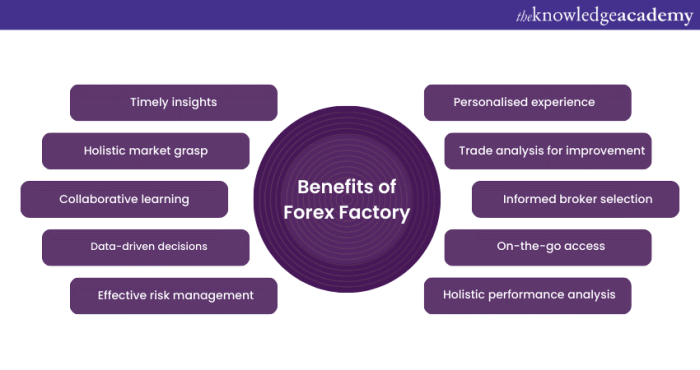

Forex Factory’s contribution to developing a profitable trading edge is significant, offering a wealth of resources for forex traders of all levels. This platform isn’t just a data provider; it’s a vibrant community and a powerful toolset rolled into one. We’ll explore how its economic calendars, news feeds, forums, and charting tools can help you sharpen your trading skills and improve your risk management, ultimately boosting your chances of success in the forex market.

We’ll also look at the potential pitfalls and how to use Forex Factory effectively as part of a well-rounded trading strategy.

From understanding the nuances of economic data to leveraging the collective wisdom of experienced traders, we’ll dissect how Forex Factory empowers you to make informed decisions, refine your technical and fundamental analysis, and ultimately, develop a more profitable trading edge. This guide is designed to provide practical insights and actionable strategies, turning the wealth of information on Forex Factory into tangible results for your trading journey.

Forex Factory’s Data and its Impact

Forex Factory is a valuable resource for forex traders, offering a wealth of data that can significantly enhance trading strategies and risk management. Its diverse data offerings, from economic calendars to news feeds and active community forums, contribute to a more informed and potentially profitable trading experience. Understanding how to effectively utilize this data is key to unlocking its full potential.Forex Factory Data Types and Their Contribution to a Trading EdgeForex Factory provides several crucial data types that contribute to a robust trading strategy.

The economic calendar, for instance, allows traders to anticipate market movements based on scheduled economic announcements. News feeds provide real-time updates on global events impacting currency pairs, enabling quick reactions to market-moving news. The forums, a vibrant community hub, offer diverse perspectives, analysis, and insights from experienced traders, enriching one’s understanding of market dynamics. Finally, the data section offers various charts and indicators which can be used for technical analysis.

The combination of these data points allows traders to build a more comprehensive picture of market conditions, leading to better-informed decisions.

Timeliness and Accuracy of Forex Factory Data and its Effect on Trading Decisions and Risk Management

The timeliness and accuracy of Forex Factory’s data are paramount to successful trading. Real-time economic news and calendar updates allow traders to react swiftly to market shifts, potentially capitalizing on short-term opportunities or mitigating potential losses. Accurate data ensures that trading decisions are based on reliable information, minimizing the risk of errors due to misinformation. For example, a delay in receiving news about a significant interest rate hike could result in missed opportunities or unexpected losses.

Conversely, access to accurate and timely data allows for precise risk management strategies, such as setting appropriate stop-loss orders based on realistic market volatility expectations.

Comparison of Forex Factory Data with Other Sources

While Forex Factory offers a comprehensive suite of tools, it’s important to compare its offerings against other market data providers to understand its strengths and weaknesses. Some competitors might offer more advanced charting tools or a wider range of technical indicators. However, Forex Factory’s strength lies in its combination of free, readily available economic calendars and news, alongside its active and engaged community forum.

This community aspect offers invaluable insights and perspectives not readily found elsewhere. Conversely, the data may not be as comprehensive or advanced as some paid professional platforms which offer more in-depth analysis or real-time data feeds with extremely low latency.

