Identifying market trends using Forex Factory’s economic calendar is a powerful technique for Forex traders. This guide will walk you through leveraging the wealth of economic data available on Forex Factory’s calendar to anticipate market movements and identify potential trading opportunities. We’ll explore how to interpret various economic indicators, prioritize high-impact events, and understand their influence on different currency pairs.

By the end, you’ll be equipped to use this valuable tool to improve your trading strategy.

Forex Factory’s economic calendar provides a comprehensive overview of upcoming economic releases, allowing traders to anticipate potential market reactions. Understanding how these releases impact currency pairs is key to successful trading. We’ll cover practical methods for analyzing data, recognizing correlations between events, and visualizing trends to make informed trading decisions. We’ll also discuss crucial risk management strategies to ensure you’re trading responsibly and mitigating potential losses.

Introduction to Forex Factory’s Economic Calendar

Forex Factory’s Economic Calendar is a free, widely used online tool that provides a comprehensive schedule of upcoming economic data releases from various countries around the world. It’s invaluable for forex traders because it helps them anticipate potential market movements based on the expected impact of these releases. Understanding how to use this calendar effectively can significantly improve your trading strategy.Economic data plays a crucial role in influencing currency values.

Obtain recommendations related to how to build a strong online community for your business that can assist you today.

Major economic announcements, such as employment figures, inflation rates, and interest rate decisions, often cause significant volatility in the forex market. Traders carefully monitor these releases because they provide insights into the overall health of a country’s economy, impacting investor sentiment and ultimately, currency exchange rates. A positive surprise (better-than-expected data) might lead to increased demand for that country’s currency, while a negative surprise (worse-than-expected data) could cause it to weaken.

Calendar Features and Functionality

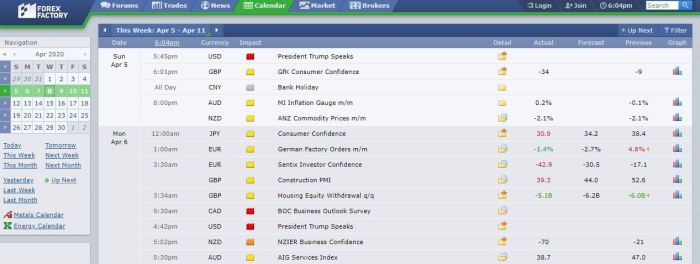

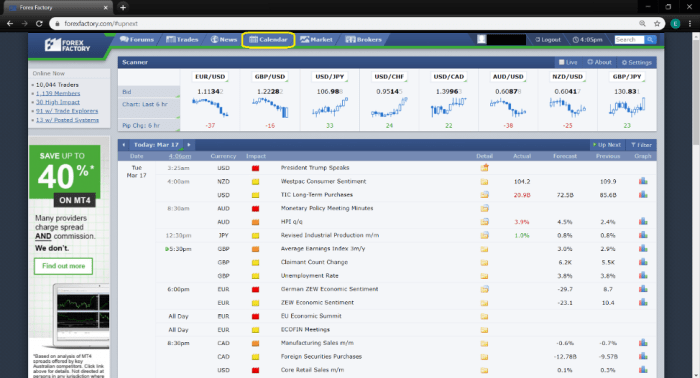

The Forex Factory Economic Calendar boasts several key features that make it a powerful trading tool. It presents data in a clear, organized manner, listing events by date and time, along with the country of origin and the expected impact. The calendar also typically includes the actual result once the data is released, allowing for quick comparison to the forecast.

Furthermore, many calendars allow users to filter events by country, currency pair, or impact level (high, medium, low). This customization helps traders focus on the most relevant information for their specific trading strategies. The visual representation, usually a table format, allows for easy scanning and identification of significant events. Many versions also include color-coding to visually highlight the importance of each event.

For example, high-impact events might be marked in red, while low-impact events might be in green.

Interpreting Economic Data and Market Movements

The calendar’s real power lies in its ability to help traders anticipate market movements. By reviewing the calendar in advance, traders can identify potential high-impact events that might cause significant price fluctuations. For instance, a surprise increase in US interest rates (a high-impact event) is likely to strengthen the US dollar against other currencies. Conversely, unexpectedly weak employment numbers in the Eurozone could weaken the Euro.

Knowing when these events are scheduled allows traders to adjust their positions accordingly, either by entering trades before the release or by protecting existing positions against potential volatility. Understanding the historical correlation between specific economic indicators and currency movements is also vital. For example, consistently high inflation rates often lead to central bank intervention, impacting interest rates and consequently, currency values.

