Forex Factory and its application in different trading platforms is a game-changer for forex traders. This powerful resource offers a wealth of data, from economic calendars and breaking news to sentiment analysis tools, all designed to help you make more informed trading decisions. We’ll explore how to leverage Forex Factory’s features effectively, integrating its data into your preferred trading platform for a streamlined and efficient trading experience.

This guide will walk you through understanding Forex Factory’s interface, mastering its economic calendar and news analysis features, and seamlessly integrating this data into popular platforms like MetaTrader 4 and TradingView. We’ll cover technical analysis strategies enhanced by Forex Factory data, the crucial role of risk management, and even compare Forex Factory to alternative resources. By the end, you’ll be equipped to use Forex Factory to its full potential.

Forex Factory News and Sentiment Analysis

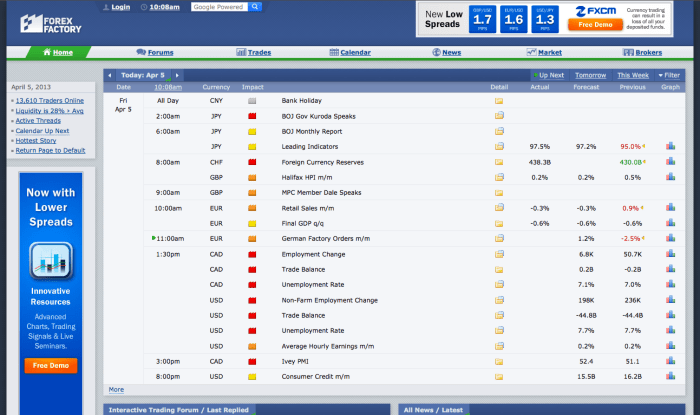

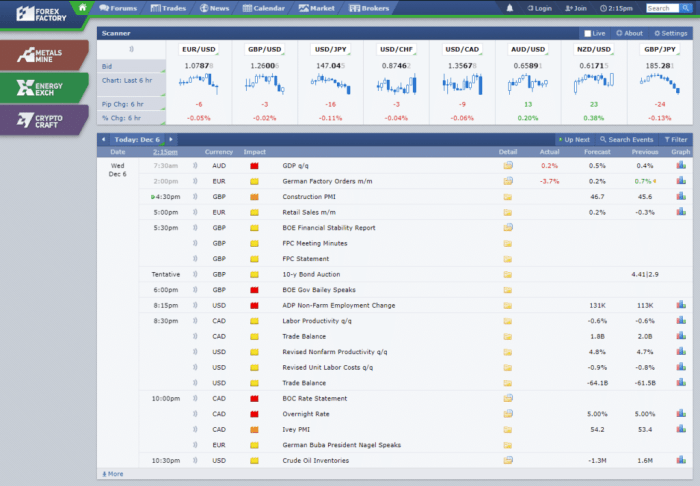

Forex Factory’s news section is a goldmine for traders, offering real-time economic calendar updates, news headlines, and market commentary. Understanding how to interpret this information and gauge market sentiment is crucial for making informed trading decisions. Effectively using Forex Factory’s news can significantly improve your trading strategy and potentially increase profitability.Forex Factory news affects currency prices by providing information that influences supply and demand.

Unexpected positive economic data, for example, might lead to increased demand for a currency, driving its price higher. Conversely, disappointing news can trigger selling pressure, pushing prices down. The speed and magnitude of these price movements depend on several factors, including the significance of the news, the market’s prior expectations, and overall market liquidity.

Examples of Forex Factory News Impacting Currency Prices

A surprise increase in US Non-Farm Payrolls (NFP) data, as reported on Forex Factory, often leads to a strengthening of the US dollar (USD) against other currencies. Traders anticipating a lower number might have already established short positions in USD pairs. The positive surprise would force these traders to cover their positions (buy USD), further pushing the price up. Conversely, a weaker-than-expected NFP number could trigger a sharp sell-off in the USD.

Imagine a scenario where the market expected an increase of 200,000 jobs, but the actual figure was only 100,000. This negative surprise could send the USD tumbling against major currencies like the EUR and JPY. This illustrates how Forex Factory’s real-time data directly influences market dynamics and currency prices.

