Forex Factory data and its relevance to different trading timeframes is a crucial topic for any forex trader, regardless of their preferred strategy. Understanding how economic news, sentiment indicators, and other data points impact price action across various timeframes – from scalping to long-term position trading – is key to consistent profitability. This guide will walk you through how to effectively leverage Forex Factory’s resources for optimal trading decisions, no matter your timeframe preference.

We’ll explore how different data types – like economic calendars, news releases, and sentiment indicators – affect trading strategies across various time horizons. We’ll examine specific examples of how traders can use this information for scalping, day trading, swing trading, and position trading. Finally, we’ll discuss the limitations and potential biases associated with using Forex Factory data, emphasizing the importance of combining it with other forms of market analysis.

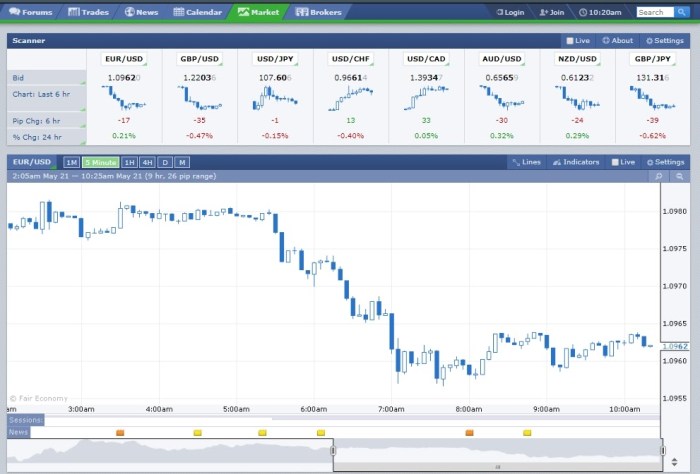

Forex Factory Data and Day Trading (Timeframes 5 minutes to 4 hours)

Forex Factory is a treasure trove of information for day traders, offering real-time economic news, calendar events, and sentiment indicators. Understanding how to effectively utilize this data within the fast-paced world of day trading, particularly across timeframes ranging from 5 minutes to 4 hours, is crucial for success. This section will explore the nuances of using Forex Factory data for day trading, differentiating its application from scalping strategies and outlining a sample trading plan.Forex Factory data plays a vital role in informing day trading decisions, but its application differs significantly from scalping.

While scalpers primarily focus on very short-term price fluctuations, often using technical analysis and fast-moving indicators, day traders utilize a broader range of tools, including fundamental data from Forex Factory. This allows them to capitalize on both short-term price movements and the longer-term effects of news releases.

Forex Factory Data Relevance for Day Trading

The most relevant Forex Factory data points for day traders include economic news releases (like Non-Farm Payrolls, inflation data, and central bank announcements), the economic calendar itself (allowing for anticipation of upcoming events), and the sentiment indicators (gauging market mood before and after news events). These data points provide a fundamental context to technical analysis, helping traders anticipate potential price swings and adjust their strategies accordingly.

For instance, a positive surprise in the Non-Farm Payroll report might lead to a sharp increase in the value of the US dollar, creating a lucrative trading opportunity for day traders who anticipated this movement.

Sample Day Trading Plan Incorporating Forex Factory Data

This plan focuses on trading the EUR/USD pair around a significant news release, such as the Eurozone CPI (Consumer Price Index) announcement.The plan begins with pre-market analysis using the Forex Factory calendar. The trader identifies the scheduled release time and the potential market impact based on previous releases and analyst forecasts. They then select a timeframe (e.g., 1-hour chart) and identify potential entry and exit points using technical indicators (e.g., moving averages, RSI) that align with their expected price movement.Prior to the release, the trader places a pending order (e.g., a buy stop order above a key resistance level if expecting a positive CPI surprise).

After the release, they monitor the market’s reaction, adjusting their strategy based on the actual data and the market’s response. If the CPI is higher than expected, and the EUR/USD rallies as anticipated, the trader might adjust their stop-loss to protect profits or even add to their position. If the market reacts negatively, the trader’s stop-loss would limit potential losses.The trader’s exit strategy is defined by their pre-determined profit targets or stop-loss orders.

