Analyzing the volatility of the cryptocurrency market. is crucial for anyone involved in this exciting yet unpredictable space. Cryptocurrencies, known for their dramatic price swings, present both incredible opportunities and significant risks. Understanding the forces driving these fluctuations—from macroeconomic trends and regulatory changes to social media sentiment and technological advancements—is key to navigating this dynamic landscape successfully. This guide will equip you with the knowledge and tools to analyze, understand, and even predict volatility in the crypto market.

We’ll explore various metrics used to measure volatility, delve into the factors that influence it, and examine different strategies for managing the inherent risks. Through real-world examples and hypothetical scenarios, we’ll demystify the complexities of cryptocurrency volatility, empowering you to make more informed investment decisions.

Defining Cryptocurrency Market Volatility

Cryptocurrency markets are notorious for their wild price swings. Understanding this volatility is crucial for anyone involved, from seasoned investors to curious onlookers. Volatility, in simple terms, refers to the rate and extent of price fluctuations over a given period. High volatility means prices change dramatically and frequently, while low volatility indicates more stable, predictable price movements.Factors Contributing to Cryptocurrency Market Volatility are numerous and complex, often interacting in unpredictable ways.

Factors Influencing Cryptocurrency Market Volatility

Several key factors contribute to the dramatic price swings seen in the crypto market. These factors range from macroeconomic conditions to specific events affecting individual cryptocurrencies. Understanding these influences is key to navigating this dynamic landscape.

- Regulatory Uncertainty: Government regulations concerning cryptocurrencies vary widely across the globe. Changes in regulations, or even the anticipation of them, can cause significant market reactions. For example, a country’s decision to ban cryptocurrency trading can trigger a sharp price drop.

- Market Sentiment and Speculation: Crypto markets are heavily influenced by investor sentiment, often driven by speculation and hype. Positive news or social media trends can quickly inflate prices, while negative news can lead to rapid sell-offs. The “fear of missing out” (FOMO) and “fear of uncertainty and doubt” (FUD) significantly impact trading activity.

- Technological Developments: Major technological advancements, such as upgrades to blockchain protocols or the launch of new cryptocurrencies, can dramatically affect market values. Successful upgrades often lead to price increases, while failures can cause significant drops.

- Macroeconomic Factors: Global economic events, such as inflation, recessionary fears, or changes in interest rates, can influence investor behavior and consequently, cryptocurrency prices. Investors may shift their assets to safer investments during times of economic uncertainty, leading to cryptocurrency sell-offs.

- Security Breaches and Hacks: High-profile security breaches or hacks targeting cryptocurrency exchanges or projects can severely impact investor confidence, leading to significant price declines. The Mt. Gox hack in 2014 is a prime example of this effect.

Types of Cryptocurrency Market Volatility

Volatility isn’t a monolithic concept; it manifests differently depending on the timeframe considered.

Short-Term Volatility, Analyzing the volatility of the cryptocurrency market.

Short-term volatility refers to price fluctuations over relatively short periods, such as hours, days, or weeks. This type of volatility is often driven by news events, social media trends, and short-term trading strategies. Short-term volatility can be extremely high, leading to significant price swings within a short time frame. For example, a sudden surge in buying pressure due to a positive tweet from a prominent figure can cause a sharp, short-lived price increase.

Long-Term Volatility

Long-term volatility considers price changes over months or years. While still subject to significant fluctuations, long-term volatility tends to be less dramatic than short-term volatility. Long-term trends are often shaped by broader macroeconomic factors, technological advancements, and the overall adoption rate of cryptocurrencies.

Historical Events Impacting Cryptocurrency Volatility

Several historical events significantly impacted cryptocurrency market volatility.

- The Mt. Gox Hack (2014): The hacking of Mt. Gox, a major Bitcoin exchange, led to a significant loss of Bitcoin and a substantial drop in the cryptocurrency’s price.

- The 2017-2018 Cryptocurrency Bubble: A period of intense speculation and rapid price increases, followed by a dramatic market correction, showcasing the cyclical nature of the market.

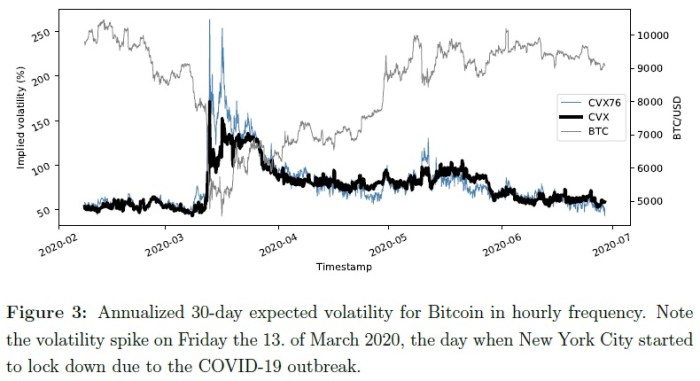

- The COVID-19 Pandemic (2020): The pandemic’s economic impact initially caused a sharp drop in cryptocurrency prices, but later saw a significant recovery and rise in value, partially due to increased interest in decentralized finance (DeFi).

