The limitations of relying solely on Forex Factory data for trading decisions are significant, often overlooked by novice traders. While Forex Factory offers a convenient hub for forex news and sentiment, it’s crucial to understand its inherent biases and incomplete data picture. Ignoring these limitations can lead to flawed trading strategies and potentially substantial losses. This guide explores the critical gaps in Forex Factory’s data and how to effectively supplement it for more informed trading.

We’ll delve into specific examples of how Forex Factory data can be misleading, examining its timeliness, accuracy, and the crucial contextual information it often lacks. We’ll compare Forex Factory’s data against other reliable sources, highlighting key discrepancies and the impact on trading decisions. Finally, we’ll Artikel a practical risk management strategy to help you avoid the pitfalls of over-reliance on a single data source.

Missing Data Points and Their Impact: The Limitations Of Relying Solely On Forex Factory Data For Trading Decisions

Forex Factory is a fantastic resource for forex traders, providing a wealth of information like economic calendar events and order book data. However, relying solely on it for trading decisions can be risky due to significant gaps in the data it offers. Understanding these limitations is crucial for making informed trading choices.The absence of certain data points on Forex Factory significantly impacts a trader’s ability to form a complete picture of the market.

This incomplete view can lead to inaccurate assessments and ultimately, poor trading outcomes.

Absence of Fundamental Economic Data

Forex Factory primarily focuses on technical analysis data. It lacks comprehensive fundamental data, such as detailed economic reports beyond the headline numbers, geopolitical analyses, or in-depth company news that can drastically affect currency pairs. For instance, while Forex Factory might show the release time and headline figure for US Non-Farm Payrolls, it won’t provide detailed breakdowns by industry sector, which could reveal nuanced market sentiment.

Ignoring these deeper layers of fundamental data can lead to a misinterpretation of the market’s overall direction. A strong headline number might be accompanied by weak sub-indices, signaling underlying weakness that a Forex Factory-only trader might miss.

Limitations in Technical Analysis Data

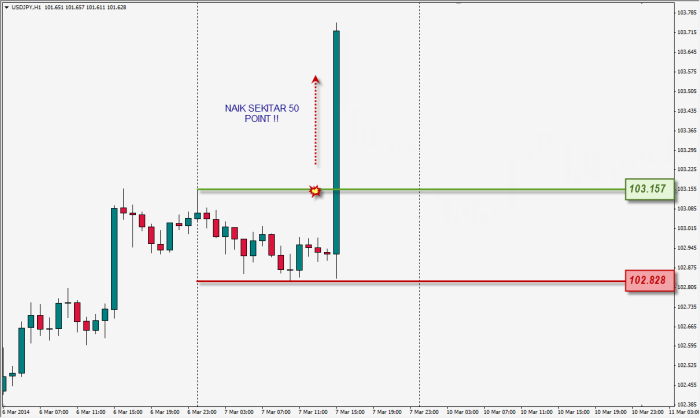

While Forex Factory provides some technical analysis tools, its offerings are limited. It lacks many advanced indicators, custom indicators, and alternative chart types readily available on other platforms. For example, you might not find specific volume profile indicators, advanced fractal analysis tools, or custom-built indicators tailored to specific trading strategies. This restricted set of tools hampers a trader’s ability to perform thorough technical analysis and identify optimal entry and exit points.

The absence of real-time market depth data, available on other platforms, also limits the ability to assess current market liquidity and potential slippage.

Finish your research with information from Understanding the correlation between Forex Factory news and market reactions.

Examples of Unfavorable Outcomes

Consider a scenario where a trader, relying solely on Forex Factory’s economic calendar, anticipates a significant EUR/USD rally based on a positive Eurozone PMI release. However, simultaneously, there was an unexpected geopolitical event impacting the Eurozone, which wasn’t reported on Forex Factory. This unforeseen event could lead to a sharp drop in the EUR/USD, resulting in significant losses for the trader.

Examine how Analyzing Forex Factory news for profitable trading opportunities can boost performance in your area.

Another example involves missing crucial technical data. A trader relying solely on Forex Factory’s limited indicators might miss a key divergence signal that would have warned of a price reversal, resulting in an unsuccessful trade.

