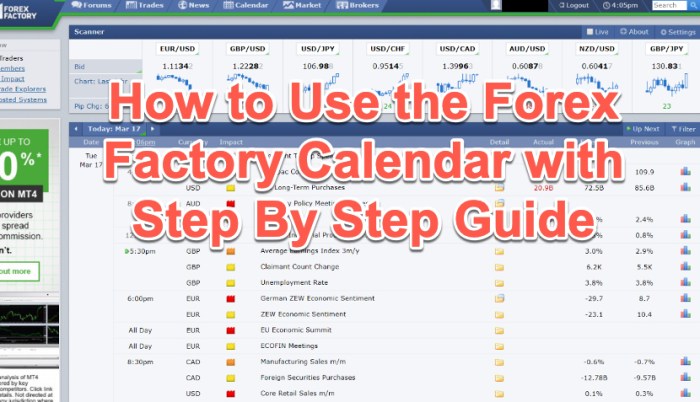

Reliable Forex Factory economic calendar interpretation techniques are crucial for successful forex trading. Mastering this skill allows you to anticipate market movements based on upcoming economic news releases, giving you a significant edge. We’ll explore how to decipher the calendar’s data, understand its color-coding system, and ultimately use this information to inform your trading strategies.

This guide breaks down the Forex Factory economic calendar, showing you how to interpret its data effectively. We’ll cover everything from understanding the different types of economic indicators and their potential impact on currency pairs to developing risk management strategies specifically tailored to news-driven trading. By the end, you’ll be confident in using the Forex Factory calendar to identify and capitalize on profitable trading opportunities.

Understanding Forex Factory’s Economic Calendar Structure

Forex Factory’s economic calendar is a powerful tool for forex traders, providing a centralized view of upcoming economic events and their potential impact on currency markets. Understanding its structure and features is crucial for effectively utilizing this resource in your trading strategy. This section will break down the key elements of the calendar, helping you interpret the data and make informed trading decisions.

Key Data Points Presented on the Forex Factory Economic Calendar

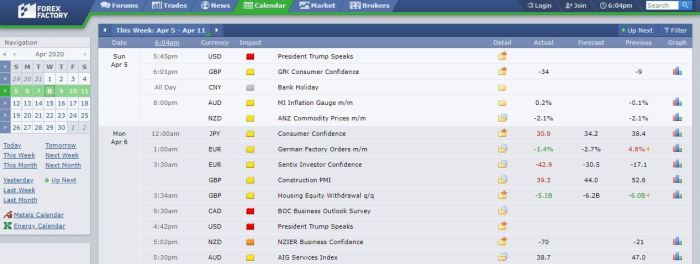

The Forex Factory economic calendar presents a wealth of information for each economic event. A clear understanding of this data is paramount for successful interpretation. The following table Artikels the key data points typically included:

| Event | Time | Currency | Actual | Forecast | Previous |

|---|---|---|---|---|---|

| US Non-Farm Payrolls | 12:30 GMT | USD | 200,000 | 180,000 | 150,000 |

| Eurozone CPI | 10:00 GMT | EUR | 2.1% | 2.0% | 1.9% |

| UK GDP | 09:30 GMT | GBP | 0.5% | 0.4% | 0.3% |

The “Actual” value represents the officially released data. The “Forecast” shows the market’s expectation before the release, while “Previous” indicates the value from the preceding reporting period. Comparing these three figures allows traders to gauge the market’s reaction to the actual data relative to expectations and past trends.

Forex Factory’s Economic Calendar Color-Coding System

Forex Factory uses a color-coding system to indicate the potential market impact of each economic event. This visual cue helps traders quickly prioritize significant releases. The system typically employs three main colors:

- High Impact (Red): Events with a high probability of causing significant price movements in the forex market. Examples include Non-Farm Payrolls (NFP), interest rate decisions from major central banks (like the Federal Reserve or the European Central Bank), and major inflation reports (CPI, PPI).

- Medium Impact (Orange): Events likely to cause moderate price fluctuations. Examples include Manufacturing PMI, Consumer Confidence Index, and Retail Sales figures.

- Low Impact (Grey/Light Grey): Events with a generally low likelihood of impacting forex prices significantly. These might include less-followed economic indicators or less influential data releases.

It’s important to remember that the impact of an event can vary depending on various factors, including market sentiment and overall economic conditions. Even a seemingly low-impact event could cause significant volatility under specific circumstances.