For instance, they might set a profit target at a specific price level or a percentage gain, or use trailing stop-loss orders to lock in profits as the price moves in their favor. Alternatively, if the market moves against their position, the stop-loss order will automatically close the trade, limiting potential losses.

Successful day trading using Forex Factory data requires careful planning, risk management, and a thorough understanding of the market’s dynamics. It’s not about predicting the future, but about adapting to it.

Forex Factory Data and Swing Trading (Timeframes 1 day to several weeks)

Swing trading, focusing on price movements over days or weeks, benefits significantly from Forex Factory’s longer-term data. Unlike day traders who focus on minute-by-minute fluctuations, swing traders use economic news and fundamental data to anticipate significant price shifts. By understanding the market’s reaction to these events, swing traders can strategically position themselves for profitable trades.Swing traders leverage Forex Factory data to identify potential entry and exit points based on anticipated market reactions to economic announcements.

They look for setups where the market’s price action confirms their analysis of the economic news, increasing the probability of a successful trade. This approach allows them to capture larger price swings compared to shorter-term strategies.

Identifying Potential Entry and Exit Points Using Forex Factory Data, Forex Factory data and its relevance to different trading timeframes

Swing traders use Forex Factory’s calendar to anticipate impactful economic news releases. They analyze the potential market reaction to these releases and look for price patterns that align with their expectations. For example, a positive surprise in Non-Farm Payrolls (NFP) data might lead to a significant upward price movement in the USD, providing a swing trader with a potential entry point at a supportive price level.

Conversely, a negative surprise could signal a potential entry point for short positions. Exit points are often determined by pre-defined profit targets or technical indicators, ensuring risk management.

You also can understand valuable knowledge by exploring how to use influencer marketing to promote your business.

The Role of Longer-Term Economic Data in Swing Trading Decisions

Longer-term economic data from Forex Factory, such as monthly employment reports, quarterly GDP figures, and central bank interest rate decisions, are crucial for swing trading. These data points provide insights into the overall health of an economy and its potential impact on currency values. For example, consistently high inflation figures might lead a central bank to increase interest rates, potentially strengthening the currency.

A swing trader might use this information to establish a long position in the currency before the rate hike is announced, aiming to profit from the anticipated price appreciation.

Relevant Forex Factory Data Points for Swing Trading

Understanding the importance of different data points is key to successful swing trading. Here’s a prioritized list of relevant Forex Factory data points:

- Central Bank Interest Rate Decisions: These announcements significantly impact currency values and are often followed by substantial price movements. Their impact is often long-lasting, making them vital for swing traders.

- Non-Farm Payrolls (NFP): A key indicator of US employment, NFP data often causes significant market volatility. Positive surprises tend to strengthen the USD, while negative surprises weaken it.

- Gross Domestic Product (GDP): This measure of economic growth provides insights into a country’s economic health and can influence currency values over the longer term.

- Inflation Data (CPI, PPI): Inflation data influences central bank policy decisions and can have a substantial impact on currency values. High inflation often leads to interest rate hikes.

- Manufacturing and Purchasing Managers’ Indices (PMI): These indicators offer insights into the health of the manufacturing sector and can predict future economic growth or contraction.

Forex Factory Data and Position Trading (Timeframes several weeks to several months): Forex Factory Data And Its Relevance To Different Trading Timeframes

Position trading, focusing on holding assets for extended periods, leverages fundamental analysis more heavily than shorter-term strategies. Forex Factory’s economic calendar, news announcements, and market sentiment indicators become invaluable tools for identifying long-term trends and potential turning points. By understanding the broader economic picture and anticipating major shifts, position traders can significantly improve their chances of success.Forex Factory data provides a comprehensive overview of the market’s fundamental landscape, allowing position traders to make informed decisions based on long-term trends rather than short-term noise.

This involves monitoring key economic indicators, central bank announcements, and geopolitical events that influence currency valuations over extended periods.