Hypothetical Scenario: Impact of Major News Event

Imagine a hypothetical scenario where a major global bank announces it will begin offering cryptocurrency trading services. This positive news would likely trigger a significant surge in buying pressure, leading to a rapid increase in the price of Bitcoin and other major cryptocurrencies. The extent of the price increase would depend on various factors, including the bank’s reputation, the details of its offering, and the overall market sentiment at the time.

However, a short-term spike in volatility is almost certain, followed by a period of consolidation as the market digests the news and adjusts to the new reality. This illustrates how significant news events can cause sudden and substantial shifts in cryptocurrency market volatility.

Measuring Cryptocurrency Market Volatility: Analyzing The Volatility Of The Cryptocurrency Market.

Understanding how volatile the cryptocurrency market is crucial for making informed investment decisions. Volatility, in simple terms, refers to the rate and extent of price fluctuations. High volatility means prices swing wildly, presenting both significant profit and loss opportunities. Accurately measuring this volatility requires the use of specific statistical tools.

Common Volatility Metrics

Several metrics exist to quantify cryptocurrency market volatility. Each has its strengths and weaknesses, making the choice of metric dependent on the specific application and desired level of detail. The most common include standard deviation, beta, and variations of these like Average True Range (ATR) and GARCH models.

Standard Deviation

Standard deviation measures the dispersion of a dataset around its mean. In the context of cryptocurrencies, it quantifies the typical deviation of a coin’s price from its average price over a given period. A higher standard deviation indicates greater volatility. The calculation involves finding the average price, then calculating the difference between each price point and the average, squaring these differences, averaging the squared differences (variance), and finally taking the square root of the variance.

Standard Deviation (σ) = √[ Σ(xi – μ)² / (N-1) ]

where: xi represents individual price points, μ represents the average price, and N represents the number of data points.

Beta

Beta measures the volatility of a cryptocurrency relative to a benchmark, often a major cryptocurrency like Bitcoin or a broader market index. A beta greater than 1 indicates that the cryptocurrency is more volatile than the benchmark; a beta less than 1 suggests it’s less volatile. Beta is particularly useful for comparing the risk of different cryptocurrencies within a portfolio.

Find out about how Is ZetaChain a good investment for long-term growth? can deliver the best answers for your issues.

Its calculation is more complex, typically involving regression analysis to determine the relationship between the cryptocurrency’s returns and the benchmark’s returns.

Do not overlook the opportunity to discover more about the subject of How to understand and interpret cryptocurrency charts..

Average True Range (ATR)

ATR focuses on the price range rather than the price itself. It measures the average true range of price movement over a specified period, considering the high-low range, the absolute value of the difference between the current close and the previous close, and the absolute value of the difference between the current close and the previous high or low. This is useful for traders who focus on range-bound movements.

Its formula is a bit more involved and typically involves an exponentially weighted moving average of the true ranges.

GARCH Models

Generalized Autoregressive Conditional Heteroskedasticity (GARCH) models are more sophisticated statistical models that account for volatility clustering – periods of high volatility followed by periods of low volatility, a common characteristic of cryptocurrency markets. GARCH models use past volatility to predict future volatility, offering a more nuanced view than simpler metrics. However, they require specialized statistical software and expertise.

Comparison of Volatility Metrics

The following table compares four common volatility metrics:

| Metric Name | Formula | Application | Limitations |

|---|---|---|---|

| Standard Deviation | √[ Σ(xi – μ)² / (N-1) ] | Measures overall price dispersion; useful for assessing risk | Assumes a normal distribution; doesn’t capture time-varying volatility |

| Beta | Regression analysis of asset returns vs. benchmark returns | Compares volatility relative to a benchmark; useful for portfolio diversification | Relies on the choice of benchmark; can be affected by market regime changes |

| Average True Range (ATR) | Exponentially weighted moving average of true ranges | Focuses on price range; useful for range-bound trading strategies | Doesn’t directly measure price changes; less sensitive to large price swings outside the typical range |

| GARCH Models | Various formulations, often involving autoregressive and moving average components | Predicts future volatility; captures volatility clustering | Complex to implement; requires specialized statistical software and expertise; model assumptions can be violated |

Factors Influencing Volatility

Cryptocurrency market volatility is a complex phenomenon shaped by a multitude of interacting factors. Understanding these influences is crucial for navigating the market effectively and mitigating risk. While predicting precise price movements remains impossible, recognizing the key drivers helps in developing informed strategies. This section will examine the major factors impacting cryptocurrency volatility, categorizing them to illustrate their relative importance.