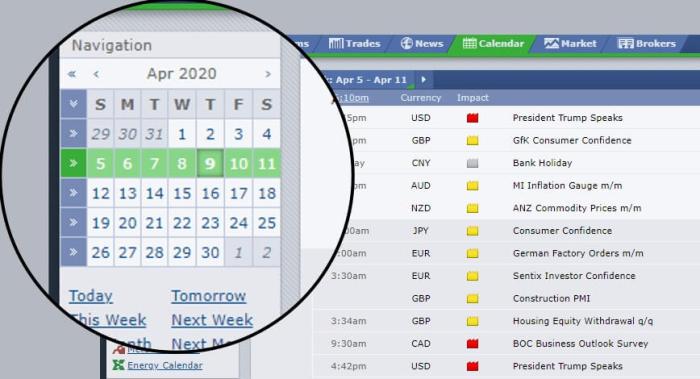

Filtering and Sorting Economic Calendar Data

Forex Factory allows users to customize their view of the economic calendar using various filtering and sorting options. This functionality enables traders to focus on the data most relevant to their trading strategies.Users can filter the calendar by:

- Currency: Focus on events impacting specific currency pairs of interest.

- Importance: View only high-impact, medium-impact, or low-impact events.

- Time Zone: Display events according to a preferred time zone for better time management.

Furthermore, users can typically sort the calendar by time, importance, or currency, allowing for a tailored and efficient analysis of upcoming economic events. These filtering and sorting options significantly enhance the usability and practicality of the Forex Factory economic calendar.

Interpreting Economic Data Releases: Reliable Forex Factory Economic Calendar Interpretation Techniques

The Forex Factory economic calendar provides a wealth of data, but understanding its significance requires more than just glancing at the numbers. Different economic indicators carry varying weight, and the market’s reaction depends on how actual figures compare to expectations. This section delves into interpreting these releases effectively, focusing on identifying potential market movements and incorporating existing market conditions.Interpreting economic data involves understanding the relative importance of various indicators and how discrepancies between forecasts and actual results can drive market volatility.

Significance of Different Economic Indicators

Economic indicators can be broadly categorized, each offering a unique perspective on the overall health of an economy. High-impact indicators, like Non-Farm Payrolls (NFP) or inflation data (CPI, PPI), tend to cause significant market reactions due to their comprehensive nature and direct impact on monetary policy. Conversely, less impactful releases might have a smaller, more localized effect. Employment data, for example, reveals the labor market’s strength, influencing consumer spending and overall economic growth.

Inflation rates (CPI and PPI) reflect the cost of goods and services, directly impacting consumer purchasing power and influencing central bank interest rate decisions. Interest rate decisions themselves are arguably the most impactful, as they directly influence borrowing costs, investment decisions, and currency valuations. A surprise rate hike, for instance, can strengthen a currency dramatically, while a cut might weaken it.

Market Reactions to Actual vs. Forecasted Values

The difference between the actual release and the forecasted value is crucial. A significant deviation, either positive or negative, often triggers substantial price movements. For example, if the forecasted NFP number is 150,000 new jobs, but the actual number is 250,000, this positive surprise could strengthen the associated currency as it suggests a robust economy. Conversely, if the actual number is only 50,000, the currency might weaken reflecting concerns about economic slowdown.

Similarly, a surprisingly high inflation figure might lead to expectations of aggressive interest rate hikes, strengthening the currency in the short term but potentially weakening it later if the hike negatively impacts economic growth. Conversely, lower-than-expected inflation could lead to a weaker currency if it suggests a less hawkish monetary policy stance.

Interpreting Data within Market Context

Analyzing economic data in isolation is insufficient. It’s crucial to consider prevailing market trends and sentiment. A positive economic surprise might have a muted impact if the market is already overwhelmingly bullish, as the positive news might already be priced in. Conversely, the same positive surprise could trigger a significant rally in a bearish market, as it could signal a shift in sentiment.

For instance, positive economic data released during a period of geopolitical uncertainty might have a limited effect, as investors remain focused on the broader geopolitical risks. Conversely, the same data released during a period of relative calm could have a more pronounced impact. Therefore, a holistic view incorporating current market conditions and prevailing investor sentiment is essential for accurate interpretation.