Gauging Market Sentiment Using Forex Factory News

Forex Factory’s news section isn’t just about raw data; it’s also a window into market sentiment. Analyzing the headlines, news articles, and accompanying comments can reveal the prevailing mood towards specific currency pairs. For example, a flood of negative news articles about a particular country’s economy might indicate bearish sentiment towards its currency. Conversely, positive news and optimistic commentary could suggest bullish sentiment.

The speed at which news spreads and the overall tone of the discussions within Forex Factory’s forums can act as leading indicators of potential price movements.

Hypothetical Trading Scenario Using Forex Factory News

Let’s say Forex Factory reports a significant upward revision in the UK’s GDP figures, exceeding market expectations. This positive news is likely to boost the British Pound (GBP). A trader might use this information to enter a long position on GBP/USD, anticipating further price appreciation. They might set a stop-loss order below the entry price to limit potential losses if the market reacts unexpectedly.

The trader would then monitor the news flow on Forex Factory for any conflicting information or shifts in market sentiment that could influence their decision to hold or exit the trade. The success of this trade depends on various factors, including the accuracy of their market analysis and risk management.

Strategies for Using Forex Factory News to Improve Trading Performance

Effective use of Forex Factory news requires a structured approach. Here are some strategies:

Developing a robust trading plan is paramount. This involves identifying your trading style, risk tolerance, and preferred currency pairs. It also means clearly defining entry and exit strategies, along with stop-loss and take-profit levels, all informed by Forex Factory news analysis.

Combining Forex Factory news with other technical indicators adds layers of confirmation. Don’t rely solely on news; incorporate chart patterns, support/resistance levels, and other indicators to enhance your trading decisions.

Find out further about the benefits of How to consistently profit from Forex Factory signals that can provide significant benefits.

Practicing risk management is crucial. Never risk more capital than you can afford to lose. Use stop-loss orders to protect your trades from significant losses, and always diversify your portfolio across different currency pairs to minimize risk.

Staying disciplined is key. Avoid emotional trading based on fleeting news headlines. Stick to your pre-defined trading plan and only enter trades that align with your strategy and risk tolerance. Regularly reviewing your trading performance and adjusting your strategy as needed will contribute to long-term success.

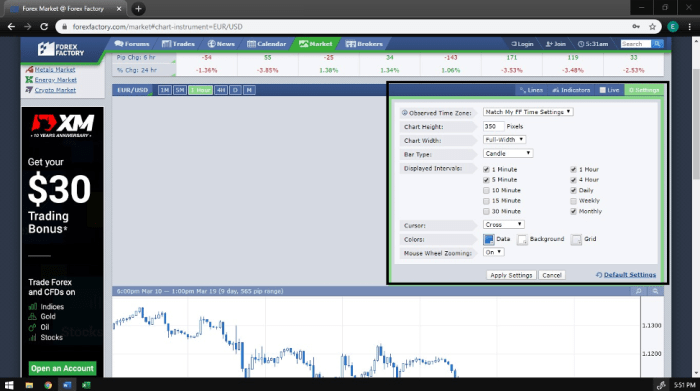

Integration with Trading Platforms

Forex Factory’s wealth of data, including economic calendars, news feeds, and sentiment indicators, can significantly enhance your trading strategies. However, accessing and utilizing this information directly within your trading platform offers a far more streamlined and efficient workflow. This section details how to integrate Forex Factory data into popular platforms, the advantages and drawbacks of doing so, and potential challenges you might encounter.Integrating Forex Factory data into your trading platform allows for real-time analysis and reaction to market events.

This direct integration avoids the need to constantly switch between different applications, improving your speed and focus. The benefits extend to automated trading strategies, where timely data feeds are crucial for efficient execution. However, this integration isn’t always seamless and requires understanding the limitations and potential hurdles.

Methods for Integrating Forex Factory Data

Several methods exist for integrating Forex Factory data, depending on the platform and your technical skills. Some platforms offer direct plugins or APIs, while others require custom scripting or the use of third-party tools. For instance, MetaTrader 4 and 5 might utilize custom indicators built using MQL4/MQL5, while TradingView might use Pine Script to pull and display data.