Macroeconomic Factors

Broad economic conditions significantly influence cryptocurrency markets. Inflation, for example, can drive investors towards assets perceived as hedges against inflation, potentially increasing demand for cryptocurrencies. Conversely, rising interest rates can make holding cryptocurrencies less attractive as investors might shift to higher-yielding bonds or other fixed-income instruments. Government fiscal policies, such as stimulus packages or austerity measures, also indirectly impact cryptocurrency markets by altering overall investor sentiment and liquidity.

For instance, during periods of economic uncertainty, investors might seek refuge in perceived safe havens, which could temporarily dampen cryptocurrency prices.

Regulatory Announcements and Government Policies

Government regulations and policy decisions directly impact the cryptocurrency market. Positive regulatory developments, such as the clarification of tax rules or the licensing of cryptocurrency exchanges, can boost investor confidence and lead to price increases. Conversely, negative news, like bans on cryptocurrency trading or stringent regulatory requirements, can trigger significant price drops. The regulatory landscape varies significantly across jurisdictions, creating a complex and often unpredictable environment.

The regulatory approach in China, for example, which has seen periods of both encouragement and severe restriction, has profoundly impacted global cryptocurrency prices.

Social Media Sentiment and News Coverage

The cryptocurrency market is highly susceptible to sentiment shifts driven by social media and news coverage. Positive news reports or influential endorsements on platforms like Twitter can create a “fear of missing out” (FOMO) effect, leading to rapid price increases. Conversely, negative news, such as security breaches or high-profile scams, can trigger panic selling and sharp price declines. The rapid spread of information and the amplification of sentiment through social media creates a highly volatile environment, making it crucial to discern credible information from misinformation.

The infamous Elon Musk tweets, for instance, have repeatedly demonstrated the power of social media influence on cryptocurrency prices. A single tweet can cause significant market fluctuations in a short time frame.

Predicting Cryptocurrency Volatility

Predicting cryptocurrency volatility is a complex but crucial task for investors and traders. While perfectly accurate prediction is impossible due to the market’s inherent unpredictability, various statistical models can offer insights and probabilities. These models help to understand potential price swings and inform risk management strategies. This section explores some of these models, their strengths and weaknesses, and illustrates a simplified application.

Statistical Models for Volatility Forecasting

Several statistical models are employed to forecast cryptocurrency price volatility. Autoregressive Integrated Moving Average (ARIMA) models analyze historical price data to identify patterns and predict future values. Generalized Autoregressive Conditional Heteroskedasticity (GARCH) models, on the other hand, focus specifically on the volatility of price changes, capturing how the variance of these changes evolves over time. Both are valuable tools, but their effectiveness depends on data quality and model selection.

ARIMA Model Application and Limitations

ARIMA models are useful for forecasting time series data, including cryptocurrency prices. They consider past values and their differences to predict future values. The model’s order (p, d, q) specifies the number of autoregressive (p), integrated (d), and moving average (q) terms. Choosing the right order is crucial for accuracy. A limitation of ARIMA is its assumption of constant variance over time, which isn’t always true for the volatile crypto market.

Furthermore, external factors influencing the market are not directly incorporated into the model. For example, an ARIMA model might struggle to accurately predict a price drop caused by a sudden regulatory announcement.

GARCH Model Application and Limitations

GARCH models are better suited for capturing volatility clustering, a characteristic of cryptocurrency markets where periods of high volatility tend to follow periods of high volatility. GARCH models explicitly model the conditional variance of the price changes, allowing for more accurate predictions during periods of heightened volatility. However, GARCH models, like ARIMA, are based on historical data and may not accurately capture the impact of unexpected events or market shifts.

The model’s parameters also need careful calibration to avoid overfitting to historical data, leading to poor predictive power for future periods. For example, a GARCH model trained on data from a bull market might underperform during a bear market.

Simple Volatility Prediction Model Example

Let’s illustrate a simplified volatility prediction using hypothetical daily Bitcoin price data. Assume we have the following daily closing prices (in USD): 30,000, 30,500, 31,000, 30,800, 32,000, 32,

500. We can calculate the daily percentage changes

1.67%, 1.64%, -0.65%, 3.89%, 1.56%. A simple moving average of these percentage changes (e.g., a 3-day moving average) can provide a basic estimate of future volatility. In this example, the 3-day moving average of volatility for the last three days would be the average of 1.64%, -0.65%, and 3.89%, resulting in an average daily volatility of approximately 1.63%.

This is a highly simplified example; real-world applications require more sophisticated models and larger datasets. The accuracy of this prediction depends heavily on the assumption that past volatility patterns will continue into the future, which is a significant limitation. More complex models would account for factors such as trading volume and news sentiment.

The cryptocurrency market’s volatility, while daunting, is also a defining characteristic. By understanding the forces at play – from macroeconomic conditions to social sentiment – investors can develop effective strategies to manage risk and potentially capitalize on market fluctuations. This analysis provides a framework for navigating this dynamic environment, emphasizing the importance of informed decision-making, risk assessment, and continuous learning.

Remember, while predicting the future is impossible, understanding the past and present allows for more informed decisions in this exciting, evolving market.