Utilizing the Calendar for Forex Trading Strategies

The Forex Factory economic calendar is a powerful tool that, when used effectively, can significantly enhance your forex trading strategies. By understanding how to interpret the data and anticipate market reactions, you can identify high-probability trading setups and improve your overall trading performance. This section will guide you through a step-by-step process for leveraging the calendar for profitable trading opportunities.

Identifying Potential Trading Opportunities

To effectively use the Forex Factory calendar for trading, follow these steps:

- Review the Calendar: Start your day by reviewing the Forex Factory calendar. Focus on high-impact economic releases (those with a significant impact on the market, usually marked with a high importance rating). Pay attention to the release time, currency pair affected, and the previous release’s result.

- Analyze Market Sentiment: Before the release, gauge market sentiment. Is the market generally bullish or bearish on the specific currency pair? This will help you anticipate the potential reaction to the upcoming data. Look at charts, news headlines, and technical indicators for clues.

- Develop a Trading Plan: Based on your analysis of the upcoming release and market sentiment, formulate a specific trading plan. This should include your entry point, stop-loss order, and take-profit target. Don’t trade without a clear plan.

- Monitor the Release: Watch the actual data release closely. Often, the initial market reaction is the most significant. Be prepared to execute your trades quickly, as prices can move rapidly.

- Manage Your Risk: Always use appropriate risk management techniques. Never risk more than a small percentage of your trading capital on any single trade. Adjust your stop-loss and take-profit levels as needed based on market conditions.

Examples of Trading Strategies Utilizing Economic Calendar Data

Economic calendar data can be used in several trading strategies. Two common examples are:

News Trading

News trading involves taking positions immediately before or after a significant economic release. For example, if a country’s inflation rate is expected to be higher than anticipated, and the market is currently bearish on its currency, you might consider buying the currency pair expecting a short-term rally after the release confirms the higher-than-expected inflation. The risk, however, is a surprise negative outcome that could lead to significant losses.

Always have a stop-loss in place.

Calendar Spread Trading

Calendar spread trading involves taking advantage of price discrepancies between different currency pairs influenced by the same economic release. For example, if the Eurozone releases positive economic data, the EUR/USD and EUR/GBP might both appreciate, but the degree of appreciation may differ. You could potentially profit from the difference in their price movements by simultaneously buying one and selling the other.

This requires a deep understanding of the relationships between various currency pairs.

Do not overlook the opportunity to discover more about the subject of creating a compelling digital marketing strategy that converts.

Risk Management Techniques for Calendar-Based Trading

Trading based on economic calendar events is inherently risky due to the volatility often associated with data releases. Effective risk management is crucial.

Stop-Loss and Take-Profit Order Placement

Stop-loss orders should be placed to limit potential losses. The placement will depend on your trading style and risk tolerance, but it’s generally advisable to place them at a level that represents an acceptable loss. Take-profit orders should be placed to secure profits once a pre-determined price target is reached. The placement should be based on your analysis of the potential price movement after the data release.

For example, if trading the EUR/USD based on a positive Eurozone inflation release, a stop-loss might be placed below the immediate support level before the news, while the take-profit could be set at a level representing a reasonable profit target based on historical price reactions to similar data releases. It is crucial to remember that stop-loss and take-profit levels are not guaranteed to be hit, and market conditions can always change.

Get the entire information you require about how to deal with negative reviews and online reputation management on this page.

Advanced Techniques and Considerations

Relying solely on the Forex Factory economic calendar for trading decisions is a risky strategy. While the calendar provides valuable information on scheduled economic releases, it’s crucial to understand its limitations and integrate it with other analytical tools for a more comprehensive trading approach. Ignoring other market factors can lead to inaccurate predictions and ultimately, losses.The Forex Factory economic calendar, while helpful, offers only a snapshot of the economic landscape.

It doesn’t account for unforeseen events or the nuances of market sentiment. Effective forex trading necessitates a multifaceted approach, incorporating both fundamental and technical analysis alongside the calendar’s data.

Limitations of Sole Reliance on the Economic Calendar

Over-reliance on the economic calendar can lead to missed opportunities and significant losses. The calendar primarily focuses on scheduled events; it doesn’t predict market reactions or account for the complex interplay of various economic indicators. For example, a positive GDP report might be overshadowed by unexpected geopolitical tensions, leading to a market reaction contrary to the calendar’s implied prediction.

Furthermore, the calendar doesn’t provide insights into market sentiment or trader psychology, both crucial factors in price movements. Ignoring these aspects can lead to inaccurate trading decisions.