Comparative Analysis of Market Data Providers

| Feature | Forex Factory | TradingView | Bloomberg Terminal |

|---|---|---|---|

| Economic Calendar | Free, comprehensive, reliable | Free and paid options, good coverage | Highly accurate, real-time, comprehensive (paid) |

| News Feeds | Free, timely updates, broad coverage | Free and paid options, customizable news alerts | Real-time, highly detailed news and analysis (paid) |

| Community Forums | Active, diverse perspectives, valuable insights (free) | Moderated community features, less emphasis on discussion | Limited community features |

| Charting Tools | Basic charting tools available | Advanced charting tools and indicators (free and paid) | Sophisticated charting tools and advanced analytics (paid) |

| Data Reliability | Generally reliable, occasional minor discrepancies | High reliability, but paid features often offer more accuracy | Highest level of accuracy and reliability (paid) |

| Cost | Free (mostly) | Free and paid options | Expensive, subscription-based |

Forex Factory’s Community and its Influence: Forex Factory’s Contribution To Developing A Profitable Trading Edge

Forex Factory’s vibrant community is arguably its most valuable asset, surpassing even its comprehensive data offerings. The forums act as a massive, constantly evolving repository of trading knowledge, shaped by the collective experiences and insights of thousands of traders, from novices to seasoned professionals. This collaborative environment fosters learning, debate, and the refinement of trading strategies in a way that’s difficult to replicate elsewhere.The sheer volume of shared experiences on Forex Factory can significantly impact trading performance.

Discussions range from technical analysis interpretations and indicator usage to risk management strategies and psychological aspects of trading. Traders can learn from others’ successes and, crucially, their mistakes, potentially avoiding costly errors and accelerating their learning curve. The platform facilitates the rapid dissemination of market insights and emerging trends, giving active users a potentially significant edge.

Risks of Relying Solely on Community Opinions

While Forex Factory’s community offers invaluable resources, relying solely on its opinions and insights presents significant risks. The information shared is not vetted for accuracy or reliability. Many contributors may be inexperienced, biased, or even promoting specific products or services. Echo chambers can form, reinforcing potentially flawed strategies or interpretations. Successful traders rarely reveal their entire strategies publicly, and what is shared may be incomplete or misleading.

Blindly following advice without critical evaluation can lead to significant financial losses. Successful trading requires independent analysis and risk management, not simply mirroring the actions of others.

A Hypothetical Scenario Illustrating Community Influence

Imagine a trader, let’s call him Alex, employing a basic moving average crossover strategy. He consistently experiences losses despite believing his approach is sound. Through Forex Factory’s forums, Alex discovers discussions regarding the limitations of moving averages in highly volatile markets. He finds several threads detailing how traders have refined their strategies by incorporating additional indicators, such as RSI or MACD, to filter out false signals.

Alex carefully reviews these discussions, noting the arguments for and against each suggested modification. He then backtests these alternative strategies using historical data, comparing their performance against his original method. Based on this analysis, he refines his approach, incorporating RSI to identify overbought and oversold conditions. This leads to a significant reduction in losing trades and a considerable improvement in his overall profitability.

This scenario highlights how Forex Factory’s community can act as a catalyst for strategic refinement and improved trading outcomes, provided the information is used critically and not blindly accepted.