More complex integrations might involve using external data feeds and connecting them to your trading platform via specific protocols. The choice depends heavily on your platform, your programming proficiency, and the specific data you wish to integrate.

Benefits of Integration

The primary benefit is increased efficiency. Having Forex Factory’s data directly within your trading platform eliminates the need for constant context switching. This is particularly crucial during fast-moving market conditions. Real-time access to news and sentiment data allows for quicker decision-making. Automated trading systems can be programmed to react instantly to events, potentially leading to more efficient trade execution.

Finally, the ability to overlay Forex Factory’s data with your charts provides a richer, more comprehensive view of market dynamics.

Limitations of Integration

Integration isn’t always perfect. Data latency can be a significant issue; the time delay between an event occurring and your platform reflecting it can be critical. Real-time data feeds often come with subscription fees. The complexity of integration varies; setting up a custom indicator or script requires programming knowledge, which might not be accessible to all traders.

Finally, the reliability of the data feed itself depends on Forex Factory’s uptime and the stability of your internet connection.

Challenges and Solutions

A common challenge is data formatting inconsistencies. Forex Factory’s data may not always align perfectly with your trading platform’s expected format. Solutions include using data cleaning and transformation techniques (e.g., using scripting to reformat data) or finding pre-built indicators that handle the formatting automatically. Another challenge is dealing with API rate limits or access restrictions. Solutions include optimizing your data requests or using caching mechanisms to reduce the number of API calls.

Network connectivity issues can also interrupt the data feed. Solutions involve ensuring a stable internet connection and potentially implementing error handling within your scripts or indicators to gracefully manage connection disruptions.

Expand your understanding about Forex Factory’s role in developing a successful trading plan with the sources we offer.

Step-by-Step Integration with MetaTrader 4

Before proceeding, ensure you have the MetaEditor (MQL4 editor) installed and have a basic understanding of MQL4 programming. This guide focuses on creating a simple custom indicator to display Forex Factory’s economic calendar data. Note that this requires access to Forex Factory’s API (which may not be publicly available, requiring alternative data sourcing methods).

- Obtain Economic Calendar Data: This step requires finding a reliable source of economic calendar data in a suitable format (e.g., XML or JSON). This may involve scraping data from Forex Factory’s website or using a third-party API (with appropriate permissions). Direct access to Forex Factory’s API might require an API key or subscription.

- Create a Custom Indicator: Open the MetaEditor and create a new Expert Advisor (EA) or custom indicator.

- Implement Data Parsing: Within your MQL4 code, implement functions to parse the downloaded economic calendar data. This involves extracting relevant information like event time, currency pair, and impact.

- Visualize the Data: Use MQL4’s charting functions to display the parsed data on your charts. This could involve plotting events on a timeline or displaying key information in a separate window within the chart.

- Compile and Install: Compile your custom indicator and install it into your MetaTrader 4 platform.

- Test and Refine: Thoroughly test your indicator to ensure it functions correctly and displays the data accurately. Refine the code as needed to improve performance and visual presentation.

Forex Factory and Technical Analysis: Forex Factory And Its Application In Different Trading Platforms

Forex Factory, while primarily known for its economic calendar and news, offers a wealth of data indirectly valuable for bolstering technical analysis strategies. By combining the insights gleaned from Forex Factory with traditional technical indicators, traders can refine their market understanding and potentially improve their trading decisions. This involves using the platform’s data to confirm or challenge technical signals, ultimately leading to a more robust trading approach.Forex Factory data can significantly enhance the effectiveness of technical analysis.

The platform’s economic calendar, for instance, provides crucial context for price movements. Understanding scheduled economic announcements helps traders anticipate potential volatility and adjust their trading strategies accordingly. Similarly, the Forex Factory forum discussions can offer insights into market sentiment, which can be used to confirm or refute technical signals. A strong uptrend supported by bullish sentiment from forum discussions, for example, increases the confidence in a long position.