Analyzing past reactions to similar data releases can help traders better predict future market responses.

Using the Calendar for Risk Management

The Forex Factory Economic Calendar is not just for identifying opportunities; it’s also a valuable risk management tool. By being aware of upcoming high-impact events, traders can avoid taking on unnecessary risk during periods of heightened volatility. They can choose to reduce their trading volume, close existing positions, or simply refrain from entering new trades until after the data is released and the market has settled.

This proactive approach helps minimize potential losses during periods of uncertainty caused by major economic announcements. For example, a trader might choose to close a position before a highly anticipated interest rate decision to avoid potential losses if the market moves against their position.

Interpreting Economic Data for Trend Identification

Forex Factory’s economic calendar is a powerful tool, but its true value lies in understanding how to interpret the data it provides. This involves recognizing high-impact events, prioritizing releases, and understanding the nuances of different economic indicators and their effects on currency pairs. Mastering this skill allows you to anticipate market movements and potentially improve your trading strategies.

For descriptions on additional topics like how to use local SEO to attract local customers, please visit the available how to use local SEO to attract local customers.

High-Impact Economic Events and Market Effects

Certain economic releases significantly impact currency markets. For example, Non-Farm Payroll (NFP) reports in the US often cause substantial volatility. A stronger-than-expected NFP number generally boosts the US dollar (USD) as it suggests a healthy economy, while a weaker report can send the USD lower. Similarly, interest rate decisions by central banks (like the Federal Reserve in the US or the European Central Bank) are major market movers.

An unexpected rate hike typically strengthens the associated currency, while a cut weakens it. Other impactful events include inflation data (CPI, PPI), GDP growth figures, and manufacturing PMI (Purchasing Managers’ Index). These reports paint a picture of a country’s economic health, influencing investor sentiment and currency valuations. For instance, unexpectedly high inflation could lead to a central bank raising interest rates, strengthening the currency, but also potentially slowing economic growth.

Prioritizing Economic Releases

Not all economic releases are created equal. Prioritize releases based on their potential impact on the specific currency pairs you trade. Consider the economic weight of the country whose data is being released. For example, data from the US or Eurozone tends to have a broader global impact compared to smaller economies. Also, focus on indicators directly related to monetary policy, like interest rates and inflation, as these are key drivers of currency values.

The Forex Factory calendar usually indicates the impact level of each event (high, medium, low), making prioritization easier. For instance, if you trade EUR/USD, prioritize Eurozone inflation and interest rate decisions as well as US employment and inflation figures.

Interpreting Different Types of Economic Data

Understanding various economic indicators is crucial. Inflation data (CPI and PPI) measures the rate of price increases. High inflation can lead to central bank intervention (raising interest rates), impacting currency values. Employment data (like NFP) reflects the health of the labor market; strong employment figures usually signal economic strength, supporting the currency. Interest rate decisions directly influence borrowing costs and investor sentiment, thus significantly affecting exchange rates.

GDP growth indicates the overall economic expansion or contraction of a country. A strong GDP growth number usually supports the currency.

Impact of Economic Indicators on Currency Pairs

| Indicator | USD/JPY | EUR/USD | GBP/USD | AUD/USD |

|---|---|---|---|---|

| US Interest Rate Hike | Likely to strengthen USD, weakening JPY | Likely to strengthen USD, weakening EUR | Likely to strengthen USD, weakening GBP | Likely to strengthen USD, weakening AUD |

| Eurozone Inflation (High) | Potentially neutral or slight weakening of USD if ECB raises rates | Potentially strengthens EUR if ECB raises rates, potentially weakens if it doesn’t meet expectations | Potentially neutral or slight weakening of GBP if ECB raises rates | Potentially neutral or slight weakening of AUD if ECB raises rates |

| Australian GDP Growth (Strong) | Potentially neutral or slight weakening of USD | Potentially neutral | Potentially neutral | Likely to strengthen AUD |

| Japanese Unemployment (Low) | Likely to strengthen JPY | Potentially neutral | Potentially neutral | Potentially neutral |

Identifying Market Trends using Calendar Data

The Forex Factory economic calendar is a powerful tool for identifying market trends. By understanding the relationship between scheduled economic data releases and subsequent market reactions, traders can significantly improve their forecasting accuracy and identify profitable trading opportunities. Essentially, the calendar helps you anticipate how the market might move

before* the news hits.

