The psychological impact of Forex Factory news on traders is a significant factor influencing trading success. Forex Factory, a popular online resource, provides real-time news and economic data impacting the forex market. This constant stream of information, however, can trigger a rollercoaster of emotions in traders, from excitement and greed to fear and anxiety. Understanding how these emotional responses affect decision-making is crucial for navigating the forex market effectively and minimizing losses.

This exploration delves into the various ways Forex Factory news affects trader psychology, examining the impact on risk tolerance, decision-making processes, and the prevalence of cognitive biases. We’ll explore how stress and anxiety influence trading performance, and offer practical coping mechanisms and risk management strategies to mitigate the negative psychological effects. We’ll also address the dangers of misinformation and discuss strategies for maintaining a healthy, sustainable approach to forex trading in the long term.

Introduction to Forex Factory News and Trader Psychology: The Psychological Impact Of Forex Factory News On Traders

Forex Factory is a popular online forum and resource for forex traders. It provides a central hub for accessing real-time news and economic data, significantly impacting trading decisions and, consequently, trader psychology. Understanding how this news affects traders is crucial for both successful trading and managing emotional responses in the market. The speed and volume of information available can be overwhelming, leading to both opportunities and challenges.Forex Factory news plays a vital role in forex trading by providing traders with timely information on economic events and announcements that can significantly influence currency prices.

This information allows traders to anticipate potential price movements and adjust their trading strategies accordingly. Without access to such real-time data, traders would be operating largely in the dark, relying solely on technical analysis or less timely sources. The impact of this real-time data is substantial, affecting market liquidity and volatility.

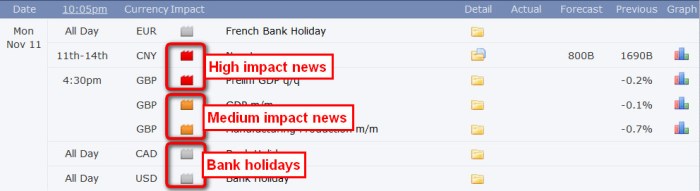

Types of News Events Covered on Forex Factory

Forex Factory covers a broad spectrum of news events relevant to the forex market. These range from macroeconomic announcements like central bank interest rate decisions (e.g., the Federal Reserve’s announcements), inflation reports (e.g., the Consumer Price Index or CPI), and employment data (e.g., Non-Farm Payroll numbers), to geopolitical events such as political instability in a specific country or international trade agreements.

Additionally, it provides coverage of economic indicators specific to individual countries, allowing traders to assess the economic health and potential of different currencies. The platform also often features news related to specific currency pairs, allowing for a targeted approach to analysis.

Typical Emotional Responses of Traders to Significant News Events

Significant news events often trigger strong emotional responses in traders. The release of unexpectedly positive economic data might lead to euphoria and overconfidence, causing traders to take on excessive risk and potentially chase profits aggressively. Conversely, negative news can induce fear and panic, resulting in hasty sell-offs and potentially significant losses. These emotional reactions can cloud judgment and lead to irrational trading decisions.

For example, the unexpected announcement of a surprise interest rate hike might lead to a sharp and immediate drop in the value of a specific currency, prompting panic selling among traders who hadn’t anticipated the move. Conversely, an unexpectedly positive jobs report might lead to a surge in buying activity, creating a rapid price increase that some traders might miss out on.

This illustrates the powerful influence of news events on trader sentiment and the importance of emotional control.

Impact of News on Trading Decisions

Forex Factory news, and similar economic data releases, significantly impact trader decisions, often overriding fundamental or technical analysis. The speed and volatility introduced by these announcements create a dynamic environment where emotional responses can heavily influence trading choices, leading to both opportunities and pitfalls. Understanding how news affects risk tolerance and decision-making is crucial for successful forex trading.News announcements dramatically shift trader risk tolerance.

Positive news, like unexpectedly strong economic data, often boosts confidence and increases risk appetite. Traders may feel emboldened to take on larger positions or enter trades with wider stop-loss orders, believing the market will continue its upward trajectory. Conversely, negative news, such as disappointing employment figures or geopolitical instability, can trigger fear and risk aversion. This can lead to hasty exits from positions, increased stop-loss orders, or a complete avoidance of trading altogether.

The degree of this shift varies depending on the individual trader’s personality, experience, and the magnitude of the news event.

