Forex Factory data and its application in different trading markets are crucial for savvy traders. This guide explores how this readily available data source can enhance your trading strategies, from technical analysis using indicators like moving averages and RSI, to incorporating fundamental analysis based on economic news events. We’ll delve into how to use Forex Factory data for various currency pairs, develop effective risk management plans, and even touch on its role in algorithmic trading.

Get ready to unlock the power of Forex Factory data!

We’ll cover everything from understanding the different types of data available on Forex Factory to comparing its effectiveness across major, minor, and exotic currency pairs. We’ll also explore the limitations, show how to integrate it with other data sources for a more holistic view of the market, and even look at how to visualize this data effectively for better decision-making.

Whether you’re a seasoned trader or just starting out, this guide will equip you with practical knowledge to leverage Forex Factory data to its fullest potential.

Introduction to Forex Factory Data: Forex Factory Data And Its Application In Different Trading Markets

Forex Factory is a popular website among forex traders, offering a wealth of information and tools to aid in their trading decisions. It’s essentially a central hub providing real-time and historical data, economic calendars, and a vibrant community forum. Understanding how to effectively utilize this data can significantly improve your trading strategies and risk management.The scope of Forex Factory data encompasses a wide range of market information, catering to both novice and experienced traders.

It’s not just about price charts; it provides context and insights that help you understand the “why” behind price movements. This contextual understanding is crucial for making informed trades.

Types of Forex Factory Data, Forex Factory data and its application in different trading markets

Forex Factory provides several key data types. These different data sources, when used in conjunction, paint a more comprehensive picture of the market’s current state and potential future direction.

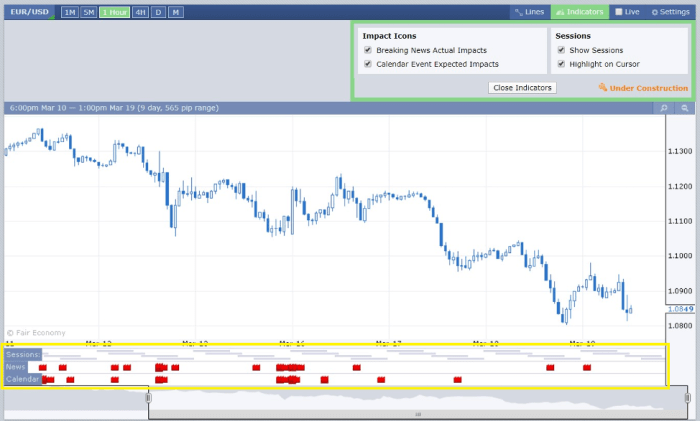

- Economic Calendar: This is arguably Forex Factory’s most utilized feature. It lists upcoming economic news releases (e.g., Non-Farm Payrolls, inflation reports, interest rate decisions) from various countries, along with their expected impact on currency pairs. The calendar provides the time of release, the actual and forecast values (when available), and often a consensus forecast from various economists. This helps traders anticipate potential volatility and plan their trades accordingly.

- Forex Forums and News: Forex Factory boasts a large and active community forum. Traders share their analysis, strategies, and opinions, creating a dynamic source of market sentiment. While this information should be treated with caution (not all opinions are equally valid), it offers a valuable pulse on the collective thinking of other traders. News sections also provide updates on major market events and their potential impact.

- Historical Data: Forex Factory provides access to historical price data for various currency pairs. This allows traders to backtest their strategies, identify recurring patterns, and assess the performance of different trading approaches over time. Access to historical data is vital for developing robust and reliable trading systems.

- Technical Analysis Tools: While not directly providing the raw data, Forex Factory links to or integrates with various tools that allow for technical analysis, such as chart plotting software and indicators. This facilitates the application of technical analysis methods to the historical data available on the site or through linked resources.

Significance of Forex Factory Data in Forex Trading

The significance of Forex Factory data lies in its ability to provide a holistic view of the forex market. By combining economic calendar data with the community sentiment and historical price action, traders can build a more comprehensive understanding of market dynamics.

Effective use of Forex Factory data allows for better trade planning, risk management, and improved decision-making.

For example, anticipating a significant economic release (like the US Non-Farm Payroll report) allows traders to adjust their position sizes or even avoid trading altogether during periods of heightened volatility. Analyzing historical data can help identify potential support and resistance levels, providing entry and exit points for trades. Understanding market sentiment from the forums can provide additional context, highlighting potential biases or trends that may influence price movements.

Therefore, Forex Factory’s comprehensive data offering contributes significantly to a more informed and successful trading approach.

Mastering Forex Factory data isn’t just about knowing

-what* the data is; it’s about understanding

-how* to effectively integrate it into your overall trading approach. By combining technical and fundamental analysis, employing robust risk management strategies, and even considering its use in algorithmic trading, you can significantly improve your trading performance. Remember, while Forex Factory data is a valuable tool, it’s crucial to use it in conjunction with other market information and sound trading principles.

Don’t just react to the data; learn to interpret it strategically for informed trading decisions.

Expand your understanding about Using Forex Factory to identify and avoid trading traps with the sources we offer.

Obtain access to how to use influencer marketing to promote your business to private resources that are additional.