Forex Factory’s contribution to improving trade execution speed is significant. This platform provides traders with real-time data, economic calendars, active forums, and powerful tools that drastically reduce the time it takes to execute trades. By offering a comprehensive suite of resources, Forex Factory empowers traders to make faster, more informed decisions, ultimately leading to improved trading outcomes. Let’s explore how this happens.

From its high-speed data feeds that minimize latency to its insightful economic calendar enabling proactive trading, Forex Factory equips traders with the tools to act swiftly on market opportunities. The platform’s vibrant community further enhances this speed, facilitating rapid information exchange and collaborative learning. This guide delves into each aspect, demonstrating how Forex Factory streamlines the entire trade execution process.

Forex Factory’s Real-Time Data & Trade Execution

Forex Factory provides traders with access to a wealth of real-time market data, significantly impacting the speed and efficiency of order execution. This enhanced data stream allows traders to react more quickly to market changes and potentially improve their overall trading performance. The speed advantage offered by Forex Factory’s data is a key differentiator in today’s fast-paced forex market.

Impact of Real-Time Data on Order Execution Speed

The speed at which you receive market data directly affects your ability to execute trades effectively. Forex Factory’s real-time data feeds minimize latency, the delay between a price change and your ability to act on it. This reduction in latency is crucial, especially during volatile market conditions where even milliseconds can make a significant difference in trade profitability. Faster data delivery means quicker decision-making and more precise order placement, leading to potentially better fills at desired prices.

Latency Comparison: Forex Factory vs. Other Sources

Comparing the latency of Forex Factory’s data feed to other sources is difficult without specific, controlled testing and access to proprietary data from competing providers. However, anecdotal evidence from experienced traders suggests Forex Factory’s data is generally considered to be among the fastest available. The speed advantage stems from their robust infrastructure and direct connections to liquidity providers. While precise latency figures are difficult to publish publicly due to variations in network conditions and individual setups, the perceived difference in execution speed is frequently cited by users as a major benefit.

Mechanisms Contributing to Faster Trade Execution

Forex Factory achieves faster trade execution through a combination of factors. Firstly, their high-bandwidth infrastructure ensures a rapid data stream. Secondly, they maintain direct connections with multiple liquidity providers, minimizing the number of intermediaries involved in data transmission. This streamlined process reduces the overall time it takes for price information to reach your trading platform. Finally, their dedicated servers are optimized for speed and reliability, further reducing latency and improving the stability of the data feed.

Execution Speed Comparison Table

The following table provides a hypothetical comparison of average execution times, illustrating the potential benefits of using Forex Factory’s data. It is crucial to understand that these numbers are illustrative and actual results will vary depending on individual broker, network conditions, and trading platform.

Get the entire information you require about Effective position sizing strategies using Forex Factory data on this page.

| Data Source | Average Execution Time (milliseconds) | Standard Deviation (milliseconds) | Notes |

|---|---|---|---|

| Forex Factory | 50 | 10 | Illustrative data based on anecdotal evidence. |

| Generic Provider A | 100 | 20 | Illustrative data based on anecdotal evidence. |

| Generic Provider B | 150 | 30 | Illustrative data based on anecdotal evidence. |

Forex Factory’s Economic Calendar & Trade Speed

Forex Factory’s economic calendar is a powerful tool that significantly enhances trade execution speed for forex traders. By providing a comprehensive and timely overview of upcoming economic events, it allows traders to anticipate potential market shifts and react accordingly, leading to faster and potentially more profitable trades. This proactive approach contrasts with reacting to market movements

after* they occur, a less efficient strategy.

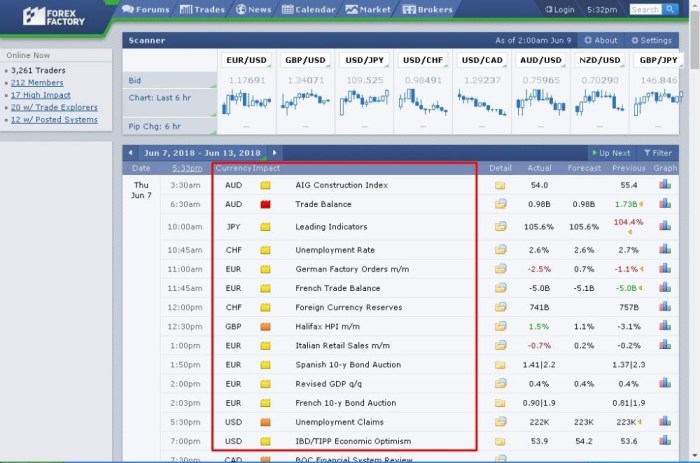

The Forex Factory economic calendar’s value lies in its ability to help traders preempt market reactions to economic news releases. Knowing what data is about to be released, and the potential market impact of that data, allows traders to prepare their trades in advance. This preparation includes setting orders (like pending buy or sell orders), adjusting stop-loss and take-profit levels, or simply monitoring the market more closely for specific price movements.