Technical Analysis Tools and Forex Factory

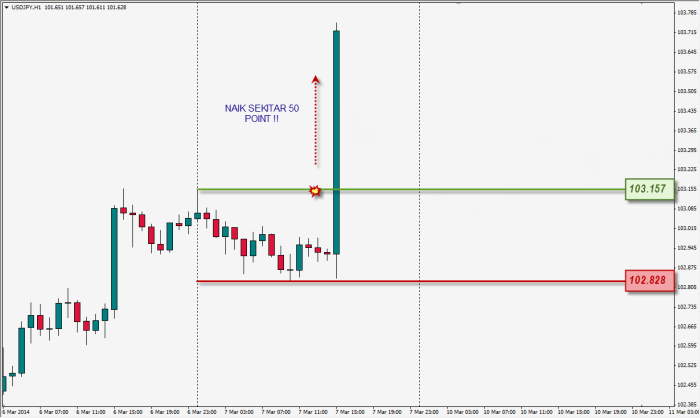

Forex Factory, while not a dedicated charting platform like TradingView or MetaTrader, offers a surprisingly robust suite of tools valuable for technical analysis. Its strength lies in its combination of readily available data, community insights, and integrated charting capabilities, all accessible in one location. This allows traders to build a comprehensive trading strategy, though with certain limitations compared to specialized software.Forex Factory’s charting tools and indicators can be effectively integrated into a technical analysis framework by using its economic calendar, news feeds, and the forum discussions to contextualize chart patterns and indicator signals.

The platform’s charts, while basic, allow for the plotting of various technical indicators, enabling traders to identify potential entry and exit points. Combining this with the wealth of market sentiment data available on the forum can significantly enhance trading decisions.

Integrating Forex Factory’s Tools into a Technical Analysis Framework

The process involves a multi-step approach. First, traders identify relevant currency pairs and timeframes. Then, they select appropriate indicators on Forex Factory’s charts, such as moving averages, RSI, or MACD. Simultaneously, they monitor Forex Factory’s economic calendar and news section for events that could impact price action. Finally, they analyze the combined information – chart patterns, indicator signals, and fundamental news – to form a trading plan.

This integrated approach allows for a more nuanced understanding of market dynamics.

Examples of Successful Trading Strategies Leveraging Forex Factory Data

One example is a strategy focusing on breakout trades. A trader might identify a potential breakout using Forex Factory’s charts and the RSI indicator. A strong upward movement in the RSI, coupled with price consolidating near a resistance level, could signal an impending breakout. Confirmation from the Forex Factory news and forum, indicating positive sentiment or upcoming positive economic data, would strengthen the trade signal.

Conversely, a bearish divergence between price and RSI, combined with negative news, could indicate a potential short opportunity. Another strategy could involve using Forex Factory’s economic calendar to anticipate market reactions to significant economic releases and then using technical indicators to pinpoint optimal entry and exit points around those events.

Limitations of Forex Factory’s Technical Analysis Tools

Forex Factory’s charting tools are less feature-rich than dedicated platforms. Customization options are limited, and advanced charting features, such as drawing complex Fibonacci retracements or using custom indicators, might be unavailable. The platform’s reliance on third-party data providers also means that data accuracy and timeliness might vary. Real-time data may not be as readily available or as fast as on professional trading platforms.

Step-by-Step Guide to Identifying Trading Opportunities

1. Select Currency Pair and Timeframe

Choose a currency pair based on your trading strategy and risk tolerance. Select a timeframe (e.g., 1-hour, 4-hour, daily) appropriate for your trading style.

2. Apply Technical Indicators

Add indicators like moving averages (e.g., 20-period and 50-period), RSI, and MACD to Forex Factory’s chart.

Browse the multiple elements of how to use SEO to drive organic traffic to your website to gain a more broad understanding.

3. Analyze Chart Patterns

Look for patterns such as head and shoulders, double tops/bottoms, or triangles that suggest potential reversals or breakouts.

4. Check Economic Calendar and News

Find out further about the benefits of The relationship between Forex Factory sentiment and price action that can provide significant benefits.

Review the Forex Factory calendar for upcoming economic events that could impact your chosen currency pair. Read relevant news articles and forum discussions for sentiment analysis.

5. Combine Information

Integrate chart patterns, indicator signals, and news/sentiment to confirm potential trading opportunities. A bullish signal should ideally be confirmed by all three.

