain platform. A direct comparison to other platforms requires careful consideration of the scale and impact of these incidents.

For instance, while Ethereum has also experienced security incidents, its longer history and larger ecosystem mean that the relative impact of any single incident might be less significant. The frequency and severity of these events, when compared to other platforms, help to provide a more comprehensive picture of the platform’s overall security posture. It is crucial to remember that ongoing development and community participation are vital for identifying and mitigating such vulnerabilities in all blockchain platforms.

Tokenomics and Governance

Solana’s tokenomics and governance model play a crucial role in its overall functionality and long-term sustainability. Understanding how SOL, its native token, is distributed, utilized, and how the network is governed is essential for comparing it to other blockchain platforms. This section will delve into these key aspects, providing a comparative analysis with other prominent blockchains.Solana’s tokenomics differ significantly from those of other platforms, particularly in terms of its inflation model and token utility.

Unlike some blockchains with fixed supplies, Solana employs an inflationary model, although the inflation rate decreases over time. This influences its price stability and ecosystem growth. We’ll examine how this contrasts with deflationary models or those with more stable inflation schedules. The use cases for SOL also impact its value proposition, encompassing staking, transaction fees, and participation in network governance.

Solana’s SOL Token Distribution and Inflation

Solana’s initial token distribution was allocated across various stakeholders, including the foundation, early investors, and the team. The current circulating supply and the scheduled inflation rate are publicly available and subject to adjustments based on community consensus. A comparison with other prominent blockchain platforms like Ethereum (ETH), Cardano (ADA), or Polkadot (DOT) reveals different approaches to initial distribution and inflation schedules.

For example, Ethereum’s supply is not capped, but its inflation rate is also decreasing over time. Cardano has a capped total supply, while Polkadot employs a similar inflation model to Solana, albeit with potentially different rate adjustments.A visual representation could be a bar chart comparing the initial distribution percentages for each token (e.g., Foundation, Team, Public Sale, etc.) across Solana, Ethereum, Cardano, and Polkadot.

A line graph could then illustrate the projected inflation rates for each blockchain over the next 5-10 years. The chart would clearly highlight the differences in initial token allocation strategies and long-term inflation paths. The y-axis would represent the percentage of total supply or the inflation rate (as a percentage), while the x-axis would represent the different blockchain platforms and time periods (for the inflation rate graph).

Governance Mechanisms in Solana

Solana’s governance mechanism relies on a delegated proof-of-stake (DPoS) system, where SOL holders can delegate their voting rights to validators. This contrasts with other platforms using different consensus mechanisms and governance models. For instance, Ethereum utilizes a more community-driven governance model, involving proposals and voting from a broader range of participants. Cardano employs a multi-stage governance model with various stakeholders involved.

Polkadot utilizes a council and treasury system, allowing for a more structured governance approach.The differences in governance models influence the decision-making processes and the level of community involvement. Solana’s DPoS system can lead to faster decision-making, but it also raises concerns about centralization compared to more distributed governance models. The comparative analysis would highlight the trade-offs between efficiency and decentralization inherent in each platform’s governance system.

A table comparing the governance mechanisms (e.g., voting rights, proposal mechanisms, decision-making processes) of Solana, Ethereum, Cardano, and Polkadot would effectively showcase these differences. The table could include columns for the consensus mechanism used, the type of governance model, the decision-making process, and the level of community participation.

Use Cases and Applications

Solana’s design, prioritizing speed and scalability, lends itself to specific application types, creating both opportunities and limitations compared to other blockchain platforms. While Ethereum’s dominance in DeFi initially gave it a significant head start, Solana’s faster transaction speeds and lower fees have attracted developers seeking to build high-throughput applications. This section explores how Solana stacks up against competitors in key application areas.Solana’s application landscape showcases its strengths and weaknesses when compared to other platforms like Ethereum, Polygon, and others.

Its high transaction throughput makes it suitable for certain applications but not others. The following sections detail this comparison across different application types.

Decentralized Finance (DeFi) Applications, How does Solana blockchain technology compare to other platforms?

Solana’s DeFi ecosystem has experienced significant growth, although it’s still smaller than Ethereum’s. However, Solana’s speed advantage allows for faster and cheaper trading and lending experiences. For example, decentralized exchanges (DEXs) on Solana, like Raydium, boast significantly higher transaction speeds compared to those on Ethereum. This allows for more complex DeFi strategies to be executed with less slippage and latency.

Conversely, Ethereum’s established DeFi ecosystem and wider range of established protocols and tools often attract developers who value familiarity and a larger user base over raw speed. The risk of smart contract vulnerabilities remains a challenge for Solana, just as it does for other platforms.

Non-Fungible Token (NFT) Marketplaces

Solana has become a popular platform for NFT projects, particularly those that require high transaction volumes and low fees. Magic Eden, a prominent Solana-based NFT marketplace, showcases the platform’s ability to handle the demands of a large number of concurrent transactions. Compared to Ethereum, Solana’s lower gas fees make it more accessible for creators and collectors, particularly for projects involving numerous NFTs.

However, Ethereum still maintains a larger and more established NFT community and a wider range of tools and resources for NFT creation and management. The overall NFT market activity on Solana, while significant, is still smaller than Ethereum’s.

Decentralized Applications (dApps)

The variety of dApps on Solana is growing rapidly, encompassing games, social media platforms, and other applications. The platform’s speed and scalability make it attractive for applications requiring fast and efficient transactions. For instance, games built on Solana can handle a large number of simultaneous players and interactions more smoothly than those on slower networks. However, the Ethereum Virtual Machine (EVM) compatibility of many other blockchains provides a larger pool of readily available tools and developer expertise, potentially leading to faster development cycles for certain types of dApps on those platforms.

The overall developer community on Solana, while growing, is still smaller than Ethereum’s, impacting the availability of tools and libraries.

Future Applications and Use Cases

Solana’s potential extends beyond its current applications. Its scalability could facilitate the development of metaverse applications, requiring high-throughput interactions between users and digital assets. The platform’s focus on speed could also benefit supply chain management applications, enabling real-time tracking and verification of goods. Further, advancements in Solana’s smart contract capabilities could open the door to more sophisticated decentralized autonomous organizations (DAOs) and governance models.

However, the long-term success of Solana will depend on addressing security concerns and fostering a larger and more diverse developer community. The competition from other platforms aiming for similar scalability and speed will also be a determining factor. Success in these areas will determine if Solana can solidify its position in the broader blockchain ecosystem.

Ultimately, the “best” blockchain platform depends on your specific priorities. Solana’s impressive speed and throughput are undeniable advantages, but its centralized nature and past security concerns are crucial factors to consider. Ethereum’s established ecosystem and robust security offer stability, though at the cost of speed and scalability. Other platforms like Cardano and Polkadot offer unique approaches, each with its own trade-offs.

By carefully weighing the pros and cons discussed in this comparison, you can make an informed decision about which blockchain aligns best with your needs and risk tolerance.