Using Forex Factory Data to Identify Support and Resistance

Identifying support and resistance levels is a cornerstone of technical analysis. Forex Factory’s data can contribute to this process. By analyzing past price action around significant economic news releases (as indicated on the calendar), traders can identify areas where price previously reversed or found significant buying or selling pressure. These areas can serve as potential support or resistance levels for future price action.

For instance, if a currency pair consistently found support at a particular level following previous negative economic data releases, traders might anticipate that level to act as support again in a similar scenario. This doesn’t guarantee future price action, but it adds a layer of context to the technical analysis. The economic calendar acts as a timeline for events that might have caused price reactions at specific levels.

Comparing Forex Factory Data with Other Technical Indicators

Forex Factory data isn’t a standalone indicator but a complementary resource. It works best in conjunction with traditional technical indicators like moving averages, RSI, MACD, and Bollinger Bands. For example, a bullish crossover of moving averages coupled with positive economic news (as per Forex Factory’s calendar) can strengthen the bullish signal, increasing the probability of a price upswing. Conversely, a bearish divergence between price and RSI, accompanied by negative economic news, could suggest a higher likelihood of a price decline.

The combination provides a more comprehensive view than relying on any single indicator alone.

Interpreting Candlestick Charts with Forex Factory Data

Let’s imagine a candlestick chart for the EUR/USD pair. We observe a bearish engulfing candlestick pattern forming near a previously identified resistance level (perhaps identified using the method described above, potentially correlated with a negative economic announcement from the Forex Factory calendar). This pattern shows a large bearish candle following a smaller bullish candle, suggesting a potential shift in momentum.

Now, let’s say Forex Factory’s calendar shows a major economic data release scheduled for the next day. If the data is expected to be negative for the Euro, this reinforces the bearish signal from the candlestick pattern. The combination of the technical pattern and the fundamental context from Forex Factory significantly increases the probability of a price decline, potentially offering a short selling opportunity.

Conversely, a bullish engulfing pattern near a support level, coupled with positive upcoming economic news, would paint a bullish picture. The strength of the signal comes from the confluence of technical and fundamental analysis, both supported by Forex Factory data.

Forex Factory and Risk Management

Forex Factory’s wealth of economic news, calendar events, and market sentiment data provides traders with crucial information for bolstering their risk management strategies. By effectively utilizing this information, traders can make more informed decisions, potentially reducing losses and maximizing profits. Proper risk management isn’t about avoiding risk entirely, but about managing it intelligently.Forex Factory data helps refine risk management by providing a clearer picture of potential market movements.

This enhanced awareness allows traders to adjust their trading plans and positions accordingly, leading to better risk-adjusted returns. Understanding the interplay between news events, market sentiment, and volatility is paramount to successful risk management.

Economic News and Stop-Loss/Take-Profit Levels

Economic news announcements, readily available on Forex Factory, significantly impact market volatility. A major positive surprise, like unexpectedly strong employment data, can cause a rapid price surge. Conversely, disappointing news can trigger a sharp decline. Traders can use this information to set more effective stop-loss and take-profit orders. For instance, before a high-impact news release, a trader might widen their stop-loss to account for potentially increased volatility.

After the release, if the market moves favorably, they might adjust their take-profit level to capture a larger portion of the anticipated price movement. Failure to consider these news events can lead to significant losses, as unexpected price swings can easily wipe out positions without adequate protection.

Market Volatility and Forex Factory Data

Understanding market volatility is crucial for effective risk management. Forex Factory provides various indicators that help gauge volatility, such as the economic calendar’s impact ratings and the overall market sentiment. High volatility periods, often signaled by significant news events or geopolitical uncertainty, require more cautious trading approaches. Traders might reduce position sizes, tighten stop-losses, or even temporarily refrain from trading during periods of extreme volatility.

Conversely, low volatility periods might allow for slightly larger positions and wider stop-loss levels. Ignoring volatility and maintaining static risk parameters irrespective of market conditions can expose traders to disproportionate losses during volatile periods.