Economic Data and Market Trends

Economic data releases, such as Non-Farm Payrolls (NFP), inflation reports (CPI, PPI), and interest rate decisions, directly impact market sentiment. Stronger-than-expected data generally boosts investor confidence, leading to increased demand for the associated currency and pushing its value higher. Conversely, weaker-than-expected data can trigger sell-offs and currency depreciation. The magnitude of the market reaction depends on several factors, including the significance of the data, the market’s prior expectations, and prevailing global economic conditions.

For example, a surprisingly high NFP number might send the USD soaring, while a disappointing inflation figure could lead to a decline.

Anticipating Shifts in Market Sentiment

The Forex Factory calendar allows you to anticipate these shifts. By reviewing upcoming releases, you can gauge the potential impact on different currency pairs. Consider the scheduled release time, the importance of the data, and the market’s current expectations (often reflected in analyst forecasts provided alongside the calendar data). If the market anticipates a positive surprise, you might see a gradual increase in the value of the related currency leading up to the release.

Conversely, a negative surprise could lead to a preemptive sell-off.

Identifying Potential Trading Opportunities

The calendar helps identify potential trading opportunities by highlighting periods of heightened volatility surrounding significant data releases. Traders can use this information to strategically position themselves for short-term trades based on anticipated market reactions. For instance, a trader might buy a currency pair just before a positive data release, anticipating a price increase, or sell short before a negative release.

However, remember that high volatility also increases the risk of significant losses, so proper risk management is crucial.

Step-by-Step Guide to Predicting Market Direction

- Review the Forex Factory Calendar: Examine the calendar for upcoming economic data releases, paying close attention to the release time and the importance of the data.

- Assess Market Expectations: Consider analyst forecasts and recent market trends to gauge the market’s expectations for the upcoming release. Is the market anticipating a positive or negative surprise?

- Analyze Historical Data: Review how the market reacted to similar data releases in the past. This helps understand the typical magnitude of the market’s response.

- Develop a Trading Strategy: Based on your analysis, develop a specific trading plan, including entry and exit points, stop-loss orders, and profit targets. This plan should account for potential market volatility.

- Monitor Market Reaction: Observe the market’s immediate reaction to the data release. If the reaction aligns with your predictions, manage your trade according to your plan. If not, be prepared to adjust your strategy or exit the trade.

For example, if the calendar shows a high-impact NFP report is expected to be positive, and the market anticipates a positive surprise, a trader might buy the USD/JPY pair shortly before the release, anticipating a price increase after the confirmation of the positive NFP number. However, if the actual NFP number disappoints, the trader’s stop-loss order should limit potential losses.

Analyzing Correlation between Economic Events: Identifying Market Trends Using Forex Factory’s Economic Calendar

Understanding how different economic events interact is crucial for effective Forex trading. By analyzing the correlation between various economic releases, you can better predict market movements and refine your trading strategies. This involves comparing the impact of multiple releases on currency pairs and identifying relationships between different indicators.The impact of multiple economic releases on a single currency pair can be complex.

For instance, a strong jobs report (positive) might initially boost a currency, but if it simultaneously triggers expectations of higher interest rates (potentially negative for the currency depending on the market’s reaction), the net effect could be muted or even negative. Conversely, weak economic data, like a decline in manufacturing output, could initially weaken a currency, but if it leads to expectations of lower interest rates (potentially positive), the market might react less negatively than initially anticipated.

This highlights the importance of considering the interplay of multiple factors.

Comparative Impacts of Multiple Economic Releases

Let’s imagine the US dollar (USD) against the Euro (EUR). A strong US Non-Farm Payroll (NFP) report might strengthen the USD/EUR pair, pushing the value of the dollar higher. However, if this is followed by unexpectedly high inflation data in the US, the Federal Reserve might be forced to raise interest rates more aggressively than anticipated. This could, paradoxically, weaken the dollar in the long run, as higher interest rates attract foreign investment initially but can also slow economic growth and reduce demand for the currency.

Therefore, analyzing the combined impact of these reports is crucial for a complete picture. A positive NFP report followed by high inflation might initially lead to a strong USD but ultimately a weaker one, depending on market perception of future interest rate hikes and their long-term economic impact.

Identifying Correlations Between Economic Indicators

Positive correlation occurs when two indicators tend to move in the same direction. For example, a rise in consumer confidence often correlates with increased consumer spending, which in turn can boost economic growth and strengthen a country’s currency. Conversely, negative correlation means indicators move in opposite directions. For example, a rise in unemployment often correlates with a decrease in consumer spending and a weakening currency.

