Exploring the use of blockchain technology in digital asset management. – Exploring the use of blockchain technology in digital asset management, we delve into a revolutionary approach to securing and streamlining the ownership and transfer of digital assets. Imagine a world where intellectual property rights are verifiable and tamper-proof, where artwork provenance is transparent and indisputable, and where financial transactions are secure and efficient. This is the promise of blockchain technology in the realm of digital asset management.

We’ll explore how blockchain’s inherent security and transparency features reshape this landscape, examining its impact on various asset types and the challenges that must be addressed for widespread adoption.

This exploration covers the core principles of blockchain, its security mechanisms, the role of smart contracts in automating processes, and the critical considerations surrounding scalability, interoperability, and legal frameworks. We’ll examine real-world applications and future trends, painting a comprehensive picture of this rapidly evolving field.

Introduction to Blockchain in Digital Asset Management

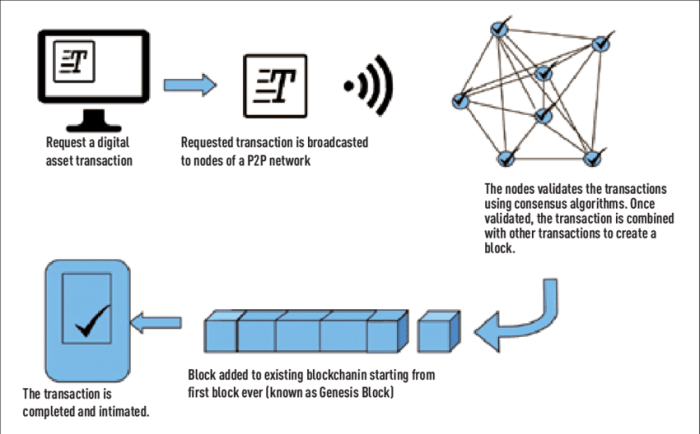

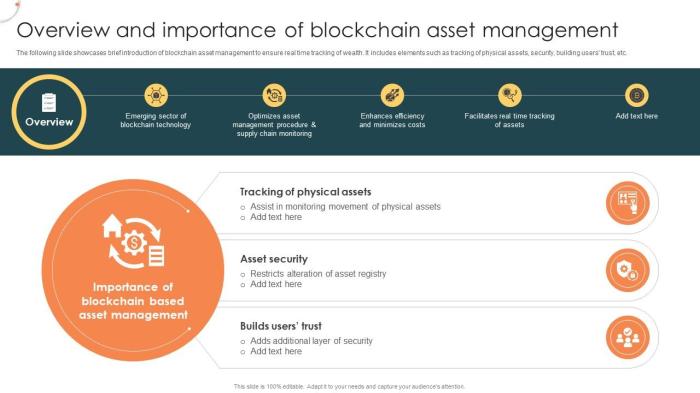

Blockchain technology, at its core, is a decentralized, distributed ledger that records and verifies transactions across multiple computers. This eliminates the need for a central authority, enhancing security and transparency. Its relevance to digital asset management stems from its ability to provide a secure, immutable record of ownership and transactions, solving many problems associated with managing digital assets in traditional systems.This inherent security and transparency significantly improves how we manage digital assets.

By recording ownership and transfer history on a blockchain, we create a verifiable and auditable trail, reducing the risk of fraud, theft, and disputes. The decentralized nature means no single point of failure, making the system more resilient to attacks and data breaches. This increased trust and accountability is particularly valuable in managing high-value or sensitive digital assets.

Types of Digital Assets Benefiting from Blockchain Management

Blockchain’s impact extends across various asset classes. Its immutable nature and enhanced security make it ideal for managing diverse digital assets. For example, intellectual property rights can be registered and tracked on a blockchain, providing clear evidence of ownership and preventing unauthorized use or infringement. Similarly, the art world is embracing blockchain to verify authenticity and track provenance of digital artwork, combating counterfeiting and increasing transparency in the art market.

Finally, blockchain’s role in financial instruments is expanding, enabling secure and efficient trading of securities and other financial assets. This facilitates fractional ownership and improved liquidity, making these assets more accessible to investors. Specific examples include the use of blockchain for tracking supply chain provenance of luxury goods and managing digital identities securely.