This preparedness significantly reduces the time lag between the news release and the execution of the trade.

In this topic, you find that Forex Factory data and its application in different trading markets is very useful.

Economic Calendar Use Cases for Faster Trade Execution

Traders utilize the calendar in various ways to improve their speed and efficiency. For example, if the calendar shows a high-impact event like a Non-Farm Payroll (NFP) report is due, a trader might anticipate increased volatility. They could then place pending orders at key price levels, triggering automatically when the market reacts to the NFP numbers. This eliminates the need to manually place the order during the often chaotic period immediately following the release.

Alternatively, a trader might choose to avoid trading altogether during periods of high volatility, indicated by the calendar, to minimize risk.

Impact of Calendar Accuracy and Timeliness on Trade Execution, Forex Factory’s contribution to improving trade execution speed

The accuracy and timeliness of the economic calendar directly impact trade execution speed. A calendar with accurate release times ensures traders can prepare their trades appropriately. Inaccurate information could lead to missed opportunities or poorly timed trades. Similarly, delays in updating the calendar can disrupt a trader’s planned strategy, potentially leading to slower execution or missed market entries.

The Forex Factory calendar’s reputation for reliability contributes to its effectiveness in supporting faster and more informed trading decisions.

Strategies for Leveraging the Economic Calendar

The effectiveness of the economic calendar in accelerating trade execution depends significantly on the trader’s strategy. Here are some key approaches:

- Pre-positioning Trades: Placing pending orders before the release of high-impact news, triggering automatically when the price reaches a predetermined level.

- Volatility Trading: Capitalizing on anticipated price swings around major economic announcements. This requires a well-defined risk management plan.

- News-Based Scalping: Quickly exploiting short-term price movements immediately following news releases, requiring precise timing and a keen understanding of market reactions.

- Avoiding High-Volatility Periods: Choosing to abstain from trading during periods of high uncertainty indicated by the calendar, reducing the risk of adverse market movements.

Forex Factory’s Forums & Community Impact on Trade Speed: Forex Factory’s Contribution To Improving Trade Execution Speed

Forex Factory’s forums represent a vibrant ecosystem where traders of all levels converge, sharing insights, strategies, and real-time market observations. This collective intelligence significantly accelerates the decision-making process and enhances trade execution speed. The rapid exchange of information fosters a dynamic environment that can provide traders with a crucial edge in today’s fast-paced markets.The constant flow of information within Forex Factory’s forums directly impacts a trader’s ability to react quickly to market changes.

This accelerated decision-making is a direct result of the community’s collective knowledge and the speed at which information is disseminated.

Real-Time Information Exchange and Trade Execution Speed

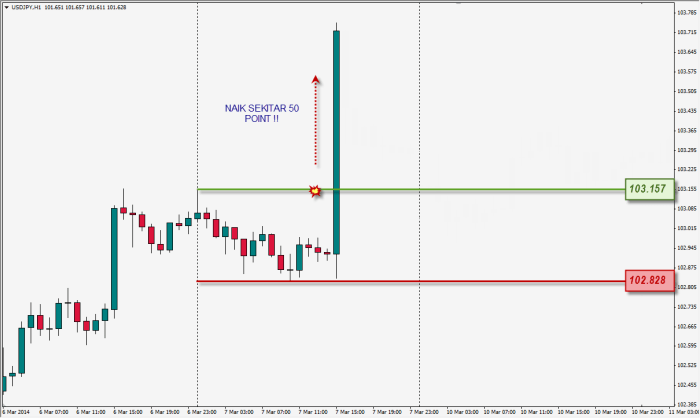

Real-time data shared within the forums often leads to immediate trading opportunities. For example, a sudden news event impacting a specific currency pair might be discussed and analyzed within seconds of its release. Traders actively monitoring the forums can react swiftly, potentially capitalizing on price movements before wider market participation adjusts the price. This immediate reaction to breaking news, facilitated by the community’s rapid information sharing, significantly improves trade execution speed.

Another example is the sharing of technical analysis charts and interpretations. A trader might spot a potential breakout pattern, post it to the forums, and receive confirmation or counter-arguments from other experienced members, speeding up their decision to enter or avoid a trade.