Understanding these correlations allows traders to anticipate market reactions to various economic events. For example, a negative correlation between unemployment and inflation might suggest that low inflation could potentially be associated with higher unemployment and a weaker currency.

Organizing Data to Highlight Market Trends

Effective organization is key. Using Forex Factory’s calendar, you can create a spreadsheet or use charting software to track several key indicators over time. This allows you to visually identify trends and correlations. For example, you might plot the correlation between the NFP report and the USD index. By observing the relationship between these two data points over time, you can better anticipate the likely market response to future NFP releases.

You can also add other data points such as inflation and interest rate announcements to get a more comprehensive picture.

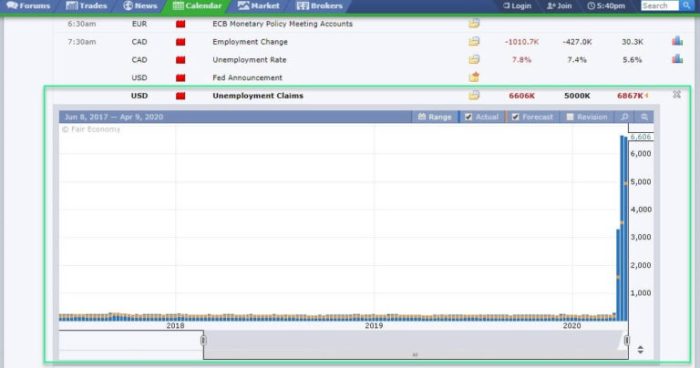

Impact of Unexpected Economic Data

Unexpected economic data often triggers significant market volatility. For example, if the market anticipates a small increase in inflation but a much larger increase is announced, the resulting shock could cause a sharp sell-off in the affected currency. This is because the unexpected data drastically alters market expectations regarding future interest rate policy and the overall economic outlook. The sudden shift in market sentiment often leads to quick and dramatic price changes.

The opposite can also occur, where positive surprises lead to significant gains. The key takeaway is that unexpected data, regardless of direction, often leads to heightened market volatility and presents both opportunities and risks for traders.

Visualizing Market Trends

Visualizing the relationship between economic data releases and subsequent currency pair movements is crucial for effective Forex trading. By creating clear and informative charts, we can better understand market reactions and improve our predictive capabilities. This section will explore different visualization techniques to achieve this.

Chart Illustrating Economic Data and Currency Pair Movements

A scatter plot would effectively illustrate the relationship between economic data and currency pair movements. The x-axis would represent the value of the economic indicator (e.g., Non-Farm Payroll figures, inflation rate), while the y-axis would show the percentage change in the currency pair’s price (e.g., EUR/USD) within a specific timeframe after the data release (e.g., the first hour, the first day).

Each data point represents a single economic data release, with its corresponding currency pair price change. A positive correlation would be indicated by data points clustering upwards from left to right, showing a positive price movement with a positive economic indicator. A negative correlation would show the opposite trend. The chart could also incorporate different colors or shapes to represent different economic indicators or timeframes.

For instance, Non-Farm Payroll data could be represented in blue, while inflation data is shown in red. This allows for a visual comparison of how different indicators impact the currency pair. Adding a trendline to the scatter plot would further highlight the overall relationship between the variables.

Visual Representation of Market Sentiment Changes

A candlestick chart overlaid with a volume indicator provides a powerful visual representation of market sentiment changes around significant economic events. The candlestick chart displays the price action of the currency pair over time, while the volume indicator shows the trading volume associated with each candlestick. A significant economic event (as per the Forex Factory calendar) would be marked on the chart.

Before the event, we might observe a period of consolidation or sideways trading, reflecting uncertainty. A strong positive economic surprise could trigger a sharp increase in price and volume, indicating bullish sentiment. Conversely, a negative surprise might result in a sharp decline in price and volume, signaling bearish sentiment. The volume indicator helps confirm the strength of the price movement; high volume accompanying a price surge or drop indicates stronger conviction in the market’s reaction.

For example, if the US Non-Farm Payroll numbers significantly exceed expectations, we might see a sharp upward movement in the EUR/USD with high volume, reflecting a strengthening dollar due to positive economic sentiment.

Using Visual Tools to Identify Patterns and Trends, Identifying market trends using Forex Factory’s economic calendar

Moving averages, such as the 20-period and 50-period simple moving averages (SMA), can be overlaid on the candlestick chart to identify longer-term trends. The intersection of these moving averages can be used as potential trading signals. For example, a bullish crossover (20-period SMA crossing above the 50-period SMA) might signal a potential buying opportunity, particularly if it occurs after a positive economic data release.