Examples of Poor Risk Management Due to Ignoring Forex Factory Data, Forex Factory and its application in different trading platforms

Imagine a trader who consistently ignores the Forex Factory economic calendar. They enter a long position in EUR/USD just before a scheduled interest rate announcement. The announcement is unexpectedly negative, causing a sharp drop in the EUR/USD pair. The trader, lacking a properly placed stop-loss order, suffers significant losses. Another scenario: A trader ignores the prevailing bearish sentiment highlighted on Forex Factory.

They enter a long position, only to see the market continue its downward trend due to the negative sentiment influencing price action. In both instances, consulting Forex Factory data beforehand could have significantly mitigated the risk and potential losses. Properly interpreting and using this information is key to better risk management.

Alternatives to Forex Factory

Forex Factory is a popular resource, but it’s not the only game in town. Several other websites and platforms offer similar functionality, each with its own strengths and weaknesses. Choosing the right alternative depends on your specific trading style and needs. Let’s explore some key competitors and compare their features to Forex Factory.While Forex Factory excels in its calendar, forum, and sentiment indicators, other platforms might offer superior charting tools, economic data analysis, or social trading features.

A thorough comparison can help you identify the best fit for your trading workflow.

Comparison of Forex Factory with Alternative Platforms

Several platforms provide similar services to Forex Factory. This section compares Forex Factory to Myfxbook, TradingView, and Investing.com, highlighting their unique features and differentiating aspects. Each platform caters to different trader preferences and priorities.

| Feature | Forex Factory | Myfxbook | TradingView | Investing.com |

|---|---|---|---|---|

| Economic Calendar | Comprehensive, widely used | Good coverage, integrated with other tools | Good coverage, integrated with charts | Comprehensive, real-time updates |

| Forex Forums | Large and active community | Limited forum functionality, focuses on portfolio tracking | Active community, but less focused on forex specifically | Offers news and comments sections, but not a dedicated forum |

| Charting Tools | Basic charting capabilities | Limited charting, mainly for portfolio visualization | Advanced charting tools, wide range of indicators | Good charting capabilities, integrated with news and data |

| Sentiment Indicators | Provides sentiment gauges based on forum activity | Sentiment analysis based on trader behavior on the platform | Offers sentiment indicators based on user activity and order flow | Provides market sentiment analysis based on various factors |

| Social Trading | Indirectly through forum discussions | Direct social trading features available | Offers social trading features and copy trading | No direct social trading features |

Myfxbook: Focus on Portfolio Management and Performance Tracking

Myfxbook differentiates itself from Forex Factory by prioritizing portfolio management and performance tracking. While it offers an economic calendar and some charting tools, its primary strength lies in its ability to monitor and analyze trading performance. It allows traders to track their trades, calculate key metrics, and even showcase their results to potential followers. However, its forum and news sections are less developed than Forex Factory’s.

The lack of a robust forum limits community interaction compared to Forex Factory’s vibrant discussion boards.

TradingView: Advanced Charting and Technical Analysis

TradingView is renowned for its superior charting capabilities and extensive range of technical indicators. It offers a vast array of tools for technical analysis, surpassing Forex Factory’s basic charting functionality. While TradingView provides an economic calendar and some news, its focus is squarely on charting and technical analysis. The platform’s strong social features, including the ability to follow other traders and share ideas, provide a different kind of community interaction compared to the forum-centric approach of Forex Factory.

Investing.com: Comprehensive Financial News and Data

Investing.com provides a broad range of financial news and data, going beyond forex. Its economic calendar is comprehensive, and its charting tools are robust. However, it lacks the dedicated forex community found on Forex Factory. The absence of a dedicated forex forum diminishes its appeal for traders seeking in-depth discussions and shared experiences specific to the forex market. The platform’s strength lies in its comprehensive coverage of various financial markets, making it a useful resource for diversified investors.

Mastering Forex Factory isn’t just about accessing data; it’s about transforming how you approach forex trading. By effectively utilizing its economic calendar, news feeds, and integration capabilities, you can significantly enhance your technical analysis, refine your risk management, and ultimately, improve your trading performance. Remember to experiment, adapt strategies to your individual trading style, and always stay informed about market dynamics.

Happy trading!