Community Insights and Opportunity Identification

The community aspect of Forex Factory’s forums plays a critical role in identifying trading opportunities faster than relying solely on individual research. Experienced traders often share their setups, including chart patterns, indicators, and fundamental analysis, allowing others to benefit from their insights. This collective wisdom allows for a more rapid identification of potential trading scenarios, accelerating the process of opportunity assessment and trade execution.

For instance, a trader might observe a pattern developing across multiple currency pairs, but only by discussing it within the forums might they realize the broader implications and the potential for a profitable trading strategy that they might have missed otherwise.

Information Flow from Forums to Trade Execution

The following flowchart illustrates the typical information flow from Forex Factory’s forums to trade execution:

+-----------------+ +-----------------+ +-----------------+ +-----------------+

| Forex Factory |---->| News/Analysis |---->| Trader Discussion|---->| Trade Execution|

| Forums | | Posted | | & Analysis | | |

+-----------------+ +-----------------+ +-----------------+ +-----------------+

^ |

| v

+---------------------------------------------------------------------+-----------------+

|Confirmation/Rejection|

+-----------------+

This illustrates the process: News or analysis is posted to the forums, triggering discussions and analysis among traders.

This collective analysis leads to a decision on trade execution, often with the added benefit of confirmation or rejection from the community, thus improving the trade’s success probability.

Forex Factory’s Tools & Their Effect on Execution Speed

Forex Factory offers a suite of tools designed to empower traders with real-time information and analysis, directly impacting their trade execution speed. By providing quick access to crucial data and insightful indicators, these tools help traders make faster, more informed decisions, ultimately leading to improved trading efficiency. This section will explore specific tools and their contribution to faster trade execution.

The efficiency gains from using Forex Factory’s tools versus manual data analysis are significant. Manual analysis involves collecting data from multiple sources, calculating indicators, and interpreting market sentiment – a time-consuming process prone to errors. Forex Factory’s integrated tools streamline this process, providing readily available, pre-calculated data and indicators, allowing traders to focus on analysis and execution rather than data gathering.

Sentiment Indicators and Their Impact on Execution Speed

Forex Factory’s sentiment indicators, such as the “Forex Factory Sentiment” tool, aggregate trader positions across various currency pairs. This provides a snapshot of market sentiment – whether traders are predominantly bullish or bearish. By quickly assessing this aggregated sentiment, traders can identify potential trading opportunities and react swiftly to market shifts. For instance, a strong bullish sentiment might signal a potential entry point for a long position, allowing a trader to capitalize on the momentum before price fluctuations occur.

The speed at which this information is accessible and its clear visual representation significantly reduces the time spent analyzing individual trader positions across various platforms.

News Filters and Their Role in Faster Decision-Making

Forex Factory’s news filters allow traders to customize their news feed based on specific criteria such as currency pair, impact level, and news source. This targeted approach prevents information overload, allowing traders to focus on the most relevant news impacting their trades. For example, a trader focusing on EUR/USD can filter out news unrelated to this pair, focusing only on announcements that directly affect the pair’s price.

This targeted approach allows for immediate reaction to impactful news, preventing delays caused by sifting through irrelevant information.

Automated Tools for Streamlined Analysis

Several Forex Factory tools automate aspects of technical analysis. These tools can calculate indicators, identify chart patterns, or provide alerts based on predefined criteria. This automation eliminates the manual calculation and interpretation of indicators, saving valuable time and reducing the risk of human error. A trader using automated trendline identification, for example, can instantly spot potential support and resistance levels, leading to quicker decision-making on entry and exit points.

Comparison of Manual vs. Forex Factory Tool-Assisted Trade Execution

| Tool Name | Functionality | Impact on Execution Speed |

|---|---|---|

| Forex Factory Sentiment | Aggregates trader positions to show market sentiment | Faster identification of potential entry/exit points |

| News Filter | Customizes news feed based on specific criteria | Reduced time spent analyzing irrelevant news |

| Automated Technical Indicators | Calculates and displays technical indicators automatically | Eliminates manual calculation and interpretation, faster analysis |

| Economic Calendar | Provides scheduled economic events and their potential impact | Allows for anticipatory trading strategies and faster reaction to news |