Alternative Data Sources

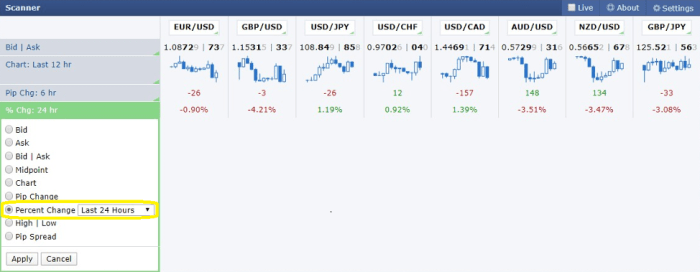

To mitigate the limitations of relying solely on Forex Factory, traders should supplement their analysis with data from other sources.

- Central Bank Websites: Access official statements, monetary policy announcements, and economic data directly from the source.

- Financial News Websites: Stay updated on breaking news, market analysis, and expert opinions from reputable sources like Bloomberg, Reuters, and the Financial Times.

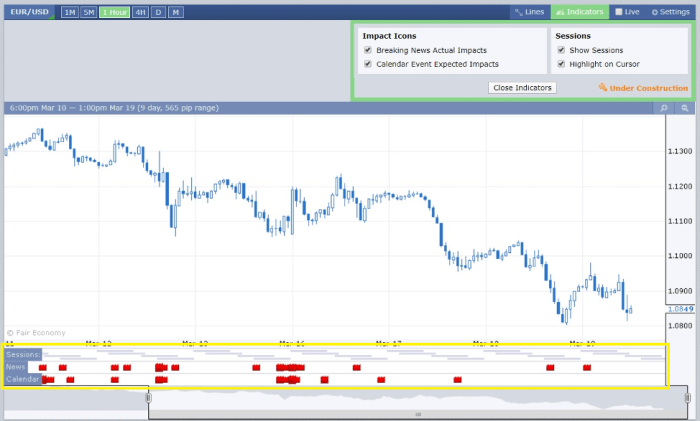

- TradingView: Access a vast library of technical indicators, charting tools, and community-generated analysis.

- Broker Platforms: Many brokers provide advanced charting tools, real-time market depth data, and economic calendars with more comprehensive information.

- Dedicated Economic Data Providers: Services like Refinitiv or Bloomberg provide extensive economic data and analytics.

The Role of Other Market Factors

Forex Factory is a valuable resource, offering a wealth of data on forex market activity. However, relying solely on its information for trading decisions is a risky strategy. Ignoring the broader context of global events and economic conditions can significantly impact your trading performance, leading to potentially substantial losses. This section will explore how these external factors influence the forex market and why incorporating them into your analysis is crucial.Geopolitical events and global economic conditions exert a powerful influence on forex markets, often in ways not immediately reflected in Forex Factory’s data.

News of political instability, international conflicts, or significant economic announcements (like changes in interest rates or inflation figures) can trigger dramatic shifts in currency values. These shifts often occur rapidly and unpredictably, making it impossible for Forex Factory’s historical data alone to provide sufficient warning or insight.

Geopolitical Events and Their Impact on Forex

Major geopolitical events, such as wars, political upheavals, or significant diplomatic shifts, can cause sudden and substantial volatility in currency markets. For instance, the outbreak of a major conflict can lead to a flight to safety, boosting demand for currencies perceived as stable havens (like the US dollar or Japanese yen) while weakening others. Forex Factory might show increased trading volume or price fluctuations, but it won’t necessarily predict the underlying cause or the extent of the movement.

The data might reflect the

- effect* of geopolitical events, but not necessarily the

- cause*. This information gap can lead to significant trading errors if you’re relying solely on the platform’s data.

Global Economic Conditions and Their Influence, The limitations of relying solely on Forex Factory data for trading decisions

Global economic indicators, such as inflation rates, unemployment figures, and GDP growth, profoundly influence currency values. A country experiencing strong economic growth might see its currency appreciate, while a nation facing high inflation or economic recession might experience a depreciation. Forex Factory may display price movements resulting from these conditions, but it doesn’t inherently predict future economic trends.

Analyzing economic reports and forecasts from reputable sources is crucial for understanding the underlying drivers of currency fluctuations and making informed trading decisions.