Blockchain’s Impact on Security and Transparency: Exploring The Use Of Blockchain Technology In Digital Asset Management.

Blockchain technology revolutionizes digital asset management by significantly enhancing security and transparency compared to traditional methods. Its inherent design features, such as immutability and cryptographic hashing, create a robust system that protects digital assets and provides a clear audit trail of ownership and transactions.The core of blockchain’s security lies in its decentralized and distributed nature. Instead of relying on a single central authority to manage and verify transactions, blockchain uses a network of computers to validate and record them.

This distributed ledger eliminates single points of failure, making it incredibly resistant to hacking and data manipulation.

Enhanced Security Mechanisms

Blockchain employs several mechanisms to bolster security. Cryptographic hashing ensures that any alteration to a block in the chain is immediately detectable. Each block contains a cryptographic hash of the previous block, creating an unbroken chain of records. This makes it computationally infeasible to tamper with past transactions without detection. Furthermore, the consensus mechanisms used by various blockchains (like Proof-of-Work or Proof-of-Stake) ensure that only legitimate transactions are added to the chain, preventing fraudulent activities.

This level of security is significantly higher than traditional systems relying on centralized databases vulnerable to single points of failure.

Improved Transparency and Auditability

Blockchain’s transparency is a direct consequence of its distributed ledger architecture. All transactions are publicly recorded and verifiable on the blockchain, providing a complete and auditable history of ownership and transfer of digital assets. This open and accessible record eliminates the need for trust in a central authority, as anyone can verify the authenticity and legitimacy of a transaction.

This increased transparency reduces disputes and enhances accountability. For example, in supply chain management, blockchain can track the journey of a product from origin to consumer, ensuring transparency and traceability.

Comparison of Traditional and Blockchain-Based Systems

The following table compares traditional digital asset management systems with blockchain-based systems in terms of security and transparency:

| Feature | Traditional System | Blockchain System | Advantages of Blockchain |

|---|---|---|---|

| Data Storage | Centralized database | Distributed ledger | Increased resilience to data breaches and single points of failure |

| Transaction Verification | Centralized authority | Consensus mechanism (e.g., Proof-of-Work, Proof-of-Stake) | Enhanced security and trust; reduced reliance on a central authority |

| Transparency | Limited transparency; access often restricted | High transparency; all transactions publicly viewable (depending on the blockchain) | Improved auditability and accountability; reduced disputes |

| Security | Vulnerable to hacking, data manipulation, and single points of failure | Highly secure due to cryptography and distributed nature | Significantly reduced risk of fraud and data breaches |

| Auditability | Can be difficult and time-consuming | Easy and efficient due to the immutable nature of the blockchain | Simplified auditing processes and increased efficiency |

Smart Contracts and Automation in Digital Asset Management

Smart contracts, self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code, revolutionize digital asset management by automating previously manual and often cumbersome processes. This automation increases efficiency, reduces costs, and enhances transparency across the entire lifecycle of a digital asset. By leveraging the immutable nature of the blockchain, smart contracts ensure that agreements are enforced reliably and predictably.Smart contracts offer a powerful mechanism for automating various aspects of digital asset management, leading to significant improvements in efficiency and security.

They eliminate the need for intermediaries, reduce the risk of fraud, and provide a clear audit trail of all transactions. This enhanced transparency and trust fosters a more robust and efficient ecosystem for digital asset management.

Asset Transfer Automation

Smart contracts streamline the transfer of digital assets by automating the process and eliminating the need for intermediaries. For example, when a digital artwork is sold on a blockchain-based marketplace, a smart contract can automatically transfer ownership from the seller to the buyer upon confirmation of payment. This eliminates delays and reduces the risk of disputes. The transfer is recorded on the blockchain, creating an immutable record of ownership.

Imagine a scenario where an NFT representing a digital painting is sold. The smart contract, triggered by the buyer’s payment, instantly transfers the NFT ownership from the seller’s digital wallet to the buyer’s wallet. This instant transfer is recorded on the blockchain, creating a transparent and secure transaction.