Experienced vs. Novice Trader Responses to News

Experienced traders generally exhibit a more measured response to news events compared to novice traders. Years of experience and exposure to market volatility have honed their ability to separate genuine market shifts from short-term noise. They are more likely to rely on their pre-existing trading plans and risk management strategies, adjusting their positions gradually rather than reacting impulsively. Novice traders, on the other hand, are more susceptible to emotional biases.

They might panic-sell during negative news or chase gains after positive news, often ignoring their own trading plans and resulting in losses. This difference stems from a lack of experience in managing emotional responses and interpreting market nuances.

Examples of News-Driven Emotional Responses Leading to Poor Trading Choices

The 2008 global financial crisis serves as a stark example of how news can trigger devastating emotional responses. The rapid dissemination of negative news regarding collapsing financial institutions and a credit crunch caused widespread panic selling, leading to massive market losses. Many novice traders, lacking the experience to navigate such uncertainty, were caught unprepared and suffered significant financial losses.

Conversely, a sudden surge in the price of a specific commodity following a positive supply-demand news report can lead novice traders to jump into the market without proper research or risk management. The price increase might prove temporary, resulting in substantial losses when the price inevitably corrects. Similarly, a news report predicting interest rate hikes can lead inexperienced traders to quickly sell their currency holdings, missing out on potential gains if the market reacts differently than anticipated.

When investigating detailed guidance, check out how to use content marketing to generate leads now.

These examples highlight the importance of disciplined risk management and emotional control in navigating the unpredictable nature of news-driven market movements.

Psychological Biases and Forex Factory News

Forex Factory, a popular platform for forex traders, provides a constant stream of news and market data. However, the way traders interpret and react to this information is heavily influenced by various psychological biases, often leading to suboptimal trading decisions. Understanding these biases is crucial for improving trading performance and mitigating potential losses.The interpretation of Forex Factory news is rarely objective.

Notice how to use video marketing to engage your audience for recommendations and other broad suggestions.

Instead, it’s filtered through the lens of our individual cognitive biases, leading to skewed perceptions and ultimately, flawed judgments. These biases can significantly impact how traders react to news events, affecting their trading strategies and profitability.

Confirmation Bias and Forex Factory News

Confirmation bias is the tendency to search for, interpret, favor, and recall information that confirms or supports one’s prior beliefs or values. In the context of Forex Factory news, this means traders might selectively focus on news items that align with their existing market outlook, while downplaying or ignoring information that contradicts it. For instance, a trader bullish on EUR/USD might readily accept positive news about the Eurozone economy from Forex Factory, while dismissing negative reports as temporary fluctuations or insignificant details.

This selective attention can lead to a distorted understanding of the market situation and result in poorly informed trading decisions. A trader might stubbornly hold onto a losing position, waiting for the market to confirm their initial prediction, even as mounting evidence suggests otherwise.

Herd Behavior and Forex Factory News

Herd behavior, also known as the bandwagon effect, describes the tendency for individuals to mimic the actions of a larger group. In the forex market, this manifests as traders reacting en masse to news releases from Forex Factory. A sudden surge in buying or selling activity triggered by a specific news item on Forex Factory can create a self-reinforcing cycle.

As more traders follow the trend, the price moves even further in that direction, attracting even more traders, ultimately leading to a market bubble or crash. This phenomenon can be particularly pronounced with high-impact news events, where the speed and volume of reactions on Forex Factory can amplify the herd behavior. For example, a surprising interest rate hike announced by a central bank and reported on Forex Factory might trigger a rapid sell-off as traders rush to adjust their positions, regardless of their individual analysis.

This collective reaction, driven by herd behavior, can often overshadow fundamental analysis and lead to significant market volatility.

News and Risk Management

Forex Factory news, while offering valuable market insights, introduces significant volatility. Effectively incorporating news analysis into your risk management strategy is crucial for protecting your capital and achieving consistent profitability. Failing to do so can lead to substantial losses, particularly during periods of high market uncertainty.Understanding how news events impact your trading positions and adjusting your risk accordingly is paramount.

This involves not just analyzing the news itself, but also anticipating its potential market effect and preparing your trading plan to mitigate any negative consequences.

Stop-Loss Orders and News-Driven Volatility

Stop-loss orders are essential tools for managing risk, especially during periods of heightened volatility triggered by Forex Factory news releases. These orders automatically sell your position when the price reaches a predetermined level, limiting potential losses. Setting appropriate stop-loss levels requires careful consideration of the expected price movement following a news event. For example, if a major economic indicator is expected to cause significant price swings, a wider stop-loss order might be necessary compared to a less impactful news release.