6. Develop a Trading Plan

Define your entry and exit points, stop-loss, and take-profit levels based on your analysis.

7. Monitor and Manage

Actively monitor your trades and adjust your positions as needed.

Fundamental Analysis and Forex Factory’s Role

Forex Factory is a powerful resource for fundamental analysis, providing traders with timely and comprehensive economic data and news that significantly impact currency markets. Its tools allow you to stay informed about global events and their potential effects on your trading strategies, offering a crucial edge in navigating the complexities of the forex market. By combining this information with technical analysis, you can make more informed and potentially profitable trading decisions.Forex Factory’s economic calendar and news section are indispensable tools for fundamental analysis.

The calendar provides a clear, concise overview of upcoming economic releases, allowing traders to anticipate potential market volatility. The news section offers real-time coverage of significant events, ensuring traders stay abreast of developments as they unfold. This combination allows for proactive strategy adjustment and risk management.

Forex Factory’s Economic Calendar and News Impact on Currency Pairs

The Forex Factory economic calendar details the timing and importance of economic releases. For instance, a scheduled release of US Non-Farm Payroll (NFP) data is flagged prominently, indicating its potential market impact. The news section then provides the actual data upon release, often followed by immediate analysis and commentary from market experts. Let’s consider a hypothetical example: If the NFP figure significantly exceeds expectations, this positive economic news could strengthen the US dollar (USD) against other currencies like the Euro (EUR).

Conversely, a weaker-than-expected NFP report could weaken the USD, causing EUR/USD to rise. Forex Factory’s real-time updates enable traders to react quickly to such data releases. Another example could be a surprise interest rate hike by a central bank, such as the European Central Bank (ECB). This event, reported promptly on Forex Factory, would likely cause the Euro to appreciate against other currencies, as higher interest rates generally attract foreign investment.

Anticipating Market Reactions and Adjusting Trading Strategies

Utilizing Forex Factory’s news and calendar involves a multi-step process. First, review the economic calendar to identify upcoming high-impact events. Next, formulate a trading plan based on your analysis of the potential market reaction to those events. For example, if a significant interest rate decision is anticipated, you might consider adjusting your position sizes or setting stop-loss orders to manage potential risk.

Finally, during the actual news release, monitor Forex Factory’s news section for real-time updates and market reactions. This allows you to react quickly to unexpected shifts in market sentiment and potentially capitalize on short-term trading opportunities. Remember, disciplined risk management is paramount, and reacting to news should always align with your overall trading plan.

Impact of Different Economic Data on Currency Valuations

Understanding how different types of economic data affect currency valuations is crucial for successful fundamental analysis. Forex Factory provides the data; understanding its implications is key.

- CPI (Consumer Price Index): A higher-than-expected CPI indicates inflation, potentially leading a central bank to raise interest rates. This typically strengthens the associated currency, as higher rates attract investment. Conversely, a lower-than-expected CPI might lead to lower interest rates and a weaker currency.

- Interest Rate Decisions: An increase in interest rates usually strengthens the currency, attracting foreign investment seeking higher returns. Conversely, a decrease in interest rates typically weakens the currency.

- GDP (Gross Domestic Product): Strong GDP growth usually indicates a healthy economy, strengthening the associated currency. Weak GDP growth suggests economic weakness, leading to a weaker currency.

- Unemployment Rate: A lower unemployment rate generally signals a strong economy, boosting the currency. A higher unemployment rate often weakens the currency.

- Trade Balance: A positive trade balance (exports exceeding imports) strengthens the currency, while a negative trade balance weakens it.

Risk Management and Forex Factory

Forex Factory offers a wealth of resources that can significantly enhance your risk management strategies in forex trading. By leveraging its data, community insights, and analytical tools, you can build a more robust and informed approach to protecting your capital and maximizing your potential for success. Effective risk management isn’t just about limiting losses; it’s about consistently making smart trading decisions that align with your overall goals and risk tolerance.Forex Factory’s data plays a crucial role in proactive risk management.