Licensing and Royalty Payments

Smart contracts can also automate the licensing and royalty payment processes for digital assets. A smart contract can be programmed to automatically release a license to a buyer upon payment, and to automatically distribute royalties to the creator each time the asset is used or sold. This ensures that creators are fairly compensated for their work, and that licensees have clear rights and responsibilities.

Consider a scenario where a musician uploads their song as an NFT. A smart contract could be embedded, automatically paying royalties to the musician every time the song is streamed or downloaded on a platform integrated with the blockchain. This eliminates the need for manual royalty tracking and payment.

Hypothetical Smart Contract for Digital Artwork Licensing

This smart contract governs the licensing of a digital artwork, specifically “Sunrise Over the Metropolis,” created by artist Anya Petrova.

Remember to click How to evaluate the potential of a new cryptocurrency project. to understand more comprehensive aspects of the How to evaluate the potential of a new cryptocurrency project. topic.

This smart contract, executed on [Blockchain Name], governs the licensing of the digital artwork “Sunrise Over the Metropolis” (Artwork ID: SOPM-1234) by Anya Petrova (Creator ID: AP-5678). The licensee agrees to the terms below.

The contract will include clauses specifying:

- Licensee: The entity granted the license (identified by their public key).

- Licensor: Anya Petrova (identified by her public key).

- Artwork: “Sunrise Over the Metropolis” (identified by its unique token ID).

- License Type: Specifies the type of license granted (e.g., non-exclusive, exclusive, etc.).

- License Duration: The period for which the license is valid.

- License Fee: The amount payable by the licensee to the licensor.

- Royalty Rate: The percentage of each resale that the licensor receives.

- Usage Rights: Specific permitted uses of the artwork (e.g., commercial, non-commercial, etc.).

- Payment Terms: Details on how and when the license fee and royalties are to be paid.

- Dispute Resolution: A mechanism for resolving disputes between the licensor and licensee.

The smart contract would automatically release the license upon payment of the license fee, and automatically distribute royalties to Anya Petrova whenever the artwork is resold, ensuring transparent and automated royalty payments. The entire process, from licensing to royalty distribution, is recorded on the blockchain, providing a permanent and auditable record.

Addressing Scalability and Interoperability Challenges

Implementing blockchain in digital asset management offers significant advantages, but scalability and interoperability remain significant hurdles. The current architecture of many blockchain networks struggles to handle the sheer volume of transactions and data associated with managing a large number of digital assets efficiently. Furthermore, the lack of seamless communication between different blockchain platforms hinders the development of a truly unified and interoperable digital asset ecosystem.The inherent limitations of many blockchain designs, particularly those using proof-of-work consensus mechanisms, present significant scalability challenges.

Processing large numbers of transactions can be slow and expensive, leading to network congestion and high transaction fees. This is especially problematic in digital asset management, where rapid and cost-effective transactions are crucial for efficient operations. For example, a large financial institution managing thousands of securities on a blockchain would face substantial delays and costs if the underlying network couldn’t handle the transaction load.

Scalability Solutions for Blockchain Networks

Several approaches are being explored to enhance the scalability of blockchain networks. These solutions aim to improve transaction throughput without compromising security or decentralization. These include layer-2 scaling solutions, which process transactions off-chain before recording them on the main blockchain, and the exploration of alternative consensus mechanisms, such as proof-of-stake, which are generally more energy-efficient and can process transactions faster.

Furthermore, sharding, a technique that divides the blockchain into smaller, more manageable parts, is being implemented to improve processing speeds and capacity.

Interoperability Between Blockchain Platforms

The lack of interoperability between different blockchain networks presents a major obstacle to the widespread adoption of blockchain in digital asset management. Digital assets often need to be transferred between different platforms, and the absence of a common standard hinders this process. Imagine trying to transfer an NFT from one marketplace to another built on a different blockchain – currently, this is often a complex and cumbersome process.

This lack of interoperability limits the potential for a truly global and interconnected digital asset ecosystem.

Further details about The potential use of blockchain technology in identity management. is accessible to provide you additional insights.

Improving Interoperability

Several initiatives are underway to improve interoperability between different blockchain platforms. These include the development of cross-chain communication protocols that allow different blockchains to communicate and exchange data seamlessly. The creation of common standards and frameworks for digital asset representation and transfer is also crucial. Furthermore, the development of interoperability bridges, which facilitate the transfer of assets between disparate blockchains, is gaining traction.