Predictive Power Comparison

The predictive power of Forex Factory data alone is limited compared to a strategy that incorporates other market indicators. Forex Factory provides a snapshot of market sentiment and price action, but it lacks the context provided by macroeconomic data, geopolitical analysis, and technical indicators derived from sources outside the platform. Using Forex Factory in conjunction with other indicators and analyses provides a more holistic and accurate picture of market dynamics, enabling better prediction of future price movements.

Hypothetical Trading Scenario Illustrating Losses

Imagine a trader solely relying on Forex Factory data to trade the EUR/USD pair. The platform shows a consistent upward trend over several weeks, suggesting a strong buy signal. However, this trader ignores the escalating geopolitical tensions between two major European countries, which are not explicitly highlighted on Forex Factory. These tensions eventually lead to a sudden and significant drop in the value of the Euro, causing the trader to suffer significant losses despite the seemingly positive signals from Forex Factory.

The trader’s reliance on a single data source, without considering the wider context of geopolitical risk, led to a flawed trading decision and substantial financial losses.

Risk Management and Diversification Strategies

Over-reliance on any single data source, especially in the volatile world of forex trading, significantly increases your risk exposure. Forex Factory, while a valuable tool, offers only a partial view of the market. Ignoring other crucial factors can lead to poor decision-making and substantial losses. A robust risk management plan needs a multi-faceted approach, incorporating diverse data streams to paint a more complete picture.Over-dependence on Forex Factory data limits your understanding of market dynamics.

It primarily focuses on sentiment and news events, neglecting technical analysis, economic indicators, and geopolitical influences. This narrow perspective can lead to inaccurate predictions and flawed trading strategies, ultimately increasing the probability of losses. A diversified approach, however, allows for a more holistic assessment, reducing reliance on any single source’s potential inaccuracies.

Risk Management Plan Incorporating Multiple Data Sources

A comprehensive risk management plan should include several key elements to counter the limitations of relying solely on Forex Factory data. First, integrate technical analysis from reputable charting platforms. Technical indicators provide insights into price trends and momentum that are not readily available on Forex Factory. Second, incorporate fundamental analysis by monitoring economic calendars and reports from sources like the Federal Reserve, the European Central Bank, and other central banks.

Third, consider geopolitical risk by monitoring news from credible international news sources to identify potential market-moving events. Finally, implement position sizing strategies that limit risk per trade, regardless of the data source used. This ensures that even if a single data source leads to an incorrect trade, the overall impact on your portfolio is minimized. For example, never risk more than 1-2% of your trading capital on any single trade.

Diversification Improves Decision-Making and Reduces Inaccuracies

Diversifying data sources enhances decision-making by providing a more comprehensive view of market conditions. Imagine relying solely on Forex Factory’s sentiment indicators suggesting a bullish trend for EUR/USD. However, if you also consult technical analysis charts showing a bearish divergence and fundamental analysis indicating weakening Eurozone economic data, you gain a more nuanced perspective. This allows you to make a more informed decision, potentially avoiding a losing trade.

The impact of inaccuracies in a single data source is significantly reduced when corroborated or contradicted by multiple sources. For example, if Forex Factory shows high buying volume, but technical indicators signal overbought conditions, it might indicate a potential short-term correction, leading to a more cautious approach.

Visual Representation of Diversification Benefits

Imagine a Venn diagram. One circle represents Forex Factory data (sentiment, news). Another circle represents technical analysis (charts, indicators). A third circle represents fundamental analysis (economic data, geopolitical events). The overlapping areas represent the synergistic effect of combining these data sources.

The larger the overlapping area, the more robust and reliable your trading decisions become. The area outside the circles represents the inherent uncertainty in the market, which cannot be entirely eliminated, but can be significantly mitigated through diversification. The more complete the overlapping area, the less reliance there is on any single source, reducing the impact of potential inaccuracies.

A single data source provides a small, potentially inaccurate, segment of the overall market picture. By combining several sources, the trader obtains a much more complete picture, making for more reliable predictions and reduced risks.

Ultimately, successful forex trading demands a holistic approach. While Forex Factory can be a valuable tool, it should never be your sole source of information. By understanding its limitations and actively supplementing its data with other reputable sources, including fundamental economic data and diverse market indicators, you can significantly improve your trading decisions, mitigate risks, and enhance your chances of profitability.

Remember, diversification is key to navigating the complexities of the forex market effectively.