It’s important to remember that stop-loss orders are not foolproof and can be triggered by slippage, especially during periods of extreme volatility. However, they provide a crucial safety net to protect your capital.

Risk Management Techniques for Minimizing Emotional Decision-Making

Emotional decision-making is a common pitfall for many Forex traders, especially when reacting to unexpected news. Implementing robust risk management techniques can significantly reduce the impact of emotional biases on trading decisions.

Several techniques are particularly effective:

- Pre-defined Trading Plan: A well-defined trading plan, developed before engaging with any news, Artikels entry and exit strategies, stop-loss and take-profit levels, and position sizing. This helps maintain discipline and prevents impulsive actions based on fear or greed in reaction to news.

- Position Sizing: Never risk more than a small percentage (e.g., 1-2%) of your trading capital on any single trade. This limits potential losses even if a trade goes against your expectations following a news event. This approach reduces the emotional impact of a losing trade, preventing excessive risk-taking to recover losses.

- Journaling: Keeping a detailed trading journal helps track your performance, identify emotional biases, and learn from past mistakes. Regularly reviewing your journal allows you to analyze your reactions to news events and refine your risk management strategies over time.

- Taking Breaks: Stepping away from the charts during periods of high volatility, especially immediately following major news releases, can help prevent impulsive trades driven by fear or excitement. This allows for a more rational assessment of the market situation once the initial volatility subsides.

- News Filtering and Selection: Focus on credible and reliable sources of news. Avoid getting overwhelmed by a constant stream of information. Prioritize news relevant to your trading strategy and avoid reacting to every minor market fluctuation.

The Impact of False News or Misinformation

Forex Factory, while a valuable resource for forex traders, is not immune to the spread of inaccurate or misleading information. Relying on such false news can have severe consequences, leading to significant financial losses and eroding trader confidence. Understanding how misinformation can impact trading decisions is crucial for mitigating risk and protecting capital.The potential for financial losses stemming from inaccurate Forex Factory news is substantial.

Misinformation can cause traders to enter trades based on false premises, leading to substantial losses if the market moves contrary to the expectation. For example, a false report of a major economic event, such as an unexpectedly strong jobs report, might trigger a rapid price movement. Traders who acted on this false information would likely experience significant losses if they were leveraged and had taken a position against the actual market direction.

Conversely, missing out on a profitable opportunity due to a false report indicating a negative event can also be costly.

Consequences of Relying on Inaccurate Information

Acting on unreliable information can lead to a cascade of negative effects. Incorrect market analysis based on false news leads to poorly informed trading decisions. This can result in significant financial losses, potentially wiping out a trader’s account if leverage is high. Furthermore, the psychological impact of repeated losses based on misinformation can be devastating, leading to decreased confidence, fear of trading, and even burnout.

This can severely impact a trader’s ability to make rational decisions in the future.

Examples of Misinformation and Financial Losses

Imagine a scenario where a rumor spreads on Forex Factory claiming a specific central bank is about to unexpectedly raise interest rates. Traders, believing this misinformation, might rush to buy the currency associated with that central bank. If the rumor is false, and the interest rate remains unchanged, the price will likely correct, leading to significant losses for those who bought at inflated prices.

Similarly, a false report of a geopolitical event, like a sudden escalation of tensions between two countries, could trigger sharp movements in currency pairs related to those nations. Traders reacting to this misinformation without verification could experience substantial losses.

Verifying Information from Multiple Sources, The psychological impact of Forex Factory news on traders

The importance of verifying information from multiple reputable sources cannot be overstated. Before making any trading decisions based on information found on Forex Factory or any online forum, traders should cross-reference the news with other established financial news outlets, economic calendars, and official government or central bank announcements. Comparing information from diverse sources helps to identify inconsistencies and assess the reliability of the initial information.

This practice significantly reduces the risk of acting on misinformation and making costly trading errors.

Successfully navigating the forex market requires more than just technical analysis; it demands a deep understanding of your own psychology and how news events can impact your trading decisions. By recognizing the potential pitfalls of emotional trading and implementing effective coping mechanisms and risk management strategies, traders can significantly improve their performance and reduce the negative psychological impact of Forex Factory news.

Remember, consistent self-awareness and a well-defined trading plan are your best defenses against the emotional rollercoaster of the forex market.