Utilizing Economic Data for Long-Term Projections

Economic data from Forex Factory, such as GDP growth rates, inflation figures, unemployment reports, and interest rate decisions, are crucial for identifying the overall health and direction of an economy. For example, consistently strong GDP growth might suggest a strengthening currency, prompting a long position. Conversely, persistently high inflation could indicate a weakening currency, potentially leading to a short position or hedging strategies.

Analyzing these indicators over several months provides a clearer picture of long-term trends compared to relying solely on short-term price fluctuations. A consistent upward trend in GDP, coupled with falling unemployment, would likely support a bullish position on the related currency pair.

Assessing Market Sentiment Through Forex Factory News and Sentiment Indicators

Forex Factory’s news section provides real-time updates on market-moving events, allowing position traders to gauge overall market sentiment. The impact of news events can be significant and long-lasting. For instance, a surprise interest rate hike announced by a central bank can trigger a substantial and sustained shift in a currency’s value. Analyzing the market’s reaction to these announcements, as reflected in Forex Factory’s discussions and sentiment indicators, helps traders anticipate future price movements.

Finish your research with information from how to use content marketing to generate leads.

A consistently negative sentiment surrounding a particular currency, coupled with weak economic data, might confirm a bearish outlook.

Step-by-Step Guide: Incorporating Forex Factory Data into a Position Trading Strategy

This guide Artikels a structured approach to using Forex Factory data within a position trading framework.

- Identify Potential Currency Pairs: Begin by researching and selecting currency pairs aligned with your trading goals and risk tolerance. Consider factors like economic strength, political stability, and historical volatility.

- Monitor Economic Calendar: Regularly review Forex Factory’s economic calendar to identify upcoming high-impact economic events. Prioritize events directly relevant to your chosen currency pairs.

- Analyze Economic Data: Carefully analyze the released economic data. Compare actual figures to forecasts and assess the market’s reaction. Consider using charts to visualize the data over time.

- Assess Market Sentiment: Monitor Forex Factory’s news section and forums to gauge market sentiment surrounding your chosen currency pairs. Look for consensus views and any significant shifts in opinion.

- Develop a Trading Plan: Based on your analysis, develop a clear trading plan outlining entry and exit points, stop-loss orders, and profit targets. Position trading requires patience and discipline; a well-defined plan minimizes emotional decision-making.

- Execute Trades and Manage Risk: Execute trades according to your plan and carefully manage your risk. Use appropriate position sizing to protect your capital and avoid excessive losses.

- Monitor and Adjust: Continuously monitor the market and your positions. Be prepared to adjust your strategy based on new information and changing market conditions. Regularly review your performance and refine your approach.

Limitations and Considerations of Using Forex Factory Data Across Timeframes

Forex Factory, while a valuable resource for traders, isn’t without its limitations. Understanding these limitations is crucial for accurately interpreting the data and avoiding potentially misleading trading decisions, regardless of your chosen timeframe. The information provided is a snapshot in time and may not always reflect the complete market picture.Potential Biases and Inaccuracies in Forex Factory DataForex Factory data relies heavily on user submissions and aggregated news sources.

This introduces the possibility of biases, inaccuracies, and even deliberate misinformation. For example, a significant news event might be reported with varying degrees of detail or interpretation across different news sources, leading to inconsistencies in the data reflected on Forex Factory. Furthermore, the timing of news events and their impact on the market can be subjective, meaning that the reported time of an event might not precisely align with its actual market effect.

Finally, the sheer volume of data can be overwhelming, and filtering for relevant information requires careful consideration.

Market Context and Forex Factory Data

Simply relying on Forex Factory data without considering broader market context is a recipe for disaster. Economic calendars, fundamental analysis, and technical indicators should all be integrated into your trading strategy. For example, a significant economic announcement (like Non-Farm Payroll data) might cause a temporary spike in volatility, regardless of what Forex Factory’s sentiment indicators might suggest. Ignoring this broader context and solely relying on Forex Factory’s sentiment data could lead to poorly timed entries or exits.

A comprehensive understanding of geopolitical events and overall market trends is essential for contextualizing Forex Factory data.