Its economic calendar, for example, allows traders to anticipate market-moving events and adjust their positions accordingly. Understanding the potential volatility associated with news releases helps in determining appropriate position sizes and setting stop-loss orders strategically. Similarly, the historical data available on Forex Factory provides context for current market conditions, allowing traders to assess the likelihood of various price movements and adjust their risk parameters based on past performance and volatility patterns.

Utilizing Forex Factory Data for Improved Risk Management, Forex Factory’s contribution to developing a profitable trading edge

Forex Factory’s economic calendar is invaluable for anticipating market volatility. By knowing when major economic news announcements are scheduled, traders can adjust their trading strategies to mitigate the increased risk associated with these events. For instance, a trader might choose to close positions before a high-impact news release to avoid potential whipsaws or significantly widen their stop-loss orders to account for the expected price swings.

Analyzing historical data on Forex Factory allows traders to identify periods of high volatility and adjust their position sizing accordingly. If a currency pair has historically exhibited significant price swings during specific times of the day or week, a trader might choose to reduce their position size during those periods to limit potential losses.

Identifying and Mitigating Risks with Forex Factory Data

Forex Factory’s news section and forums offer valuable insights into geopolitical events and market sentiment, allowing traders to identify potential risks before they materialize. For example, a news report about a potential political crisis in a specific country might signal increased volatility in the currency of that nation. Traders can use this information to adjust their trading strategies, perhaps by reducing their exposure to that currency or tightening their stop-loss orders.

Monitoring the sentiment expressed in Forex Factory’s forums can also help identify emerging risks. If a significant number of traders are expressing concerns about a particular market trend, it could indicate a potential reversal or correction, prompting traders to adjust their positions accordingly.

Forex Factory Community and Risk Tolerance

The discussions within Forex Factory’s community can profoundly influence a trader’s risk tolerance and position sizing. Exposure to different trading styles and risk management approaches broadens perspective and encourages a more nuanced understanding of appropriate risk levels. Observing how experienced traders manage risk in various market conditions can be a valuable learning experience, leading to more informed decisions about position sizing and stop-loss placement.

Furthermore, engaging in respectful discussions with fellow traders can help refine your own risk tolerance by exposing you to diverse viewpoints and perspectives on managing risk. It’s crucial, however, to always critically evaluate the information shared in the forums and to avoid blindly following the strategies of others.

Risk Management Techniques and Forex Factory Support

| Risk Management Technique | Forex Factory Resource | Implementation Example | Benefit |

|---|---|---|---|

| Stop-Loss Orders | Historical Volatility Data, Economic Calendar | Setting a stop-loss order 1% below the entry price based on historical volatility data and avoiding high-impact news releases. | Limits potential losses on a trade. |

| Position Sizing | Historical Data, Community Discussion | Adjusting position size based on the average daily range of a currency pair observed on Forex Factory’s charts and discussions on risk tolerance. | Manages overall risk exposure. |

| Diversification | Currency Correlation Data | Diversifying portfolio across multiple uncorrelated currency pairs identified through Forex Factory’s correlation tools. | Reduces overall portfolio risk. |

| Hedging | Real-time Quotes, Economic News | Hedging against a potential loss in one currency pair by taking an offsetting position in another, informed by Forex Factory’s real-time data and economic news. | Reduces risk associated with specific market movements. |

Mastering the forex market requires a multifaceted approach, combining solid trading skills with access to reliable information and insightful community support. Forex Factory provides a unique blend of all three, acting as a central hub for data, analysis, and shared experience. By effectively utilizing its tools and resources, and by critically evaluating the information you find there, you can significantly enhance your trading strategy, improve your risk management, and ultimately, increase your chances of achieving consistent profitability.

Remember that Forex Factory is a tool; your success ultimately depends on your discipline, risk management, and the overall strategy you employ.