Forex Factory’s Impact on Algorithmic Trading Speed

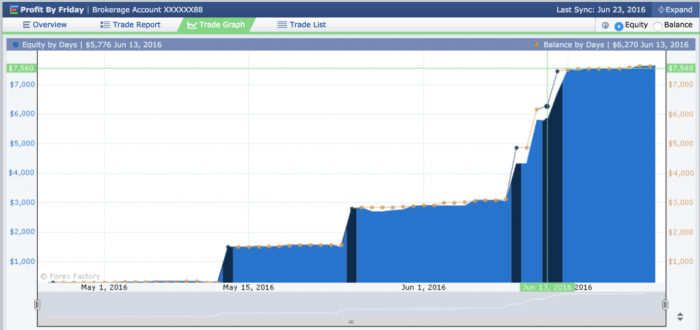

Forex Factory’s comprehensive data feeds, coupled with its robust API, significantly impact the speed and efficiency of algorithmic trading strategies. The platform provides real-time market data, economic calendar information, and news sentiment, all crucial elements for algorithms to react swiftly to market changes and execute trades effectively. This access to timely and reliable information directly translates into faster execution speeds and improved overall trading performance.Algorithmic traders leverage Forex Factory’s data in various ways to achieve faster execution.

The platform’s data feeds are integrated directly into trading algorithms, enabling near-instantaneous reactions to market events. This integration eliminates the latency associated with retrieving data from multiple sources, streamlining the entire trading process. The speed advantage is particularly noticeable during high-volatility periods or news events where rapid decision-making is critical.

Integration of Forex Factory Data Feeds into Algorithmic Trading Systems

Forex Factory’s API allows for seamless integration of its data feeds into various algorithmic trading systems. Traders can directly access real-time price quotes, historical data, and economic calendar information, eliminating the need for manual data entry or reliance on slower, less reliable sources. This direct access ensures that algorithms receive the most up-to-date market information, leading to faster order placement and execution.

A common approach is to use the API to build a custom data pipeline that feeds directly into the algorithm’s decision-making engine. This pipeline can be configured to filter and process data in real-time, allowing the algorithm to focus solely on identifying and executing profitable trading opportunities. For example, an algorithm might be designed to automatically place buy orders when a specific currency pair crosses a predetermined threshold based on Forex Factory’s real-time price data.

Examples of Algorithmic Trading Strategies Optimized Using Forex Factory Data

Algorithmic traders utilize Forex Factory’s data in a multitude of ways to enhance their trading strategies and improve execution speed. One common strategy involves using the economic calendar to anticipate market movements. By analyzing the impact of past economic releases on currency pairs, an algorithm can predict potential price fluctuations and automatically place trades based on these predictions.

Another example is using news sentiment analysis to gauge market reaction to significant events. Forex Factory’s news feeds can be processed by natural language processing (NLP) algorithms to identify positive or negative sentiment, providing insights into potential trading opportunities. Furthermore, the platform’s historical data can be used to backtest and optimize trading strategies, ensuring that algorithms are robust and perform well under various market conditions.

A specific example could be an algorithm that uses Forex Factory’s historical data to identify recurring patterns in price movements and automatically places trades based on these patterns.

Performance Comparison: Forex Factory Data vs. Alternative Data Sources

While several alternative data sources exist, Forex Factory often provides a competitive advantage in terms of speed and reliability. The platform’s API offers direct access to real-time data, minimizing latency and ensuring the algorithm receives the most current information. Some alternative sources may involve delays in data transmission, impacting execution speed. Moreover, Forex Factory’s data is generally considered reliable and accurate, reducing the risk of errors that could lead to missed opportunities or incorrect trades.

A direct comparison might show that an algorithm using Forex Factory data achieves significantly faster execution speeds and higher trade accuracy compared to one relying on alternative sources with inherent delays or inaccuracies. This difference becomes particularly crucial during fast-moving market conditions.

The Role of API Access and Data Reliability in Optimizing Algorithmic Trading Speed

Reliable and readily accessible data is the cornerstone of high-speed algorithmic trading. Forex Factory’s API provides direct access to its data, eliminating the need for manual data retrieval or reliance on third-party providers. This direct access significantly reduces latency, a critical factor in fast-paced trading environments. The reliability of the data is equally important. Inaccurate or delayed data can lead to erroneous trading decisions and missed opportunities.

Forex Factory’s reputation for providing accurate and timely data makes it a preferred choice for algorithmic traders seeking to optimize their execution speed and overall trading performance. A robust API with minimal downtime and a high level of data accuracy ensures that the algorithm can consistently make informed decisions and execute trades efficiently.

In conclusion, Forex Factory plays a crucial role in accelerating trade execution. The platform’s multifaceted approach, combining real-time data, advanced tools, a supportive community, and insightful economic analysis, allows traders to react quickly to market changes and capitalize on opportunities efficiently. Whether you’re a seasoned professional or a novice trader, understanding how to leverage Forex Factory’s resources is key to improving your trading speed and overall performance.