Reliability Across Asset Classes

The reliability of Forex Factory data can vary across different asset classes. Currency pairs, being the most heavily traded instruments, generally have more robust data and sentiment readings. However, the reliability can diminish when looking at less liquid assets like certain commodities or indices. For instance, sentiment data for a less actively traded commodity might be based on a smaller sample size, making it less representative of the overall market sentiment.

Traders should therefore exercise extra caution when using Forex Factory data for less liquid instruments and supplement it with other reliable data sources.

Visualizing Forex Factory Data’s Impact

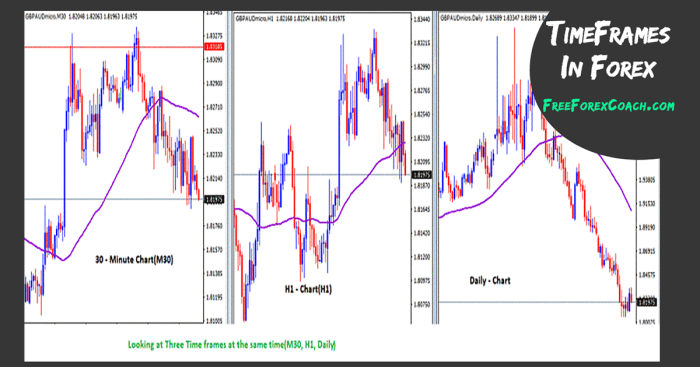

Forex Factory data, while valuable, isn’t directly plotted on price charts. Instead, its impact is observedindirectly* through price action following news releases. Visualizing this impact requires careful chart analysis, focusing on price movements and volatility around the time of the news event. This allows traders to gauge the market’s reaction and potentially improve their trading strategies.Understanding how Forex Factory news affects different timeframes is crucial for effective visual analysis.

A significant news event might cause a dramatic spike on a 5-minute chart, but only a minor adjustment on a weekly chart. The visual representation will differ drastically depending on the timeframe chosen.

Candlestick Chart Analysis Following News Events

To effectively visualize Forex Factory data’s impact, examine candlestick charts around the time of news releases. Look for significant price gaps, increased volatility (longer candlestick bodies and wicks), and changes in trend direction. For example, a positive economic surprise might result in a bullish gap up, followed by a period of higher volatility and potentially a continuation of the uptrend.

Conversely, a negative surprise might cause a bearish gap down, increased volatility, and a potential reversal or continuation of a downtrend. The magnitude of these changes will vary greatly depending on the timeframe. On shorter timeframes (5-minute, 15-minute), you might see sharp, dramatic price swings immediately after the news. On longer timeframes (daily, weekly), the impact might appear as a significant price change, but the immediate volatility may be less pronounced.

Relationship Between Economic Data and Price Movements Across Timeframes

Let’s consider a hypothetical scenario: the release of unexpectedly strong Non-Farm Payroll (NFP) data. On a 5-minute chart, we might observe a rapid price surge immediately after the release, shown as several consecutive bullish candles with long bodies and relatively short wicks. The volatility is high, reflecting the immediate market reaction. On a 1-hour chart, the same NFP data might appear as a strong bullish candle, but the volatility might be less dramatic than on the 5-minute chart.

The price might continue to trend upwards for several hours following the initial surge. On a daily chart, the strong NFP data would likely manifest as a significant bullish candle, potentially breaking through resistance levels. The price action might continue its upward trend for several days. The overall upward movement is clear, but the sharp, immediate volatility seen on shorter timeframes is less apparent.

Conversely, if the NFP data were weaker than expected, we’d see the opposite pattern: bearish candles, price drops, and potential trend reversals, with the intensity of the reaction diminishing as we move from shorter to longer timeframes. This illustrates how the same news event can be visually interpreted differently depending on the timeframe used for analysis.

Mastering the art of interpreting Forex Factory data across different timeframes is a game-changer for forex traders. By understanding how news events and economic indicators influence price movements on various scales, you can significantly improve your trading decisions. Remember that while Forex Factory is a powerful tool, it’s essential to use it in conjunction with other forms of technical and fundamental analysis, always considering the broader market context.

Consistent practice and refinement of your strategies will be key to your success.