These bridges often utilize atomic swaps or other mechanisms to ensure the secure and efficient transfer of assets across different networks. The success of these initiatives is vital for unlocking the full potential of blockchain in digital asset management.

Regulatory and Legal Considerations

Navigating the legal landscape surrounding blockchain in digital asset management is crucial for responsible implementation and adoption. The decentralized and often borderless nature of blockchain presents unique challenges for regulators worldwide, leading to a complex and evolving regulatory environment. Understanding these legal and regulatory frameworks is essential for businesses and individuals operating in this space.The application of blockchain technology to digital asset management raises several key legal issues, primarily concerning the definition, ownership, and transfer of these assets.

Existing legal frameworks, designed for traditional assets, often struggle to adapt to the unique characteristics of digital assets and their management via blockchain. This necessitates a careful consideration of jurisdictional boundaries and the harmonization of regulations across different jurisdictions.

Existing and Potential Regulatory Frameworks

The regulatory landscape for blockchain and digital assets is still developing, varying significantly across jurisdictions. Some countries are actively creating comprehensive frameworks, while others are adopting a more wait-and-see approach. Many regulatory bodies are grappling with how to classify digital assets – are they securities, commodities, or something else entirely? This classification significantly impacts the applicable regulations and compliance requirements.

For example, securities regulations often impose strict requirements on issuers and exchanges, while commodity regulations might focus on market manipulation and trading practices. The absence of a universally accepted definition creates uncertainty and hampers cross-border transactions. Furthermore, anti-money laundering (AML) and know-your-customer (KYC) regulations are increasingly being applied to blockchain platforms to combat illicit activities. The challenge lies in balancing the need for regulatory oversight with the inherent decentralization and transparency of blockchain technology.

Legal Challenges to Ownership and Transfer Rights

Establishing clear ownership and transfer rights for digital assets on a blockchain presents several legal challenges. The immutability of blockchain transactions, while a strength in terms of security, can also create difficulties if errors occur or disputes arise. Determining the legal standing of smart contracts, which automate asset transfers, is another key issue. The enforceability of smart contracts varies across jurisdictions, and questions around their legal interpretation and potential liability in case of malfunction or fraud need careful consideration.

Furthermore, the decentralized nature of blockchain can make it difficult to identify and hold accountable parties responsible for fraudulent activities or breaches of contract. The absence of a central authority also complicates the process of resolving disputes related to digital asset ownership or transactions. Cross-border enforcement of judgments related to blockchain transactions poses additional challenges.

Examples of Legal Precedents and Regulatory Guidelines

Several jurisdictions have begun to address the legal aspects of blockchain and digital assets through legislation, guidelines, and court rulings. These examples illustrate the evolving nature of this field and the diversity of approaches taken globally.

- United States: The Securities and Exchange Commission (SEC) has taken a case-by-case approach to classifying digital assets, often determining whether a particular token qualifies as a security under the Howey Test. This has led to uncertainty and litigation regarding the regulatory status of various cryptocurrencies and initial coin offerings (ICOs).

- European Union: The EU’s Markets in Crypto-assets (MiCA) regulation aims to create a unified regulatory framework for crypto-assets within the EU, addressing issues such as market abuse, consumer protection, and anti-money laundering.

- Singapore: Singapore has adopted a relatively progressive approach, issuing guidelines and licensing frameworks for cryptocurrency exchanges and other blockchain-related businesses. They focus on fostering innovation while maintaining regulatory oversight.

- Switzerland: Switzerland has established itself as a blockchain-friendly jurisdiction, with clear legal frameworks for certain types of blockchain projects and digital assets.

Case Studies and Real-World Applications

Blockchain technology’s impact on digital asset management is best understood through examining real-world implementations. These case studies highlight the practical benefits and challenges encountered when integrating blockchain into existing workflows across diverse sectors. By analyzing successful deployments, we can gain valuable insights into the technology’s potential and limitations.

Several industries are leveraging blockchain to improve their digital asset management processes. These implementations demonstrate how blockchain’s inherent features – immutability, transparency, and enhanced security – translate into tangible advantages. However, scalability, interoperability, and regulatory hurdles remain significant challenges that need to be addressed for wider adoption.