Incorporating Other Market Information Sources

Effective forex trading involves combining the economic calendar with fundamental and technical analysis. Fundamental analysis involves assessing the overall economic health of a country or region, considering factors beyond the calendar’s scope, such as interest rates, inflation, and political stability. Technical analysis, on the other hand, focuses on chart patterns and price movements to identify trading opportunities. By integrating these analyses with the economic calendar’s data, traders gain a more holistic view of the market and can make more informed decisions.

For instance, a positive economic indicator might be confirmed by a bullish technical pattern, strengthening the signal for a long position. Conversely, a negative indicator coupled with a bearish pattern might signal a potential short opportunity.

Impact of Geopolitical Events and Unexpected News

Geopolitical events and unexpected news can significantly impact market expectations and render economic calendar forecasts unreliable. The 2014 Russian annexation of Crimea, for example, caused significant volatility in global markets, regardless of any scheduled economic releases. Similarly, unexpected political events, such as surprise elections or policy shifts, can drastically alter market sentiment and lead to sharp price movements.

The COVID-19 pandemic in 2020 is another prime example; the initial outbreak triggered widespread market panic and volatility, completely overshadowing any pre-existing economic forecasts based on the calendar. These unforeseen circumstances highlight the limitations of relying solely on scheduled economic data.

Visualizing Economic Calendar Data

Visualizing the data from the Forex Factory economic calendar effectively is crucial for understanding market reactions and developing successful trading strategies. By representing the information visually, even without charts and graphs, we can better grasp the potential impact of economic news on currency pairs. This section will explore several methods for visualizing this data, focusing on creating mental models and descriptive representations.

A Hypothetical Scenario: Impact of a Major Economic Release, Reliable Forex Factory economic calendar interpretation techniques

Imagine the US releases unexpectedly strong Non-Farm Payroll (NFP) data, significantly exceeding forecasts. We can visualize this scenario as follows: The initial reaction would be a sharp upward movement in the USD/JPY pair. The dollar strengthens (USD appreciates) as investors seek higher yields in US assets, leading to increased demand for the dollar. Conversely, the Japanese Yen (JPY) would likely weaken (depreciate) against the dollar as investors move capital from Japanese assets to higher-yielding US assets.

This movement would be represented by a steep, upward-sloping line on a hypothetical chart (though we’re describing it textually here). The magnitude of the move would depend on the degree of the surprise and market sentiment. A similarly strong but expected NFP report might produce a less dramatic, or even muted, response.

Categorizing Economic Events by Impact on Currency Pairs

The following table categorizes economic events based on their likely impact on different currency pairs. Note that this is a simplified representation, and actual market reactions can be complex and influenced by many factors.

| Economic Event | USD/JPY | EUR/USD | GBP/USD |

|---|---|---|---|

| Strong US NFP | USD strengthens, JPY weakens | USD strengthens, EUR weakens | USD strengthens, GBP weakens |

| Positive Eurozone GDP | Little to no effect | EUR strengthens, USD weakens | Little to no effect |

| Unexpected UK Interest Rate Hike | Little to no effect | Little to no effect | GBP strengthens, USD weakens |

| Negative Global Manufacturing PMI | JPY strengthens (safe-haven), USD weakens | EUR weakens, USD weakens (risk-off sentiment) | GBP weakens, USD weakens (risk-off sentiment) |

Representing the Relationship Between Multiple Economic Indicators

Consider a scenario where both inflation and unemployment data are released simultaneously. High inflation might normally suggest a rate hike, strengthening the currency. However, if high inflation is accompanied by high unemployment, it suggests a weaker economy and might lead to a more cautious approach by the central bank, thus potentially weakening the currency. This interplay creates a complex relationship.

Imagine a scenario where the market initially reacts positively to the inflation data, pushing the currency up. However, as the market digests the unemployment data, the initial gains are partially or fully reversed, resulting in a more subdued or even negative reaction. The overall effect is a more nuanced and less predictable market response compared to if only one indicator were released.

This illustrates how multiple indicators can interact and impact market expectations in unpredictable ways.

Successfully navigating the forex market requires a multi-faceted approach, and understanding the Forex Factory economic calendar is a key component. By learning to interpret the data, anticipate market reactions, and incorporate this knowledge into your overall trading strategy, you’ll be better equipped to make informed decisions and manage risk effectively. Remember, while the calendar provides valuable insights, it’s crucial to combine this information with other forms of analysis for a comprehensive trading approach.