Similarly, a bearish crossover could signal a potential selling opportunity. Furthermore, visual tools like Bollinger Bands can highlight periods of high and low volatility. Increased volatility around major economic announcements can be visually identified, providing insights into the market’s reaction and potential trading opportunities. By combining these visual tools with the information from the Forex Factory economic calendar, traders can gain a more comprehensive understanding of market dynamics and improve their trading strategies.

For instance, observing high volatility in the Bollinger Bands after a surprising inflation report can be used to adjust position sizes or take advantage of short-term price fluctuations.

Risk Management and Economic Calendar

Using the Forex Factory economic calendar for trading decisions offers exciting opportunities, but it’s crucial to remember that no strategy guarantees profit. Successfully leveraging this tool requires a robust risk management plan to protect your capital and minimize potential losses. Ignoring risk management can quickly turn promising trades into significant setbacks.The economic calendar provides insights into potential market movements, but it doesn’t predict the future with certainty.

Unexpected events, market sentiment shifts, and even errors in the data itself can significantly impact outcomes. Therefore, a well-defined risk management strategy is paramount to navigating the complexities of forex trading based on economic calendar data.

Stop-Loss Orders and Position Sizing

Stop-loss orders are your first line of defense against significant losses. They automatically close a trade when the price reaches a predetermined level, limiting your potential loss to a pre-defined amount. This is particularly crucial when trading on high-impact economic news releases, where volatility can be extreme. Coupled with stop-losses, proper position sizing is essential. Never risk more than a small percentage (typically 1-2%) of your trading capital on any single trade, regardless of how confident you are in your analysis based on the economic calendar.

For example, if you have a $10,000 trading account, you shouldn’t risk more than $100-$200 on a single trade.

Considering Unexpected Events and Their Impact

Unexpected events, such as geopolitical crises, natural disasters, or sudden changes in government policy, can drastically alter market conditions and invalidate even the most well-researched economic calendar-based trades. These “black swan” events are difficult to predict, but their potential impact must be factored into your risk assessment. Diversification across different currency pairs and trading strategies can help mitigate the risk associated with unexpected events.

Regularly reviewing your trading plan and adjusting your positions based on evolving market conditions is also vital.

Additional Risk Management Techniques

Beyond stop-losses and position sizing, several other risk management techniques can enhance your trading approach when using the economic calendar. These include:

- Take-Profit Orders: Setting take-profit orders helps you lock in profits when your trade reaches a predetermined target price, minimizing the risk of giving back gains due to unforeseen market reversals.

- Trailing Stop-Losses: These orders move your stop-loss in the direction of the trade as the price moves favorably, locking in profits while reducing the risk of a sudden reversal wiping out your gains.

- Hedging Strategies: In certain circumstances, hedging (taking an offsetting position in a related market) can help reduce overall risk, though it’s important to understand the complexities of hedging before implementing it.

- Backtesting and Simulation: Before implementing any trading strategy based on the economic calendar, it’s essential to backtest it using historical data to assess its potential performance and risk profile. This helps identify potential weaknesses and refine your approach.

Potential Pitfalls to Avoid

Relying solely on the economic calendar for trading decisions is a risky approach. It’s crucial to be aware of the following pitfalls:

- Overreliance on Calendar Data: The economic calendar is a valuable tool, but it shouldn’t be the sole basis for your trading decisions. Consider other factors, such as technical analysis and fundamental analysis.

- Ignoring Market Sentiment: Market sentiment can significantly influence price movements, even if the economic data is favorable. Pay attention to news headlines, social media sentiment, and other indicators of market mood.

- Data Revisions: Economic data is often revised after the initial release. Be prepared for potential discrepancies between preliminary and revised figures, and factor this into your risk assessment.

- False Signals: Not all economic events lead to significant price movements. Learn to differentiate between high-impact and low-impact events to avoid chasing false signals.

- Ignoring Risk Management: This is perhaps the most critical pitfall. Always have a robust risk management plan in place, regardless of how promising the economic calendar data appears.

Mastering the art of using Forex Factory’s economic calendar to identify market trends significantly enhances your trading prowess. By understanding how to interpret economic data, prioritize releases, and recognize correlations, you can gain a significant edge in the Forex market. Remember, consistent practice and disciplined risk management are essential for success. Use this knowledge wisely, and happy trading!