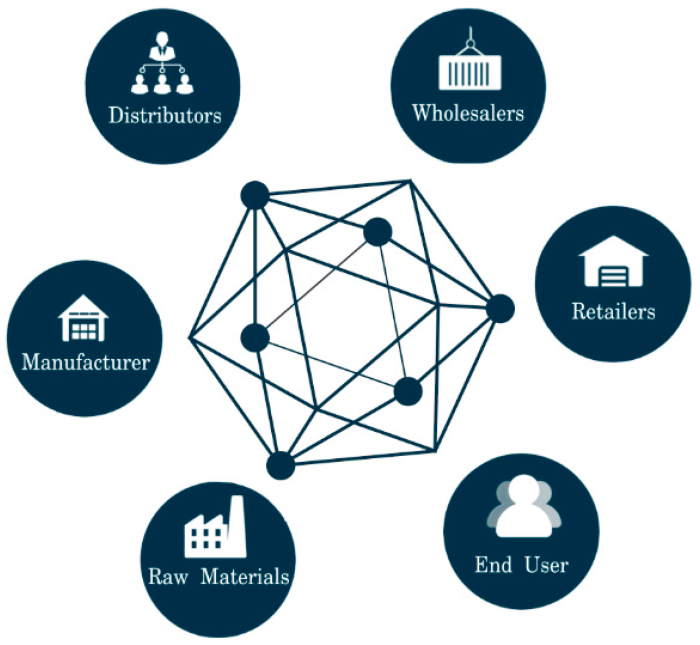

Digital Asset Management in the Supply Chain Industry

This section explores how a major beverage company implemented a blockchain-based system to track its products from origin to consumer. The system utilizes unique, cryptographically secured tokens assigned to each product, allowing for real-time tracking and verification of authenticity. This eliminates counterfeiting and improves supply chain efficiency. For example, each bottle of a particular beverage receives a unique digital ID upon bottling, which is recorded on the blockchain.

This ID is then scanned at various points in the supply chain, providing a complete and immutable record of the bottle’s journey. This transparency allows the company to quickly identify and address any issues, such as product recalls or instances of counterfeiting. The blockchain system also allows for improved inventory management and enhanced traceability, which can be invaluable in case of product recalls or quality control issues.

Workflow Illustration: Blockchain-Based Beverage Supply Chain, Exploring the use of blockchain technology in digital asset management.

Imagine a visual representation: The workflow begins with the bottling plant, where each bottle receives its unique digital ID and is registered on the blockchain. This ID is then scanned at distribution centers, wholesalers, retailers, and finally, by the consumer using a smartphone app. Each scan updates the blockchain with the location and timestamp, creating an immutable audit trail.

This allows the company to track the product’s movement in real-time, identify bottlenecks, and ensure product authenticity. The visual would show a flowchart with boxes representing each stage, arrows indicating the flow of information, and the blockchain as a central database storing all the transaction records. The flowchart clearly illustrates the transparency and immutability provided by the blockchain.

A key element is the integration of the blockchain with existing enterprise resource planning (ERP) systems for seamless data flow.

Challenges and Benefits in Real-World Applications

Implementing blockchain solutions is not without its challenges. Scalability remains a concern, especially when dealing with large volumes of data. Integration with existing systems can also be complex and expensive. Furthermore, regulatory uncertainty and a lack of standardized protocols can hinder widespread adoption. However, the benefits are significant, including improved security, enhanced transparency, reduced costs, and increased efficiency.

These benefits often outweigh the challenges, particularly in industries where trust and traceability are paramount. For instance, in the case of the beverage company, the improved traceability and reduced counterfeiting led to significant cost savings and enhanced brand reputation.

Blockchain technology presents a compelling solution to the challenges inherent in managing digital assets. By leveraging its inherent security, transparency, and automation capabilities, we can create a more efficient, trustworthy, and secure ecosystem for digital ownership. While challenges remain in areas such as scalability, regulation, and interoperability, the ongoing advancements and real-world applications showcase the immense potential of blockchain to transform digital asset management.

The future likely involves further integration of innovative technologies and the development of robust legal frameworks to support this transformative technology.